- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:CBOX

3 UK Penny Stocks With Market Caps Over £70M To Watch

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, influenced by weak trade data from China, which has affected major indices like the FTSE 100 and FTSE 250. Amid such global economic pressures, investors often seek opportunities in smaller companies that can offer potential growth and value. Penny stocks, though an older term, still represent these smaller or less-established firms that might provide stability and upside potential for those looking to explore beyond the well-known names.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.07 | £779.9M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.17 | £99.96M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.298 | £200.19M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4395 | $255.49M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.385 | £304.74M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Cake Box Holdings (AIM:CBOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cake Box Holdings Plc, with a market cap of £77 million, operates in the United Kingdom retailing fresh cream celebration cakes through its subsidiaries.

Operations: The company generates revenue of £38.62 million from its food processing segment.

Market Cap: £77M

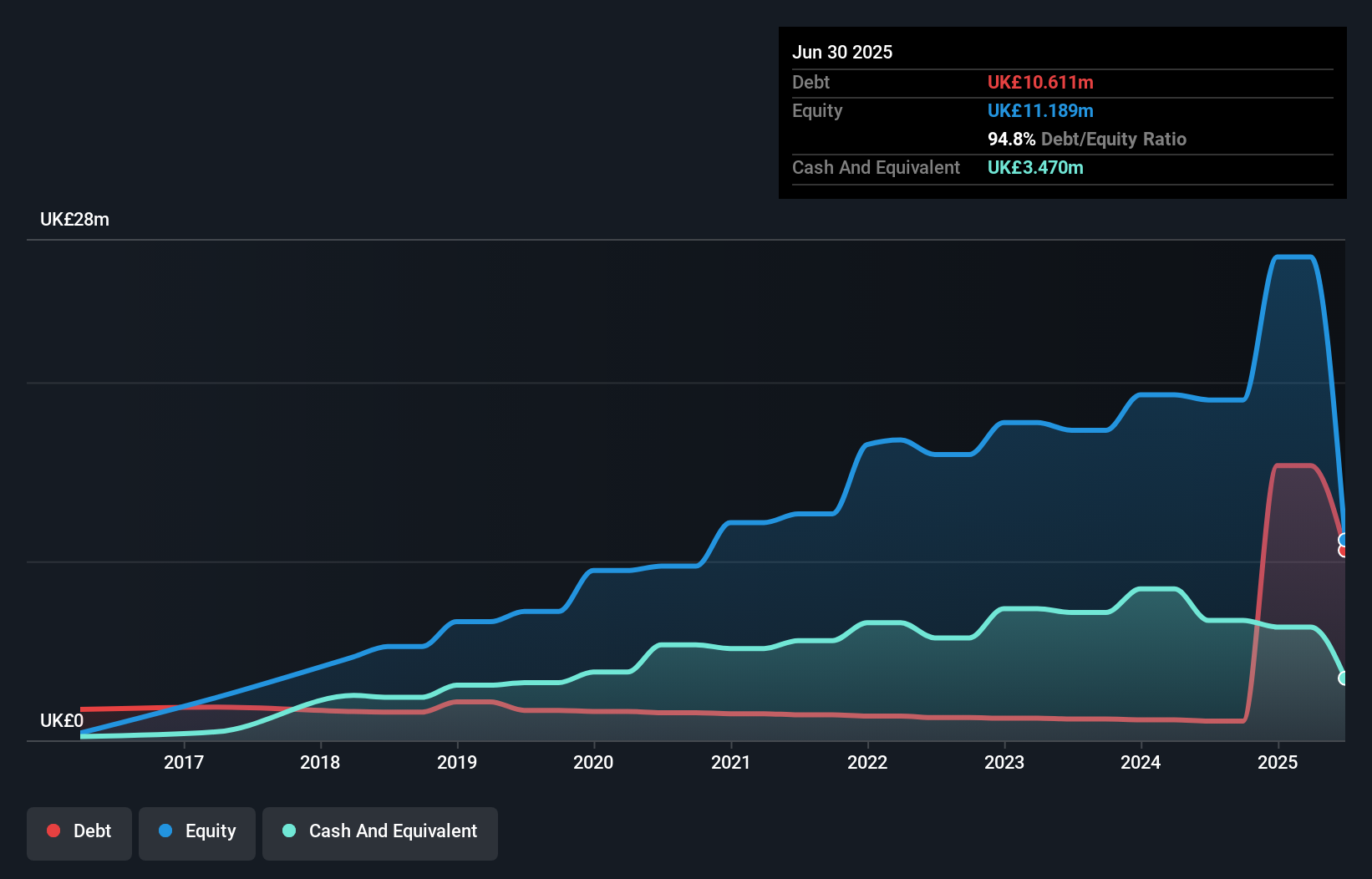

Cake Box Holdings Plc, with a market cap of £77 million, has shown steady financial performance. Earnings have grown by 8.7% annually over the past five years, with recent half-year sales reaching £18.73 million and net income rising to £2.07 million. The company boasts high-quality earnings and a strong return on equity at 26%. Debt levels are well-managed, supported by operating cash flow covering debt significantly. Recent strategic moves include a collaboration with Nutella to launch new products in the UK market, potentially enhancing brand appeal and revenue streams. However, its dividend coverage remains an area for improvement despite recent increases.

- Jump into the full analysis health report here for a deeper understanding of Cake Box Holdings.

- Gain insights into Cake Box Holdings' outlook and expected performance with our report on the company's earnings estimates.

Tristel (AIM:TSTL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tristel plc develops, manufactures, and sells infection prevention products across the United Kingdom, Australia, Germany, Western Europe, and internationally with a market cap of £185.99 million.

Operations: The company's revenue is primarily derived from Hospital Medical Device Decontamination at £36.34 million and Hospital Environmental Surface Disinfection at £3.44 million.

Market Cap: £186M

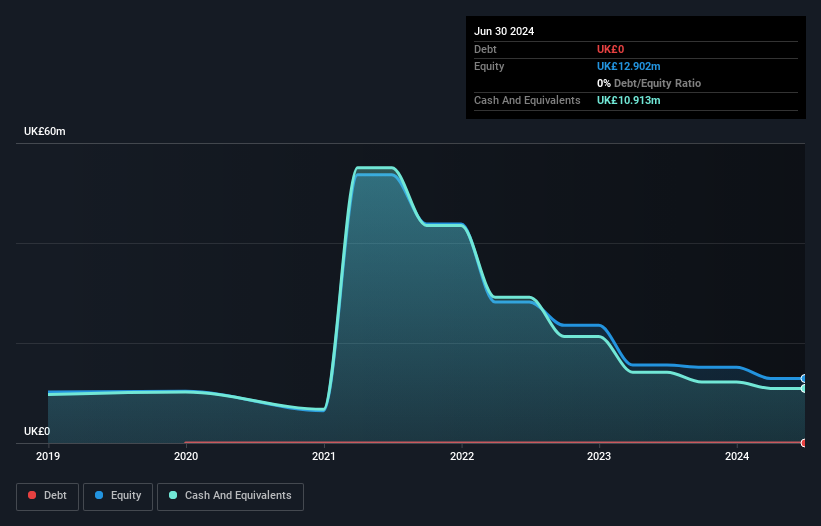

Tristel plc, with a market cap of £185.99 million, exhibits strong financial health, operating debt-free with stable weekly volatility. The company reported sales of £41.93 million for the fiscal year ending June 2024 and net income of £6.49 million, reflecting robust profit growth at 45.5% over the past year—outpacing industry averages. Despite a less experienced management team, Tristel maintains high-quality earnings and a solid return on equity at 20%. However, its dividend yield of 3.47% is not fully covered by earnings, indicating potential sustainability concerns despite recent dividend increases aligning with EPS growth targets.

- Take a closer look at Tristel's potential here in our financial health report.

- Evaluate Tristel's prospects by accessing our earnings growth report.

PensionBee Group (LSE:PBEE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PensionBee Group plc is a direct-to-consumer financial technology company offering online pension services in the United Kingdom and the United States, with a market cap of £371.78 million.

Operations: The company generates £28.32 million in revenue from its Internet Information Providers segment.

Market Cap: £371.78M

PensionBee Group plc, with a market cap of £371.78 million, is navigating its expansion into the U.S. market following its success in the U.K. The company recently launched a new app to streamline pension management and partnered with State Street Global Advisors for exclusive investment portfolios. Despite being unprofitable and having diluted shares by 5.4% over the past year, PensionBee remains debt-free and anticipates exceeding £30 million in revenue for 2024. With short-term assets covering liabilities comfortably, it raised approximately $25 million to support growth initiatives in the United States.

- Dive into the specifics of PensionBee Group here with our thorough balance sheet health report.

- Gain insights into PensionBee Group's future direction by reviewing our growth report.

Next Steps

- Embark on your investment journey to our 472 UK Penny Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CBOX

Cake Box Holdings

Engages in the retail of fresh cream celebration cakes in the United Kingdom.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives