- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:CBOX

Discover Promising Penny Stocks On The UK Exchange This November 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, investors often seek opportunities in smaller or newer companies that offer potential growth at lower price points. Penny stocks, though a somewhat outdated term, continue to attract attention for their ability to combine value and growth when backed by strong financials and fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.05 | £402.8M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.925 | £70.05M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.65 | £192.41M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.255 | £107.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.27 | £195.87M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.41 | £179.57M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.325 | £425.48M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.40 | £209.85M | ★★★★★★ |

Click here to see the full list of 464 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cake Box Holdings (AIM:CBOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cake Box Holdings Plc, with a market cap of £77 million, operates in the United Kingdom retail sector specializing in fresh cream celebration cakes.

Operations: The company's revenue is derived from its food processing segment, totaling £38.62 million.

Market Cap: £77M

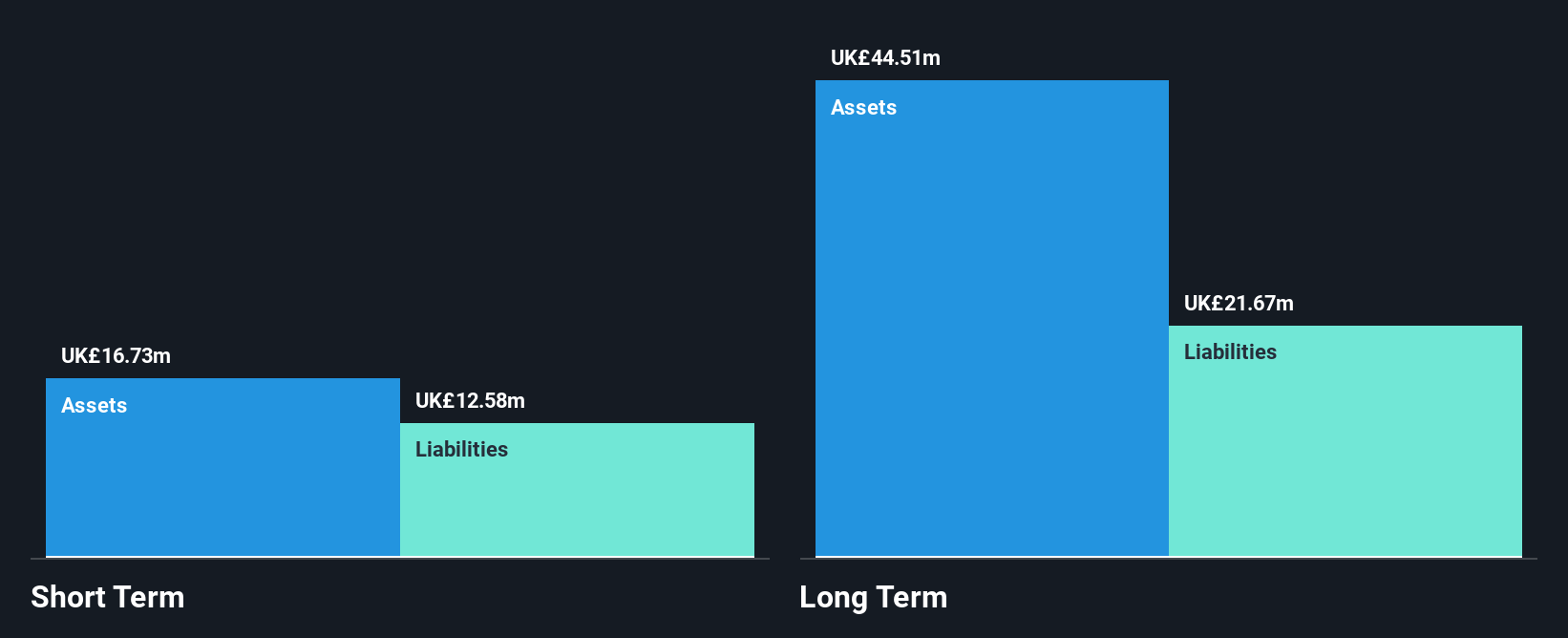

Cake Box Holdings Plc, with a market cap of £77 million, has demonstrated stable growth and financial health in the UK retail sector. Recent earnings for the half-year ended September 30, 2024, showed increased sales of £18.73 million and net income of £2.07 million compared to last year. The company announced a strategic alliance with Nutella for new product launches, potentially boosting revenue streams. Despite a high dividend yield not fully covered by free cash flow, Cake Box's debt is well-managed with operating cash flow coverage at 576.8%, and short-term assets comfortably cover liabilities, indicating strong liquidity management.

- Navigate through the intricacies of Cake Box Holdings with our comprehensive balance sheet health report here.

- Learn about Cake Box Holdings' future growth trajectory here.

Metals Exploration (AIM:MTL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metals Exploration plc is involved in identifying, acquiring, exploring, and developing mining and processing properties in the Philippines with a market cap of £99.37 million.

Operations: The company's revenue is derived from its Metals & Mining segment, specifically focused on Gold & Other Precious Metals, totaling $168.22 million.

Market Cap: £99.37M

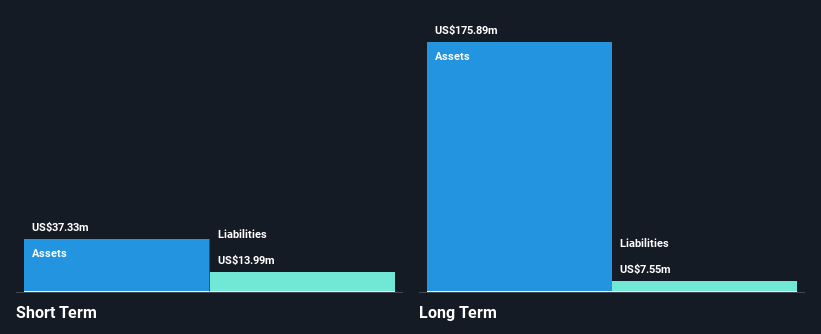

Metals Exploration plc, with a market cap of £99.37 million, is actively enhancing its mining operations in the Philippines. Recent board appointments bring substantial industry experience, potentially strengthening strategic oversight. The company has initiated exploration drilling at the Abra tenements, aiming for an initial resource estimate by Q3 2025. Financially robust with no debt and strong earnings growth of 213.3% over the past year, Metals Exploration's net profit margins have improved significantly to 83.7%. However, its share price remains highly volatile and insider selling was noted recently, which may concern some investors.

- Click here and access our complete financial health analysis report to understand the dynamics of Metals Exploration.

- Examine Metals Exploration's earnings growth report to understand how analysts expect it to perform.

Tristel (AIM:TSTL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tristel plc develops, manufactures, and sells infection prevention products in the United Kingdom, Australia, Germany, Western Europe, and internationally with a market cap of £209.85 million.

Operations: The company's revenue is primarily derived from its Hospital Medical Device Decontamination segment, which accounts for £36.34 million, followed by the Hospital Environmental Surface Disinfection segment at £3.44 million.

Market Cap: £209.85M

Tristel plc, with a market cap of £209.85 million, has demonstrated robust financial performance and stability. The company reported a significant increase in sales to £41.93 million and net income to £6.49 million for the year ended June 30, 2024. It boasts high-quality earnings, strong profit growth of 45.5% over the past year, and maintains a debt-free balance sheet with short-term assets exceeding liabilities comfortably. Despite its promising growth trajectory and stable weekly volatility at 6%, recent insider selling may raise concerns for some investors about potential internal sentiment shifts or future prospects.

- Dive into the specifics of Tristel here with our thorough balance sheet health report.

- Assess Tristel's future earnings estimates with our detailed growth reports.

Make It Happen

- Click through to start exploring the rest of the 461 UK Penny Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CBOX

Cake Box Holdings

Engages in the retail of fresh cream celebration cakes in the United Kingdom.

Flawless balance sheet with solid track record.