- United Kingdom

- /

- Medical Equipment

- /

- LSE:CTEC

3 UK Stocks That Investors May Be Undervaluing By Up To 35.3%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 and FTSE 250 indices have experienced declines, influenced by weak trade data from China and its sluggish economic recovery efforts. In this challenging environment, identifying undervalued stocks can be crucial for investors seeking opportunities; these are stocks that may not yet reflect their true potential value amidst broader market pressures.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.196 | £11.80 | 47.5% |

| Van Elle Holdings (AIM:VANL) | £0.38 | £0.74 | 49% |

| Topps Tiles (LSE:TPT) | £0.378 | £0.7 | 45.7% |

| TBC Bank Group (LSE:TBCG) | £47.95 | £94.76 | 49.4% |

| Moonpig Group (LSE:MOON) | £2.115 | £4.02 | 47.4% |

| Marlowe (AIM:MRL) | £4.43 | £8.39 | 47.2% |

| LSL Property Services (LSE:LSL) | £3.02 | £5.85 | 48.4% |

| Gooch & Housego (AIM:GHH) | £6.06 | £11.18 | 45.8% |

| Franchise Brands (AIM:FRAN) | £1.40 | £2.69 | 47.9% |

| Begbies Traynor Group (AIM:BEG) | £1.21 | £2.26 | 46.4% |

Let's uncover some gems from our specialized screener.

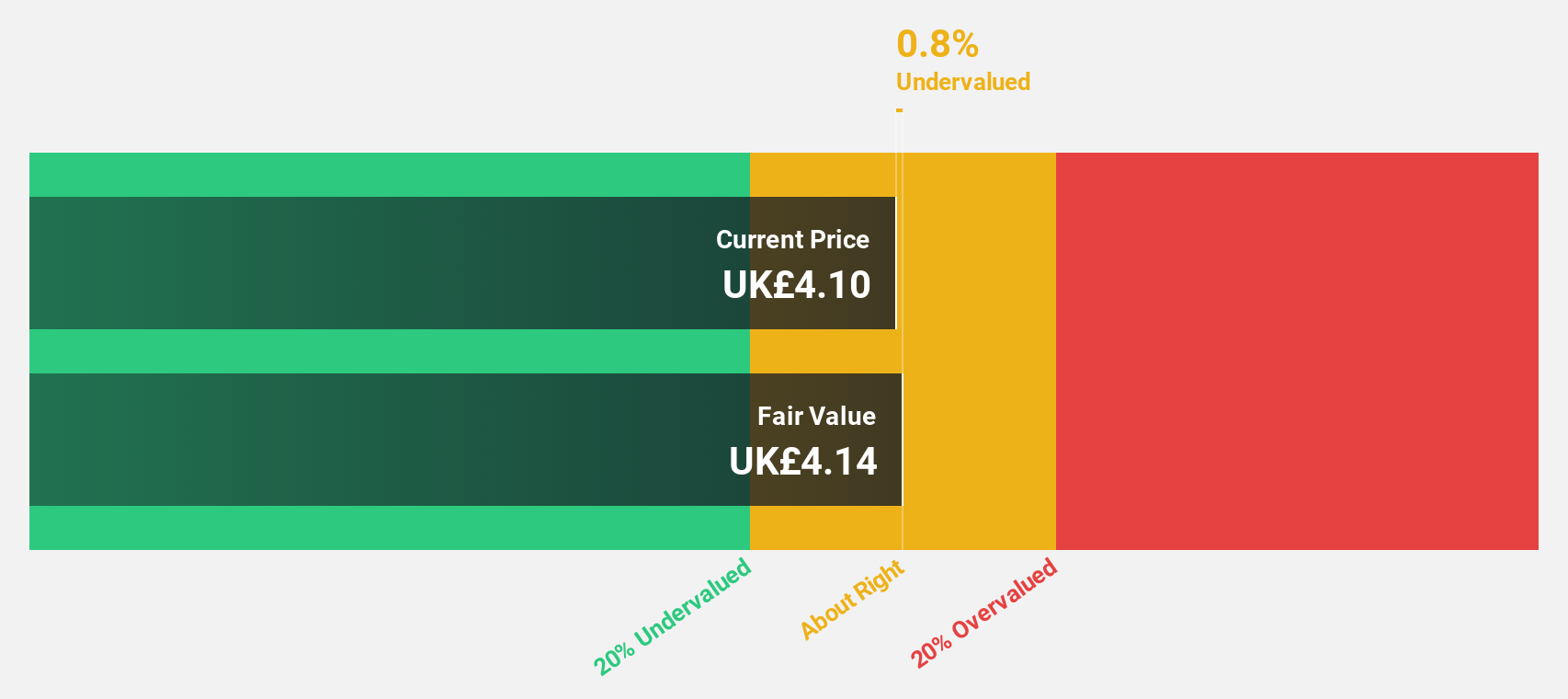

Tristel (AIM:TSTL)

Overview: Tristel plc develops, manufactures, and sells infection prevention products across the United Kingdom, Australia, Germany, Western Europe, and internationally with a market cap of £186.08 million.

Operations: The company's revenue is primarily derived from its Hospital Medical Device Decontamination segment at £37.68 million, followed by Hospital Environmental Surface Disinfection at £3.51 million.

Estimated Discount To Fair Value: 10%

Tristel is trading at £3.9, below its estimated fair value of £4.34, highlighting potential undervaluation based on cash flows. The company's earnings have consistently grown by 10% annually over the past five years and are projected to grow faster than the UK market at 19% per year. Recent FDA clearance for Tristel OPH in the U.S. could enhance revenue growth prospects, though dividend coverage remains a concern with a yield of 3.47%.

- According our earnings growth report, there's an indication that Tristel might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Tristel.

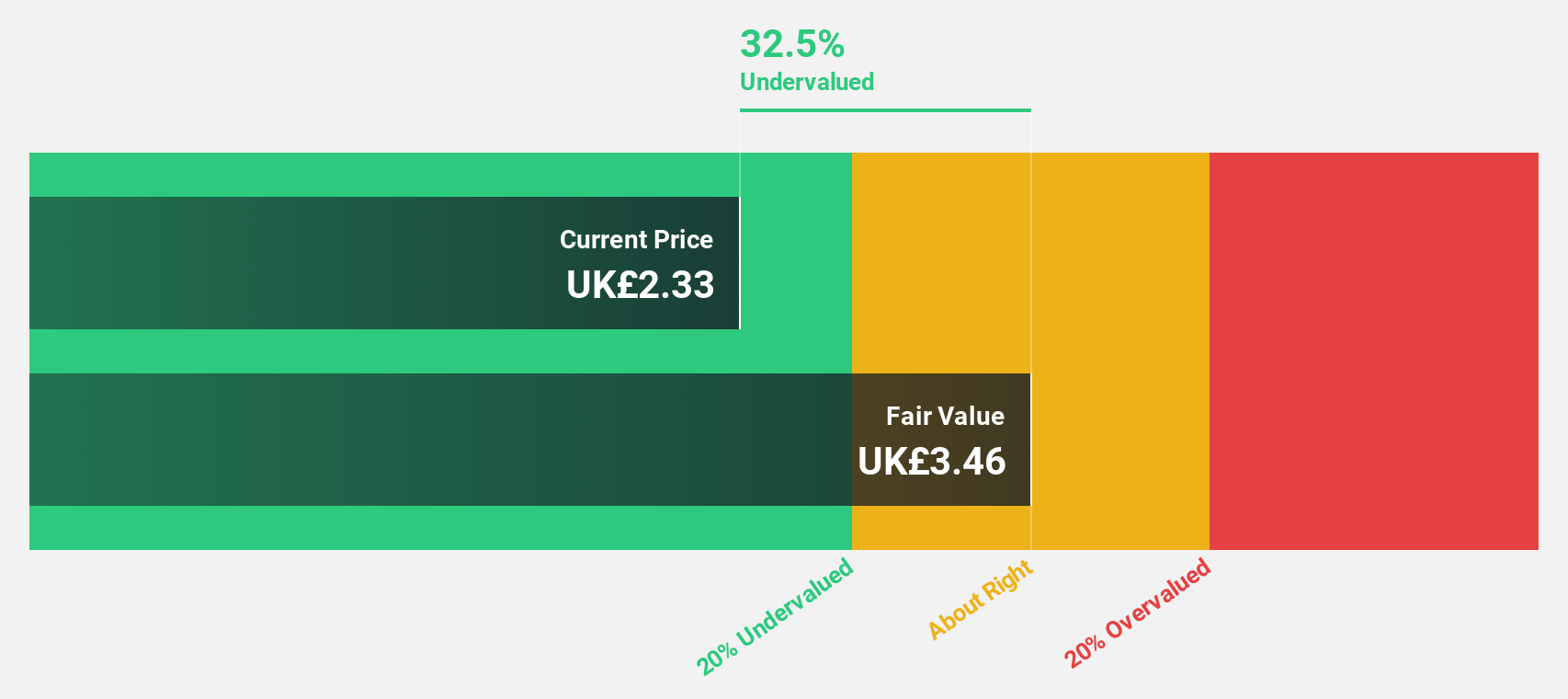

ConvaTec Group (LSE:CTEC)

Overview: ConvaTec Group PLC develops, manufactures, and sells medical products, services, and technologies globally with a market cap of £4.96 billion.

Operations: The company's revenue segment comprises the development, manufacture, and sale of medical products and technologies, generating $2.29 billion.

Estimated Discount To Fair Value: 35.3%

ConvaTec Group is trading at £2.43, significantly below its estimated fair value of £3.75, indicating undervaluation based on cash flows. Despite a high debt level, the company has shown strong earnings growth of 46.2% over the past year and is expected to outpace UK market growth with projected earnings increases of 16.82% annually. Revenue growth forecasts also exceed market expectations at 5.6% per year, supporting a positive outlook for future cash flows.

- Our earnings growth report unveils the potential for significant increases in ConvaTec Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of ConvaTec Group.

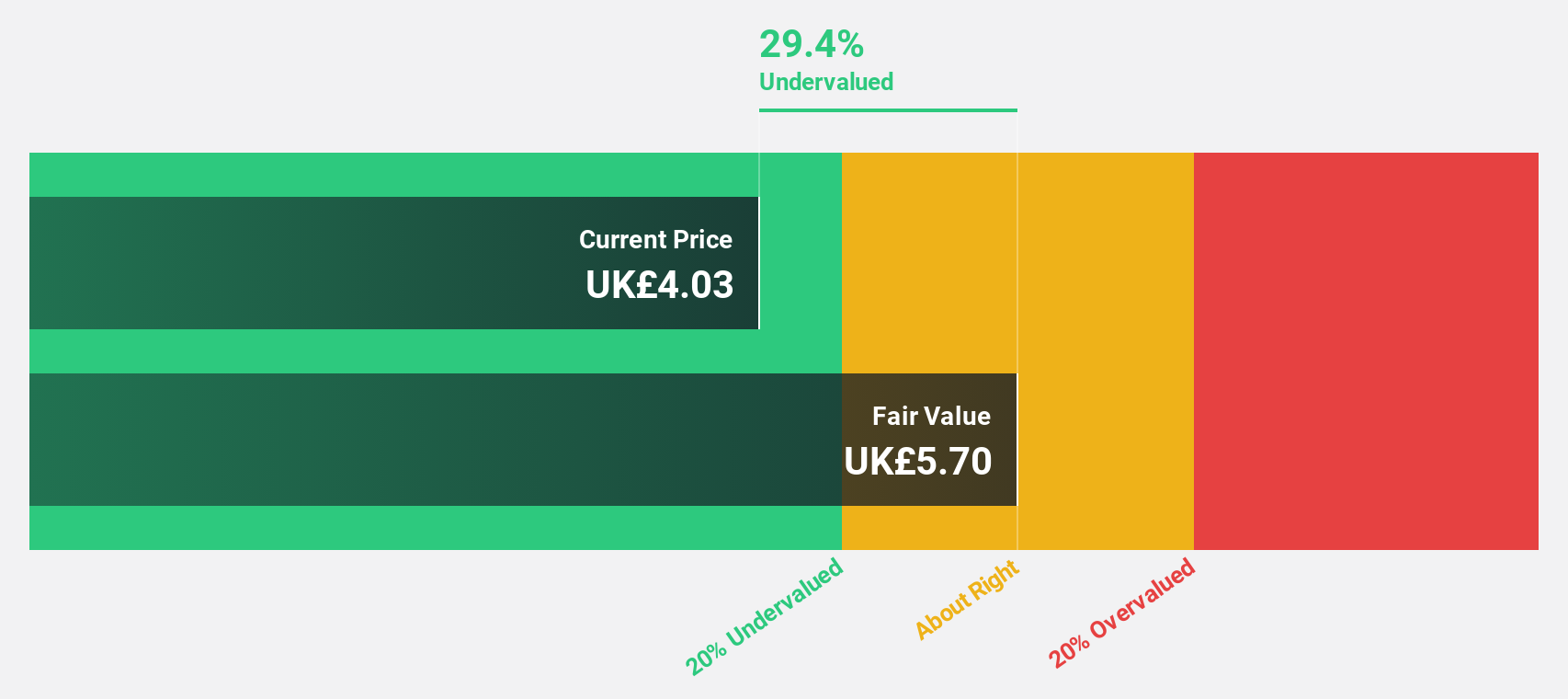

Foresight Group Holdings (LSE:FSG)

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £511.62 million.

Operations: The company's revenue is derived from three segments: Infrastructure (£95.89 million), Private Equity (£50.52 million), and Foresight Capital Management (£7.58 million).

Estimated Discount To Fair Value: 13.9%

Foresight Group Holdings is trading at £4.56, below its estimated fair value of £5.3, reflecting potential undervaluation based on cash flows. The company reported a net income increase to £33.25 million for the year ended March 31, 2025, and earnings per share growth, highlighting robust financial health. With forecasted earnings growth of 18.6% annually and revenue growth outpacing the UK market at 9.5% per year, Foresight remains focused on strategic acquisitions using its strong cash generation capabilities.

- Our growth report here indicates Foresight Group Holdings may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Foresight Group Holdings' balance sheet health report.

Turning Ideas Into Actions

- Gain an insight into the universe of 54 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CTEC

ConvaTec Group

Engages in the development, manufacturing, and sale of medical products, services and technologies in Europe, North America, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives