- United Kingdom

- /

- Beverage

- /

- LSE:CCR

Undervalued Small Caps With Insider Activity On UK Radar December 2024

Reviewed by Simply Wall St

Amidst a backdrop of faltering trade data from China and its ripple effects on the UK's FTSE indices, small-cap stocks in the United Kingdom are capturing attention as potential opportunities for discerning investors. In such a fluctuating market environment, identifying small-cap companies with notable insider activity can be an indicator of confidence and may offer intriguing prospects for those seeking value amidst broader economic uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Pets at Home Group | 10.5x | 0.6x | 37.64% | ★★★★★★ |

| 4imprint Group | 15.2x | 1.2x | 41.57% | ★★★★★☆ |

| Tracsis | 314.1x | 1.9x | 48.20% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 35.93% | ★★★★★☆ |

| Sabre Insurance Group | 11.7x | 1.5x | 8.75% | ★★★★☆☆ |

| iomart Group | 25.8x | 0.7x | 29.27% | ★★★★☆☆ |

| NCC Group | NA | 1.4x | 21.25% | ★★★★☆☆ |

| Telecom Plus | 18.2x | 0.7x | 29.72% | ★★★☆☆☆ |

| Alpha Group International | 9.9x | 4.6x | -29.90% | ★★★☆☆☆ |

| THG | NA | 0.3x | -1006.50% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Breedon Group (LSE:BREE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Breedon Group is a leading construction materials company operating primarily in the UK and Ireland, with a focus on cement and aggregates, and has a market cap of approximately £1.39 billion.

Operations: Breedon Group's revenue primarily stems from its operations in Great Britain and Ireland, with a significant contribution from the cement segment. The company's gross profit margin has shown variability, reaching 36.23% as of June 2023 before declining to 10.32% by December 2024. Operating expenses have been consistently managed alongside non-operating expenses and depreciation costs impacting net income margins over time.

PE: 16.1x

Breedon Group, a UK-based construction materials company, presents an intriguing opportunity among smaller stocks. With earnings projected to grow by 14.2% annually, they show potential for expansion. However, reliance on external borrowing for all liabilities introduces higher risk compared to customer deposits. Insider confidence is evident with share purchases made consistently over the past year, signaling trust in future prospects. The combination of growth potential and insider activity suggests Breedon could be positioned for value appreciation despite funding risks.

- Get an in-depth perspective on Breedon Group's performance by reading our valuation report here.

Gain insights into Breedon Group's historical performance by reviewing our past performance report.

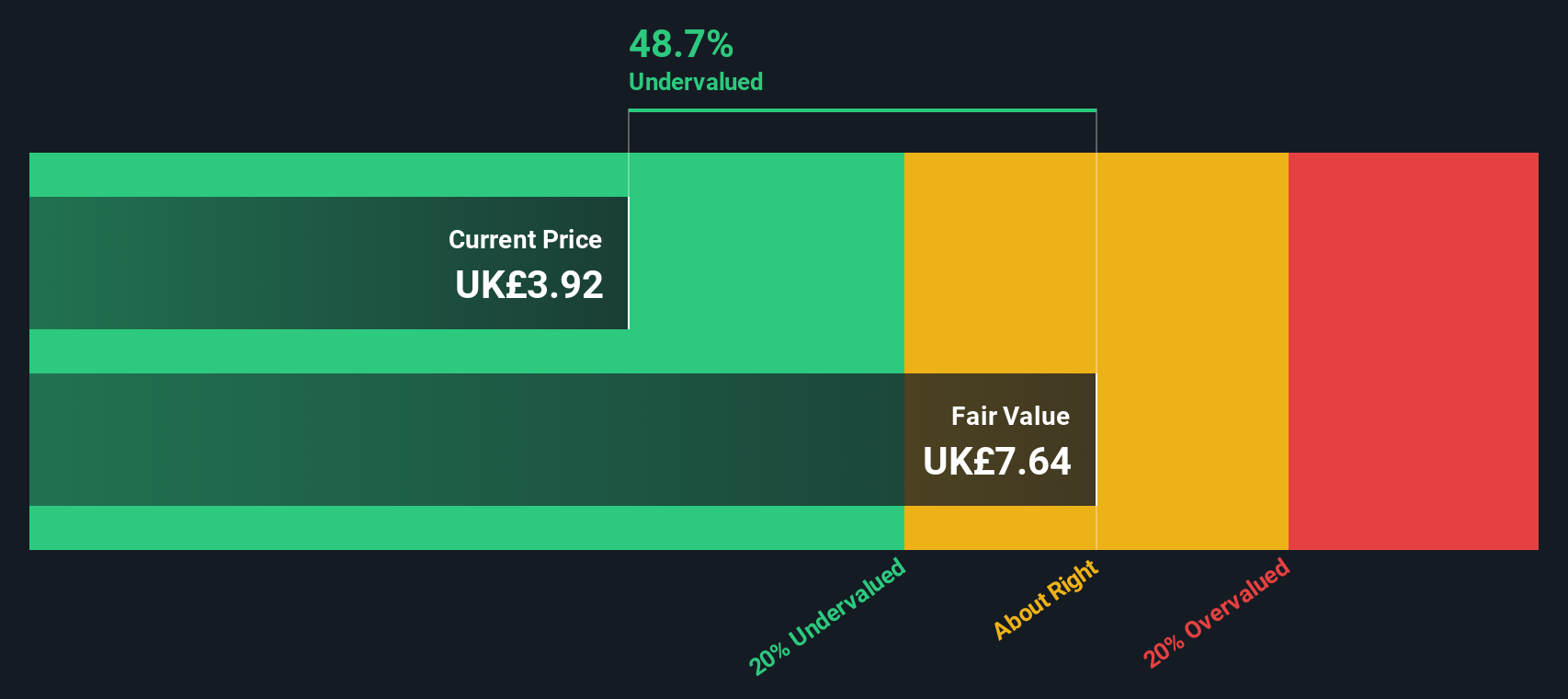

C&C Group (LSE:CCR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: C&C Group is a leading manufacturer, marketer, and distributor of branded cider, beer, wine, spirits, and soft drinks with a market capitalization of approximately €1.11 billion.

Operations: C&C Group's revenue primarily comes from sales, with recent figures showing a gross profit margin of 23.23%. The company faces significant costs, including cost of goods sold (COGS) and operating expenses, which have impacted net income margins negatively in recent periods.

PE: -5.7x

C&C Group, a company in the UK market, is drawing attention as an undervalued stock with insider confidence indicated by Ralph Findlay's purchase of 66,183 shares valued at €99,003. This move reflects potential optimism about future growth prospects. Despite a slight dip in half-year sales and net income compared to last year (€1.04 billion sales and €12.9 million net income), the company's earnings are forecasted to grow significantly by 90% annually. Recent executive changes include appointing Roger White as CEO from January 2025, potentially steering the company towards improved performance in the consumer goods sector.

- Delve into the full analysis valuation report here for a deeper understanding of C&C Group.

Gain insights into C&C Group's past trends and performance with our Past report.

Sirius Real Estate (LSE:SRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sirius Real Estate is a company focused on property investment, with operations centered around acquiring and managing business parks, offices, and industrial complexes in Germany; its market capitalization is approximately €1.36 billion.

Operations: The primary revenue stream is from property investment, with recent figures showing revenue of €306.6 million. The cost of goods sold (COGS) amounted to €128.3 million, leading to a gross profit margin of 58.15%. Operating expenses are noted at €51.0 million, while non-operating expenses include a credit of €4.3 million, contributing to a net income margin of 42.92%.

PE: 10.8x

Sirius Real Estate, a company with a focus on strategic acquisitions, recently expanded its portfolio by acquiring a development site in Munich for €13.3 million and a light industrial park in Lancashire for £9.05 million. These moves enhance their asset base and offer future development opportunities. Despite having higher-risk external funding, the company shows insider confidence with recent purchases, suggesting optimism about growth prospects amid an 18% annual earnings forecast increase.

- Click here to discover the nuances of Sirius Real Estate with our detailed analytical valuation report.

Explore historical data to track Sirius Real Estate's performance over time in our Past section.

Taking Advantage

- Investigate our full lineup of 34 Undervalued UK Small Caps With Insider Buying right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CCR

C&C Group

Manufactures, markets, and distributes beer, cider, wine, spirits, and soft drinks in the Republic of Ireland, Great Britain, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives