- United Kingdom

- /

- Personal Products

- /

- AIM:W7L

February 2025's UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK stock market has recently experienced some turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market uncertainties, penny stocks continue to capture investor interest by offering potential growth at a lower price point. While the term "penny stocks" might seem outdated, they remain relevant for investors seeking smaller or newer companies with strong financials that could provide promising opportunities for growth and value.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £329.61M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.38 | £336.16M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.05 | £460.22M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.285 | £861.02M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £159.09M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.70 | £89.64M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.684 | £2.05B | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

James Halstead (AIM:JHD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: James Halstead plc is a manufacturer and supplier of flooring products for both commercial and domestic markets across the UK, Europe, Scandinavia, Australasia, Asia, and other international regions with a market cap of £693.95 million.

Operations: The company generated £274.88 million from its flooring products manufacturing and distribution segment.

Market Cap: £693.95M

James Halstead plc, with a market cap of £693.95 million, has shown stable financial health and resilience despite recent management changes. The company maintains a strong balance sheet with more cash than total debt and covers its short-term liabilities comfortably. Its net profit margins have improved to 15.1%, and it pays a reliable dividend of 5.11%. Although earnings growth was negative last year, the company's return on equity remains high at 22.9%. The board is experienced; however, the management team is relatively new, which could influence future strategic direction.

- Get an in-depth perspective on James Halstead's performance by reading our balance sheet health report here.

- Assess James Halstead's future earnings estimates with our detailed growth reports.

Warpaint London (AIM:W7L)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Warpaint London PLC, along with its subsidiaries, is engaged in the production and sale of cosmetics and has a market cap of £329.61 million.

Operations: The company's revenue is primarily derived from its Own Brand segment, which accounts for £96.72 million, while the Close-Out segment contributes £2.12 million.

Market Cap: £329.61M

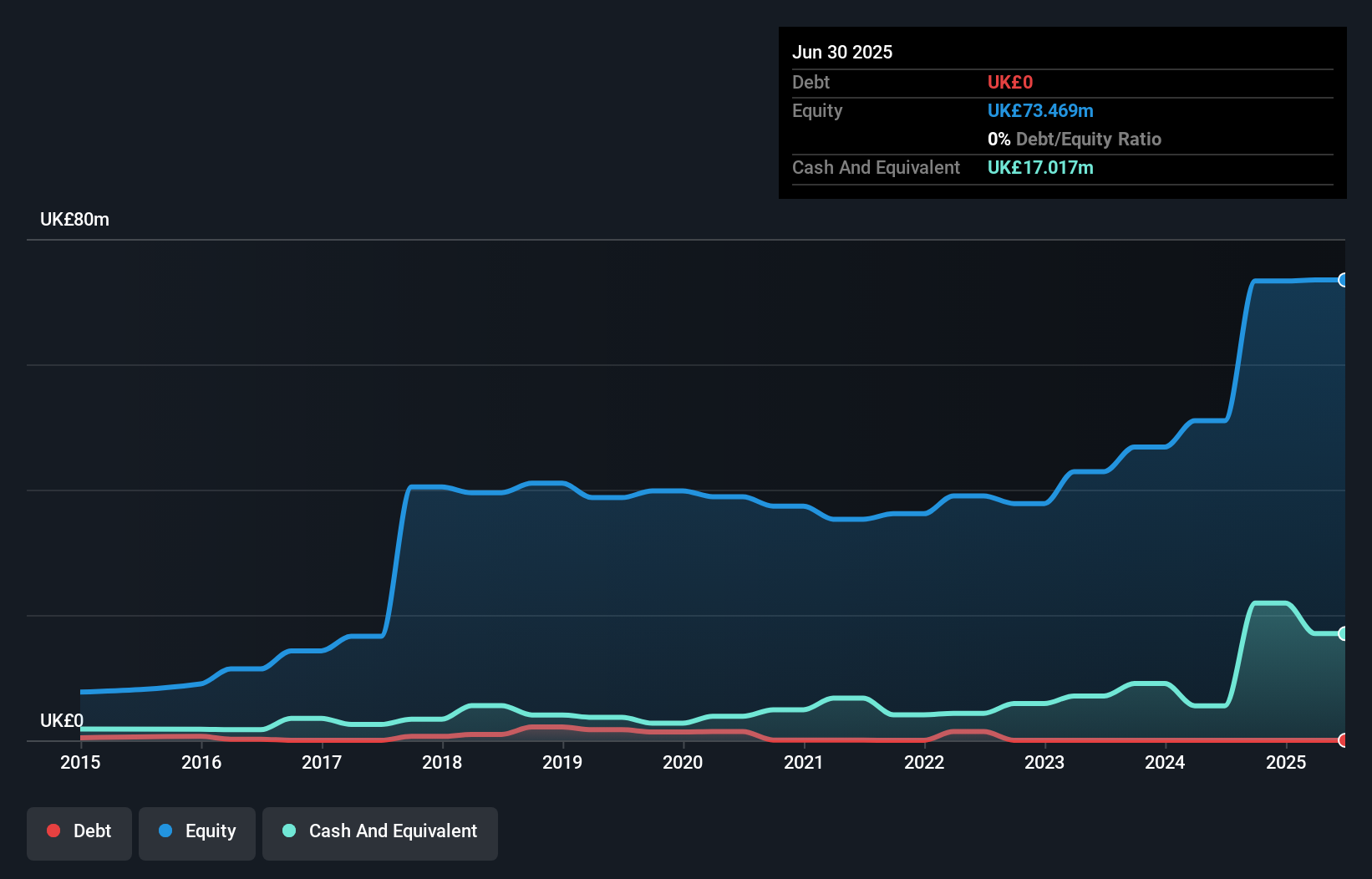

Warpaint London PLC, with a market cap of £329.61 million, demonstrates strong financial health and growth potential. The company is trading 34.9% below estimated fair value and has no debt, which enhances its financial stability. Earnings have grown significantly by 106.1% over the past year, surpassing industry averages and improving net profit margins to 17.4%. Despite recent equity offerings totaling £15 million to support expansion, shareholder dilution remains minimal. However, the dividend yield of 2.33% is not well covered by free cash flows, indicating potential risks in dividend sustainability amidst high earnings growth forecasts of 15.09% annually.

- Take a closer look at Warpaint London's potential here in our financial health report.

- Examine Warpaint London's earnings growth report to understand how analysts expect it to perform.

Currys (LSE:CURY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Currys plc is an omnichannel retailer of technology products and services across several countries including the UK, Ireland, and Nordic regions, with a market cap of approximately £1.08 billion.

Operations: The company's revenue is primarily derived from two geographical segments: UK & Ireland, generating £5.15 billion, and the Nordics, contributing £3.43 billion.

Market Cap: £1.08B

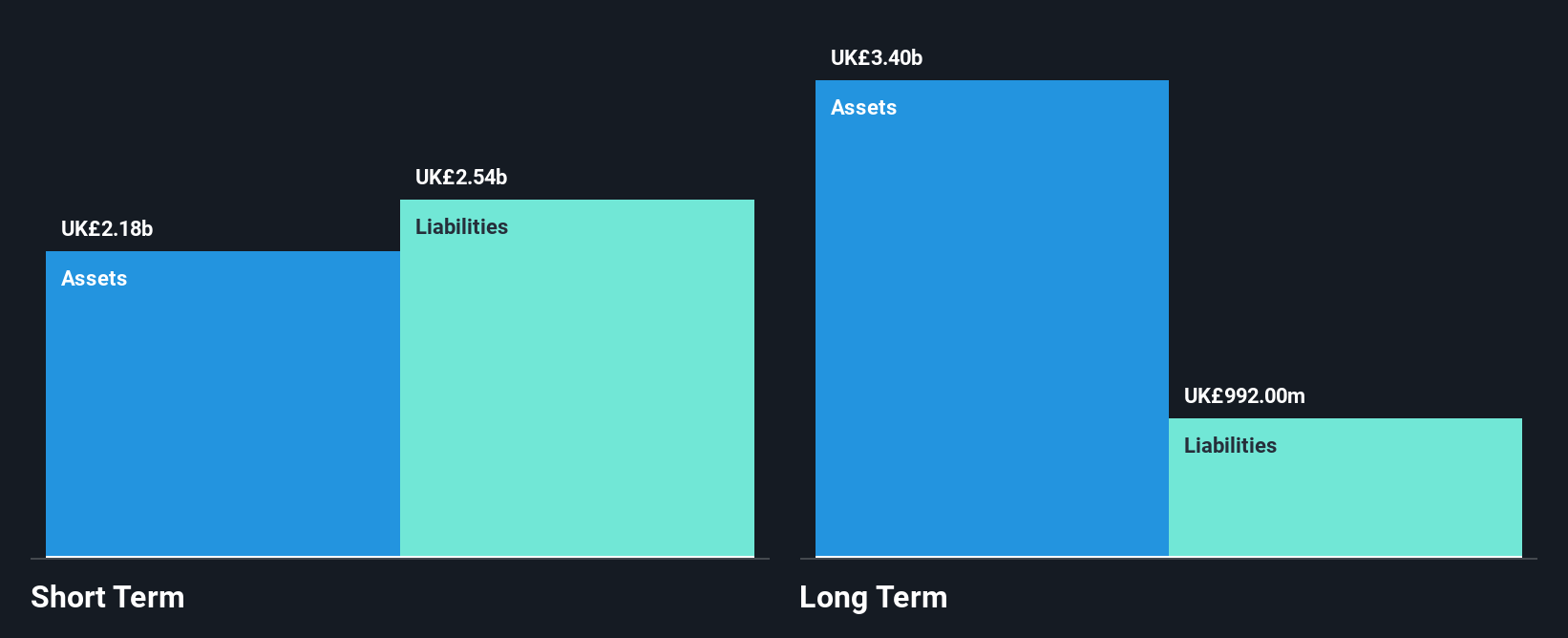

Currys plc, with a market cap of £1.08 billion, has shown significant earnings growth of 121.2% over the past year, surpassing industry averages. Despite this growth, its Return on Equity remains low at 2.7%. The company has improved its debt position significantly over five years and now holds more cash than total debt, though interest coverage is weak with EBIT covering interest payments only twice over. Recent financials revealed a net loss reduction from £39 million to £8 million year-on-year for the half-year ending October 2024. Currys plans to declare a final dividend reflecting strong cash flow performance in July 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of Currys.

- Learn about Currys' future growth trajectory here.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 440 UK Penny Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warpaint London might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:W7L

Flawless balance sheet and undervalued.

Market Insights

Community Narratives