- United Kingdom

- /

- Chemicals

- /

- LSE:ELM

3 Undervalued Small Caps In Global With Recent Insider Action

Reviewed by Simply Wall St

In recent weeks, global markets have been marked by a mix of economic indicators and geopolitical tensions, with U.S. consumer confidence experiencing its steepest drop since 2021 and small-cap indices like the Russell 2000 seeing declines amid broader growth concerns. Despite these challenges, opportunities may still exist within the small-cap segment for those who can identify stocks that are potentially undervalued and show signs of insider confidence through recent actions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.1x | 4.9x | 25.14% | ★★★★★★ |

| Speedy Hire | NA | 0.2x | 27.48% | ★★★★★☆ |

| Hong Leong Asia | 8.6x | 0.2x | 47.48% | ★★★★☆☆ |

| 4imprint Group | 15.8x | 1.3x | 36.56% | ★★★★☆☆ |

| Gamma Communications | 22.6x | 2.3x | 35.47% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 11.6x | 1.9x | 23.60% | ★★★★☆☆ |

| Franchise Brands | 37.5x | 1.9x | 27.90% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.00% | ★★★★☆☆ |

| Yixin Group | 8.8x | 0.8x | -264.99% | ★★★☆☆☆ |

| HBM Holdings | 24.1x | 7.1x | 13.24% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

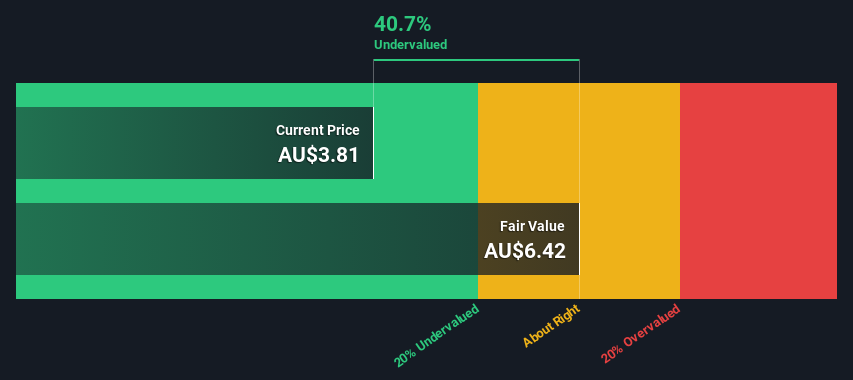

Regal Partners (ASX:RPL)

Simply Wall St Value Rating: ★★★★★★

Overview: Regal Partners is an investment management company focused on providing investment management services, with a market cap of A$1.45 billion.

Operations: Regal Partners generates revenue primarily from investment management services, with recent figures reaching A$257.55 million. The company's cost of goods sold (COGS) was A$107.07 million, contributing to a gross profit margin of 58.43%. Operating expenses include research and development costs and general administrative expenses, impacting net income margins which have shown variability over the periods analyzed.

PE: 15.7x

Regal Partners, a smaller company in the investment space, recently showcased significant growth with revenue jumping to A$257.55 million for 2024 from A$105.28 million the previous year. Net income surged to A$66.24 million from just A$1.6 million, highlighting its potential despite past shareholder dilution and reliance on external borrowing for funding. Insider confidence is evident as they have been purchasing shares since late 2024, suggesting optimism about future prospects amidst rising earnings forecasts of 21% annually.

- Click to explore a detailed breakdown of our findings in Regal Partners' valuation report.

Evaluate Regal Partners' historical performance by accessing our past performance report.

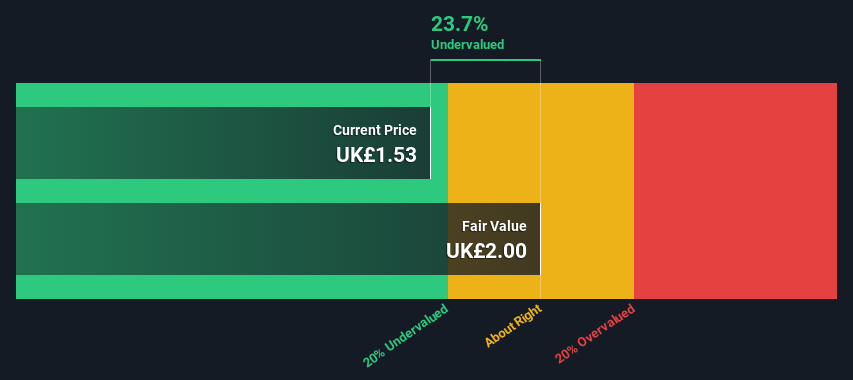

Elementis (LSE:ELM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Elementis is a specialty chemicals company focused on producing talc, personal care, and coatings products, with a market cap of approximately £0.72 billion.

Operations: Elementis generates revenue primarily from three segments: Talc, Personal Care, and Coatings (Including Energy), with the Coatings segment contributing the most. The company has experienced fluctuations in its net income margin, which was -0.047% as of the latest period. Gross profit margin has shown varied trends, reaching 41.87% in recent data points.

PE: -32.1x

Elementis, a company in the smaller stock category, has caught attention with its potential for growth. Earnings are projected to increase by 98% annually, suggesting significant upside. However, all liabilities stem from external borrowing, adding financial risk. Insider confidence is evident as insiders have been purchasing shares since late 2024. Christopher Mills joined as a Non-Executive Director in January 2025, potentially bringing strategic insight from his extensive investment background.

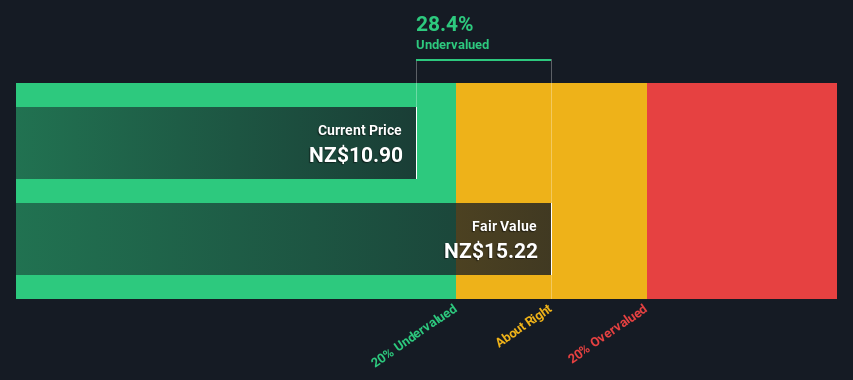

Freightways Group (NZSE:FRW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Freightways Group operates in the express package and business mail sector, as well as information management services, with a market cap of NZ$1.73 billion.

Operations: Freightways Group's revenue primarily comes from the Express Package & Business Mail segment, contributing NZ$1.03 billion, and the Information Management segment with NZ$226.23 million. The company's gross profit margin has shown a decline over time, standing at 29.52% as of March 2025. Operating expenses have consistently increased, reaching NZ$227.40 million in the same period.

PE: 26.4x

Freightways Group, a smaller company in its sector, shows signs of being undervalued with recent insider confidence as they increased their shareholdings between January and February 2025. Despite relying solely on external borrowing for funding, the company reported improved sales of NZ$662 million and net income of NZ$44.64 million for the half year ending December 2024. With earnings per share rising to NZ$0.25, future growth is projected at 12% annually.

Seize The Opportunity

- Investigate our full lineup of 117 Undervalued Global Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elementis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ELM

Elementis

Operates as a specialty chemical company in the United Kingdom, rest of Europe, North America, and internationally.

Excellent balance sheet and fair value.