- United Kingdom

- /

- Metals and Mining

- /

- AIM:AAZ

UK's Top Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting the interconnectedness of global economies. Amid these broader market fluctuations, investors often seek opportunities in less conventional areas such as penny stocks. Although considered an outdated term, penny stocks can still offer significant potential for growth when they possess strong financial foundations and sound business models.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.724 | £60.99M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.85 | £293.89M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.20 | £159.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.74 | £421.42M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.10 | £395.29M | ✅ 3 ⚠️ 2 View Analysis > |

| FRP Advisory Group (AIM:FRP) | £1.24 | £306.06M | ✅ 4 ⚠️ 0 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.00 | £159.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 404 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Anglo Asian Mining (AIM:AAZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anglo Asian Mining PLC, along with its subsidiaries, is involved in the exploration and production of mineral properties in Azerbaijan, with a market cap of £154.23 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: £154.23M

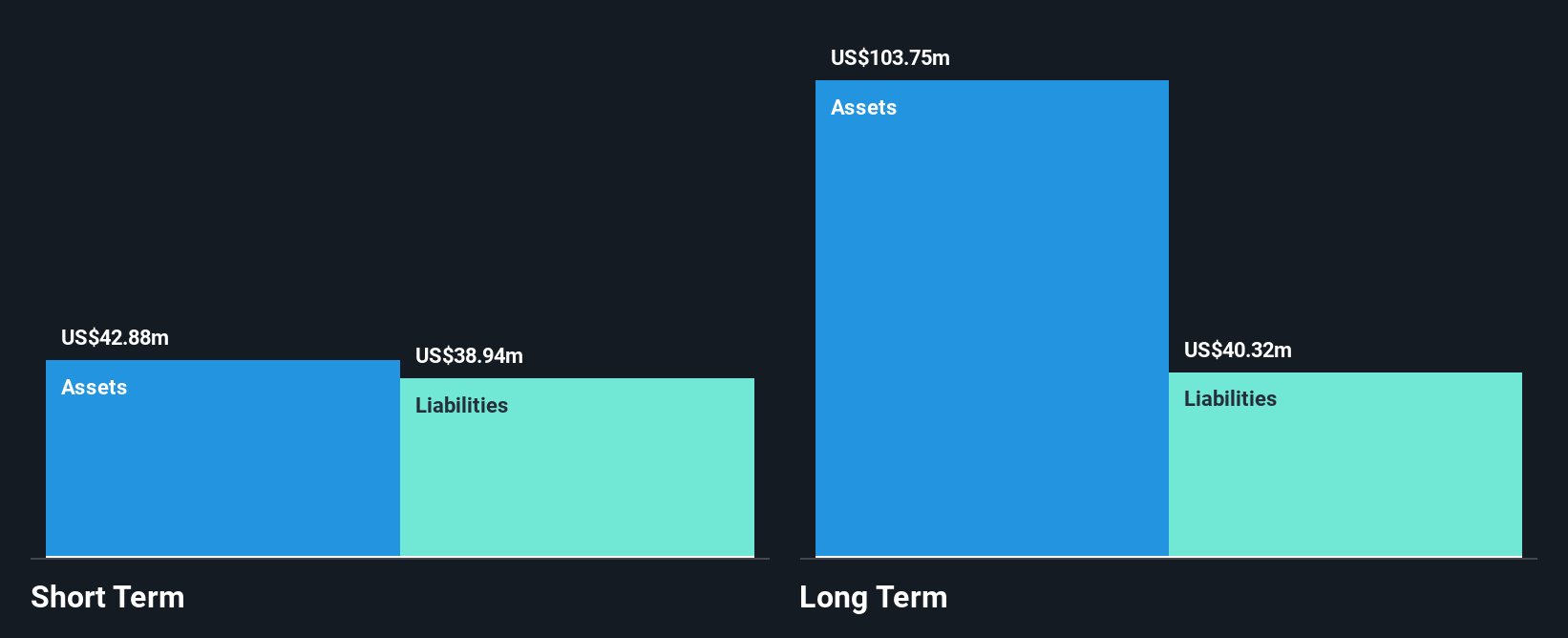

Anglo Asian Mining PLC, with a market cap of £154.23 million, recently reported a net loss of US$17.5 million for 2024 on sales of US$39.59 million, reflecting ongoing challenges in profitability. The company has initiated production from its Gilar underground mine, which is expected to significantly boost copper and gold output as it transitions towards becoming a mid-tier producer. Despite high volatility in share price and increased debt levels over the past five years, Anglo Asian's short-term assets exceed liabilities, providing some financial stability amidst its strategic expansion efforts in Azerbaijan's mining sector.

- Take a closer look at Anglo Asian Mining's potential here in our financial health report.

- Review our growth performance report to gain insights into Anglo Asian Mining's future.

Springfield Properties (AIM:SPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Springfield Properties Plc, with a market cap of £116.04 million, operates in the United Kingdom as a house building company through its subsidiaries.

Operations: The company's revenue is primarily derived from its Housing Building Activity, which generated £250.48 million.

Market Cap: £116.04M

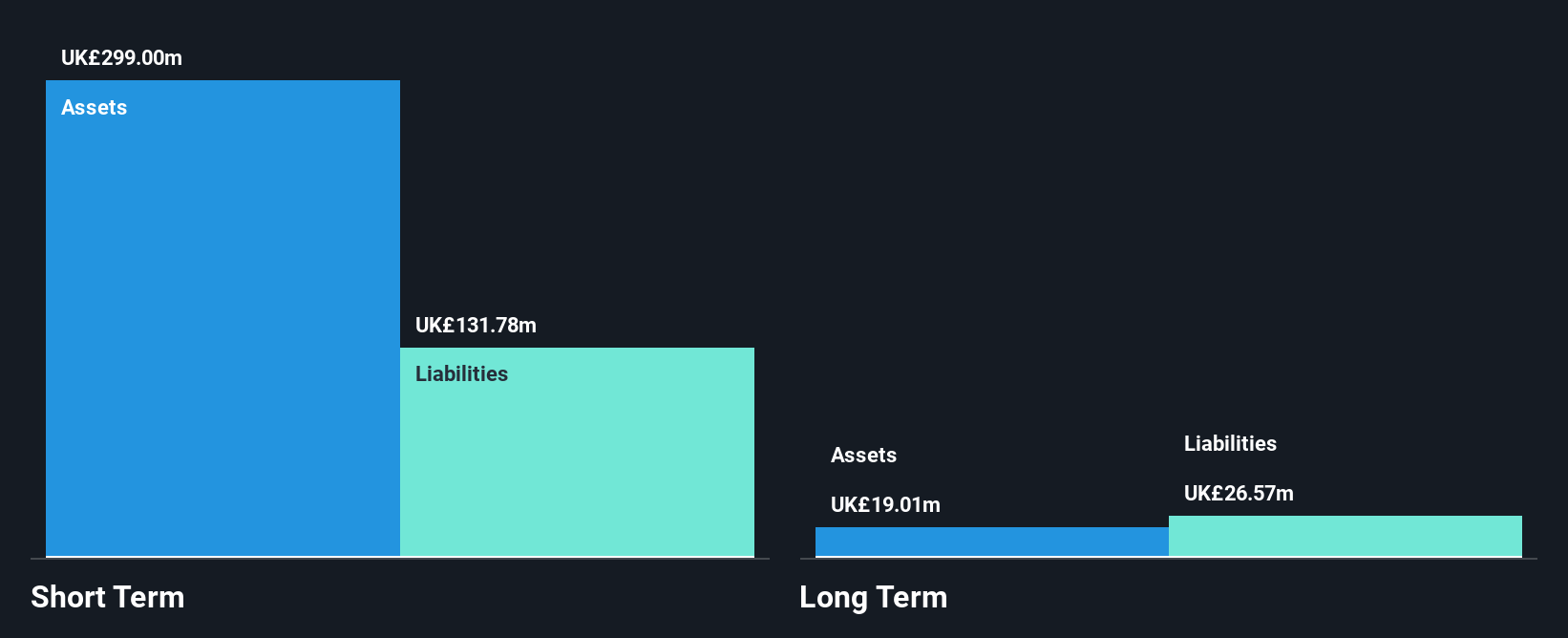

Springfield Properties Plc, with a market cap of £116.04 million, has shown resilience despite challenges in the UK housing sector. Its earnings grew by 9.9% last year, outpacing industry averages and improving profit margins to 3.6%. The company's financial health is supported by short-term assets of £299 million exceeding both short- and long-term liabilities, while its debt level remains satisfactory with a net debt to equity ratio of 39.4%. Recent auditor changes indicate proactive governance as it navigates an anticipated earnings decline over the next three years amidst stable weekly volatility in share price movements.

- Get an in-depth perspective on Springfield Properties' performance by reading our balance sheet health report here.

- Understand Springfield Properties' earnings outlook by examining our growth report.

GSTechnologies (LSE:GST)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GSTechnologies Ltd., along with its subsidiaries, offers data infrastructure, storage, and technology services globally, with a market cap of £29.22 million.

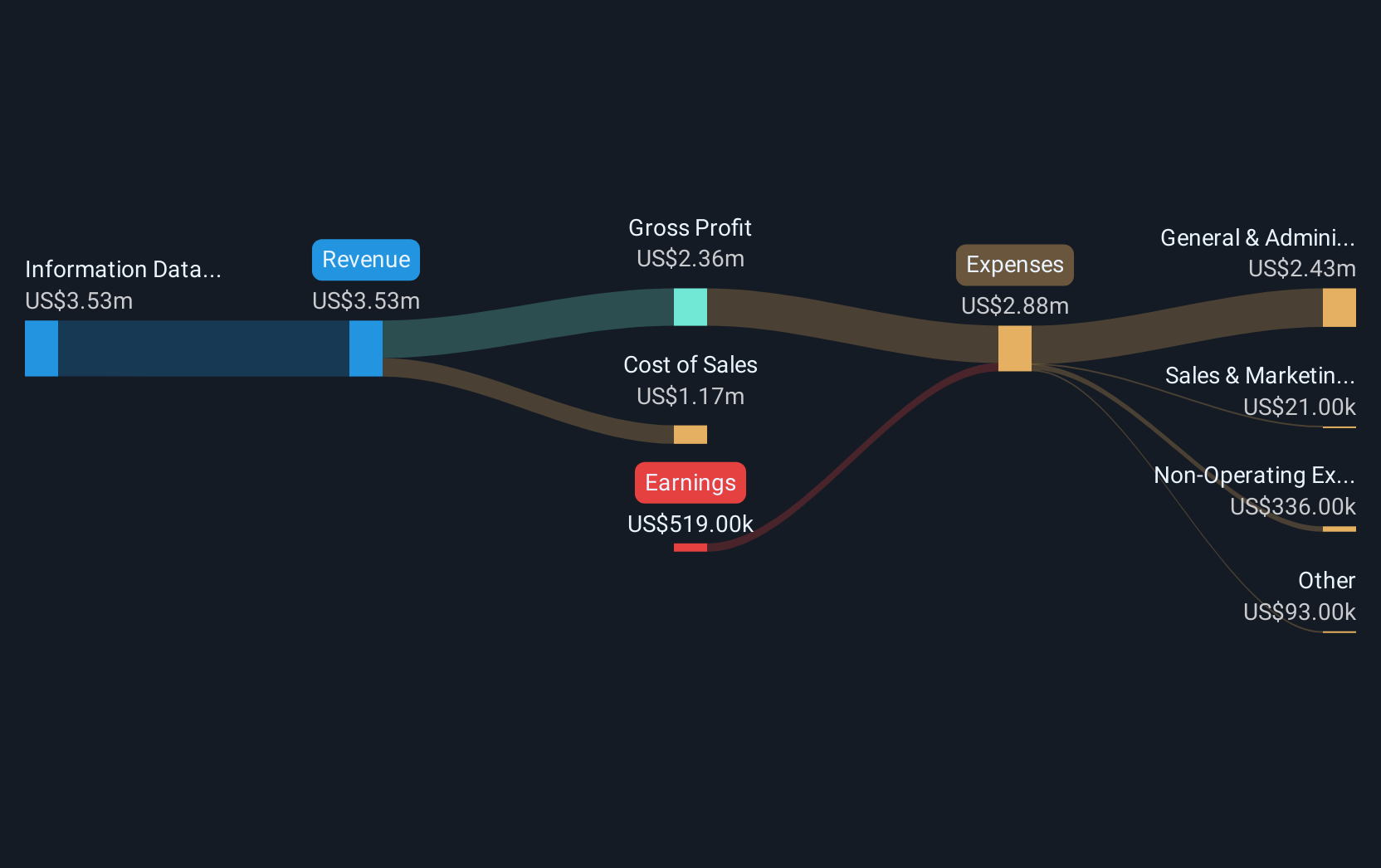

Operations: The company generates revenue of $3.53 million from its information data technology and infrastructure segment.

Market Cap: £29.22M

GSTechnologies Ltd., with a market cap of £29.22 million, operates in the data infrastructure and technology services sector, generating US$3.53 million in revenue. Despite being unprofitable and experiencing earnings declines over the past five years, GST maintains financial stability with short-term assets exceeding both short- and long-term liabilities, and more cash than total debt. The management team is experienced with an average tenure of 3.6 years, while shareholders have not faced significant dilution recently. However, the company's share price remains highly volatile compared to most UK stocks despite stable weekly volatility over the past year.

- Jump into the full analysis health report here for a deeper understanding of GSTechnologies.

- Review our historical performance report to gain insights into GSTechnologies' track record.

Summing It All Up

- Explore the 404 names from our UK Penny Stocks screener here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AAZ

Anglo Asian Mining

Owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives