- United Kingdom

- /

- Metals and Mining

- /

- LSE:RIO

Is Now the Moment to Reassess Rio Tinto Stock After Recent 10% Rally?

Reviewed by Bailey Pemberton

So, you are weighing what to do with Rio Tinto Group stock right now. Should you build your position, take some profits, or just keep a watchful eye? It is a timely question, since the stock has picked up momentum over the last month, jumping 10.4% and climbing 2.6% in just the past week. Over longer stretches, Rio Tinto has managed a steady, if not spectacular, climb: up 6.7% year to date, 7.1% over the past year, and a striking 67% in five years. Clearly, something is going right, but what does that really mean for people thinking about the value sitting in this stock?

Behind some of this growth are broader moves in global commodities and mining, with market watchers paying close attention to demand signals from key industrial sectors. Risk sentiment has shifted at times, but investors seem cautiously optimistic, hunting for stocks with real underlying value rather than making speculative bets. Rio Tinto catches the eye here, with a valuation score of 5 out of 6. It appears genuinely undervalued in almost every standard check analysts run.

But how are those valuations actually calculated, and what do they miss? Let us dig into the standard methods for judging Rio Tinto’s true worth. Before we finish, we will also explore an even better lens for thinking about value in today’s market.

Why Rio Tinto Group is lagging behind its peers

Approach 1: Rio Tinto Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and then discounting those back to today's value. This approach helps investors assess what a company's shares should truly be worth, based on how much cash the business is expected to generate in years ahead.

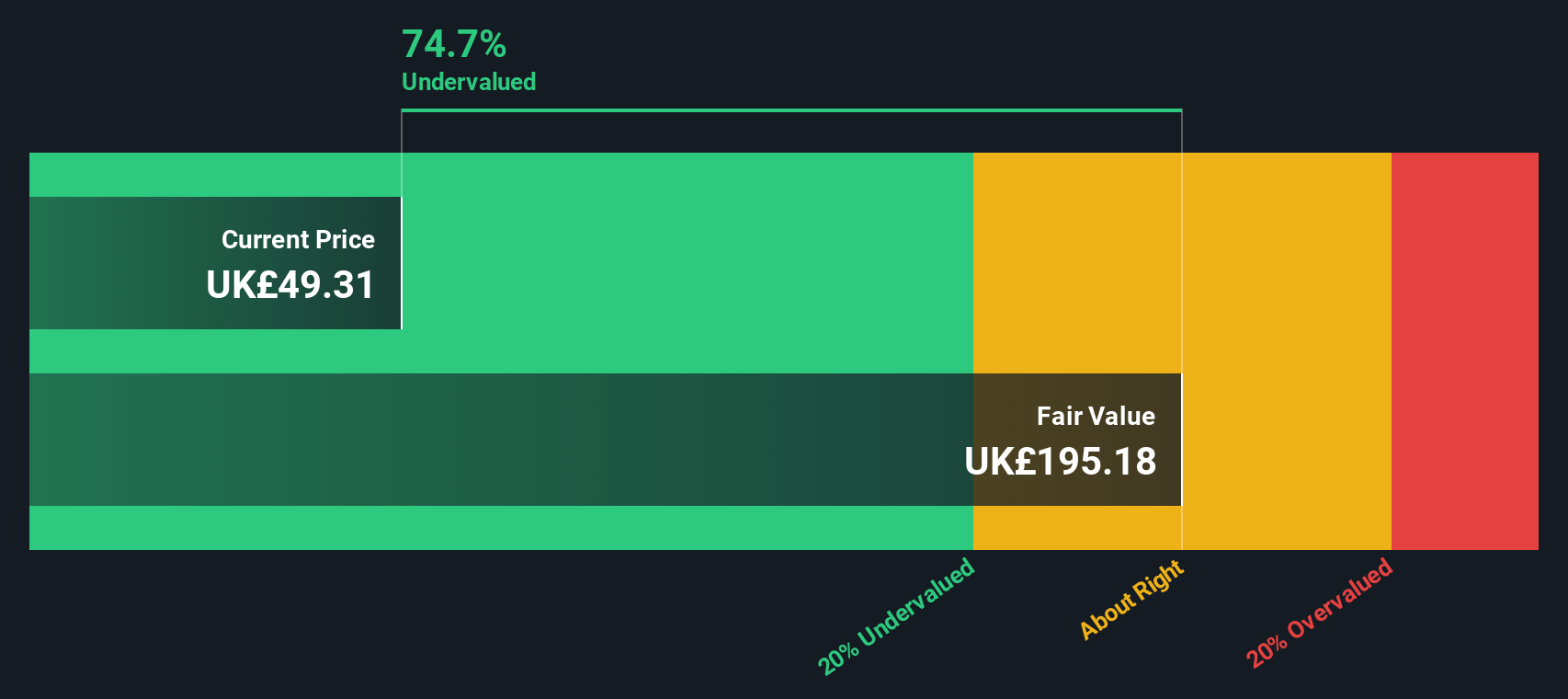

For Rio Tinto Group, the DCF model starts with its latest trailing twelve months free cash flow, which stands at $7.08 Billion. The company is expected to grow its free cash flow steadily over the coming years, with analysts projecting $14.36 Billion by 2028, and Simply Wall St extrapolating further growth to $31.14 Billion by 2035. All projections and calculations are based in US dollars.

Despite these impressive future cash flows, Rio Tinto’s current share price suggests the market is not fully pricing in this potential. The estimated intrinsic value is $183.38 per share, which implies the stock is trading at a 72.3% discount to its fair value according to this analysis.

In plain terms, the DCF model sees Rio Tinto as deeply undervalued on a cash flow basis. For investors looking for a strong value case, this is a notable finding.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rio Tinto Group is undervalued by 72.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Rio Tinto Group Price vs Earnings

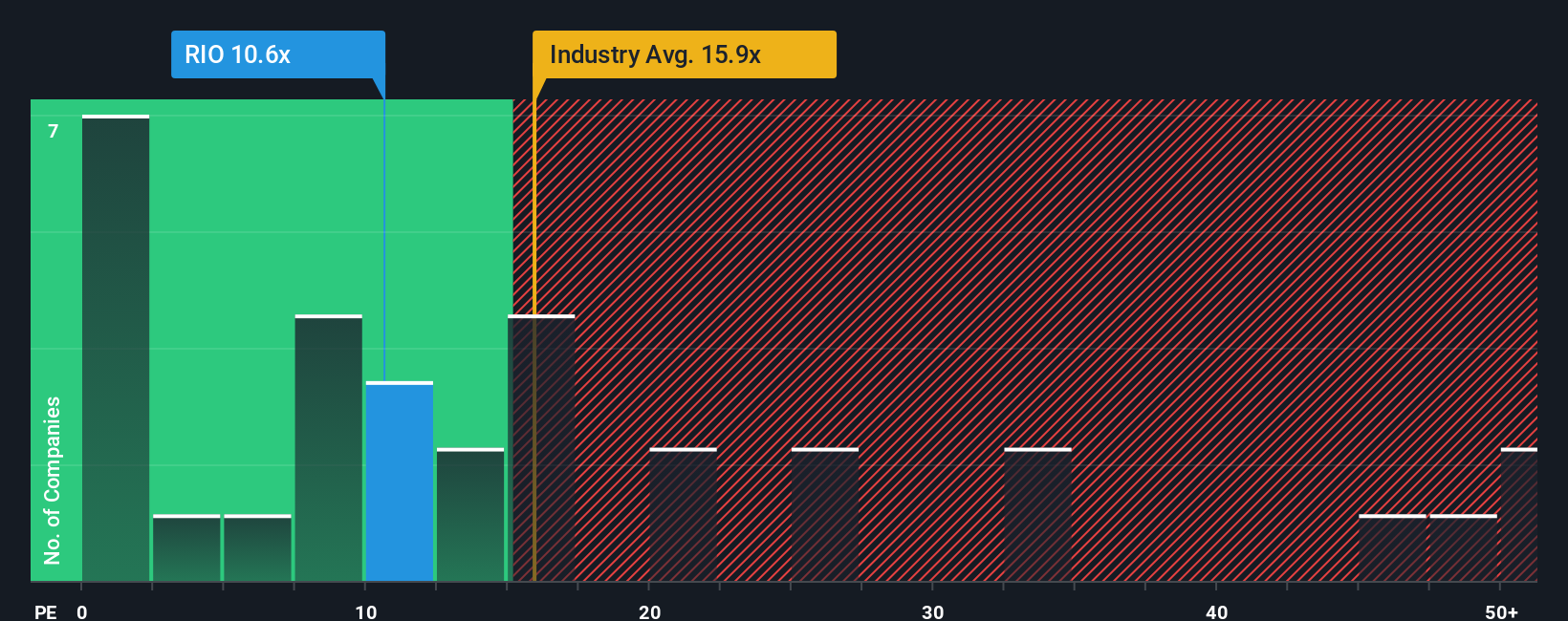

The price-to-earnings (PE) ratio is a widely used valuation tool for profitable companies like Rio Tinto Group, because it directly relates a company’s share price to its actual bottom line performance. Investors often start with the PE ratio to gauge how the market values a company’s ability to generate consistent profits.

A “normal” or “fair” PE ratio depends heavily on growth prospects and perceived risks. High-growth companies or those with stable, predictable earnings generally command higher PEs, while higher risks or muted growth weigh the ratio down. Context is key when interpreting whether a low or high PE ratio signals value or caution.

At the moment, Rio Tinto Group trades at a PE of 10.7x. This is significantly below the Metals and Mining industry average of 16.3x, and notably lower than the peer group average of 38.1x. On the surface, this discount could indicate undervaluation. However, benchmarks can be misleading if they do not factor in a company’s unique growth prospects, profitability, and risk profile.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike simple benchmarks, the Fair Ratio is tailored to Rio Tinto’s characteristics, incorporating its growth outlook, profit margins, market cap, and risks to estimate what a justified PE should be. For Rio Tinto, the Fair Ratio stands at 23.8x, well above the current multiple. This broader context suggests Rio Tinto’s stock is trading materially below its fair value, even when considering all its company-specific factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rio Tinto Group Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a clear, personalized investment story that connects your view of a company’s future, such as expected revenue growth, profit margins, and market risks, to a detailed financial forecast and an actionable estimate of Fair Value.

Narratives go beyond static ratios, empowering you to blend your own insights and research into the numbers. This allows you to see how changes in growth drivers, margins, or macro themes might alter what Rio Tinto Group is truly worth. On Simply Wall St’s Community page, millions of investors are using Narratives as an easy, interactive way to track and refine their views. You can compare your Fair Value to the current market Price, helping you decide with clarity whether now feels like the right time to buy, hold, or sell.

Best of all, Narratives constantly update when real-world news, earnings releases, or analyst estimates change, keeping your investment case fresh. For example, some investors see Rio Tinto’s expansion into copper and lithium as major tailwinds that drive up future earnings and fair value, while others focus on commodity price risks or project execution challenges. This leads to a range of fair value targets from £41.00 to £66.68 per share. With Narratives, you can easily test which perspective matches your own and upgrade your decision making for every stock you own.

Do you think there's more to the story for Rio Tinto Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RIO

Rio Tinto Group

Engages in exploring, mining, and processing mineral resources worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives