- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

UK Growth Stocks With High Insider Ownership Expecting Up To 81% Earnings Growth

Reviewed by Simply Wall St

In the last week, the United Kingdom market has remained flat, though it has experienced a 7.5% increase over the past year, with earnings projected to grow by 14% annually. In this context of steady growth, companies with high insider ownership often attract attention as potential investment opportunities due to their alignment of interests between management and shareholders and their capacity for significant earnings expansion.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Judges Scientific (AIM:JDG) | 10.6% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 29.0% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 81.3% |

| Petrofac (LSE:PFC) | 16.5% | 130.6% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

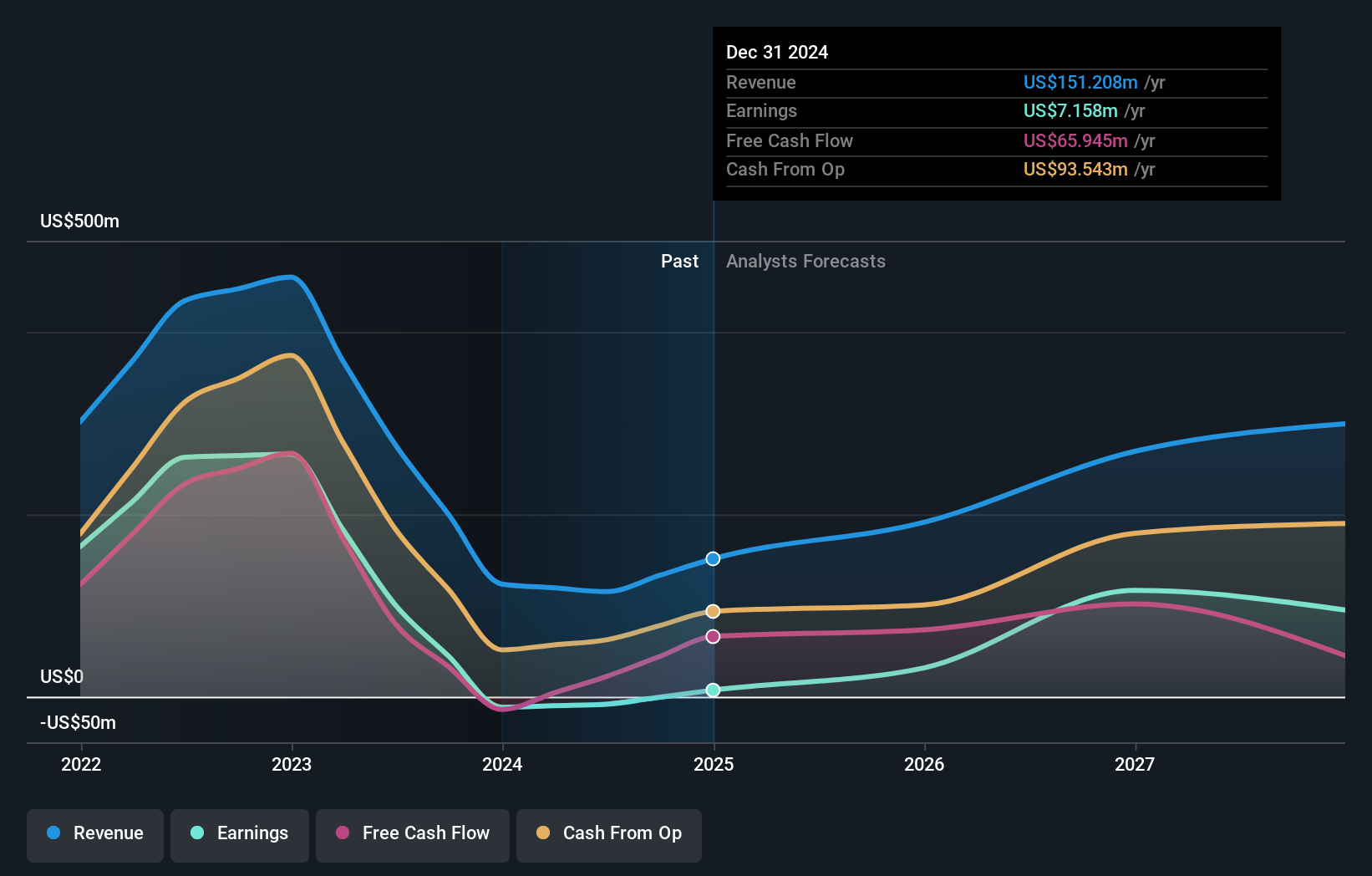

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £292.79 million.

Operations: The company generates revenue of $115.15 million from its oil and gas exploration and production activities in the Kurdistan Region of Iraq.

Insider Ownership: 12.2%

Earnings Growth Forecast: 81.3% p.a.

Gulf Keystone Petroleum has seen substantial insider buying recently, indicating confidence in its growth prospects. The company is trading at 27% below estimated fair value and expects revenue growth of 42.6% annually, outpacing the UK market. Despite a low forecasted return on equity of 19.9%, Gulf Keystone's earnings are projected to grow by 81.29% per year, with profitability anticipated within three years. However, its dividend yield of 7.75% isn't well covered by earnings or free cash flows.

- Unlock comprehensive insights into our analysis of Gulf Keystone Petroleum stock in this growth report.

- The valuation report we've compiled suggests that Gulf Keystone Petroleum's current price could be inflated.

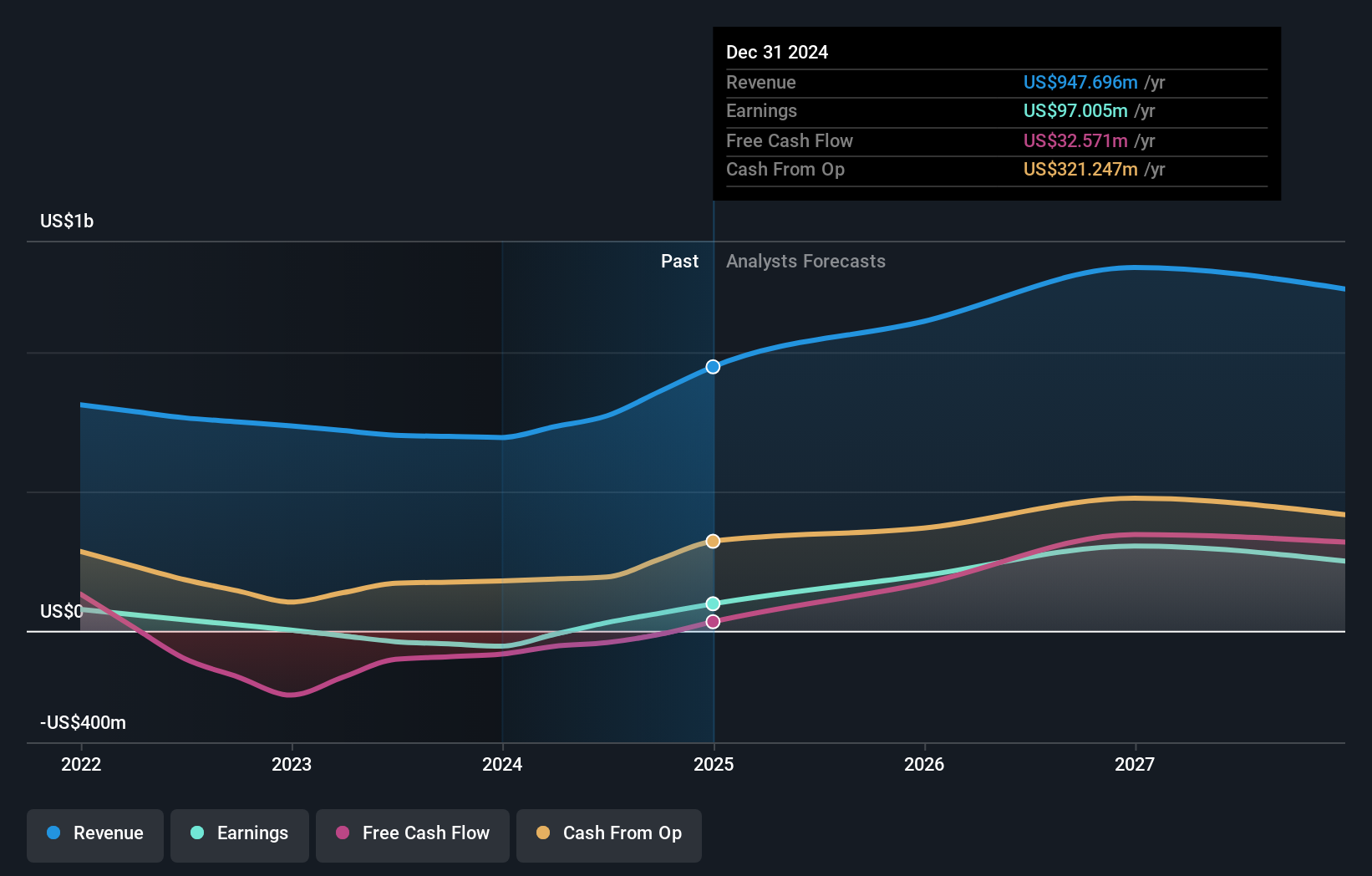

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £1.05 billion.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 49.8% p.a.

Hochschild Mining's recent profitability turnaround, with net income reaching US$39.52 million for H1 2024, underscores its growth potential despite high debt levels. Forecasts suggest earnings will grow significantly at 49.8% annually, outpacing the UK market. Revenue is also expected to rise faster than the market average but remains below 20% per year. The stock trades at a substantial discount to estimated fair value, though its share price has been highly volatile recently.

- Navigate through the intricacies of Hochschild Mining with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Hochschild Mining's share price might be on the expensive side.

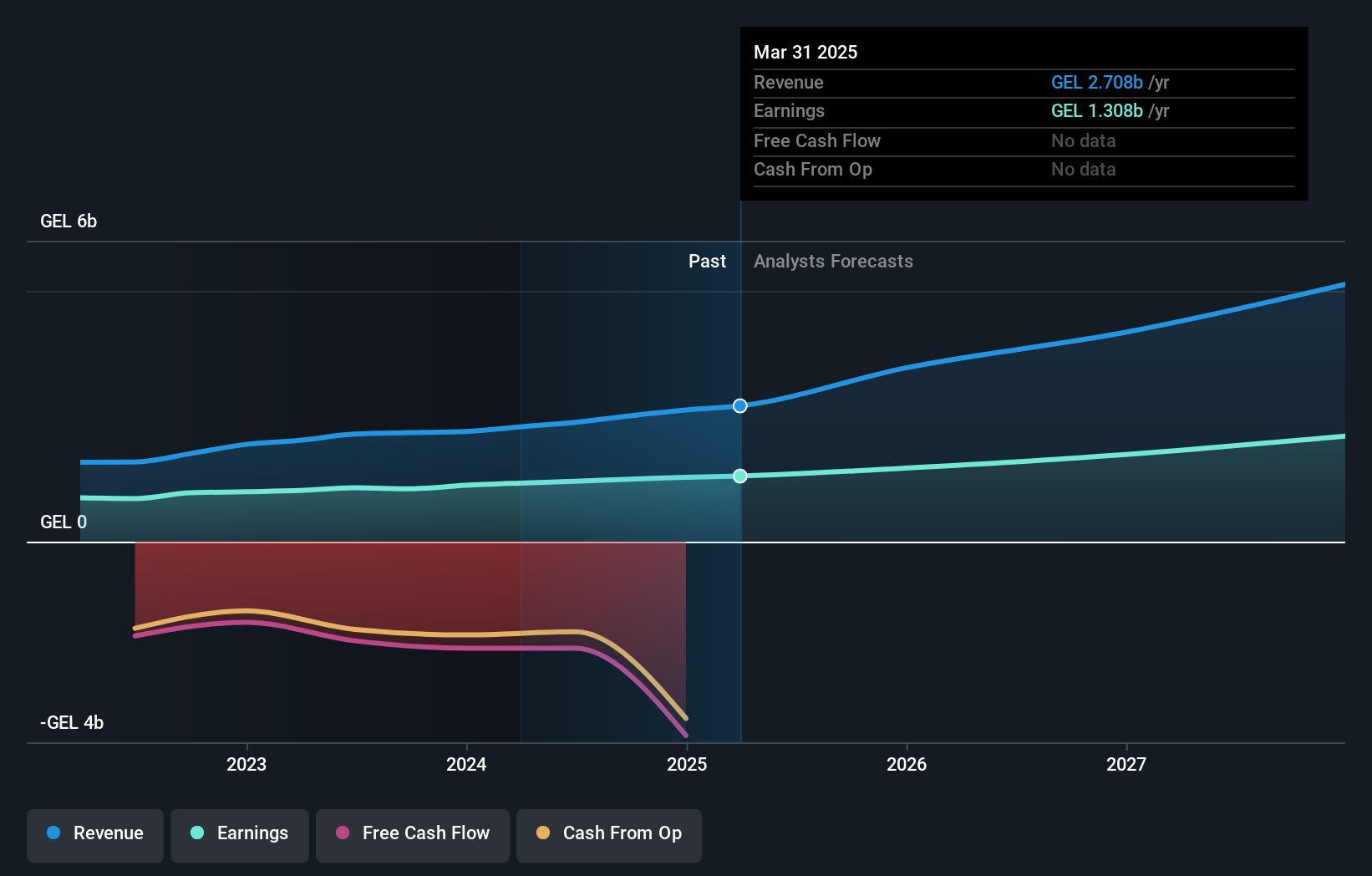

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC offers a range of financial services including banking, leasing, insurance, brokerage, and card processing to corporate and individual clients in Georgia, Azerbaijan, and Uzbekistan with a market cap of £1.45 billion.

Operations: The company generates revenue from its Uzbekistan operations amounting to GEL 236.42 million.

Insider Ownership: 17.6%

Earnings Growth Forecast: 15.3% p.a.

TBC Bank Group's growth potential is highlighted by its 12.1% earnings increase over the past year and forecasted revenue growth of 18.9% annually, surpassing the UK market average. Despite trading at a significant discount to estimated fair value, its dividend track record remains unstable. Recent executive changes, including appointing Giorgi Giguashvili as Company Secretary, reflect strategic governance enhancements while maintaining robust financial performance with GEL 617.4 million net income for H1 2024.

- Take a closer look at TBC Bank Group's potential here in our earnings growth report.

- According our valuation report, there's an indication that TBC Bank Group's share price might be on the cheaper side.

Turning Ideas Into Actions

- Discover the full array of 63 Fast Growing UK Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile.

Outstanding track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026