- United Kingdom

- /

- Electrical

- /

- AIM:GELN

Alliance Pharma Leads 3 UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has been experiencing fluctuations, with the FTSE 100 and FTSE 250 indices recently closing lower due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors often seek opportunities in smaller or less-established companies that can offer potential value despite broader market challenges. While the term "penny stocks" may seem outdated, these stocks still represent an intriguing investment area for those focusing on companies with robust financials and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.75 | £182.42M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £780M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.85M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.885 | £491.62M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.67 | £432.46M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.70 | £343.12M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.33 | £85.44M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.025 | £90.69M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.425 | £180.84M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Alliance Pharma (AIM:APH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alliance Pharma plc acquires, markets, and distributes consumer healthcare products and prescription medicines across various regions including Europe, the Middle East, Africa, the Asia Pacific, China, and the Americas with a market cap of £330.83 million.

Operations: The company generates revenue from two main segments: Consumer Healthcare, contributing £136.21 million, and Prescription Medicines, accounting for £46.93 million.

Market Cap: £330.83M

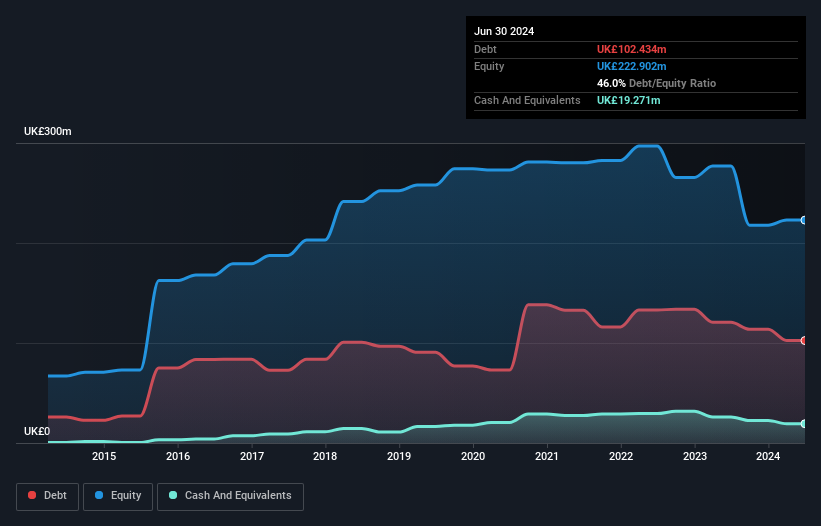

Alliance Pharma is undergoing a significant transition with an acquisition deal set to delist it from AIM, as a consortium led by DBAY Advisors plans to buy the remaining shares for approximately £250 million. Despite being unprofitable with a negative return on equity of -15.07%, the company has managed its debt well, covering it through operating cash flow and maintaining a satisfactory net debt to equity ratio of 37.3%. While short-term assets exceed liabilities, long-term liabilities remain uncovered. The management team is experienced, though the board lacks tenure stability. The stock trades below estimated fair value despite recent volatility and insider selling.

- Click to explore a detailed breakdown of our findings in Alliance Pharma's financial health report.

- Evaluate Alliance Pharma's prospects by accessing our earnings growth report.

Gelion (AIM:GELN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gelion plc, along with its subsidiary, focuses on the research and development, manufacture, and sale of battery systems both in the United Kingdom and internationally, with a market cap of £21.76 million.

Operations: The company generates revenue from its Battery Production and Development segment, amounting to £1.99 million.

Market Cap: £21.76M

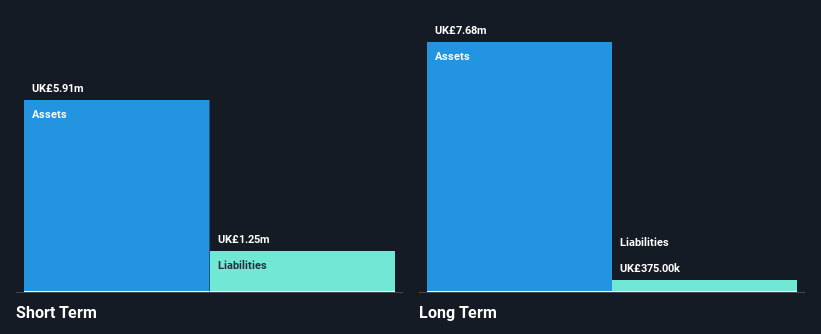

Gelion plc is navigating a challenging landscape as it focuses on advancing its battery technologies, with recent developments including a £2.5 million grant from the Australian Renewable Energy Agency to enhance its production capabilities. Despite generating £1.99 million in revenue, the company remains unprofitable and faces significant financial hurdles, highlighted by auditor concerns about its ability to continue as a going concern. Recent equity offerings have bolstered cash reserves, providing some runway for operations. The appointment of Dr Graham Cooley strengthens the board with extensive industry expertise, potentially aiding strategic growth initiatives amid high share price volatility and limited revenue streams.

- Dive into the specifics of Gelion here with our thorough balance sheet health report.

- Learn about Gelion's historical performance here.

Hansard Global (LSE:HSD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hansard Global plc is a specialist long-term savings provider offering savings and investment products to investors, institutions, and wealth-management groups in the Isle of Man, Republic of Ireland, and The Bahamas, with a market cap of £62.56 million.

Operations: The company's revenue is primarily generated from the distribution and servicing of long-term investment products, totaling £168.3 million.

Market Cap: £62.56M

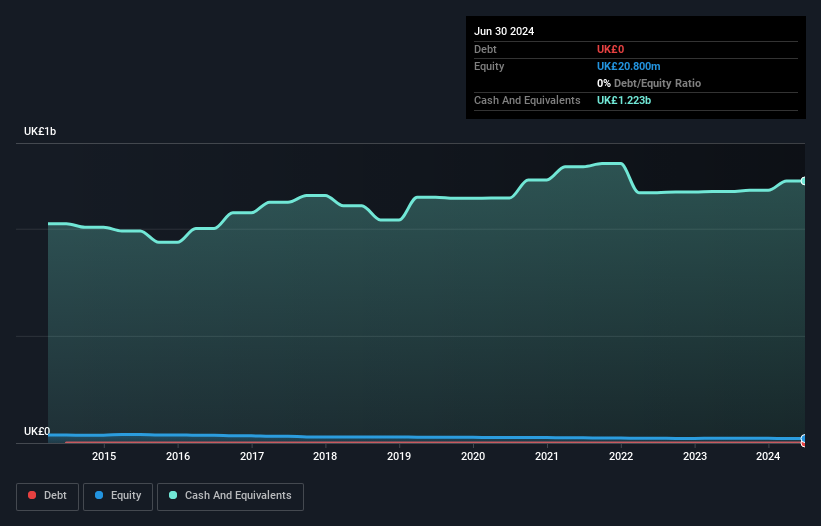

Hansard Global plc, with a market cap of £62.56 million, is navigating complex financial dynamics typical of penny stocks. Despite being debt-free and having a high return on equity at 25%, the company faces challenges such as negative earnings growth and declining profit margins from 6.3% to 3.1%. Its short-term assets comfortably cover short-term liabilities but not long-term ones. Recent board changes include Noel Harwerth taking key roles, potentially stabilizing governance amidst these financial pressures. A dividend yield of 9.67% appears unsustainable given current earnings and cash flow constraints, underscoring the need for strategic adjustments in its operations.

- Take a closer look at Hansard Global's potential here in our financial health report.

- Examine Hansard Global's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Unlock our comprehensive list of 446 UK Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GELN

Gelion

Together with its subsidiary, engages in the research and development, manufacture, and sale of battery systems in the United Kingdom and internationally.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives