- United Kingdom

- /

- Chemicals

- /

- AIM:HAYD

Shareholders May Not Be So Generous With Haydale Graphene Industries plc's (LON:HAYD) CEO Compensation And Here's Why

Key Insights

- Haydale Graphene Industries will host its Annual General Meeting on 7th of December

- Salary of UK£209.0k is part of CEO Keith Broadbent's total remuneration

- The total compensation is similar to the average for the industry

- Haydale Graphene Industries' three-year loss to shareholders was 89% while its EPS grew by 3.8% over the past three years

In the past three years, the share price of Haydale Graphene Industries plc (LON:HAYD) has struggled to grow and now shareholders are sitting on a loss. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 7th of December could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Haydale Graphene Industries

How Does Total Compensation For Keith Broadbent Compare With Other Companies In The Industry?

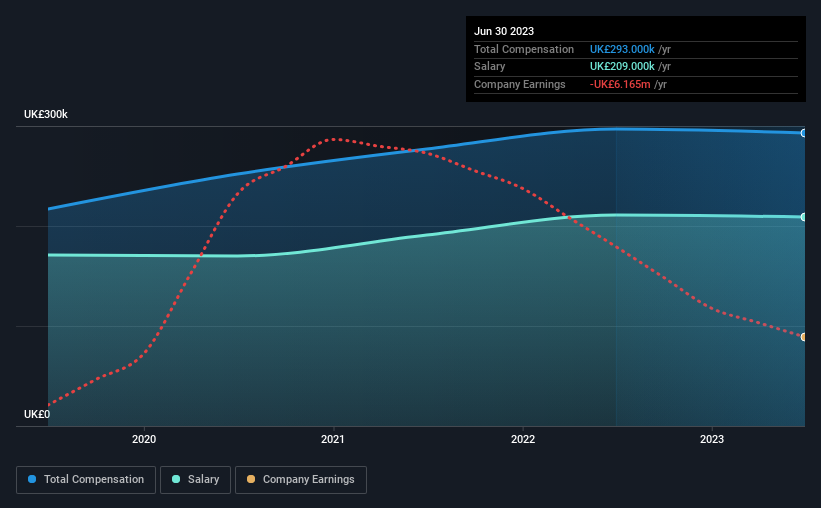

According to our data, Haydale Graphene Industries plc has a market capitalization of UK£7.8m, and paid its CEO total annual compensation worth UK£293k over the year to June 2023. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is UK£209.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the British Chemicals industry with market capitalizations below UK£158m, we found that the median total CEO compensation was UK£284k. From this we gather that Keith Broadbent is paid around the median for CEOs in the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | UK£209k | UK£211k | 71% |

| Other | UK£84k | UK£86k | 29% |

| Total Compensation | UK£293k | UK£297k | 100% |

Talking in terms of the industry, salary represented approximately 71% of total compensation out of all the companies we analyzed, while other remuneration made up 29% of the pie. There isn't a significant difference between Haydale Graphene Industries and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Haydale Graphene Industries plc's Growth Numbers

Haydale Graphene Industries plc has seen its earnings per share (EPS) increase by 3.8% a year over the past three years. In the last year, its revenue is up 48%.

It's hard to interpret the strong revenue growth as anything other than a positive. With that in mind, the modestly improving EPS seems positive. We'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Haydale Graphene Industries plc Been A Good Investment?

The return of -89% over three years would not have pleased Haydale Graphene Industries plc shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 5 warning signs for Haydale Graphene Industries (of which 3 are concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Haydale Graphene Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HAYD

Haydale Graphene Industries

Through its subsidiaries, engages in the design, development, and commercialization of advanced materials using graphene and other nanomaterials in United Kingdom, Europe, the United States, China, Thailand, South Korea, Japan, and internationally.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.