- United Kingdom

- /

- Insurance

- /

- LSE:CRE

May 2025's Leading UK Dividend Stocks

Reviewed by Simply Wall St

In light of recent challenges faced by the UK's FTSE 100 index, including weak trade data from China and declining commodity prices, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. Amidst these market fluctuations, identifying companies with strong fundamentals and consistent dividend payouts can offer a measure of stability in uncertain economic times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 6.80% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.69% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.33% | ★★★★★☆ |

| Treatt (LSE:TET) | 3.29% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.59% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.96% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.70% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.50% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.45% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.01% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Conduit Holdings (LSE:CRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Conduit Holdings Limited, with a market cap of £544.71 million, operates globally through its subsidiary to offer reinsurance products and services.

Operations: Conduit Holdings Limited generates revenue through its reinsurance operations, with segments comprising $190.60 million from Casualty, $344.20 million from Property, and $154.40 million from Specialty.

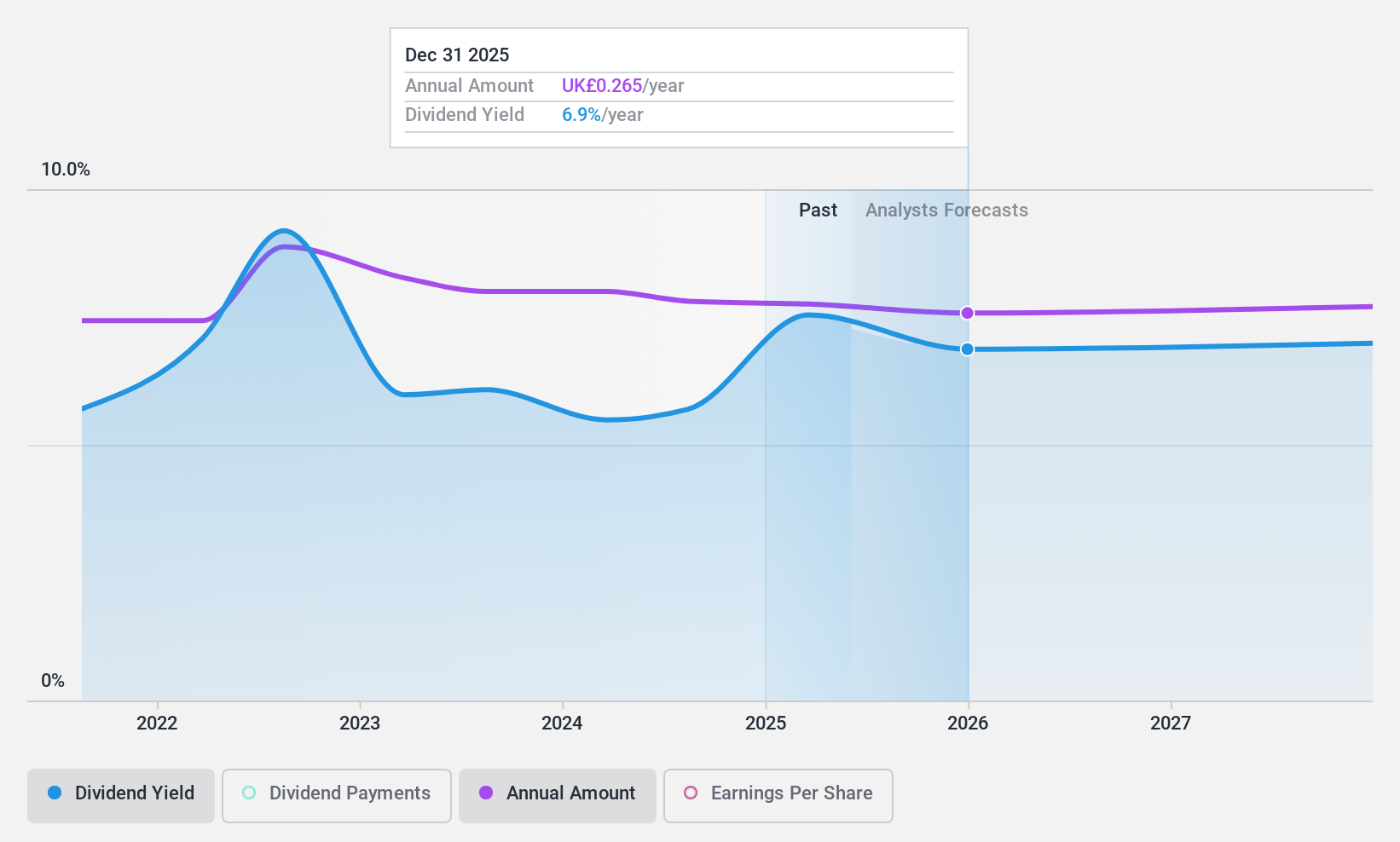

Dividend Yield: 7.8%

Conduit Holdings offers a mixed dividend profile, with its 7.8% yield placing it among the top UK payers. However, its dividends have been unstable over the past four years and recently decreased to $0.18 per share for 2024. While dividends are well-covered by earnings (payout ratio of 45.1%) and cash flows (cash payout ratio of 13.9%), recent executive changes and a significant loss estimate from California wildfires may impact future stability.

- Take a closer look at Conduit Holdings' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Conduit Holdings shares in the market.

RS Group (LSE:RS1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: RS Group plc, along with its subsidiaries, distributes maintenance, repair, and operations products and service solutions across the UK, US, France, Germany, Italy, Mexico and internationally with a market cap of £2.46 billion.

Operations: RS Group plc generates revenue through two main segments: Own-Brand Products, contributing £404.70 million, and Other Product and Service Solutions, which account for £2.53 billion.

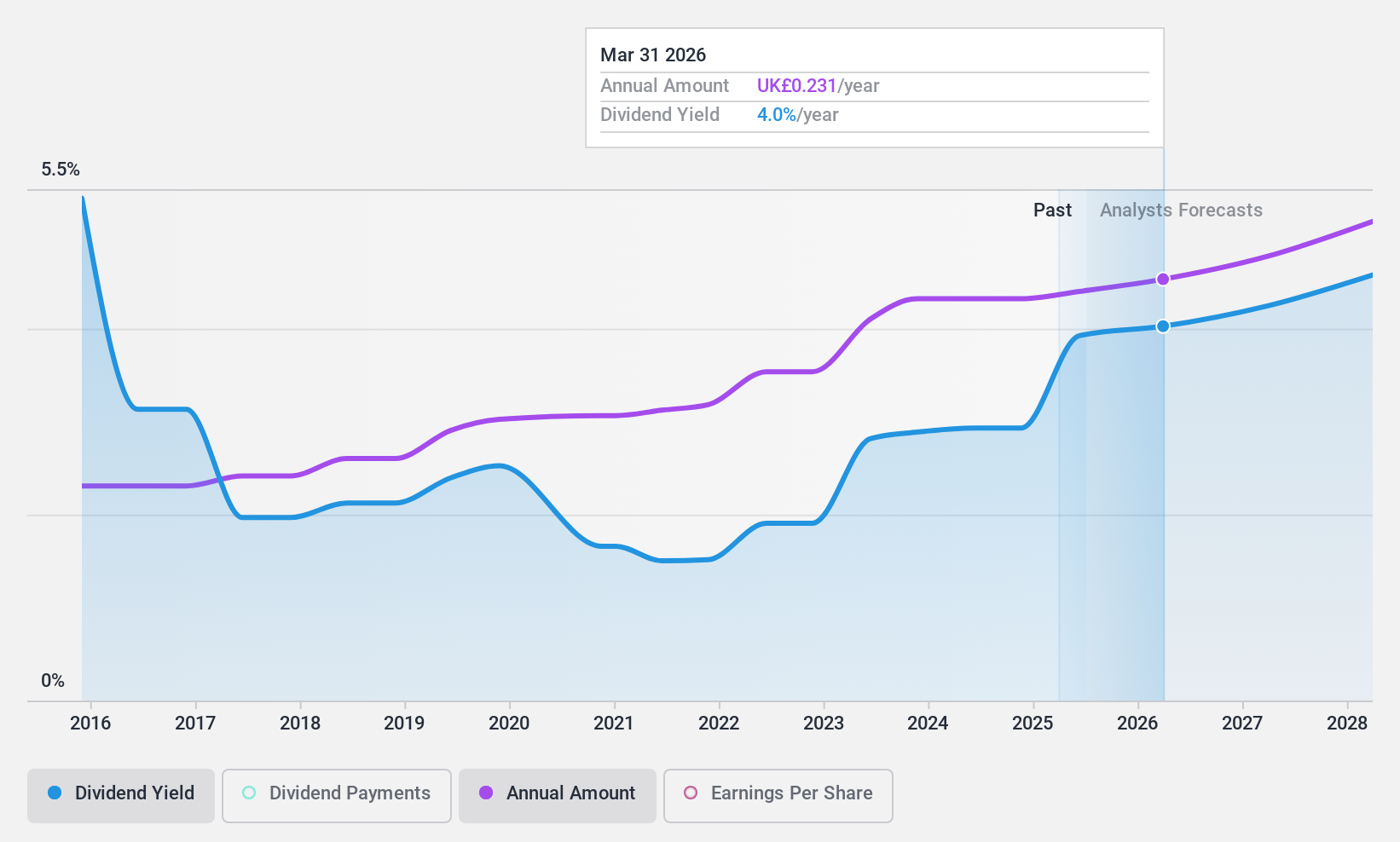

Dividend Yield: 4.3%

RS Group provides a stable dividend with a yield of 4.27%, though it is below the top UK payers. Its dividends have been reliable and steadily increasing over the past decade, supported by earnings and cash flows with payout ratios of 61.8% and 49.2% respectively. Recent expansion in industrial automation offerings, such as Siemens' IP6X systems, may bolster future growth prospects, enhancing RS's ability to maintain its consistent dividend payments amidst evolving market demands.

- Unlock comprehensive insights into our analysis of RS Group stock in this dividend report.

- In light of our recent valuation report, it seems possible that RS Group is trading behind its estimated value.

J Sainsbury (LSE:SBRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J Sainsbury plc operates in the United Kingdom and the Republic of Ireland, providing food, general merchandise, clothing retailing, and financial services with a market cap of £6.30 billion.

Operations: J Sainsbury plc generates revenue through its retail segment, which accounts for £32.63 billion, and its financial services segment, contributing £182 million.

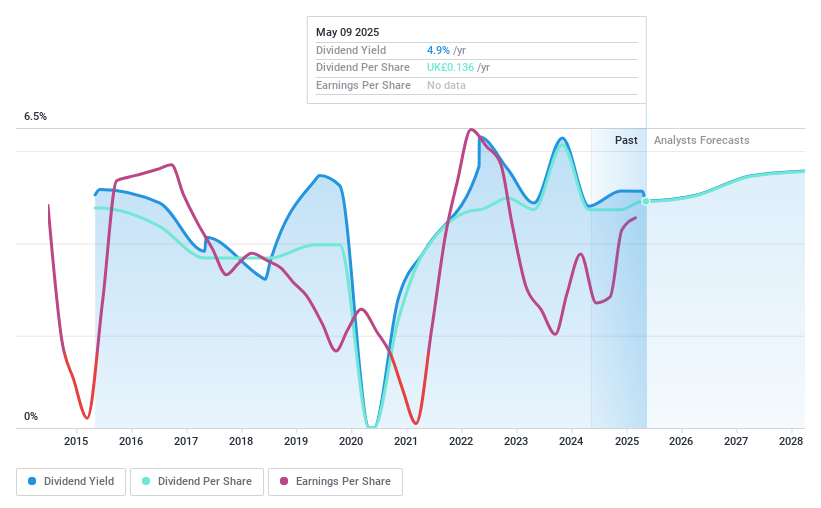

Dividend Yield: 5%

J Sainsbury's dividend yield of 4.96% is below the top UK payers, but recent increases show a commitment to progressive payouts. The dividends are well-covered by cash flows with a low cash payout ratio of 16.7%, although past volatility raises concerns about stability. A £200 million share buyback and anticipated special dividend from bank disposal proceeds could enhance shareholder value, while earnings growth supports future dividend sustainability despite some store closures planned for 2025/2026.

- Click here and access our complete dividend analysis report to understand the dynamics of J Sainsbury.

- Our expertly prepared valuation report J Sainsbury implies its share price may be lower than expected.

Key Takeaways

- Investigate our full lineup of 62 Top UK Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRE

Conduit Holdings

Through its subsidiary, provides reinsurance products and services worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives