- United Kingdom

- /

- Basic Materials

- /

- LSE:RHIM

Here's Why RHI Magnesita (LON:RHIM) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies RHI Magnesita N.V. (LON:RHIM) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for RHI Magnesita

What Is RHI Magnesita's Net Debt?

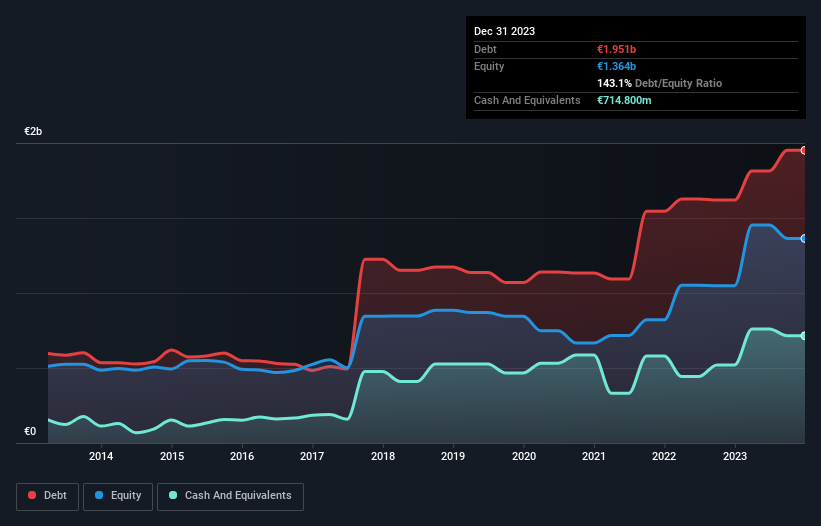

As you can see below, at the end of December 2023, RHI Magnesita had €1.95b of debt, up from €1.62b a year ago. Click the image for more detail. However, because it has a cash reserve of €714.8m, its net debt is less, at about €1.24b.

How Healthy Is RHI Magnesita's Balance Sheet?

The latest balance sheet data shows that RHI Magnesita had liabilities of €1.10b due within a year, and liabilities of €2.39b falling due after that. On the other hand, it had cash of €714.8m and €722.1m worth of receivables due within a year. So it has liabilities totalling €2.05b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's €1.94b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With net debt to EBITDA of 2.5 RHI Magnesita has a fairly noticeable amount of debt. But the high interest coverage of 7.1 suggests it can easily service that debt. Notably RHI Magnesita's EBIT was pretty flat over the last year. Ideally it can diminish its debt load by kick-starting earnings growth. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine RHI Magnesita's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, RHI Magnesita created free cash flow amounting to 5.8% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

To be frank both RHI Magnesita's level of total liabilities and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Overall, we think it's fair to say that RHI Magnesita has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for RHI Magnesita you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RHIM

RHI Magnesita

Develops, produces, sells, installs, and maintains refractory products and systems used in industrial high-temperature processes worldwide.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives