- United Kingdom

- /

- Food

- /

- LSE:BAKK

UK Penny Stocks With Market Caps Below £2B

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over weak trade data from China. Despite these broader market pressures, certain investment opportunities remain attractive, particularly among smaller companies. Penny stocks, although an outdated term, continue to offer potential for growth when supported by strong financials. We'll explore three such stocks that may present promising prospects for investors seeking hidden value in the UK market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.04M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.87 | £296.27M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.85 | £311.03M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.765 | £425.47M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.935 | £379.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.65 | £1.03B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £147.37M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.974 | £2.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.35 | £37.87M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 398 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

NIOX Group (AIM:NIOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NIOX Group Plc designs, develops, and commercializes medical devices for asthma diagnosis, monitoring, and management globally with a market cap of £258.92 million.

Operations: The company generates revenue primarily from its NIOX® segment, totaling £41.8 million.

Market Cap: £258.92M

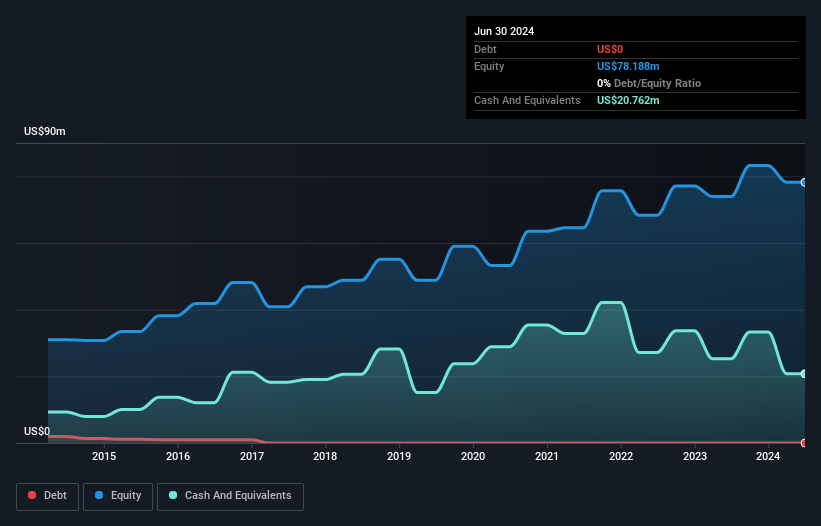

NIOX Group, with a market cap of £258.92 million, has seen its earnings decline by 64.2% over the past year despite being profitable over the last five years with annual earnings growth of 60.6%. The company is debt-free and has sufficient short-term assets to cover liabilities, but its net profit margin decreased to 8.1% from 25.8% last year. Recent volatility in share price and a failed acquisition attempt by Keensight Capital highlight potential instability in investor sentiment, though NIOX trades below fair value estimates and forecasts suggest significant future earnings growth at 36.84% annually.

- Click here to discover the nuances of NIOX Group with our detailed analytical financial health report.

- Learn about NIOX Group's future growth trajectory here.

Somero Enterprises (AIM:SOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Somero Enterprises, Inc. designs, assembles, remanufactures, sells, and distributes concrete leveling and contouring equipment globally, with a market cap of £117.71 million.

Operations: The company generates revenue of $109.15 million from its Construction Machinery & Equipment segment.

Market Cap: £117.71M

Somero Enterprises, with a market cap of £117.71 million, operates debt-free and maintains strong short-term asset coverage over liabilities. Despite high-quality earnings and a return on equity of 22.1%, the company has faced challenges with declining net profit margins from 23.2% to 17% and reduced revenues to US$109.15 million in 2024 from US$120.7 million the previous year. Recent executive changes include appointing Timothy Averkamp as CEO, bringing extensive industry experience that could support future growth strategies despite recent negative earnings growth of -33.5%. The company declared dividends totaling 16.89 US cents per share for 2024 amidst an unstable dividend track record.

- Take a closer look at Somero Enterprises' potential here in our financial health report.

- Learn about Somero Enterprises' historical performance here.

Bakkavor Group (LSE:BAKK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bakkavor Group plc, along with its subsidiaries, specializes in the preparation and marketing of fresh prepared foods across the United Kingdom, the United States, and China, with a market cap of £1.02 billion.

Operations: The company's revenue is primarily derived from the United Kingdom at £1.95 billion, followed by the United States with £227.7 million and China contributing £116.5 million.

Market Cap: £1.02B

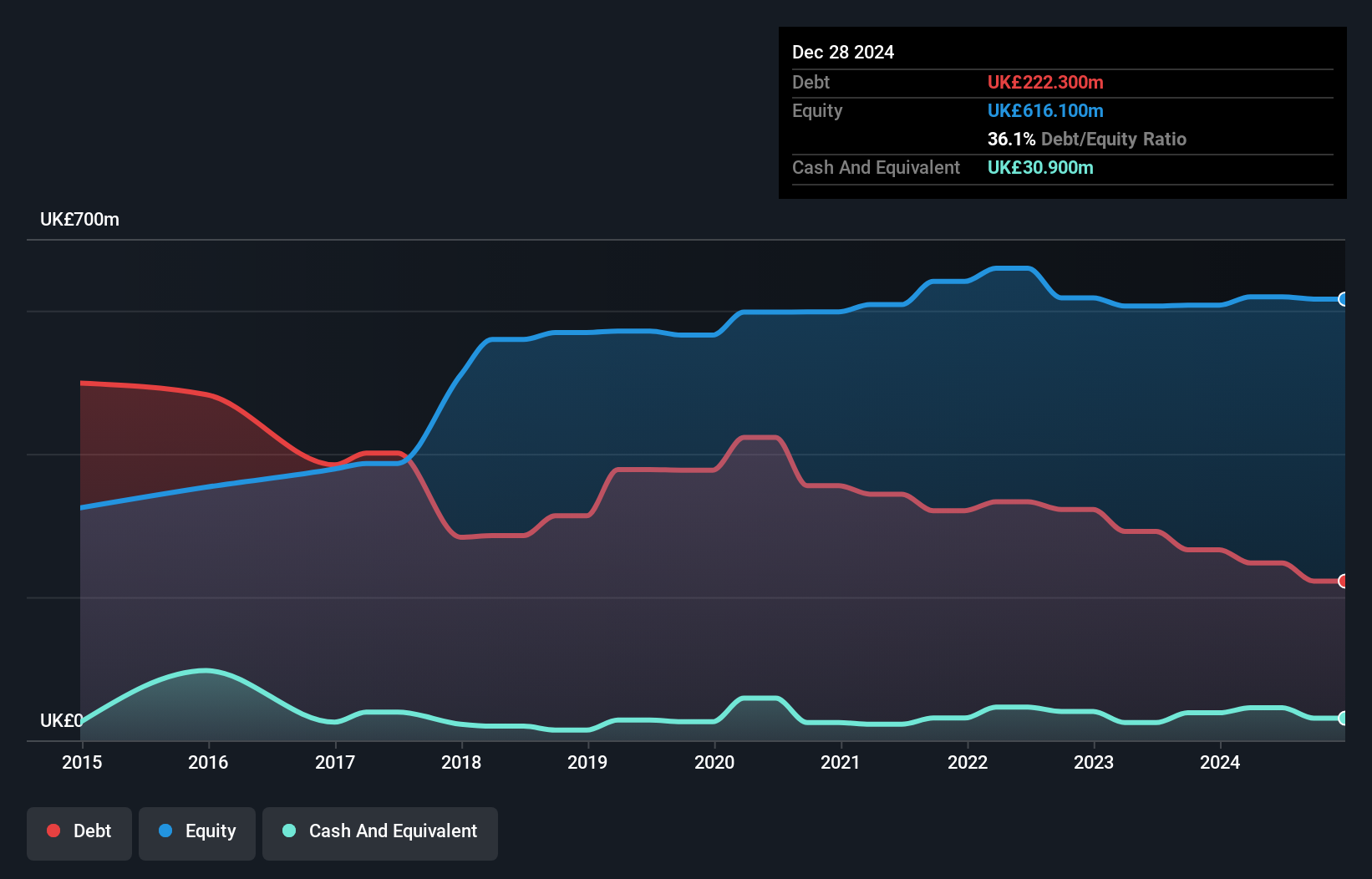

Bakkavor Group, with a market cap of £1.02 billion, has seen earnings grow by 7.7% annually over five years despite recent volatility in profit margins and a large one-off loss impacting its latest financial results. The company's debt is well-covered by operating cash flow, and interest payments are adequately managed with EBIT coverage of 4.7 times. However, short-term assets do not cover liabilities, presenting potential liquidity concerns. Recent M&A discussions with Greencore Group valued Bakkavor at £1.4 billion but were rejected for undervaluing the company’s prospects; talks continue as stakeholders seek value creation opportunities amidst ongoing dividend increases and stable management tenure.

- Click to explore a detailed breakdown of our findings in Bakkavor Group's financial health report.

- Understand Bakkavor Group's earnings outlook by examining our growth report.

Seize The Opportunity

- Explore the 398 names from our UK Penny Stocks screener here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Bakkavor Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bakkavor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BAKK

Bakkavor Group

Engages in the preparation and marketing of fresh prepared foods in the United Kingdom, the United States, and China.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives