- United Kingdom

- /

- Metals and Mining

- /

- AIM:SRB

Serabi Gold's (LON:SRB) three-year earnings growth trails the fantastic shareholder returns

For us, stock picking is in large part the hunt for the truly magnificent stocks. But when you hold the right stock for the right time period, the rewards can be truly huge. One such superstar is Serabi Gold plc (LON:SRB), which saw its share price soar 974% in three years. On top of that, the share price is up 38% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. It really delights us to see such great share price performance for investors.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

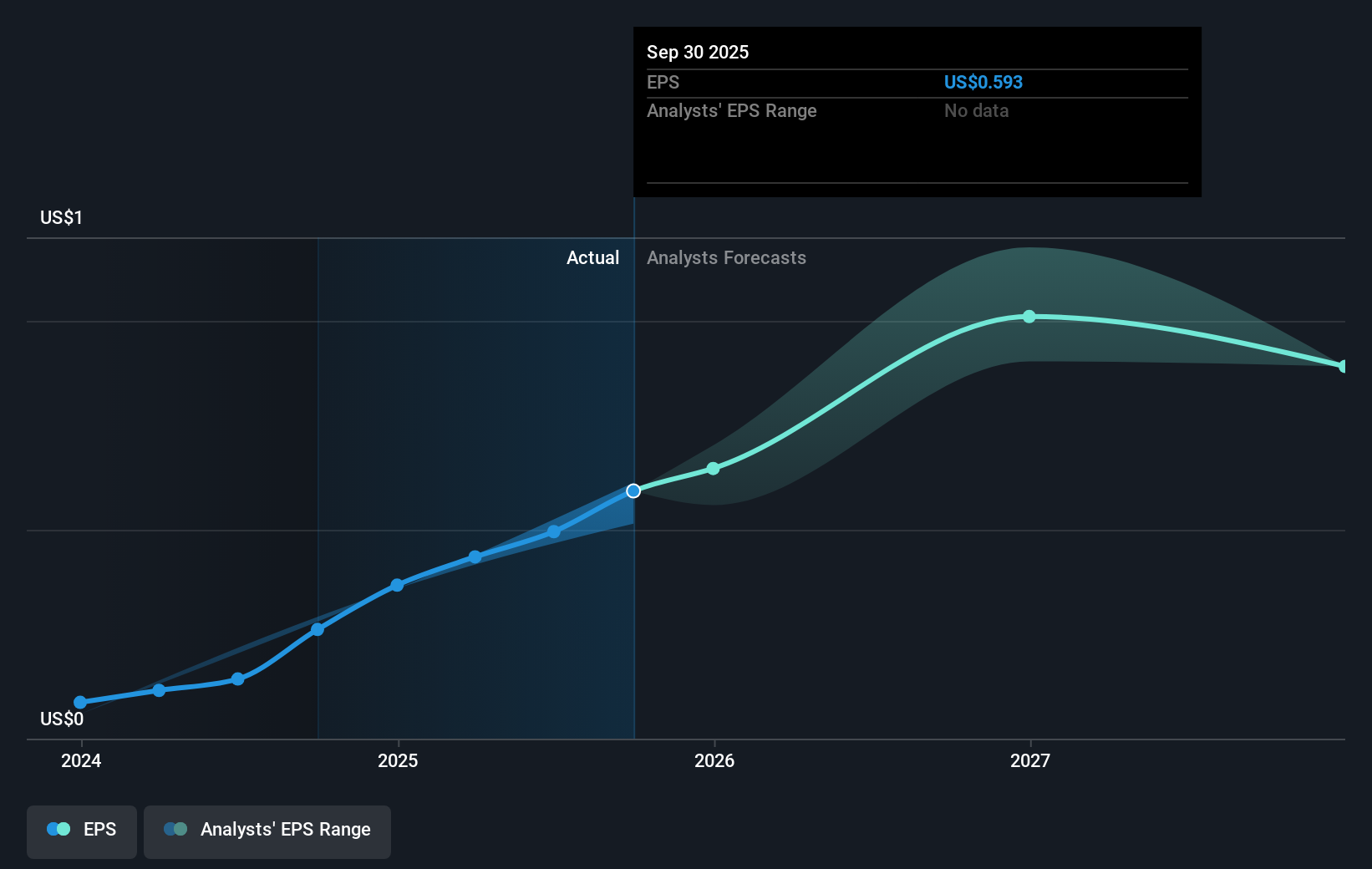

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Serabi Gold was able to grow its EPS at 215% per year over three years, sending the share price higher. The average annual share price increase of 121% is actually lower than the EPS growth. So it seems investors have become more cautious about the company, over time. We'd venture the lowish P/E ratio of 6.52 also reflects the negative sentiment around the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Serabi Gold's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Serabi Gold shareholders have received a total shareholder return of 179% over the last year. That's better than the annualised return of 27% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Serabi Gold better, we need to consider many other factors. Take risks, for example - Serabi Gold has 1 warning sign we think you should be aware of.

Serabi Gold is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SRB

Serabi Gold

Engages in the evaluation, exploration, and development of gold and other metals mining projects in Brazil.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026