- United Kingdom

- /

- Chemicals

- /

- LSE:VCT

We Think Shareholders May Want To Consider A Review Of Victrex plc's (LON:VCT) CEO Compensation Package

Shareholders will probably not be too impressed with the underwhelming results at Victrex plc (LON:VCT) recently. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 10 February 2023. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

See our latest analysis for Victrex

Comparing Victrex plc's CEO Compensation With The Industry

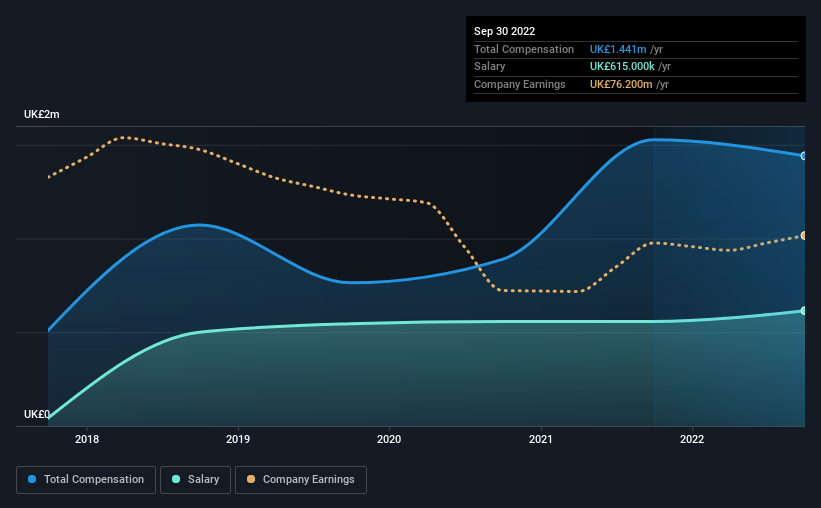

According to our data, Victrex plc has a market capitalization of UK£1.7b, and paid its CEO total annual compensation worth UK£1.4m over the year to September 2022. That's a slight decrease of 5.6% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£615k.

On comparing similar companies from the British Chemicals industry with market caps ranging from UK£830m to UK£2.7b, we found that the median CEO total compensation was UK£1.3m. This suggests that Victrex remunerates its CEO largely in line with the industry average. What's more, Jakob Sigurdsson holds UK£601k worth of shares in the company in their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | UK£615k | UK£558k | 43% |

| Other | UK£826k | UK£969k | 57% |

| Total Compensation | UK£1.4m | UK£1.5m | 100% |

Talking in terms of the industry, salary represented approximately 55% of total compensation out of all the companies we analyzed, while other remuneration made up 45% of the pie. It's interesting to note that Victrex allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Victrex plc's Growth

Over the last three years, Victrex plc has shrunk its earnings per share by 6.5% per year. It achieved revenue growth of 11% over the last year.

Overall this is not a very positive result for shareholders. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Victrex plc Been A Good Investment?

Given the total shareholder loss of 8.5% over three years, many shareholders in Victrex plc are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Victrex that you should be aware of before investing.

Switching gears from Victrex, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:VCT

Victrex

Through its subsidiaries, engages in the manufacture and sale of polymer solutions worldwide.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)