- United Kingdom

- /

- Chemicals

- /

- LSE:CAR

Further Upside For Carclo plc (LON:CAR) Shares Could Introduce Price Risks After 32% Bounce

Carclo plc (LON:CAR) shares have continued their recent momentum with a 32% gain in the last month alone. The annual gain comes to 215% following the latest surge, making investors sit up and take notice.

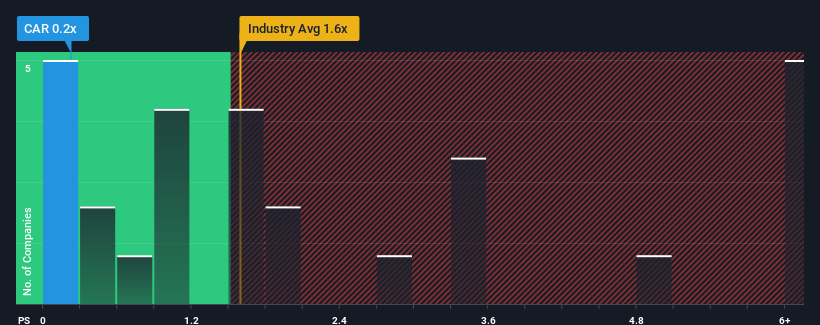

In spite of the firm bounce in price, Carclo's price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Chemicals industry in the United Kingdom, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Carclo

What Does Carclo's P/S Mean For Shareholders?

Recent times have been more advantageous for Carclo as its revenue hasn't fallen as much as the rest of the industry. One possibility is that the P/S ratio is low because investors think this relatively better revenue performance might be about to deteriorate significantly. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Carclo.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Carclo would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.5%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 23% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth will be highly resilient over the next three years growing by 6.8% per annum. Meanwhile, the broader industry is forecast to contract by 2.7% each year, which would indicate the company is doing very well.

In light of this, it's quite peculiar that Carclo's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What Does Carclo's P/S Mean For Investors?

Despite Carclo's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Carclo currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Carclo you should be aware of, and 2 of them can't be ignored.

If these risks are making you reconsider your opinion on Carclo, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CAR

Carclo

Provides plastic components for the life sciences, aerospace, and advanced industries in the United Kingdom, France, the Czech Republic, China, India, rest of Europe, North America, and internationally.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives