- United Kingdom

- /

- Media

- /

- LSE:INF

UK Stocks Including Tristel That May Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting concerns about global economic recovery. In such a climate, identifying undervalued stocks can be crucial for investors looking to capitalize on potential opportunities; these are stocks trading below their estimated fair value despite strong fundamentals or growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| QinetiQ Group (LSE:QQ.) | £4.264 | £7.65 | 44.2% |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £1.68 | 43.9% |

| AstraZeneca (LSE:AZN) | £102.40 | £190.61 | 46.3% |

| Informa (LSE:INF) | £7.806 | £15.32 | 49% |

| On the Beach Group (LSE:OTB) | £2.72 | £4.99 | 45.5% |

| Duke Capital (AIM:DUKE) | £0.2875 | £0.55 | 47.4% |

| Vistry Group (LSE:VTY) | £6.10 | £11.37 | 46.3% |

| Deliveroo (LSE:ROO) | £1.749 | £3.21 | 45.6% |

| Ibstock (LSE:IBST) | £1.86 | £3.23 | 42.3% |

| Crest Nicholson Holdings (LSE:CRST) | £1.929 | £3.85 | 49.9% |

Here's a peek at a few of the choices from the screener.

Tristel (AIM:TSTL)

Overview: Tristel plc develops, manufactures, and sells infection prevention products across the United Kingdom, Australia, Germany, Western Europe, and internationally with a market cap of £188.42 million.

Operations: The company's revenue segments include £37.68 million from Hospital Medical Device Decontamination and £3.51 million from Hospital Environmental Surface Disinfection.

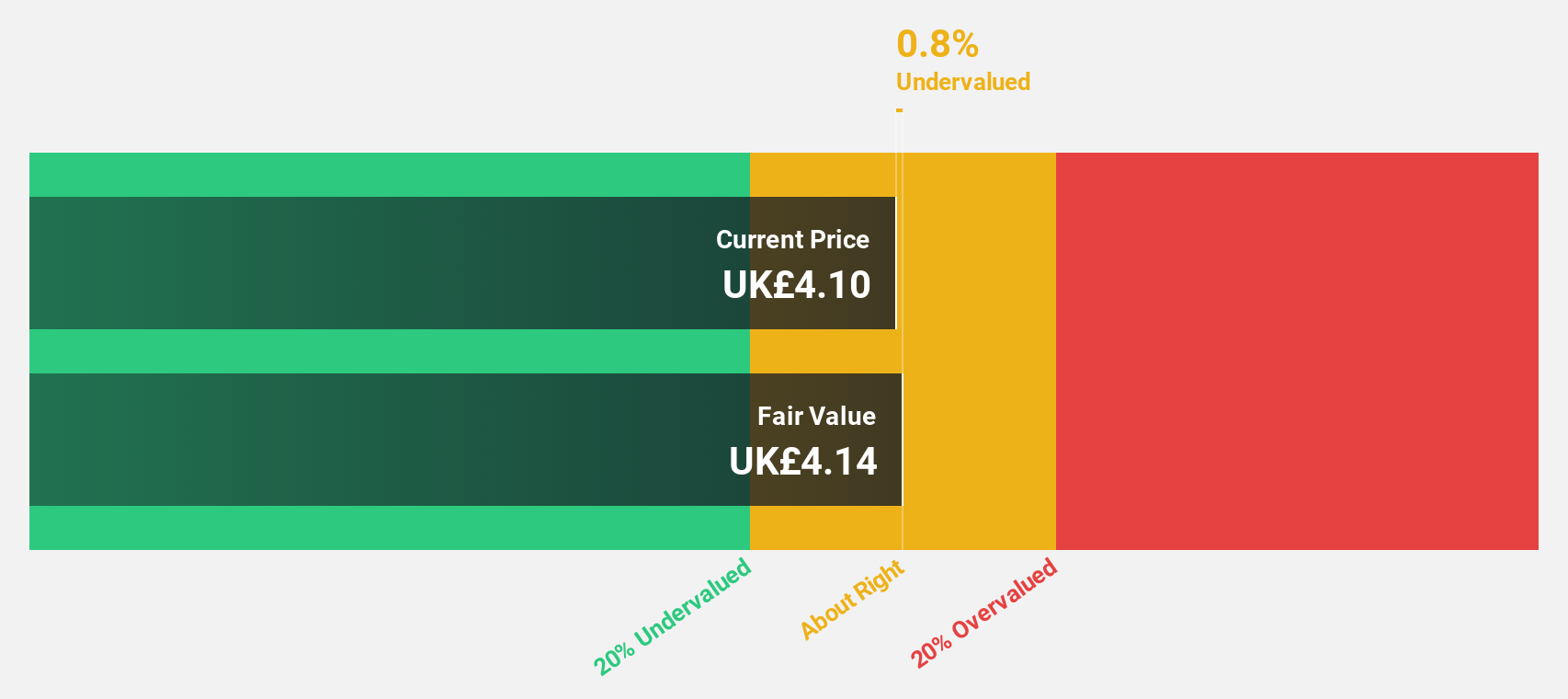

Estimated Discount To Fair Value: 18%

Tristel is currently trading at £3.95, below its estimated fair value of £4.82, suggesting it may be undervalued based on cash flows. While the dividend yield of 3.42% isn't well covered by earnings, the company forecasts robust growth with earnings expected to rise 19% annually, outpacing the UK market's 14.1%. Recent FDA-related developments for its disinfectant products could enhance future revenue streams and operational efficiencies in North America.

- According our earnings growth report, there's an indication that Tristel might be ready to expand.

- Take a closer look at Tristel's balance sheet health here in our report.

Informa (LSE:INF)

Overview: Informa plc is an international company specializing in event organization, digital services, and academic research across the UK, Continental Europe, the US, China, and other global markets with a market cap of £10.20 billion.

Operations: The company's revenue segments include Informa Tech at £423.90 million, Informa Connect at £631 million, Informa Markets at £1.72 billion, and Taylor & Francis at £698.20 million.

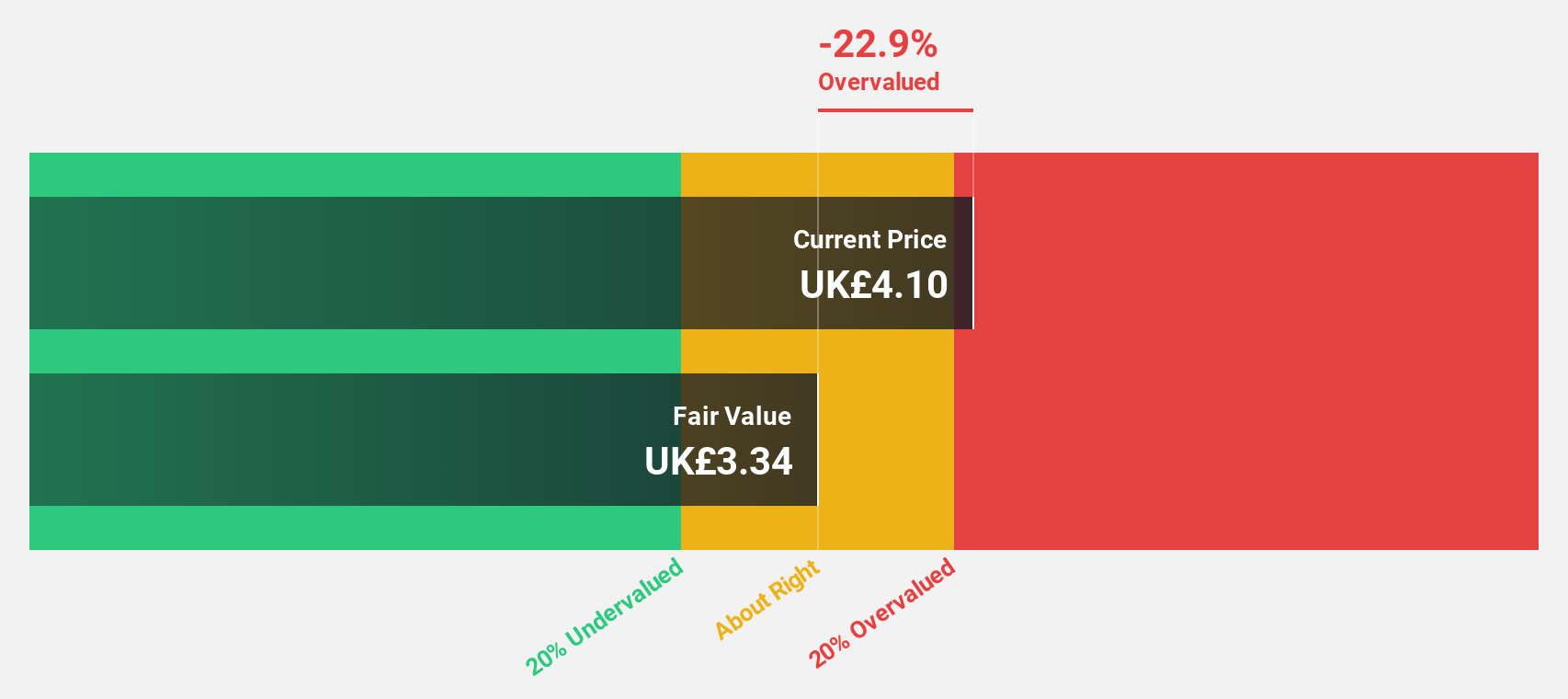

Estimated Discount To Fair Value: 49%

Informa is trading at £7.81, significantly below its estimated fair value of £15.32, highlighting potential undervaluation based on discounted cash flows. Despite a lower profit margin of 8.4% compared to last year's 13.1%, earnings are forecasted to grow substantially at 21% annually, surpassing the UK market growth rate of 14.1%. The company's reaffirmed revenue guidance for 2025 targets £4.1 billion, indicating confidence in achieving double-digit growth despite recent financial challenges.

- Our comprehensive growth report raises the possibility that Informa is poised for substantial financial growth.

- Navigate through the intricacies of Informa with our comprehensive financial health report here.

Watches of Switzerland Group (LSE:WOSG)

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry across the United Kingdom, Europe, and the United States with a market cap of £873.95 million.

Operations: The company's revenue is derived from two main segments: the United States, contributing £718.90 million, and the UK & Europe, generating £842.40 million.

Estimated Discount To Fair Value: 14.8%

Watches of Switzerland Group is trading at £3.65, slightly below its estimated fair value of £4.28, suggesting it may be undervalued based on discounted cash flows. Earnings are expected to grow significantly at 23.83% annually, outpacing the UK market's growth rate of 14.1%. Despite a decline in profit margins from 6.8% to 2.6%, the company has initiated a share repurchase program, potentially enhancing shareholder value amidst these financial dynamics.

- Our growth report here indicates Watches of Switzerland Group may be poised for an improving outlook.

- Get an in-depth perspective on Watches of Switzerland Group's balance sheet by reading our health report here.

Taking Advantage

- Click through to start exploring the rest of the 49 Undervalued UK Stocks Based On Cash Flows now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, North America, China, and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives