- United Kingdom

- /

- Chemicals

- /

- OFEX:SNOX

UK Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the UK market has remained flat, though it is up 11% over the past year and earnings are forecast to grow by 14% annually. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.95 | £184.64M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £768.58M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.355 | £407.27M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.555 | £180.75M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.325 | £324.93M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.50 | £191.03M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.596 | £235.97M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.41 | £119.17M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.86 | £70.81M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.457 | $261.6M | ★★★★★★ |

Click here to see the full list of 466 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Serabi Gold (AIM:SRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Serabi Gold plc is involved in the evaluation, exploration, and development of gold and other metals mining projects in Brazil, with a market cap of £70.81 million.

Operations: The company's revenue primarily comes from its gold mining and exploration activities, generating $75.85 million.

Market Cap: £70.81M

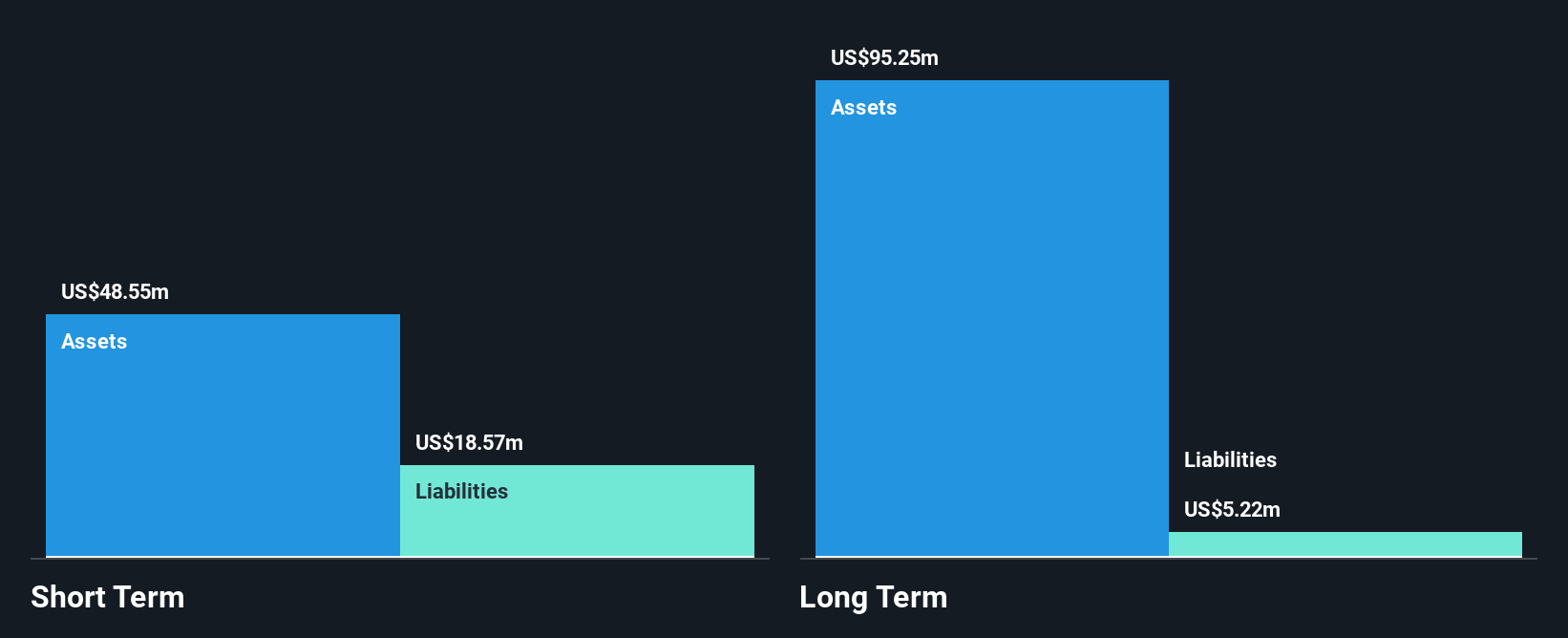

Serabi Gold plc has demonstrated substantial earnings growth, with a notable 462.3% increase over the past year, surpassing industry averages. The company's financial health appears robust, as short-term assets of $31.2 million exceed both short and long-term liabilities, while cash reserves surpass total debt. Recent production results show an increase in gold output to 9,489 ounces for Q3 2024, supporting their reiterated annual guidance of up to 40,000 ounces. Operational updates highlight advancements at the Coringa project and promising exploration results at Palito. However, Return on Equity remains modest at 11.5%, indicating potential areas for improvement in capital efficiency.

- Get an in-depth perspective on Serabi Gold's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Serabi Gold's future.

Tristel (AIM:TSTL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tristel plc develops, manufactures, and sells infection prevention products in the United Kingdom and internationally with a market cap of £184.64 million.

Operations: Tristel plc has not reported any specific revenue segments.

Market Cap: £184.64M

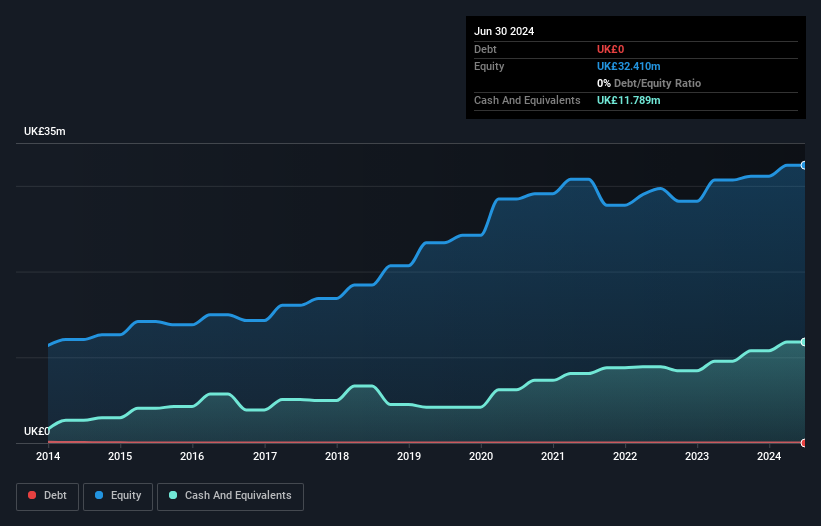

Tristel plc has reported strong financial performance with earnings growth of 45.5% over the past year and a high return on equity of 20%. The company is trading at a value below its estimated fair value, suggesting potential for appreciation. Despite significant insider selling recently, Tristel remains debt-free with robust coverage of liabilities through short-term assets (£24.7M). Recent announcements include a substantial increase in dividends by 29% and an FDA filing for their ophthalmic disinfectant product, which could impact North American markets positively. However, the management team lacks extensive experience with an average tenure under two years.

- Click here and access our complete financial health analysis report to understand the dynamics of Tristel.

- Gain insights into Tristel's future direction by reviewing our growth report.

SulNOx Group (OFEX:SNOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SulNOx Group PLC manufactures and develops fuel conditioners and emulsifiers aimed at decarbonizing liquid hydrocarbon fuels across various global markets, with a market cap of £59.56 million.

Operations: The company generates revenue of £0.54 million from its specialty chemicals segment.

Market Cap: £59.56M

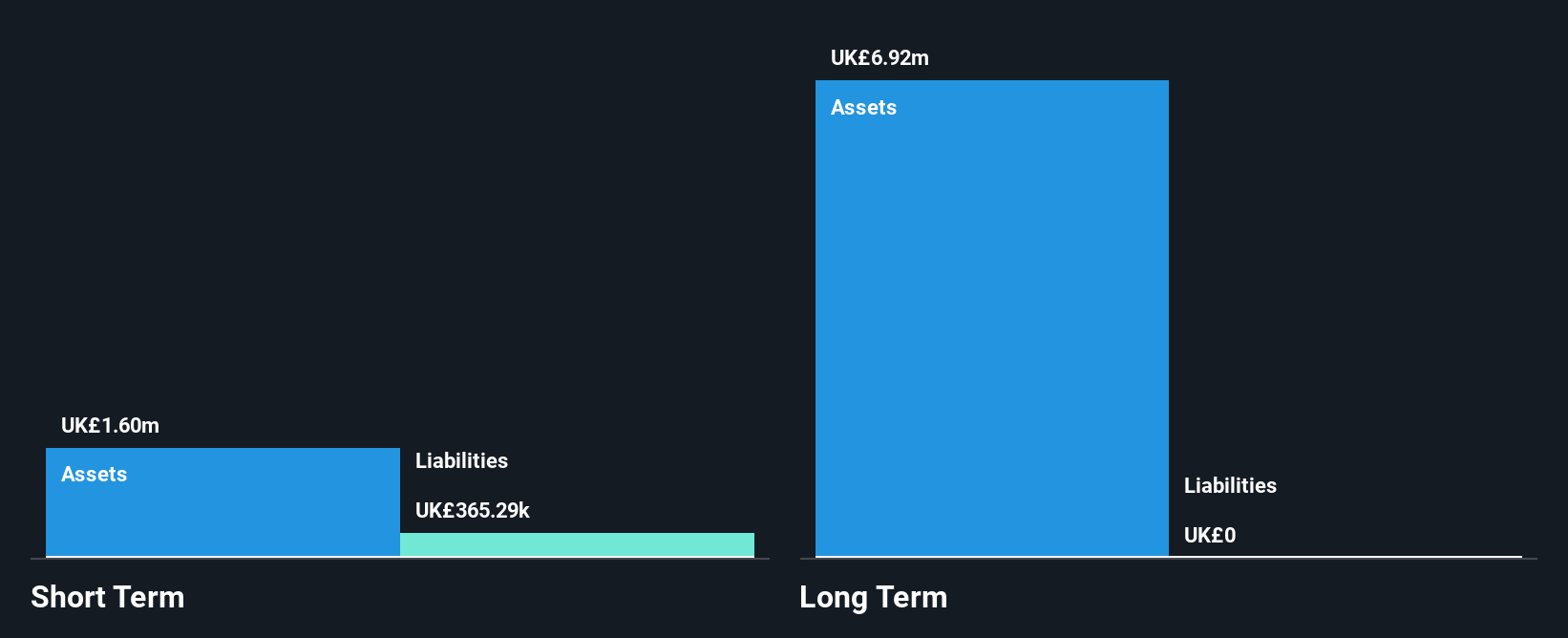

SulNOx Group PLC is a pre-revenue company with a market cap of £59.56 million and reported sales of £0.54 million for the year ending March 31, 2024. Despite being debt-free and having no long-term liabilities, SulNOx faces challenges due to its unprofitability and shareholder dilution over the past year. The company has sufficient cash runway for more than a year but continues to experience high share price volatility. Recent developments include collaboration with Peninsula Yacht Services to promote its fuel conditioner, which could enhance market visibility despite current financial hurdles.

- Unlock comprehensive insights into our analysis of SulNOx Group stock in this financial health report.

- Gain insights into SulNOx Group's historical outcomes by reviewing our past performance report.

Next Steps

- Get an in-depth perspective on all 466 UK Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OFEX:SNOX

SulNOx Group

Manufactures and develops fuel conditioners and emulsifiers for decarbonization of liquid hydrocarbon fuels in the United Kingdom, the Americas, Europe, Africa, Asia, Oceania, and internationally.

Flawless balance sheet very low.