- United Kingdom

- /

- Personal Products

- /

- AIM:REVB

Revolution Beauty Group plc (LON:REVB) Shares Fly 29% But Investors Aren't Buying For Growth

Those holding Revolution Beauty Group plc (LON:REVB) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 52% share price decline over the last year.

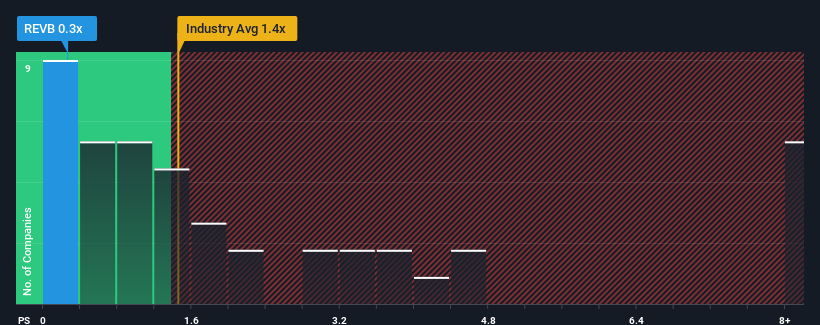

Although its price has surged higher, when around half the companies operating in the United Kingdom's Personal Products industry have price-to-sales ratios (or "P/S") above 2.6x, you may still consider Revolution Beauty Group as an incredibly enticing stock to check out with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Revolution Beauty Group

What Does Revolution Beauty Group's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Revolution Beauty Group's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Revolution Beauty Group will help you uncover what's on the horizon.How Is Revolution Beauty Group's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Revolution Beauty Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 10% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 15% over the next year. With the industry predicted to deliver 3.3% growth, that's a disappointing outcome.

In light of this, it's understandable that Revolution Beauty Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Revolution Beauty Group's P/S

Shares in Revolution Beauty Group have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Revolution Beauty Group's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Revolution Beauty Group (2 don't sit too well with us!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:REVB

Revolution Beauty Group

Engages in the development, production, wholesale, and retail of beauty products in the United Kingdom, the United States, and internationally.

Slight risk and fair value.

Market Insights

Community Narratives