- United Kingdom

- /

- Software

- /

- AIM:SWG

Bezant Resources And 2 Other UK Penny Stocks To Consider

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market fluctuations, investors often seek opportunities in lesser-known areas such as penny stocks. While the term "penny stock" might seem outdated, it still represents a segment of smaller or newer companies that can offer significant potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £5.00 | £481.98M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.972 | £153.33M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.68 | £420.17M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.045 | £770.58M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.415 | £180.2M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.505 | £348.59M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.05 | £89.71M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.02 | £144.11M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Bezant Resources (AIM:BZT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bezant Resources Plc is involved in the exploration, evaluation, and development of mineral resources with a market cap of £2.52 million.

Operations: There are no specific revenue segments reported for this company.

Market Cap: £2.52M

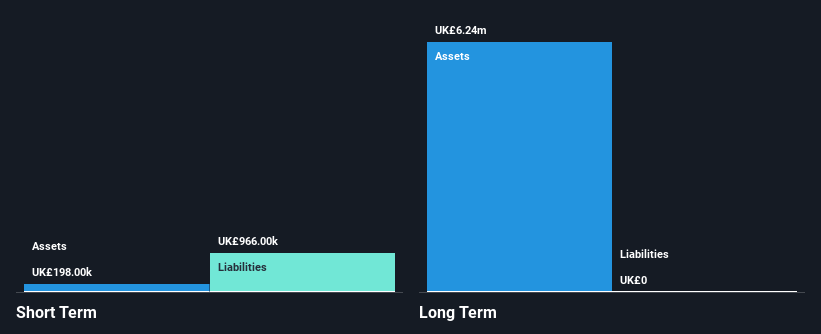

Bezant Resources, with a market cap of £2.52 million, is pre-revenue and faces financial constraints, having only two months of cash runway before recent capital raising efforts. The company has no long-term liabilities but struggles with short-term liabilities exceeding its assets (£198K vs. £966K). Despite being unprofitable and experiencing increased losses over the past five years, Bezant has initiated promising ventures such as drilling at the Hope & Gorob deposit in Namibia and a collaboration on a gold project in Zambia. These projects aim to optimize mineral extraction processes and potentially enhance future revenue streams.

- Dive into the specifics of Bezant Resources here with our thorough balance sheet health report.

- Examine Bezant Resources' past performance report to understand how it has performed in prior years.

Eleco (AIM:ELCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eleco Plc is a company that offers software and related services across the United Kingdom, Scandinavia, Germany, other parts of Europe, the United States, and internationally, with a market cap of £116.19 million.

Operations: The company generates £30.77 million in revenue from its software segment.

Market Cap: £116.19M

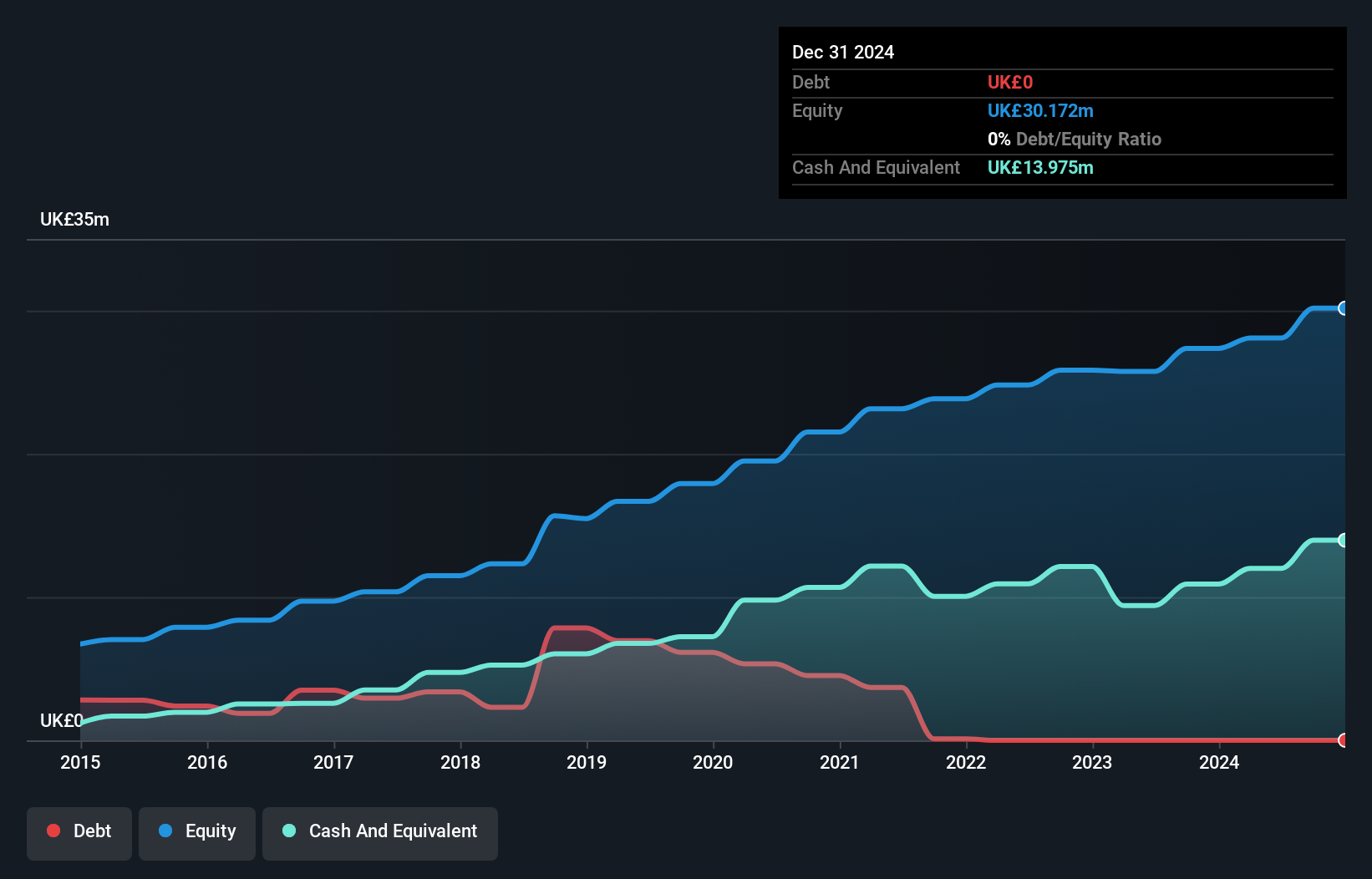

Eleco Plc, with a market cap of £116.19 million, demonstrates financial stability and growth potential within the software industry. The company has no debt, which eliminates concerns over interest coverage and cash flow sufficiency for debt servicing. Its short-term assets of £17.7 million comfortably cover both short and long-term liabilities, indicating strong liquidity management. Eleco's earnings grew by 40.3% last year, surpassing the industry average growth rate of 18%, although its Return on Equity remains low at 10.4%. Despite a relatively inexperienced board, Eleco maintains high-quality earnings without shareholder dilution in the past year.

- Navigate through the intricacies of Eleco with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Eleco's future.

Shearwater Group (AIM:SWG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shearwater Group plc, along with its subsidiaries, offers cyber security, managed security, and professional advisory solutions for corporate clients across the UK, Europe, North America, and internationally with a market cap of £8.46 million.

Operations: The company's revenue is derived from two main segments: Services, contributing £21.17 million, and Software, generating £2.27 million.

Market Cap: £8.46M

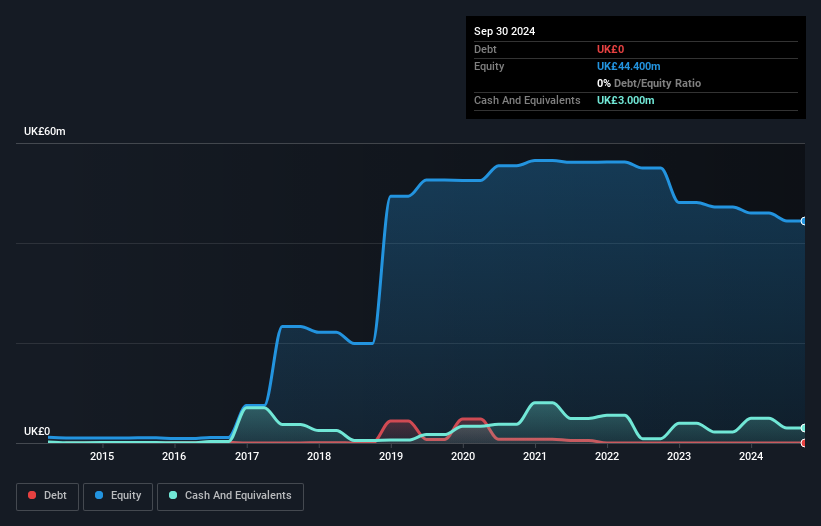

Shearwater Group plc, with a market cap of £8.46 million, is navigating the penny stock landscape through strategic contract wins and maintaining financial resilience despite ongoing unprofitability. Recent contract announcements totaling £2.3 million, including a significant £1.5 million deal for advanced email encryption services, highlight its potential to leverage cybersecurity expertise across diverse sectors. The company remains debt-free and has sufficient short-term assets (£11.4M) to cover liabilities (£10.5M), providing a stable financial base amidst losses that have increased over five years at 29.6% annually. Its experienced management and board contribute positively to governance stability while maintaining positive free cash flow growth ensures operational runway for over three years without shareholder dilution concerns.

- Click to explore a detailed breakdown of our findings in Shearwater Group's financial health report.

- Explore historical data to track Shearwater Group's performance over time in our past results report.

Next Steps

- Dive into all 445 of the UK Penny Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SWG

Shearwater Group

Provides cyber security, managed security, and professional advisory solutions for corporate clients in the United Kingdom, rest of Europe, North America, and internationally.

Flawless balance sheet and good value.