- United Kingdom

- /

- Communications

- /

- AIM:MWE

Atlantic Lithium And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market pressures, certain investment opportunities remain intriguing. Penny stocks, though an older term, continue to attract interest for their potential in offering growth at a lower entry cost. This article will explore three such stocks that stand out for their promising financial health and potential resilience amidst current market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.235 | £306.34M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.275 | £345.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.42 | £45.44M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.05 | £51.39M | ✅ 3 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.852 | £315.05M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.10 | £319.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.40 | £122.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.20 | £191.44M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.805 | £11.08M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.12 | £65.5M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Atlantic Lithium (AIM:ALL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atlantic Lithium Limited is involved in the exploration and development of mineral properties in Australia, Ivory Coast, and Ghana, with a market cap of £50.39 million.

Operations: The company's revenue segment is derived from exploration for base and precious metals, amounting to A$1.15 million.

Market Cap: £50.39M

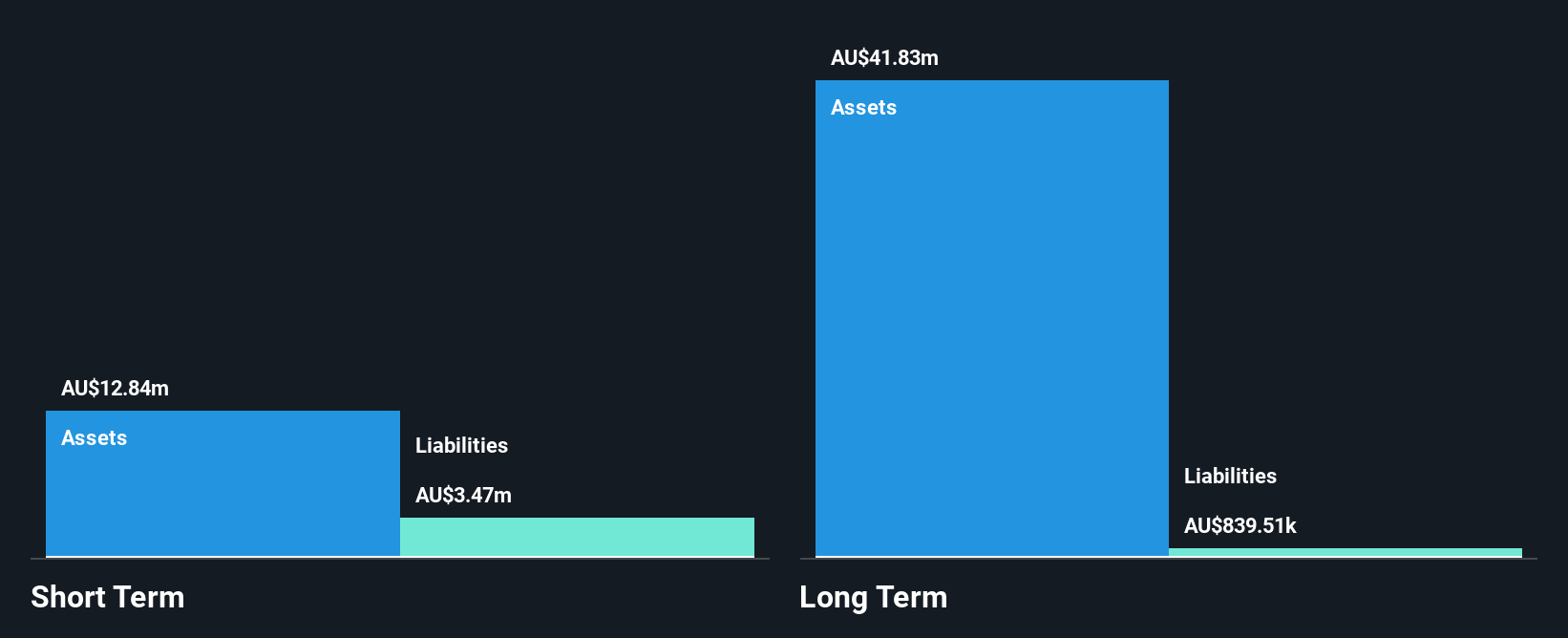

Atlantic Lithium, with a market cap of £50.39 million, is currently pre-revenue and unprofitable, with earnings forecasted to decline by an average of 46.2% annually over the next three years. The company has no debt and covers its short-term liabilities with A$12.8 million in assets but faces less than a year of cash runway based on current cash flow trends. Recent executive changes aim to enhance operational efficiency as CEO Keith Muller leads efforts on the Ewoyaa Project in Ghana and new exploration initiatives in Cote d'Ivoire, which could support broader lithium production goals despite high share price volatility.

- Click to explore a detailed breakdown of our findings in Atlantic Lithium's financial health report.

- Review our growth performance report to gain insights into Atlantic Lithium's future.

M.T.I Wireless Edge (AIM:MWE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: M.T.I Wireless Edge Ltd. designs, develops, manufactures, and markets antennas for military and civilian sectors with a market cap of £44.18 million.

Operations: The company's revenue is primarily derived from three segments: Antennas generating $14.86 million, Water Solutions contributing $17.30 million, and Distribution & Consultation with $14.55 million.

Market Cap: £44.18M

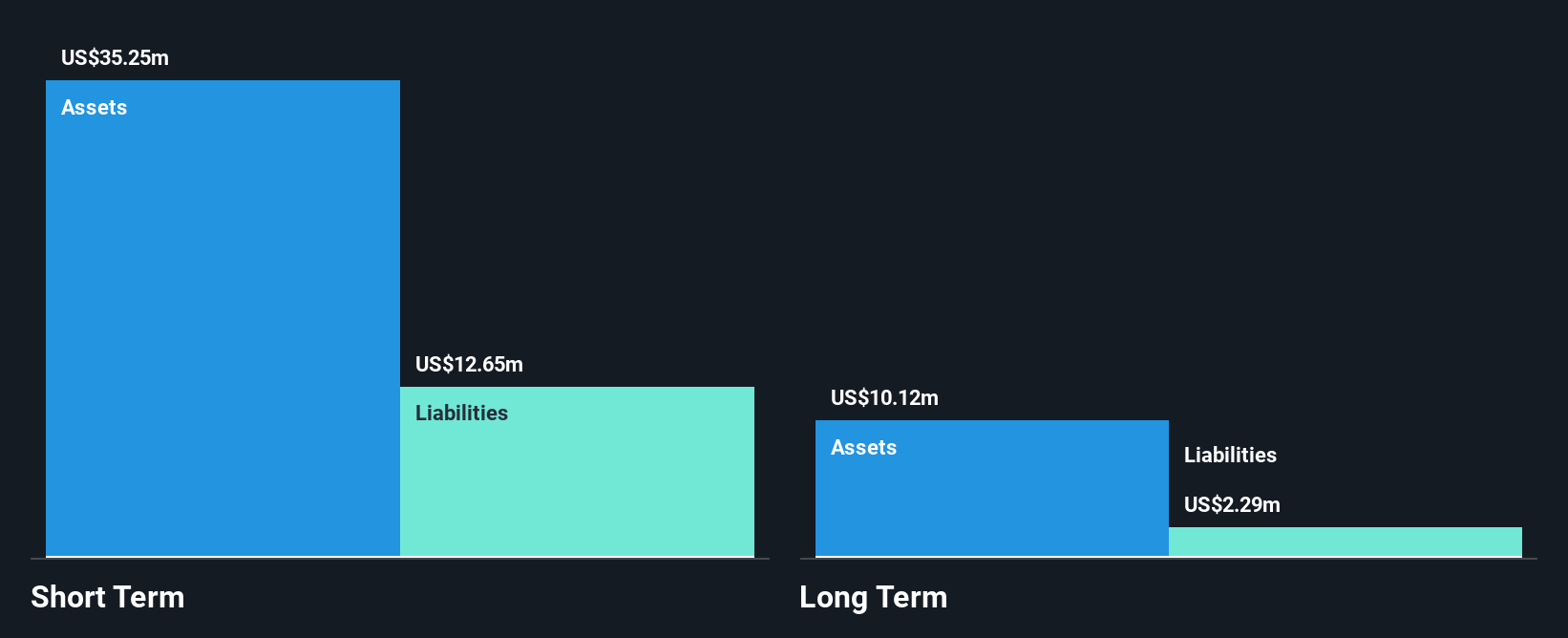

M.T.I Wireless Edge Ltd., with a market cap of £44.18 million, shows financial stability with cash exceeding total debt and robust coverage of interest payments by EBIT. The company's revenue streams are well-diversified across antennas, water solutions, and distribution segments. Recent earnings indicate growth, with net income rising to US$1.02 million in Q1 2025 from US$0.932 million the previous year. While the board's average tenure is short, suggesting inexperience, the company continues to secure military antenna contracts worth US$1.6 million over 20 months despite recent leadership changes following the chairman's passing.

- Jump into the full analysis health report here for a deeper understanding of M.T.I Wireless Edge.

- Gain insights into M.T.I Wireless Edge's future direction by reviewing our growth report.

Capital (LSE:CAPD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Capital Limited, with a market cap of £170.36 million, offers drilling, mining, mineral assaying, and surveying services through its subsidiaries.

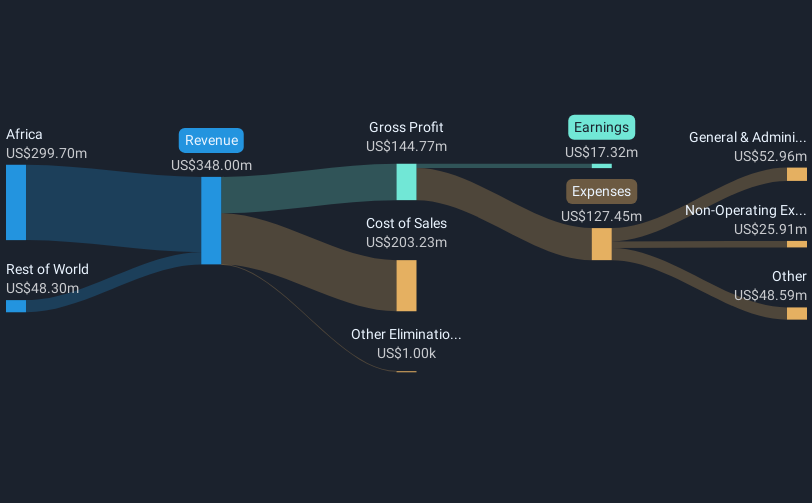

Operations: The company generates revenue of $348 million from its Business Services segment.

Market Cap: £170.36M

Capital Limited, with a market cap of £170.36 million, is navigating challenges and opportunities in the penny stock space. The company's debt to equity ratio has increased over five years, now at 40.6%, and its interest coverage by EBIT is below ideal levels at 2.6x. Despite these concerns, Capital's short-term assets comfortably cover both short- and long-term liabilities, indicating financial stability. Recent contract wins in drilling services for the Reko Diq project signify potential revenue growth amidst stable weekly volatility (5%). However, earnings have declined recently despite a forecasted annual growth rate of 9.26%.

- Get an in-depth perspective on Capital's performance by reading our balance sheet health report here.

- Evaluate Capital's prospects by accessing our earnings growth report.

Summing It All Up

- Click here to access our complete index of 296 UK Penny Stocks.

- Seeking Other Investments? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MWE

M.T.I Wireless Edge

Designs, develops, manufactures, and markets antennas for the military and civilian sectors.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives