- United Kingdom

- /

- Chemicals

- /

- LSE:ZTF

Volex Leads These 3 UK Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 and FTSE 250 indices have recently faced downward pressure, largely influenced by disappointing trade data from China, highlighting the interconnectedness of global markets. In such a landscape, investors often look for opportunities in smaller companies that may offer value and growth potential. Penny stocks, though an older term, still signify investment opportunities in smaller or newer firms with strong financials. Here we explore three UK penny stocks that stand out for their financial resilience and potential upside amidst current market challenges.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.35 | £171.93M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4395 | $255.49M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.12 | £472M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.45 | £313.05M | ★★★★★★ |

Click here to see the full list of 473 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Volex (AIM:VLX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Volex plc manufactures and sells power and data cables across North America, Europe, and Asia with a market cap of £508.44 million.

Operations: The company's revenue is derived from three main regions: $197.3 million from Asia, $421.2 million from Europe, and $415 million from North America.

Market Cap: £508.44M

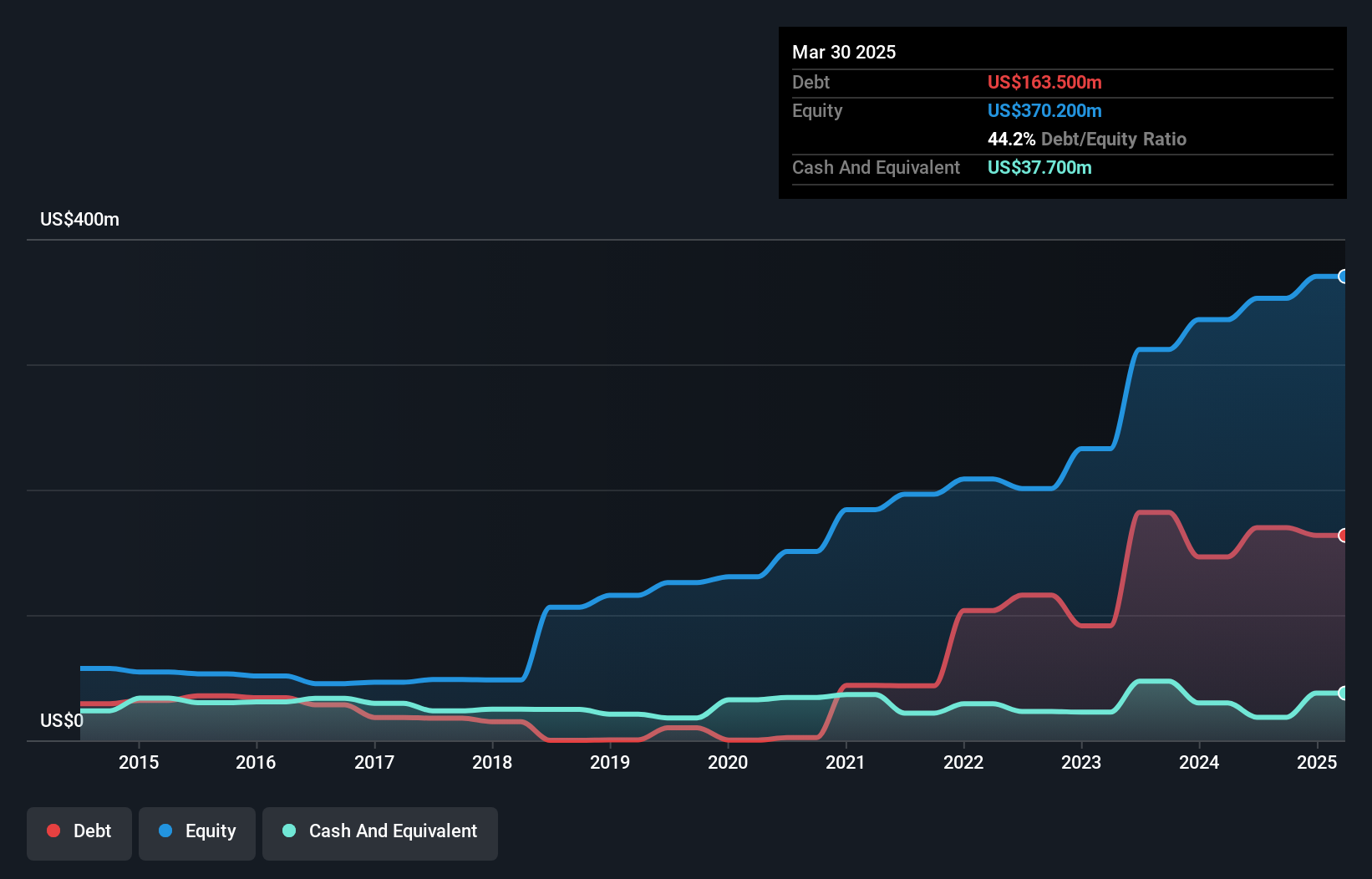

Volex plc, with a market cap of £508.44 million, has demonstrated strong financial performance, reporting half-year sales of US$518.2 million and net income of US$19.3 million, up from the previous year. The company is trading at good value compared to its peers and industry but carries a high net debt to equity ratio of 42.9%. Volex's earnings growth has outpaced the electrical industry average, although its profit margins have slightly decreased recently. Despite TT Electronics rejecting acquisition proposals from Volex, the latter remains committed to strategic growth and maintaining a progressive dividend policy with recent increases in payouts.

- Unlock comprehensive insights into our analysis of Volex stock in this financial health report.

- Gain insights into Volex's future direction by reviewing our growth report.

Breedon Group (LSE:BREE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Breedon Group plc operates in the quarrying, manufacture, and sale of construction materials and building products across the United Kingdom, Republic of Ireland, and internationally, with a market cap of £1.54 billion.

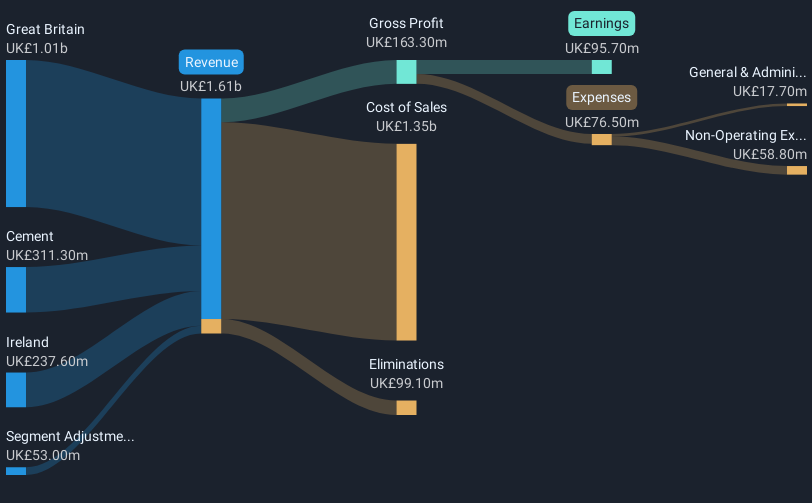

Operations: The company's revenue is primarily derived from its operations in Great Britain (£1.01 billion), the Cement segment (£311.3 million), and Ireland (£237.6 million).

Market Cap: £1.54B

Breedon Group plc, with a market cap of £1.54 billion, operates in the construction materials sector and has seen earnings grow by 15.6% annually over the past five years, though recent earnings growth was negative at -10.7%. Its debt is well managed, with operating cash flow covering 36.8% of its debt and interest payments covered 12.5 times by EBIT. The company trades at a significant discount to its estimated fair value but faces challenges such as lower profit margins this year (6.3%) compared to last year (7.3%). Despite these issues, Breedon's experienced management and board provide stability amidst volatility concerns.

- Jump into the full analysis health report here for a deeper understanding of Breedon Group.

- Gain insights into Breedon Group's outlook and expected performance with our report on the company's earnings estimates.

Zotefoams (LSE:ZTF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zotefoams plc, with a market cap of £149.71 million, manufactures, distributes, and sells polyolefin block foams in the United Kingdom, Europe, North America, and internationally.

Operations: The company's revenue is primarily derived from three segments: Polyolefin Foams (£64.39 million), Mucell Extrusion LLC (MEL) (£1.21 million), and High-Performance Products (HPP) (£67.81 million).

Market Cap: £149.71M

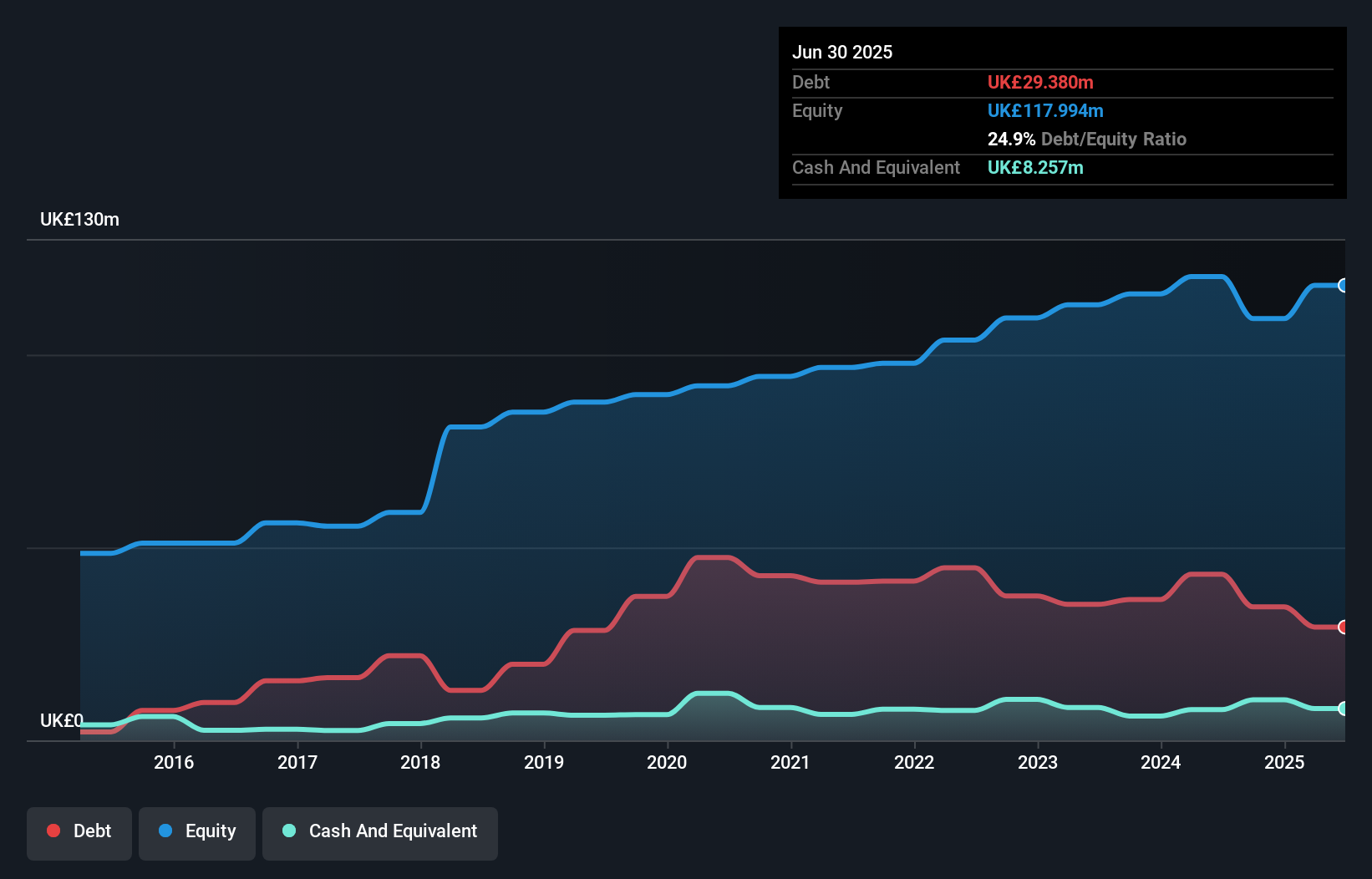

Zotefoams plc, with a market cap of £149.71 million, shows mixed signals for investors in penny stocks. The company trades significantly below its estimated fair value and boasts high-quality earnings with satisfactory debt levels, as operating cash flow covers 23.2% of its debt. Despite negative earnings growth last year, Zotefoams has achieved 7.1% annual profit growth over five years and forecasts a 20.01% increase per year moving forward. Recent sales surged by 54% in Q3 2024 compared to the prior year, supporting positive revenue momentum into the year's end despite potential demand volatility risks in some sectors.

- Take a closer look at Zotefoams' potential here in our financial health report.

- Review our growth performance report to gain insights into Zotefoams' future.

Make It Happen

- Access the full spectrum of 473 UK Penny Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zotefoams might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ZTF

Zotefoams

Manufactures, distributes, and sells polyolefin block foams in the United Kingdom, rest of Europe, North America, and internationally.

Excellent balance sheet and good value.