- United Kingdom

- /

- Entertainment

- /

- AIM:OMIP

UK Penny Stocks: Huddled Group And 2 More Promising Investments

Reviewed by Simply Wall St

The United Kingdom's market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic interdependencies. Despite these challenges, there remains interest in smaller or newer companies often categorized as penny stocks—a term that might seem outdated but still holds relevance for investors seeking growth opportunities at lower price points. By focusing on financial strength and solid fundamentals, these stocks can offer potential upside while mitigating some of the risks typically associated with this segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £1.01 | £159.32M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.145 | £808.16M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.175 | £100.28M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.95 | £188.38M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.292 | £199.26M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.29 | £426.67M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.442 | $256.95M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.15 | £87.09M | ★★★★★★ |

Click here to see the full list of 466 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Huddled Group (AIM:HUD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Huddled Group Plc, with a market cap of £10.60 million, operates in the United Kingdom offering virtual reality headsets under the Vodiac brand name.

Operations: The company generates revenue primarily from the United Kingdom (£7.14 million) and to a lesser extent from USA & Canada (£0.5 million).

Market Cap: £10.6M

Huddled Group Plc, with a market cap of £10.60 million, has shown significant revenue growth in the past year, reporting £5.27 million for the first half of 2024 compared to just £0.062 million a year ago. Despite this increase, the company remains unprofitable with a net loss of £1.75 million for the same period. The company's financial position is relatively stable; it has more cash than debt and its short-term assets exceed both short and long-term liabilities. However, high weekly volatility and negative return on equity highlight ongoing challenges in achieving profitability amidst its expanding operations in virtual reality headsets under the Vodiac brand name.

- Take a closer look at Huddled Group's potential here in our financial health report.

- Examine Huddled Group's past performance report to understand how it has performed in prior years.

One Media iP Group (AIM:OMIP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: One Media iP Group Plc focuses on acquiring and exploiting mixed media intellectual property rights for digital and traditional media distribution globally, with a market cap of £9.45 million.

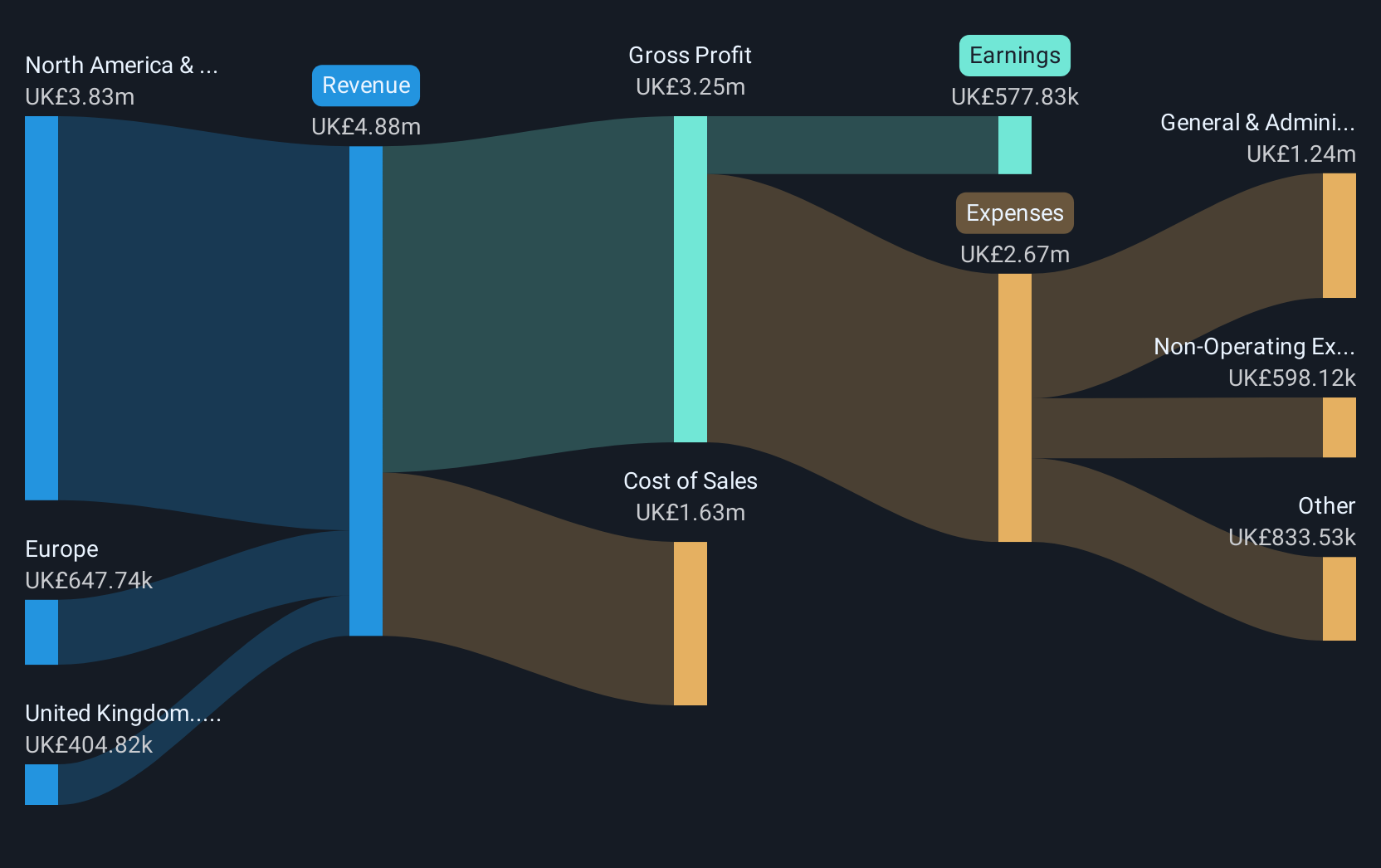

Operations: The company's revenue is primarily derived from Licenses (£5.08 million) and Tcat (£0.30 million).

Market Cap: £9.45M

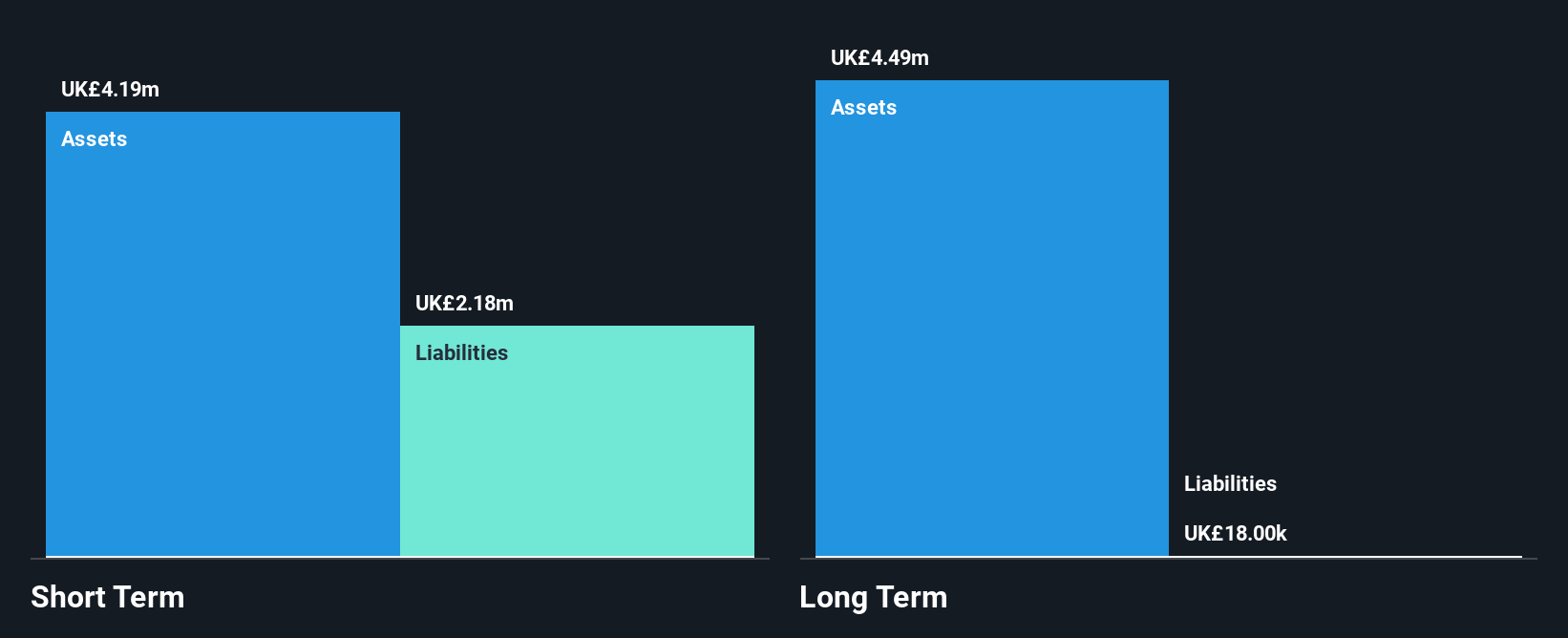

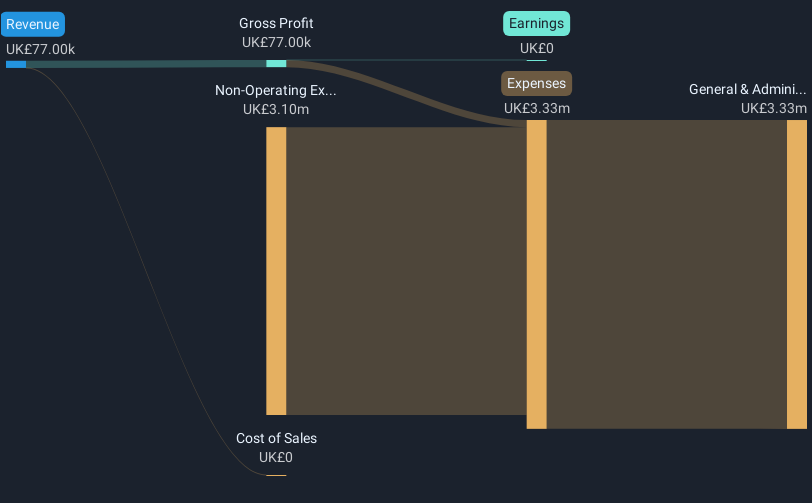

One Media iP Group Plc, with a market cap of £9.45 million, derives revenue primarily from Licenses (£5.08 million) and Tcat (£0.30 million). The company's financial health is supported by short-term assets exceeding both short and long-term liabilities, while its debt levels are satisfactory with a net debt to equity ratio of 3.1%. However, challenges persist as earnings have declined by 16.3% annually over the past five years, and recent negative earnings growth complicates comparisons within the entertainment industry. Despite trading significantly below estimated fair value, low return on equity (0.8%) remains a concern for potential investors in this space.

- Navigate through the intricacies of One Media iP Group with our comprehensive balance sheet health report here.

- Gain insights into One Media iP Group's future direction by reviewing our growth report.

Power Metal Resources (AIM:POW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Power Metal Resources plc, with a market cap of £16.82 million, is involved in the exploration and exploitation of mineral resources across Africa, Australia, Canada, and the United States.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £16.82M

Power Metal Resources plc, with a market cap of £16.82 million, is pre-revenue and focused on mineral exploration across several continents. Recent activities highlight its uranium-focused joint venture with UCAM Ltd., which involves multiple projects in Canada. The company has identified promising targets through geophysical surveys and sampling programs, particularly at the Drake Lake-Silas Uranium Project and Perch River Uranium Project. Despite shareholder dilution over the past year, Power Metal remains debt-free with short-term assets covering liabilities. However, its volatile share price and negative return on equity reflect ongoing financial challenges typical for early-stage exploration companies.

- Click here to discover the nuances of Power Metal Resources with our detailed analytical financial health report.

- Evaluate Power Metal Resources' historical performance by accessing our past performance report.

Taking Advantage

- Click this link to deep-dive into the 466 companies within our UK Penny Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:OMIP

One Media iP Group

Engages in the acquisition and exploitation of mixed media intellectual property rights for distribution through the digital medium and traditional media outlets in the United Kingdom, Europe, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives