- United Kingdom

- /

- Hospitality

- /

- LSE:PTEC

3 UK Growth Companies With Insider Ownership Up To 38%

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over China's sluggish economic recovery and its impact on global trade. In such a volatile environment, growth companies with significant insider ownership can be appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| QinetiQ Group (LSE:QQ.) | 14.3% | 74.4% |

| Metals Exploration (AIM:MTL) | 10.4% | 96.3% |

| Manolete Partners (AIM:MANO) | 35.6% | 38.1% |

| Kainos Group (LSE:KNOS) | 23.8% | 23% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Energean (LSE:ENOG) | 19% | 21.1% |

| B90 Holdings (AIM:B90) | 21.3% | 157.2% |

| Afentra (AIM:AET) | 37.7% | 38.2% |

| ActiveOps (AIM:AOM) | 19.5% | 102.9% |

Let's explore several standout options from the results in the screener.

AO World (LSE:AO.)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AO World plc operates as an online retailer specializing in domestic appliances and ancillary services in the United Kingdom and Germany, with a market capitalization of approximately £599.19 million.

Operations: The company's revenue from the online retailing of domestic appliances and ancillary services is £1.21 billion.

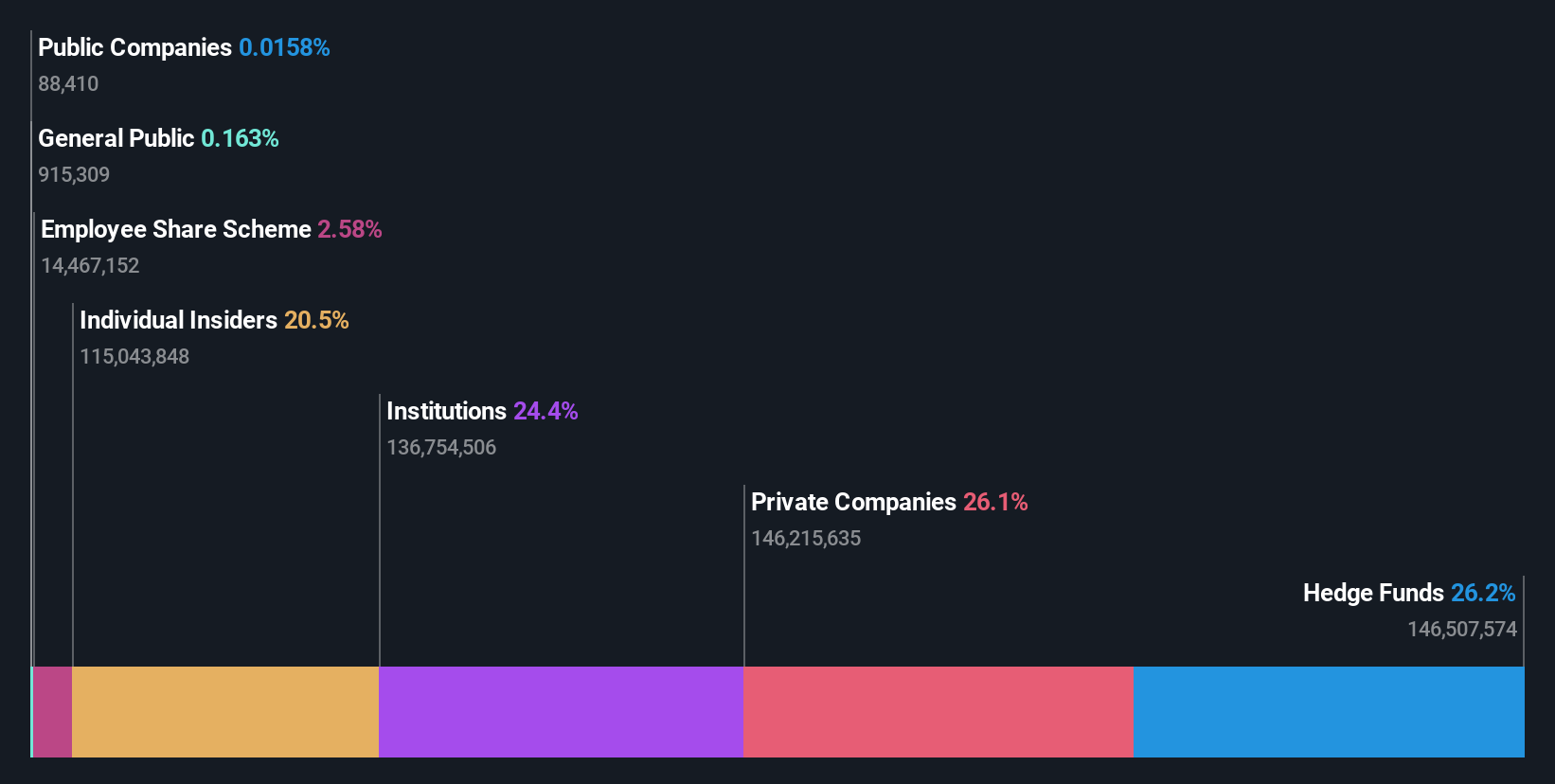

Insider Ownership: 20.5%

AO World anticipates robust earnings growth of 37.6% annually, outpacing the UK market's average. Despite a dip in profit margins from 2.5% to 0.9%, recent upgrades in earnings guidance suggest confidence in future performance, with profits before tax expected near £50 million for fiscal year 2025. While insider transactions show more buying than selling recently, revenue growth remains moderate at 7.4%. The company is actively repurchasing shares to enhance shareholder value.

- Navigate through the intricacies of AO World with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that AO World is priced higher than what may be justified by its financials.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile with a market cap of £2.24 billion.

Operations: The company's revenue is primarily derived from its operations at Inmaculada ($568.64 million), San Jose ($320.31 million), and Mara Rosa ($186.58 million).

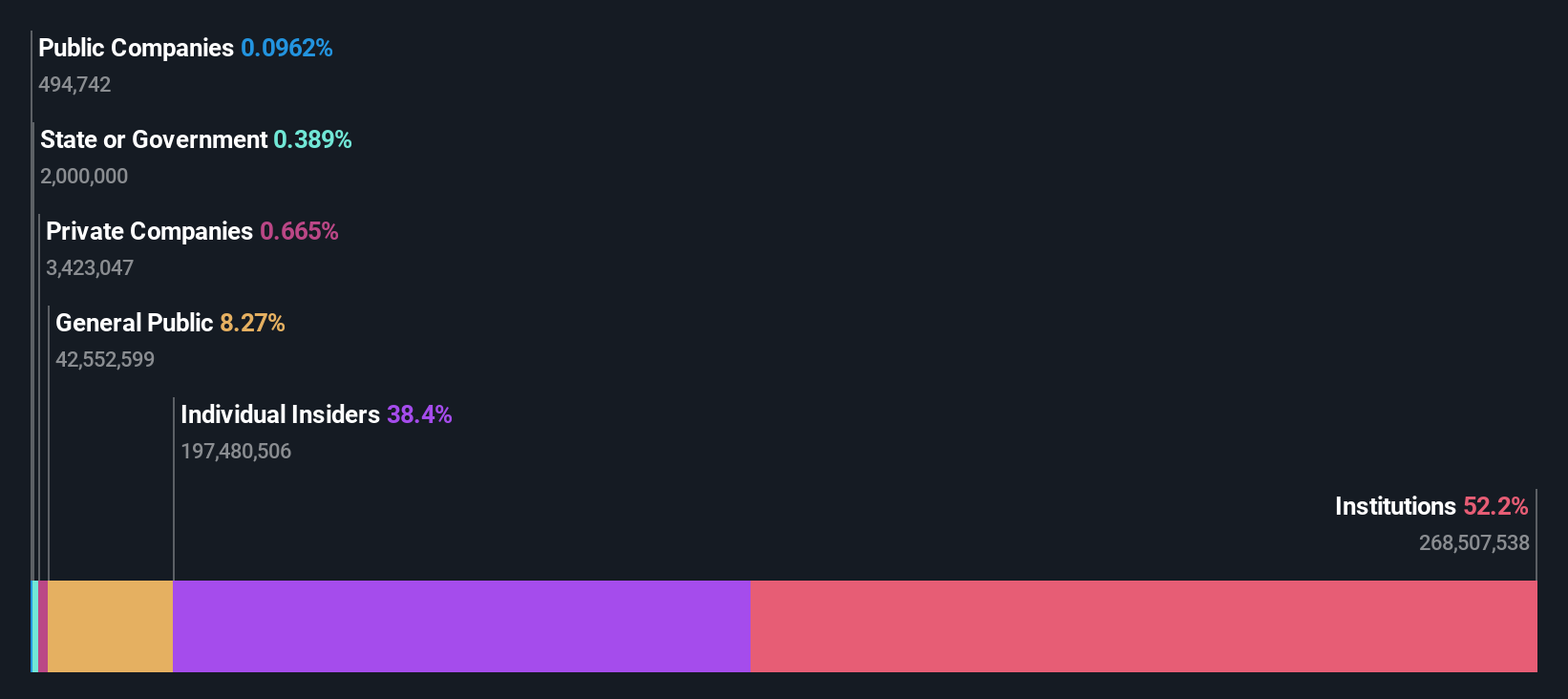

Insider Ownership: 38.4%

Hochschild Mining's earnings are expected to grow significantly at 24.42% annually, surpassing the UK market average. Despite a volatile share price and a forecasted low return on equity, the company trades 48.2% below its estimated fair value. Recent management changes aim to bolster operations in Brazil, a key market for Hochschild, amid ongoing reorganization efforts. Production guidance for 2025 remains steady despite lower Q3 production figures compared to last year.

- Dive into the specifics of Hochschild Mining here with our thorough growth forecast report.

- Our valuation report here indicates Hochschild Mining may be undervalued.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a technology company providing gambling software, services, content, and platform technologies across various international markets including Italy, Mexico, the UK, Europe, and Latin America with a market cap of £881.19 million.

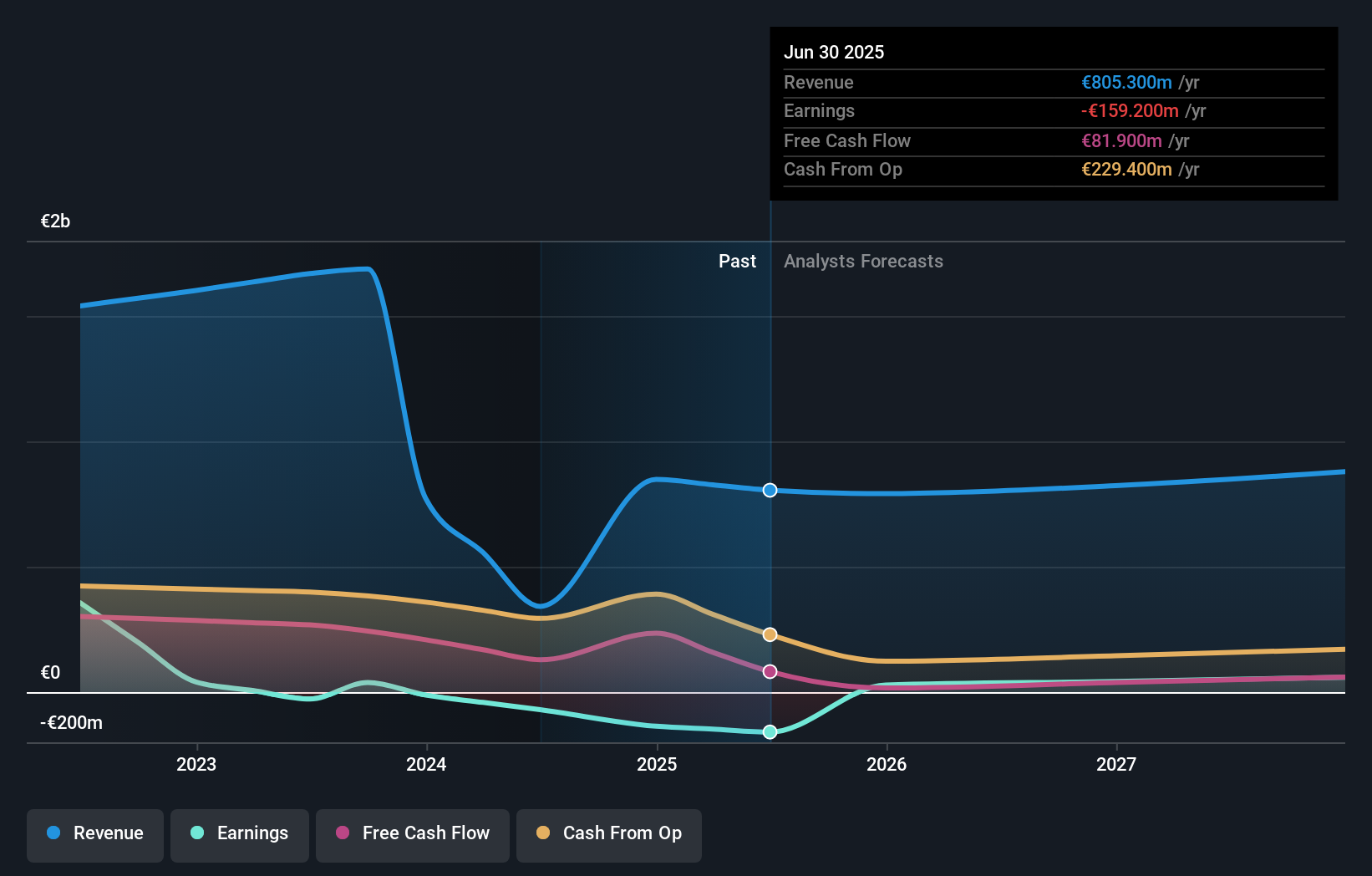

Operations: Playtech's revenue segments include €719.70 million from B2B operations, €17.10 million from HAPPYBET, and €72.20 million from Sun Bingo and other B2C activities.

Insider Ownership: 13.9%

Playtech's revenue is forecast to grow at 5.4% annually, outpacing the UK market. Earnings are expected to rise significantly by 62.56% per year, with profitability anticipated within three years. Despite a volatile share price and low return on equity projections, Playtech trades at a discount of 33.4% below its estimated fair value. The company has initiated a £43.7 million share repurchase program and seeks strategic acquisitions to enhance its B2B technology focus while maintaining financial flexibility.

- Click to explore a detailed breakdown of our findings in Playtech's earnings growth report.

- Our comprehensive valuation report raises the possibility that Playtech is priced lower than what may be justified by its financials.

Make It Happen

- Unlock our comprehensive list of 53 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Ready To Venture Into Other Investment Styles? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PTEC

Playtech

A technology company, operates as a gambling software, services, content, and platform technologies provider in Italy, Mexico, the United Kingdom, rest of Europe, Latin America, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)