- United Kingdom

- /

- Chemicals

- /

- LSE:CRDA

Should You Be Adding Croda International (LON:CRDA) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Croda International (LON:CRDA), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Croda International with the means to add long-term value to shareholders.

Check out the opportunities and risks within the GB Chemicals industry.

How Quickly Is Croda International Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Croda International's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 41%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

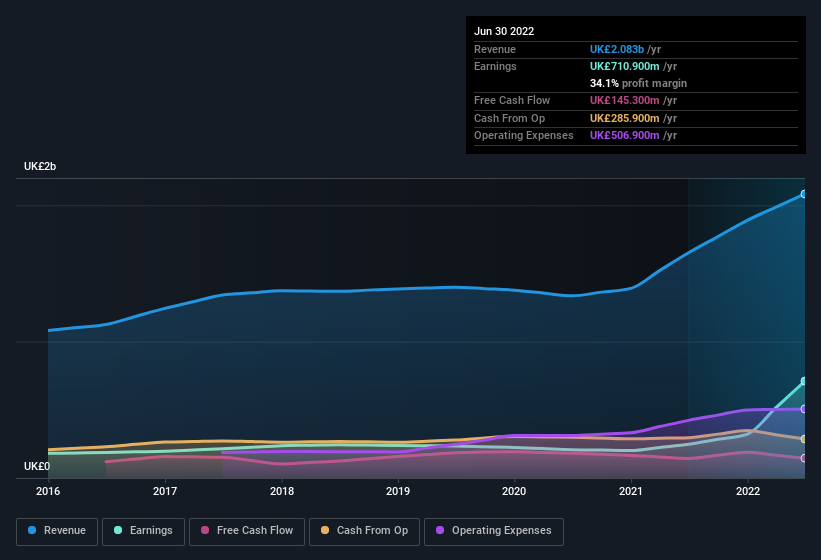

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Croda International maintained stable EBIT margins over the last year, all while growing revenue 26% to UK£2.1b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Croda International's future profits.

Are Croda International Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a UK£9.6b company like Croda International. But we are reassured by the fact they have invested in the company. Indeed, they hold UK£29m worth of its stock. This considerable investment should help drive long-term value in the business. Despite being just 0.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Croda International Deserve A Spot On Your Watchlist?

Croda International's earnings per share growth have been climbing higher at an appreciable rate. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Croda International for a spot on your watchlist. Even so, be aware that Croda International is showing 2 warning signs in our investment analysis , you should know about...

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Croda International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CRDA

Croda International

Engages in the consumer care, life science, and industrial specialty businesses in in Europe, the Middle East, Africa, North America, Asia, and Latin America.

Flawless balance sheet and fair value.