- United Kingdom

- /

- Insurance

- /

- LSE:ADM

UK Dividend Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the UK market grapples with global economic uncertainties, notably impacted by China's sluggish recovery efforts, the FTSE 100 has experienced a downturn, reflecting broader concerns about international trade and commodity demand. In such a volatile environment, dividend stocks can offer investors a degree of stability and income potential, making them an attractive option for those looking to navigate these challenging times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.74% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.17% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.25% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.09% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.99% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.35% | ★★★★★★ |

| Macfarlane Group (LSE:MACF) | 5.55% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.46% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.61% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.48% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

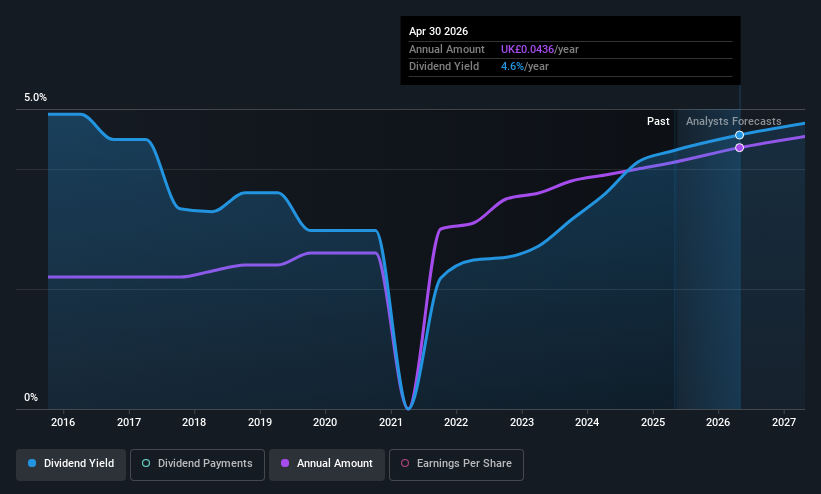

Begbies Traynor Group (AIM:BEG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Begbies Traynor Group plc offers business recovery, financial advisory, and property services consultancy in the United Kingdom with a market cap of £180.35 million.

Operations: Begbies Traynor Group plc generates revenue from its Business Recovery and Advisory segment, which accounts for £107.30 million, and its Property Advisory services, contributing £46.40 million in the United Kingdom.

Dividend Yield: 3.8%

Begbies Traynor Group has demonstrated consistent dividend growth over the past decade, though its 3.81% yield is below the top UK payers. The dividends have been reliable and covered by cash flows despite not being well covered by earnings due to a high payout ratio of 108.5%. Recent leadership changes with Mark Fry as CEO aim to support strategic growth, reflecting their significant business expansion and profit increase over recent years.

- Take a closer look at Begbies Traynor Group's potential here in our dividend report.

- Our expertly prepared valuation report Begbies Traynor Group implies its share price may be lower than expected.

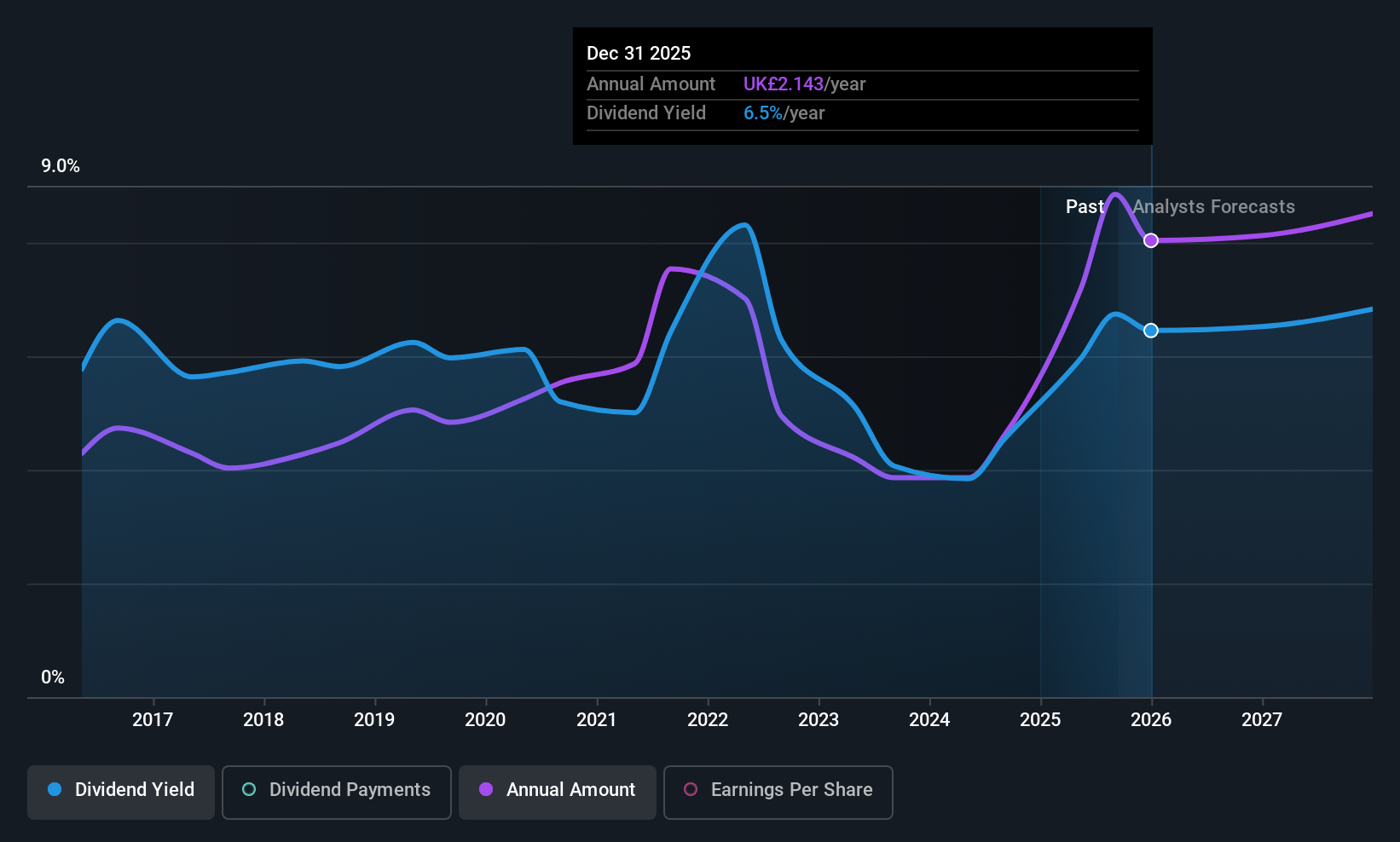

Admiral Group (LSE:ADM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Admiral Group plc is a financial services company offering insurance and personal lending products across the UK, France, Italy, Spain, and the US, with a market cap of £9.75 billion.

Operations: Admiral Group's revenue segments include UK Insurance at £4.33 billion and Admiral Money at £20.10 million.

Dividend Yield: 7.3%

Admiral Group's dividend yield of 7.33% ranks it among the top UK payers, yet its sustainability is questionable due to a high cash payout ratio of 248%. Despite a reasonable earnings payout ratio of 65.1%, dividends aren't covered by free cash flows and have been volatile over the past decade. Recent half-year earnings showed significant growth with net income reaching £401 million, yet future earnings are forecasted to decline slightly over the next three years.

- Unlock comprehensive insights into our analysis of Admiral Group stock in this dividend report.

- Upon reviewing our latest valuation report, Admiral Group's share price might be too pessimistic.

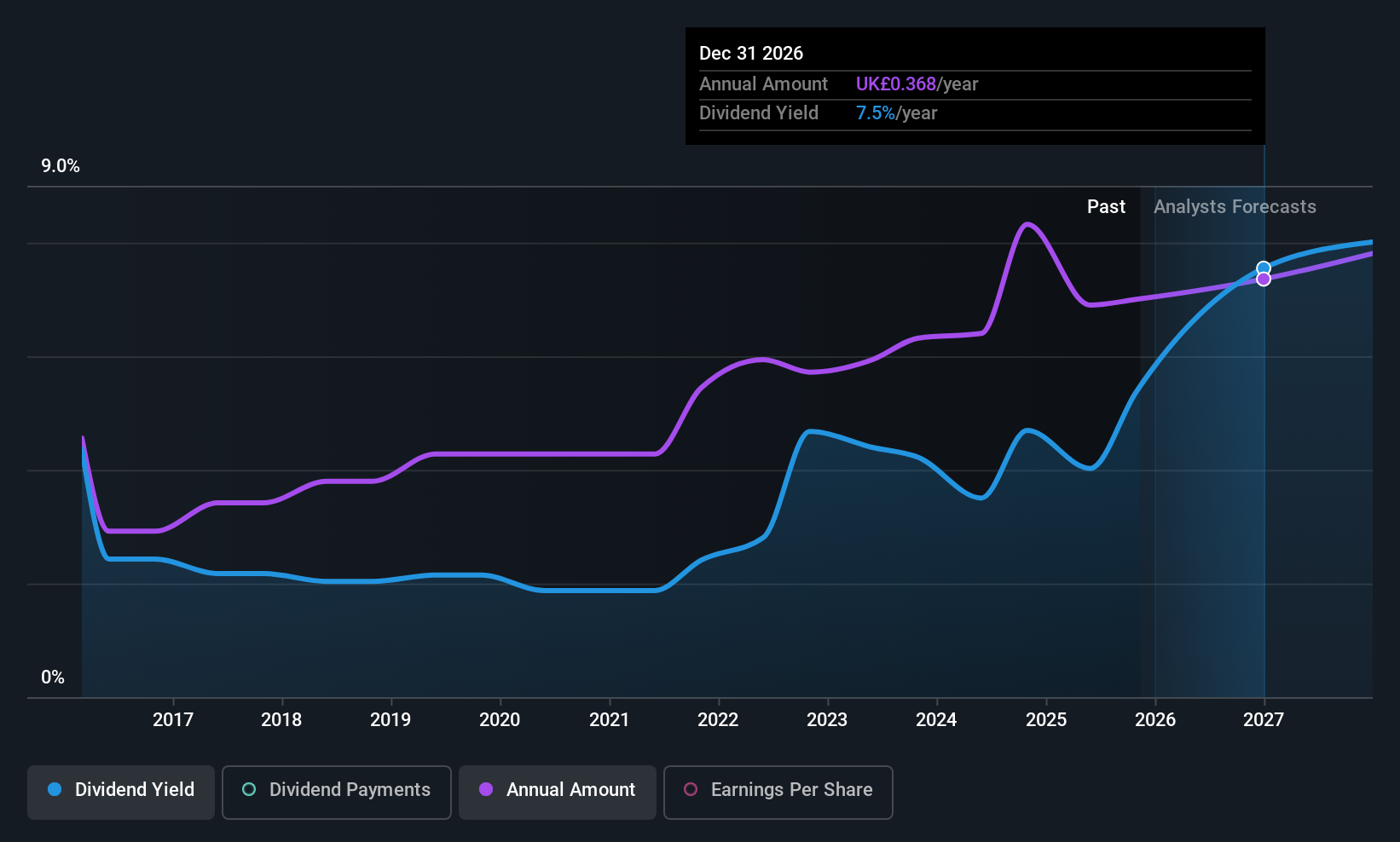

Hilton Food Group (LSE:HFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hilton Food Group plc, with a market cap of £445.48 million, operates in the food packing industry through its subsidiaries.

Operations: Hilton Food Group plc generates revenue through its food packing operations across three primary segments: APAC (£1.50 billion), Europe (£1.09 billion), and UK & Ireland (£1.59 billion).

Dividend Yield: 7.1%

Hilton Food Group's dividend yield of 7.06% places it in the top quartile of UK payers, but its sustainability is concerning as dividends exceed free cash flows and are only partially covered by earnings. The recent interim dividend increase to 10.1 pence per share highlights growth, yet past payments have been volatile and unreliable over a decade. Despite sales rising to £2.09 billion for H1 2025, net income slightly decreased, indicating potential challenges ahead.

- Dive into the specifics of Hilton Food Group here with our thorough dividend report.

- The valuation report we've compiled suggests that Hilton Food Group's current price could be quite moderate.

Seize The Opportunity

- Access the full spectrum of 53 Top UK Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ADM

Admiral Group

A financial services company, provides insurance and personal lending products in the United Kingdom, France, Italy, Spain, and the United States.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives