- United Kingdom

- /

- Insurance

- /

- LSE:AV.

Aviva (LSE:AV.) Leverages Strong Financial Health and Strategic Initiatives for Future Growth

Reviewed by Simply Wall St

Aviva (LSE:AV.) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a notable 31.2% increase in dividend payouts and innovative product launches, juxtaposed against a 16.7% drop in Q2 net sales and inflationary pressures. In the discussion that follows, we will explore Aviva's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click here and access our complete analysis report to understand the dynamics of Aviva.

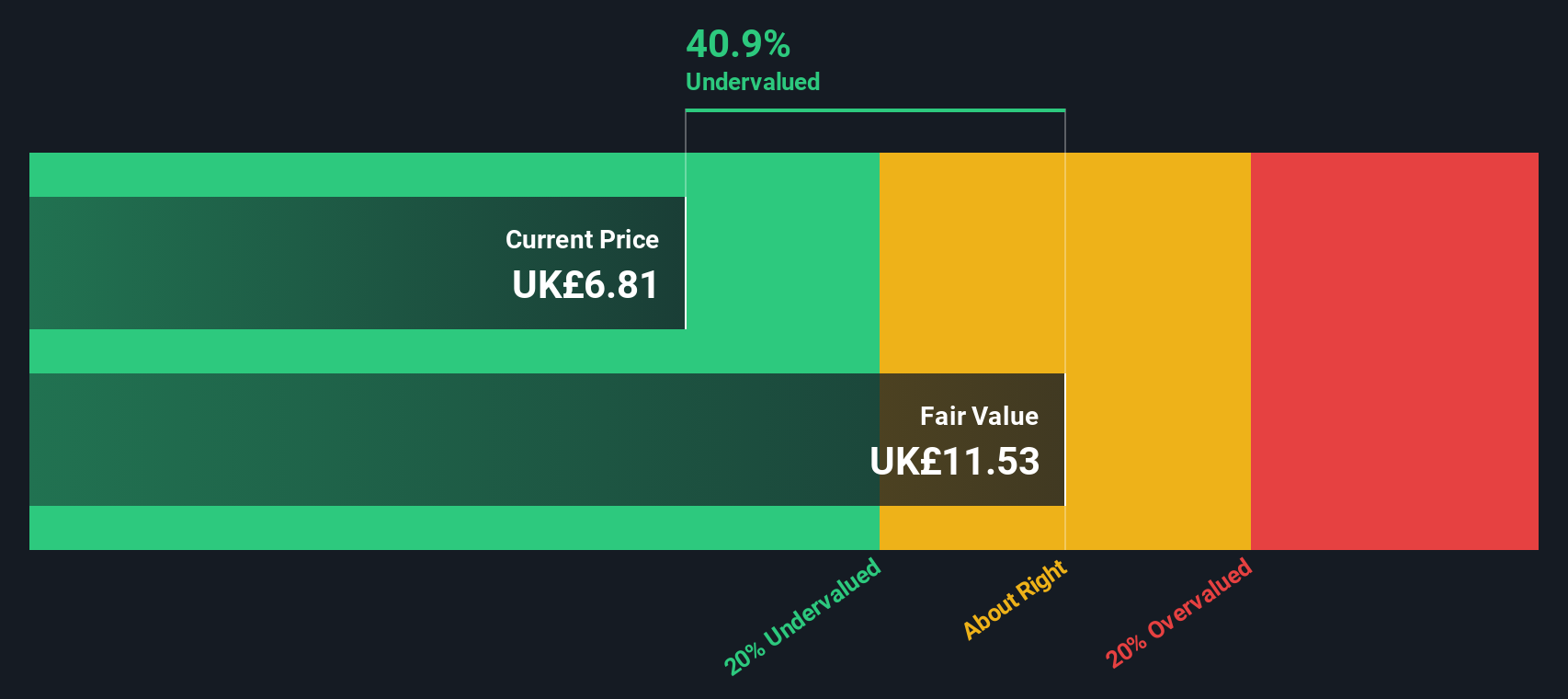

Key Assets Propelling Aviva Forward

Aviva's financial health is evident with a total shareholder equity of £9.5 billion and a debt-to-equity ratio of 67.1%. The company boasts substantial cash and short-term investments of £16.9 billion, supporting its capital position with a cover ratio of 205%, as highlighted by CFO Charlotte Jones. The company's Price-To-Earnings Ratio (10x) positions it favorably compared to both its peers (19.9x) and the European Insurance industry average (11.4x). Additionally, Aviva is trading at 48% below its estimated fair value of £9.22, indicating potential undervaluation. CEO Amanda Blanc's emphasis on growth in capital-light areas and strong customer engagement, evidenced by a 4 percentage point increase in the Net Promoter Score, further underscores the company's strategic direction.

Challenges Constraining Aviva's Potential

Aviva faces notable challenges. The company's operating profit saw a decrease to £216 million, which CFO Charlotte Jones attributes to claims normalization and inflation impacts in the Health segment. Additionally, Aviva's earnings are forecast to grow at a modest 4.6% per year, lagging behind the UK market's expected growth of 14.3%. The Return on Equity (RoE) is also projected to be relatively low at 14.5% in three years. Furthermore, Aviva's dividend payments, although increasing, have been volatile and are not well covered by free cash flows. The company's reliance on higher-risk funding sources, as it reports no customer deposits, adds another layer of financial risk.

Emerging Markets Or Trends for Aviva

Aviva has several opportunities to enhance its market position. The company is poised to benefit from market expansion in the UK, which CEO Amanda Blanc describes as having significant wealth and structural growth opportunities. Strategic initiatives, such as working with the government to support better retirement provision and launching innovative products like Aviva Simple Wealth, aim to make financial advice more accessible. The company's strategy of investing both organically and through targeted mergers and acquisitions (M&A) is designed to drive growth. These initiatives are expected to capitalize on emerging opportunities and strengthen Aviva's market presence.

Regulatory Challenges Facing Aviva

However, Aviva must navigate several external threats that could impact its growth. Economic factors, including the ongoing monitoring of Ogden rates, pose regulatory challenges. Competitive pressures remain a significant concern, as noted by CFO Charlotte Jones. The company's dividend sustainability is also under scrutiny, given that the current dividend yield of 6.96% is not well covered by free cash flows. Additionally, the recent debt financing activities, including the tender offer for £700 million of subordinated notes and the issuance of £500 million Tier 2 Fixed Rate Reset Notes, indicate a focus on managing financial obligations amidst these external pressures.

Conclusion

Aviva's financial health, evidenced by its substantial cash reserves and favorable debt-to-equity ratio, positions it well to navigate future challenges and capitalize on growth opportunities. The company's current trading price, at 48% below its estimated fair value, suggests significant upside potential, making it an attractive investment relative to its peers and the broader European insurance industry. However, the modest earnings growth forecast and concerns around dividend sustainability highlight the need for careful management of financial risks. Strategic initiatives in capital-light areas and market expansion efforts, combined with prudent financial management, will be crucial for Aviva to enhance its market position and deliver sustained shareholder value.

Summing It All Up

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:AV.

Aviva

Provides various insurance, retirement, investment, and savings products in the United Kingdom, Ireland, Canada, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives