- United Kingdom

- /

- Healthcare Services

- /

- LSE:IDHC

UK Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China and the struggles of major companies tied to global commodity markets. As investors navigate these challenging market conditions, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those seeking resilience in their portfolios.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.49% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 5.48% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.97% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.99% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.27% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.57% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.41% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.21% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.62% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.19% | ★★★★★☆ |

Click here to see the full list of 50 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

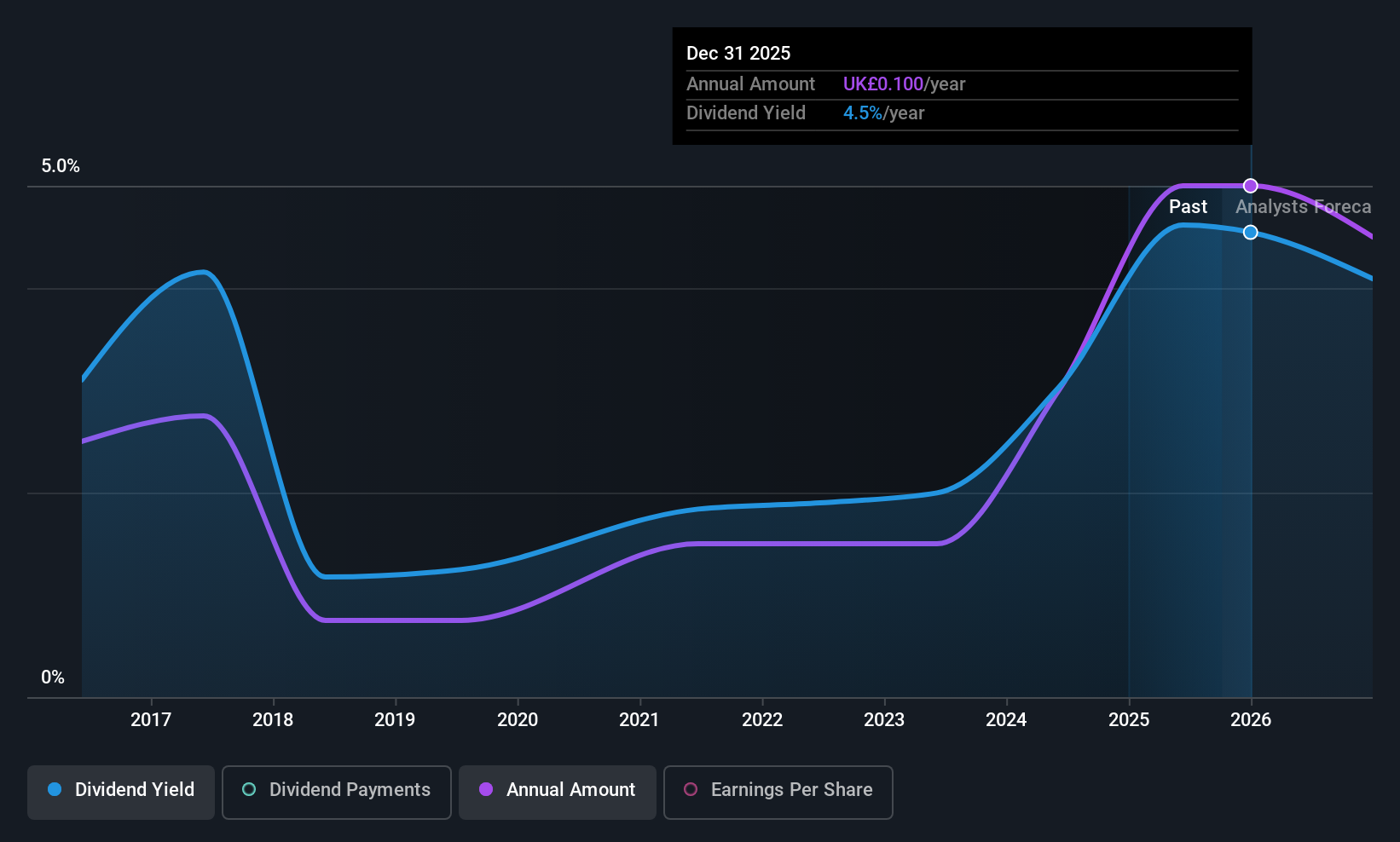

Helios Underwriting (AIM:HUW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Helios Underwriting plc, with a market cap of £155.95 million, operates by offering limited liability investment opportunities for shareholders in the Lloyd’s insurance market in the United Kingdom.

Operations: Helios Underwriting plc generates its revenue by providing shareholders with limited liability investment opportunities within the Lloyd’s insurance market in the UK.

Dividend Yield: 4.6%

Helios Underwriting's dividend payments have been volatile, with an unreliable track record over the past decade. Despite this, recent earnings improvements, with net income reaching £4.41 million for the first half of 2025, suggest potential stability. The dividend is well-covered by both earnings and cash flows, boasting a low payout ratio of 29.8%. However, its yield of 4.59% remains below the top UK market payers. Recent leadership changes could influence future performance positively or negatively.

- Delve into the full analysis dividend report here for a deeper understanding of Helios Underwriting.

- According our valuation report, there's an indication that Helios Underwriting's share price might be on the cheaper side.

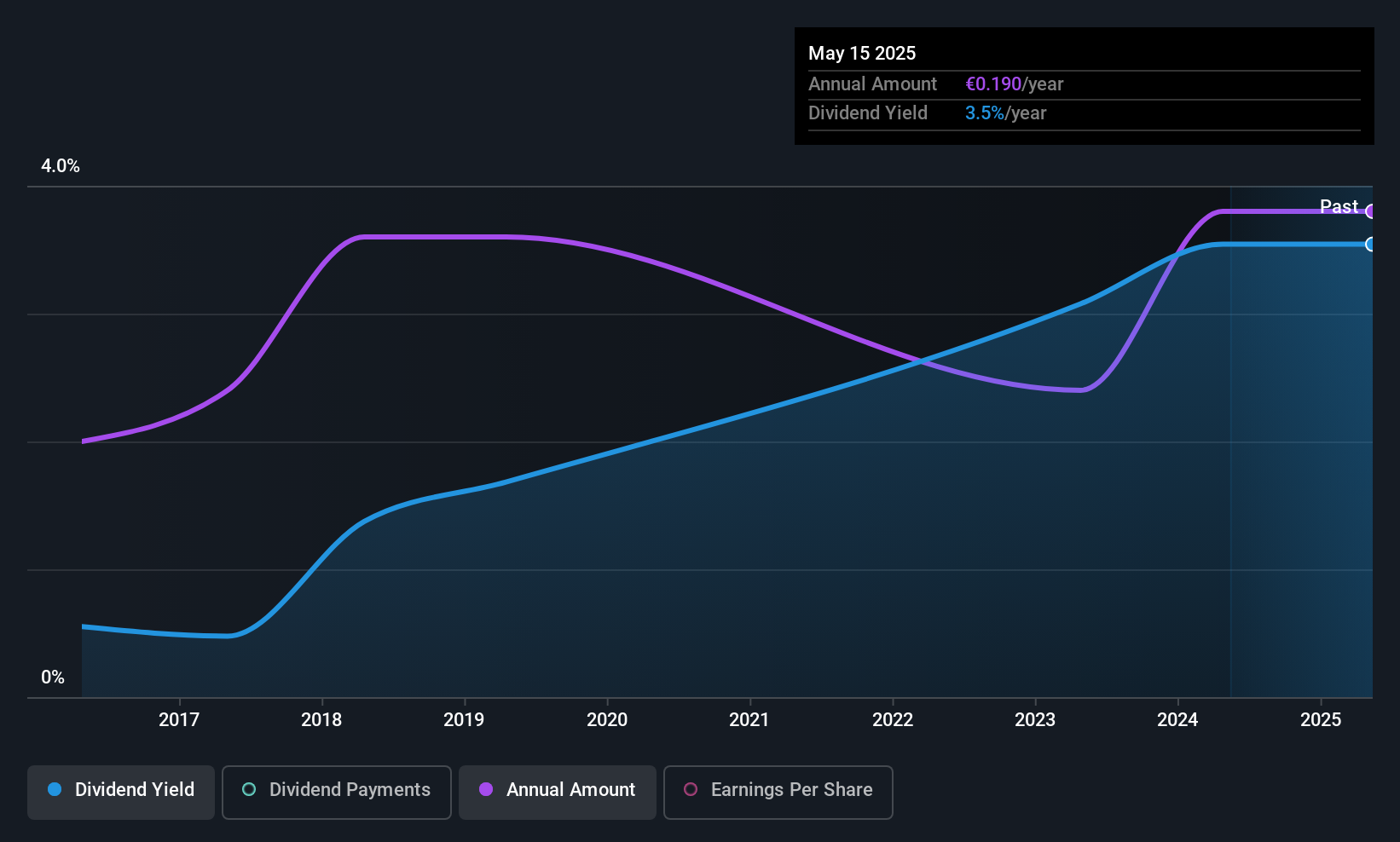

Multitude (LSE:0R4W)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multitude AG, along with its subsidiaries, offers digital lending and online banking services in Finland and has a market cap of €148.04 million.

Operations: Multitude AG generates revenue through three main segments: SME Banking (€15.75 million), Consumer Banking (€114.14 million), and Wholesale Banking (€8.36 million).

Dividend Yield: 3.5%

Multitude AG's dividend payments have been volatile over the past decade, despite a low payout ratio of 23.5% and cash payout ratio of 5.1%, indicating strong coverage by earnings and cash flows. Recent earnings growth, with net income rising to €14.16 million for the first half of 2025, underscores potential financial stability. However, its dividend yield of 3.49% is lower than top UK market payers, and historical unreliability may concern cautious investors.

- Navigate through the intricacies of Multitude with our comprehensive dividend report here.

- The analysis detailed in our Multitude valuation report hints at an deflated share price compared to its estimated value.

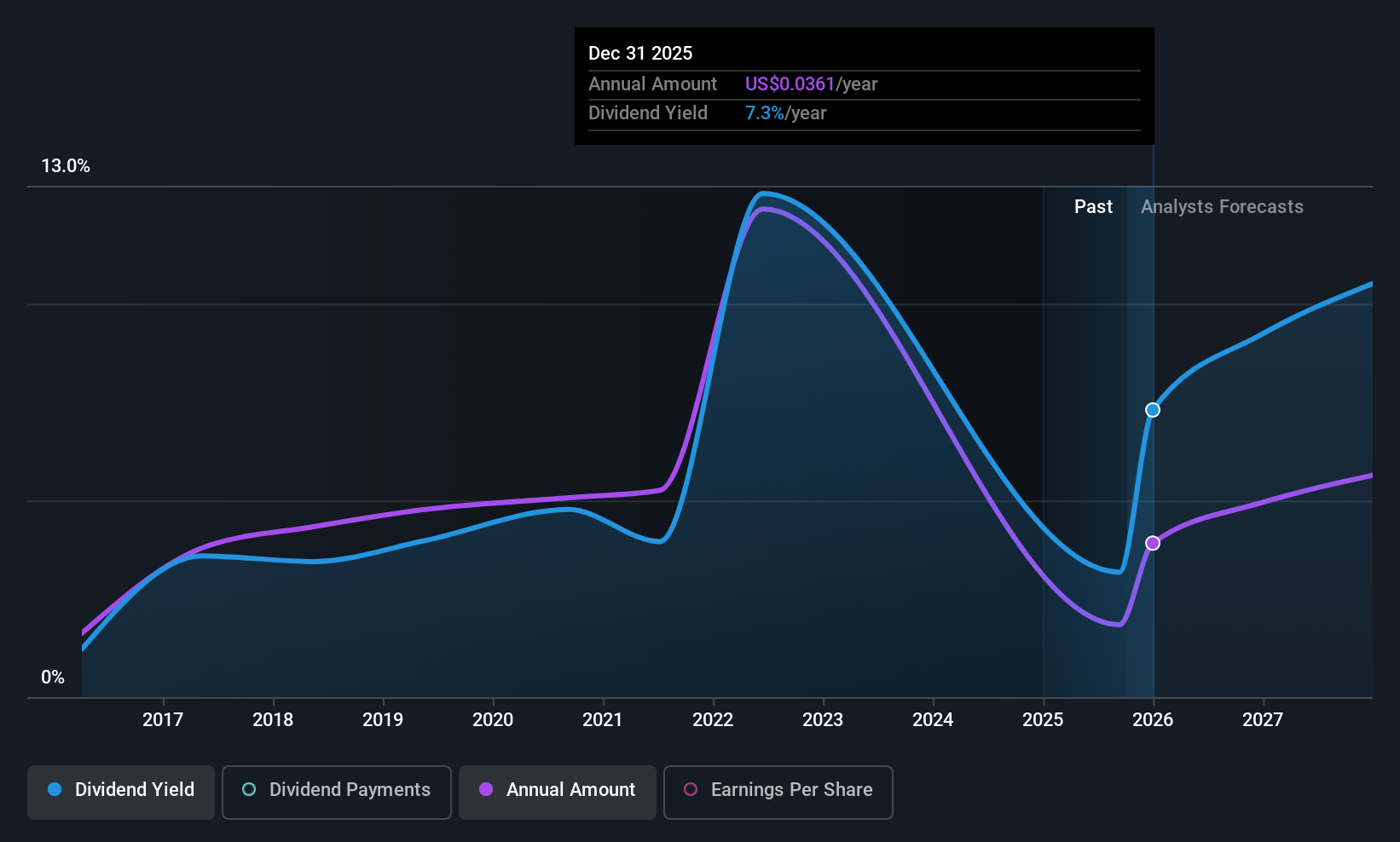

Integrated Diagnostics Holdings (LSE:IDHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company offering medical diagnostics services, with a market cap of $321.18 million.

Operations: Integrated Diagnostics Holdings plc generates its revenue through the provision of medical diagnostics services to patients.

Dividend Yield: 3.1%

Integrated Diagnostics Holdings offers a well-covered dividend with a 46% payout ratio and 40.3% cash payout ratio, yet its history of volatile payments may concern investors seeking stability. Despite trading at good value and earnings growing by 34.3% last year, its dividend yield of 3.08% is below top UK payers. Recent announcements indicate strong performance with revenue growth exceeding 30%, suggesting potential for future financial resilience despite past dividend unreliability.

- Dive into the specifics of Integrated Diagnostics Holdings here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Integrated Diagnostics Holdings is priced lower than what may be justified by its financials.

Seize The Opportunity

- Explore the 50 names from our Top UK Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IDHC

Integrated Diagnostics Holdings

Operates as a consumer healthcare company that provides medical diagnostics services to patients.

Undervalued with high growth potential and pays a dividend.

Market Insights

Community Narratives