- United Kingdom

- /

- Semiconductors

- /

- LSE:AWE

Central Asia Metals And 2 Other UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Amid these fluctuations, investors often seek opportunities in undervalued areas of the market. Penny stocks, though a somewhat outdated term, represent smaller or newer companies that can offer potential growth when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.35 | £171.93M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4395 | $255.49M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.12 | £472M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.45 | £313.05M | ★★★★★★ |

Click here to see the full list of 473 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Central Asia Metals (AIM:CAML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Central Asia Metals plc, along with its subsidiaries, operates as a base metals producer and has a market cap of £271.40 million.

Operations: The company generates revenue from two main segments: $81.49 million from Sasa and $117.70 million from Kounrad.

Market Cap: £271.4M

Central Asia Metals plc has demonstrated significant earnings growth, with a remarkable increase of 2874.7% over the past year, positioning it well within the metals and mining industry. Despite its low return on equity at 10.9%, the company benefits from strong financial health, evidenced by more cash than total debt and robust operating cash flow coverage of debt at a very large percentage. While trading below estimated fair value by 73.9%, potential investors should note that its dividend yield of 11.52% is not well covered by earnings, and recent management changes bring a less experienced team to lead future strategies.

- Dive into the specifics of Central Asia Metals here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Central Asia Metals' future.

Alphawave IP Group (LSE:AWE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alphawave IP Group plc specializes in developing and selling connectivity solutions across multiple regions, including North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom with a market cap of £677.79 million.

Operations: The company's revenue is primarily derived from its communications equipment segment, totaling $225.52 million.

Market Cap: £677.79M

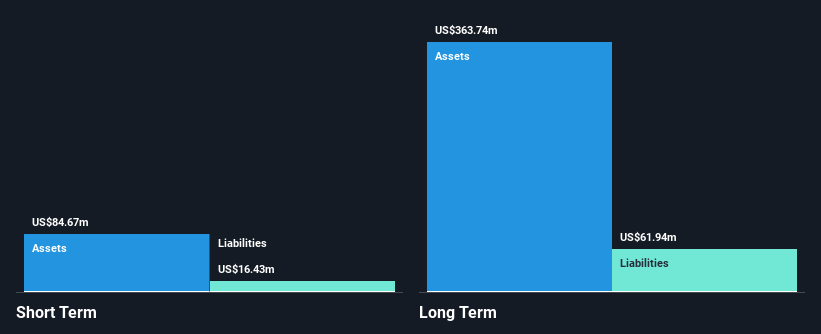

Alphawave IP Group plc, with a market cap of £677.79 million, is navigating the penny stock landscape with its focus on high-performance connectivity solutions. Despite being unprofitable and facing increased losses over the past five years, it maintains a satisfactory net debt to equity ratio of 32.2% and has sufficient cash runway for over three years. Recent advancements include introducing the industry's first 64 Gbps UCIe Die-to-Die IP Subsystem, enhancing its position in high-demand sectors like AI and data centers. However, shareholder dilution and management changes may pose challenges as it seeks to leverage these technological innovations.

- Click here and access our complete financial health analysis report to understand the dynamics of Alphawave IP Group.

- Learn about Alphawave IP Group's future growth trajectory here.

Dr. Martens (LSE:DOCS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dr. Martens plc designs, develops, procures, markets, sells, and distributes footwear under the Dr. Martens brand and has a market cap of approximately £714.13 million.

Operations: The company generates £805.9 million in revenue from its footwear segment.

Market Cap: £714.13M

Dr. Martens plc, with a market cap of £714.13 million, faces challenges in the penny stock arena despite generating £805.9 million in revenue from its footwear segment. The company has experienced declining profit margins and negative earnings growth recently, reporting a net loss of £20.8 million for the half-year ending September 2024 compared to a net income previously. While its short-term assets exceed liabilities, Dr. Martens' debt levels remain high with interest payments not well covered by earnings. Upcoming leadership changes may impact strategic direction as new CEO Ije Nwokorie takes over in January 2025 amidst these financial pressures.

- Click here to discover the nuances of Dr. Martens with our detailed analytical financial health report.

- Gain insights into Dr. Martens' outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Get an in-depth perspective on all 473 UK Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AWE

Alphawave IP Group

Develops and sells connectivity solutions in North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives