- United Kingdom

- /

- Insurance

- /

- LSE:SAGA

Even after rising 10% this past week, Saga (LON:SAGA) shareholders are still down 78% over the past five years

While not a mind-blowing move, it is good to see that the Saga plc (LON:SAGA) share price has gained 12% in the last three months. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Five years have seen the share price descend precipitously, down a full 80%. So we don't gain too much confidence from the recent recovery. The important question is if the business itself justifies a higher share price in the long term.

While the stock has risen 10% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Saga

Because Saga made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Saga saw its revenue increase by 3.6% per year. That's far from impressive given all the money it is losing. It's not so sure that share price crash of 12% per year is completely deserved, but the market is doubtless disappointed. We'd be pretty cautious about this one, although the sell-off may be too severe. A company like this generally needs to produce profits before it can find favour with new investors.

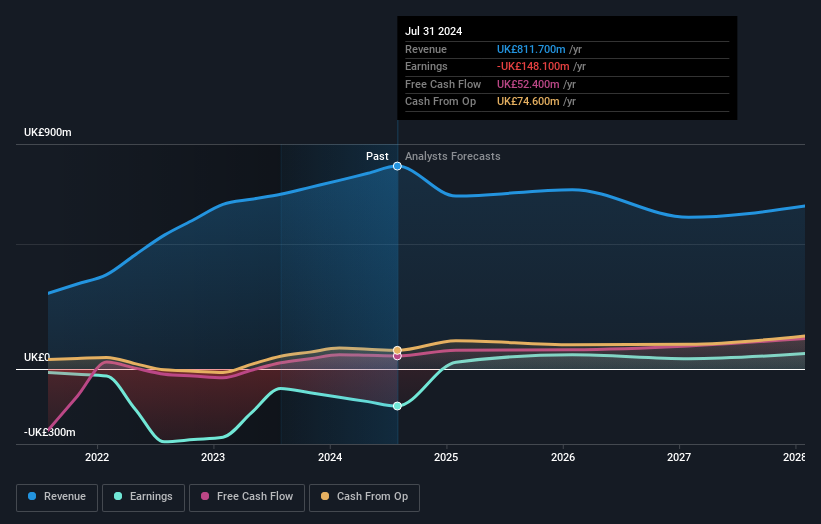

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Saga's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Saga shareholders gained a total return of 9.5% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 12% endured over half a decade. It could well be that the business is stabilizing. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SAGA

Saga

Provides package and cruise holidays, general insurance, and personal finance products and services in the United Kingdom.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives