- United Kingdom

- /

- Marine and Shipping

- /

- LSE:ICGC

Exploring Central Asia Metals Alongside Two Distinguished UK Dividend Stocks

Reviewed by Kshitija Bhandaru

In recent times, the United Kingdom market has shown a consistent pattern, maintaining a flat trajectory over the last week and similarly over the past year. However, with earnings anticipated to grow by 13% annually, investors may find reassurance in dividend stocks that offer potential for steady income and growth prospects in these stable market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 7.86% | ★★★★★★ |

| Keller Group (LSE:KLR) | 4.49% | ★★★★★☆ |

| BAE Systems (LSE:BA.) | 2.30% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.32% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 7.59% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.29% | ★★★★★☆ |

| Intertek Group (LSE:ITRK) | 2.30% | ★★★★★☆ |

| Nationwide Building Society (LSE:NBS) | 7.62% | ★★★★★☆ |

| Cohort (AIM:CHRT) | 2.35% | ★★★★★☆ |

| BBGI Global Infrastructure (LSE:BBGI) | 6.26% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Central Asia Metals (AIM:CAML)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Central Asia Metals plc is a base metals producer with a diverse portfolio of operations, currently holding a market capitalization of approximately £315.59 million.

Operations: Central Asia Metals plc generates its revenues primarily from two segments: the Sasa mine, contributing $86.67 million, and the Kounrad project, accounting for $114.01 million.

Dividend Yield: 9.4%

Central Asia Metals, despite a dividend yield among the UK's top 25%, faces challenges with sustainability, as earnings and cash flows do not fully cover its high payout ratio of 3101.7%. The company's recent production guidance anticipates stable output for 2024, yet profit margins have significantly dipped from last year to just 0.7%. Moreover, dividends have shown volatility over the past decade, adding an element of uncertainty for income-focused investors.

- Click here to discover the nuances of Central Asia Metals with our detailed analytical dividend report.

Our expertly prepared valuation report Central Asia Metals implies its share price may be too high.

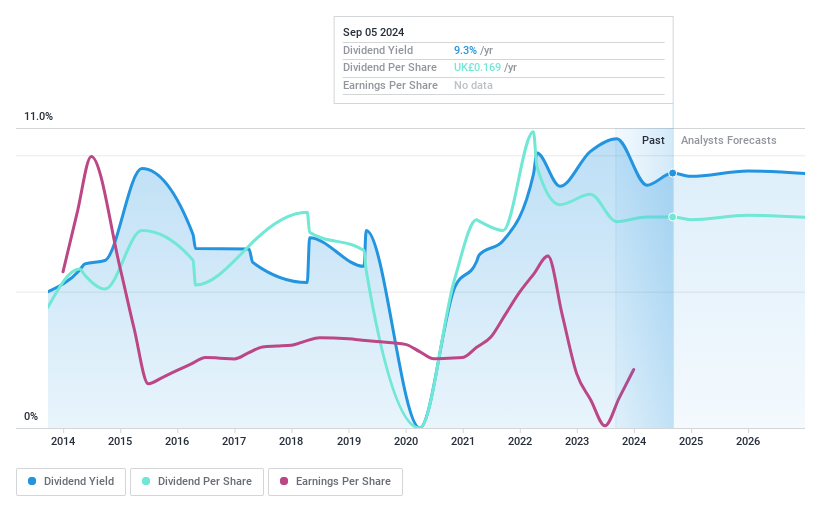

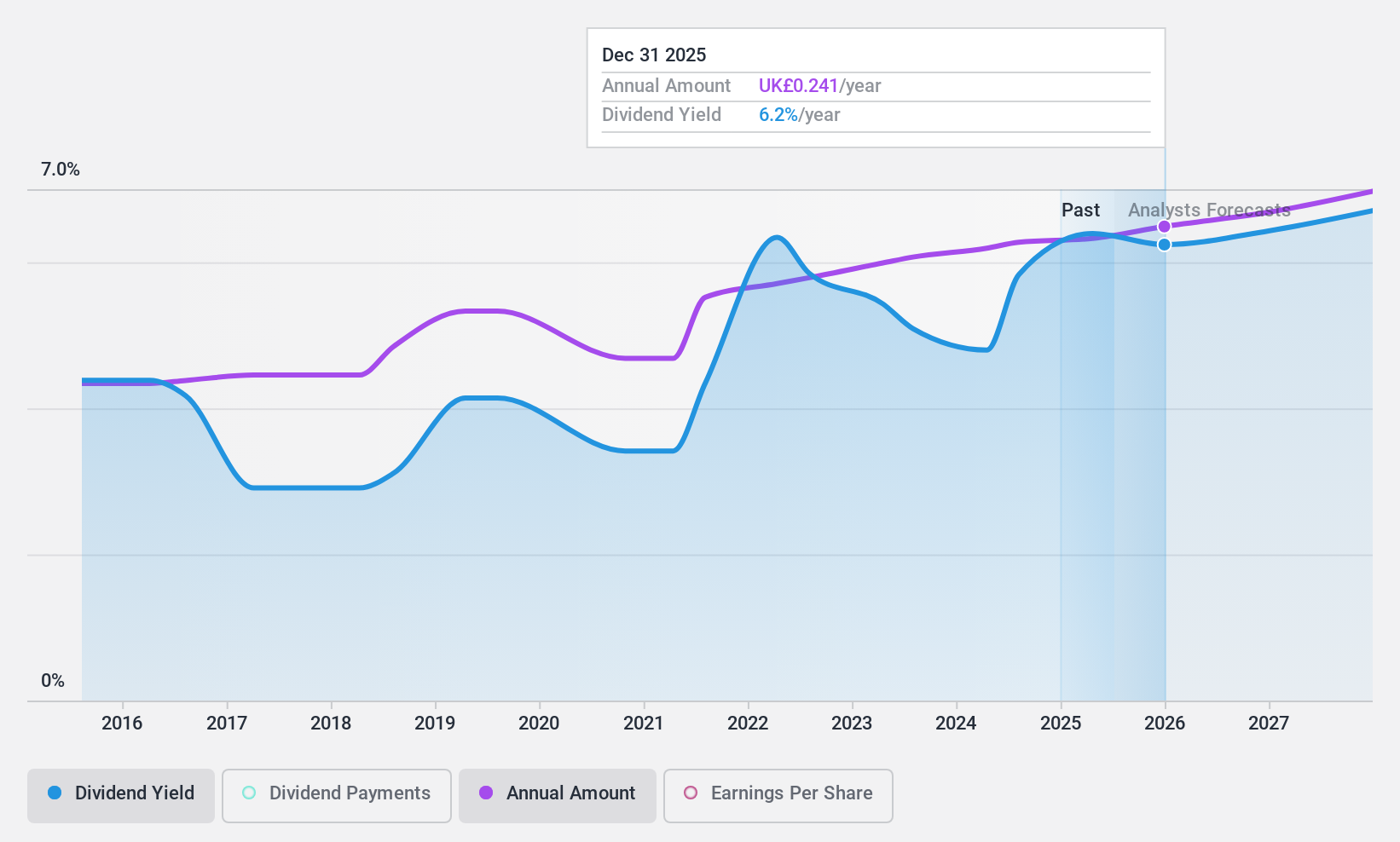

Vesuvius (LSE:VSVS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vesuvius plc is a global company specializing in molten metal flow engineering and technology services for the steel and foundry industries, with a market capitalization of approximately £1.28 billion.

Operations: Vesuvius plc generates its revenue from various segments, primarily including Foundry at £529.8 million, Steel - Flow Control at £793 million, Steel - Sensors & Probes at £39.1 million, and Steel - Advanced Refractories at £567.9 million.

Dividend Yield: 4.8%

Vesuvius plc's dividend, at 23.0 pence per share for the year, is backed by both earnings and cash flows with payout ratios of 52.2% and 49.3% respectively, suggesting financial prudence in its distribution policy. However, the company's dividend yield stands at a modest 4.77%, below the UK market's top quartile of 6.22%. Recent strategic moves indicate potential growth avenues through M&A activities supported by a strong balance sheet and liquidity position, yet dividends have historically been inconsistent, and profit margins have contracted to 6.1%.

- Take a closer look at Vesuvius' potential here in our dividend report.

Upon reviewing our latest valuation report, Vesuvius' share price might be too pessimistic.

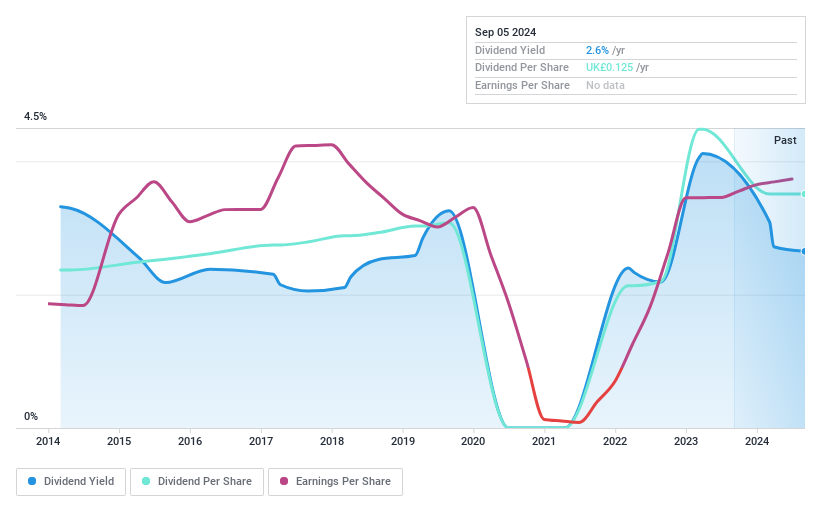

Irish Continental Group (LSE:ICGC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Irish Continental Group plc is a maritime transport company with a market capitalization of approximately £667.59 million, providing shipping and travel services primarily between Ireland, the UK, and continental Europe.

Operations: Irish Continental Group plc generates its income primarily through two segments: ferry operations, which brought in €412.30 million, and container and terminal services with revenues of €194.10 million.

Dividend Yield: 3.1%

Irish Continental Group's dividend history shows inconsistency with significant drops, yet recent actions signal a commitment to shareholder returns, proposing a final dividend of €16.4 million. The dividends are well-supported by both earnings and cash flows, with payout ratios of 40.8% and 31.6%, respectively, indicating sustainability from the company's financials. Despite this support, the current yield of 3.13% lags behind the UK market's top dividend payers. Revenue growth projections stand at an annual rate of 4.52%, offering a cautiously optimistic outlook for future financial health without guaranteeing dividend growth or stability.

Turning Ideas Into Actions

- Click this link to deep-dive into the 58 companies within our Top Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion.

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ICGC

Solid track record with adequate balance sheet and pays a dividend.