- United Kingdom

- /

- Retail REITs

- /

- LSE:NRR

3 UK Stocks Estimated To Be Undervalued By 27.1% To 31.9%

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China and declining commodity prices. As global economic challenges persist, investors may find opportunities in stocks that appear undervalued based on current market conditions. Identifying such stocks requires careful consideration of their intrinsic value relative to their market price, especially in a fluctuating economic environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Brickability Group (AIM:BRCK) | £0.59 | £1.04 | 43.5% |

| On the Beach Group (LSE:OTB) | £2.605 | £4.59 | 43.3% |

| Gateley (Holdings) (AIM:GTLY) | £1.36 | £2.64 | 48.5% |

| Victrex (LSE:VCT) | £9.66 | £18.19 | 46.9% |

| Duke Capital (AIM:DUKE) | £0.3025 | £0.53 | 43.2% |

| Deliveroo (LSE:ROO) | £1.406 | £2.43 | 42.2% |

| Likewise Group (AIM:LIKE) | £0.19 | £0.37 | 48.8% |

| Nexxen International (AIM:NEXN) | £8.06 | £15.27 | 47.2% |

| Optima Health (AIM:OPT) | £1.775 | £3.31 | 46.3% |

| Melrose Industries (LSE:MRO) | £6.434 | £11.85 | 45.7% |

Let's dive into some prime choices out of the screener.

Warpaint London (AIM:W7L)

Overview: Warpaint London PLC, with a market cap of £331.23 million, produces and sells cosmetics through its subsidiaries.

Operations: The company's revenue is derived from two primary segments: Close-Out, contributing £2.12 million, and Own Brand, generating £96.72 million.

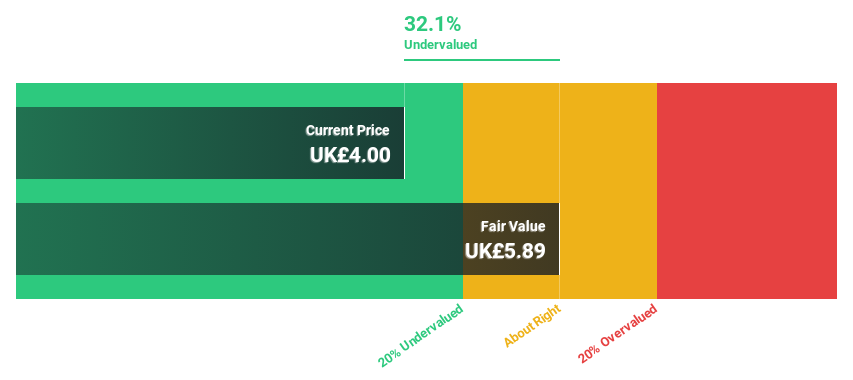

Estimated Discount To Fair Value: 30.4%

Warpaint London is trading at £4.1, below its estimated fair value of £5.89, suggesting it may be undervalued based on cash flows. The company expects revenue of approximately £102 million for 2024 and has completed follow-on equity offerings totaling nearly £15 million, enhancing liquidity. Despite high share price volatility, earnings grew by a very large amount over the past year and are forecast to grow faster than the UK market, indicating potential for future growth.

- The growth report we've compiled suggests that Warpaint London's future prospects could be on the up.

- Get an in-depth perspective on Warpaint London's balance sheet by reading our health report here.

NewRiver REIT (LSE:NRR)

Overview: NewRiver REIT plc is a prominent Real Estate Investment Trust focused on acquiring, managing, and developing durable retail assets across the UK, with a market cap of £347.55 million.

Operations: NewRiver REIT generates revenue primarily through its activities in acquiring, managing, and developing robust retail properties across the UK.

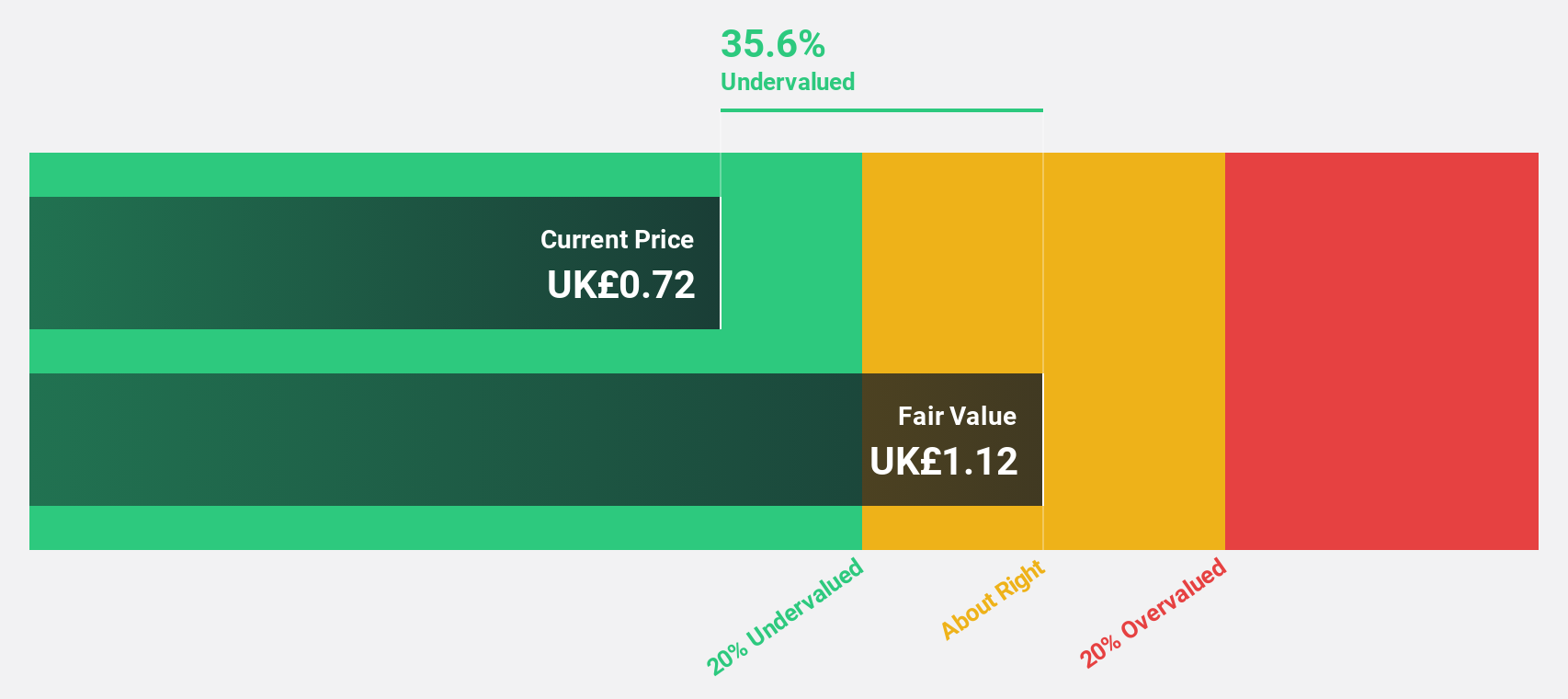

Estimated Discount To Fair Value: 31.9%

NewRiver REIT is trading at £0.73, significantly below its estimated fair value of £1.07, highlighting potential undervaluation based on cash flows. Although earnings are forecast to grow 48.15% annually, the current dividend yield of 8.48% isn't well covered by free cash flows. Recent results show a return to profitability with net income reaching £8.2 million for the half year ended September 2024, despite past shareholder dilution and large one-off items affecting financials.

- Upon reviewing our latest growth report, NewRiver REIT's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in NewRiver REIT's balance sheet health report.

Pinewood Technologies Group (LSE:PINE)

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry in the UK and internationally, with a market cap of £283.88 million.

Operations: The company generates revenue through its software segment, amounting to £22.62 million.

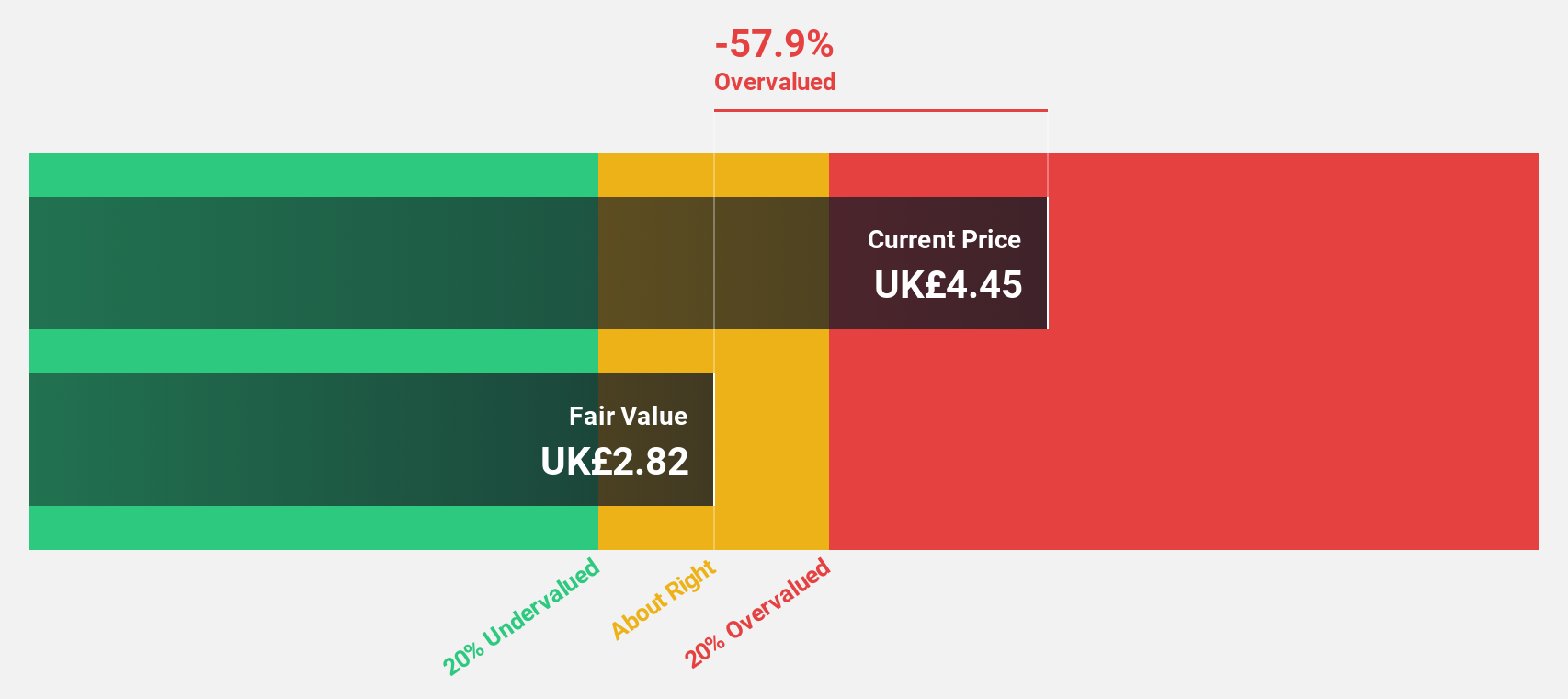

Estimated Discount To Fair Value: 27.1%

Pinewood Technologies Group is trading at £3.39, 27.1% below its estimated fair value of £4.65, suggesting it is undervalued based on cash flows. Earnings and revenue are forecast to grow significantly faster than the UK market, with earnings expected to increase by 23.2% annually. However, recent shareholder dilution poses a concern. A new five-year contract with Global Auto Holdings could boost future earnings but involves issuing warrants equivalent to 7% of current share capital.

- Our earnings growth report unveils the potential for significant increases in Pinewood Technologies Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Pinewood Technologies Group.

Turning Ideas Into Actions

- Unlock our comprehensive list of 56 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewRiver REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:NRR

NewRiver REIT

NewRiver REIT plc ('NewRiver') is a leading Real Estate Investment Trust specialising in buying, managing and developing resilient retail assets throughout the UK.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives