- United Kingdom

- /

- Chemicals

- /

- LSE:ESNT

Essentra's (LON:ESNT) Shareholders Will Receive A Bigger Dividend Than Last Year

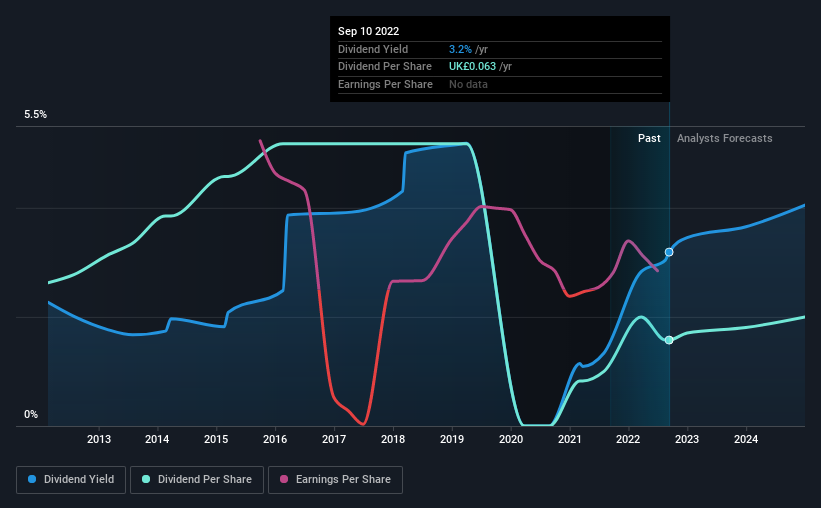

The board of Essentra plc (LON:ESNT) has announced that it will be increasing its dividend by 15% on the 28th of October to £0.023, up from last year's comparable payment of £0.02. This takes the annual payment to 3.2% of the current stock price, which is about average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Essentra's stock price has reduced by 36% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

See our latest analysis for Essentra

Essentra's Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before this announcement, Essentra was paying out 182% of what it was earning, and not generating any free cash flows either. Paying out such a large dividend compared to earnings while also not generating free cash flows is a major warning sign for the sustainability of the dividend as these levels are certainly a bit high.

Analysts expect a massive rise in earnings per share in the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 27%, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was £0.105 in 2012, and the most recent fiscal year payment was £0.063. The dividend has shrunk at around 5.0% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth Could Be Constrained

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. We are encouraged to see that Essentra has grown earnings per share at 20% per year over the past five years. Although earnings per share is up nicely Essentra is paying out 182% of its earnings as dividends, which we feel is borderline unsustainable without extenuating circumstances.

Essentra's Dividend Doesn't Look Sustainable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Essentra that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Essentra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ESNT

Essentra

Engages in the manufacturing and distribution of plastic injection moulded, vinyl dip moulded, and metal items in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.