- United Kingdom

- /

- Metals and Mining

- /

- LSE:CGS

December 2024 UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic uncertainties. In such a climate, identifying stocks that offer potential value is crucial for investors. Penny stocks, although an older term, remain relevant as they often represent smaller or newer companies that can provide unique opportunities when supported by strong financials and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.245 | £845.83M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.99 | £74.98M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.20 | £102.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Tristel (AIM:TSTL) | £4.20 | £200.31M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4125 | $239.8M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.48 | £365.3M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kooth (AIM:KOO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kooth plc, with a market cap of £64.75 million, provides digital mental health services to children, young people, and adults in the United Kingdom.

Operations: The company generates revenue from its Pharmacy Services segment, which amounts to £54.17 million.

Market Cap: £64.75M

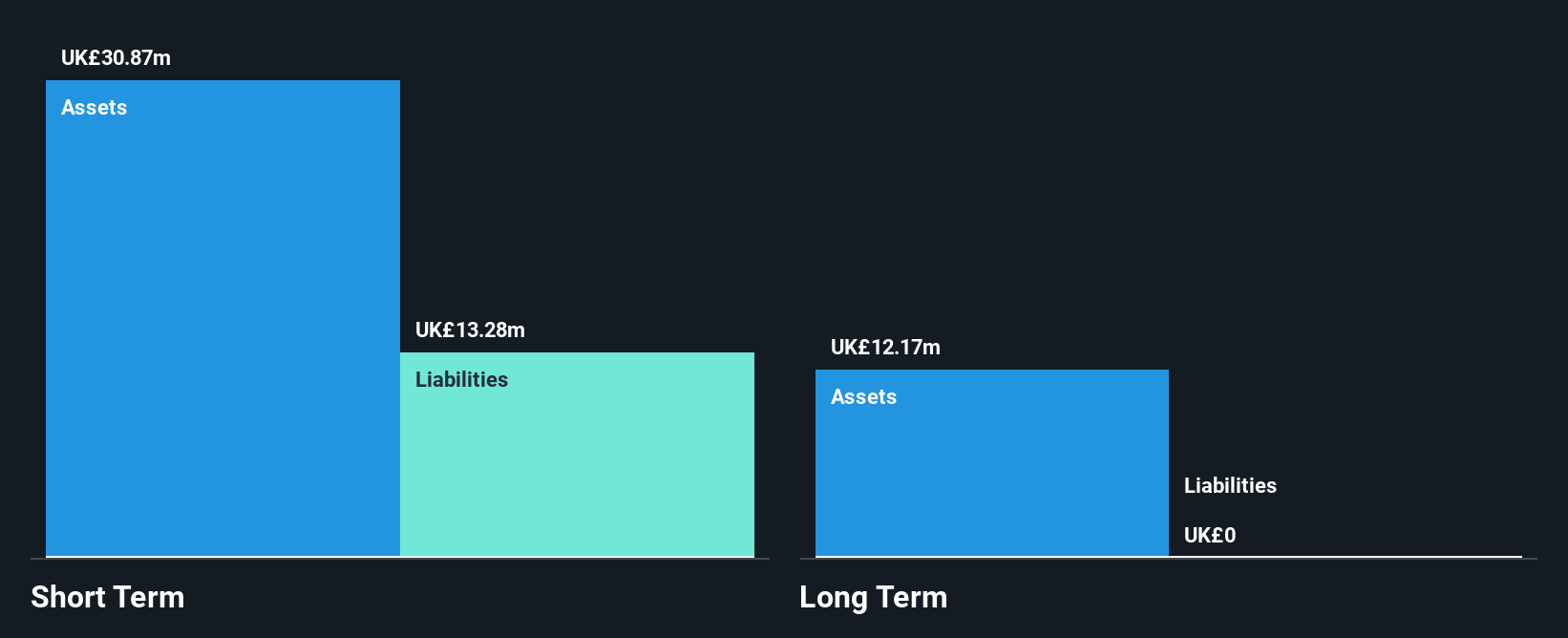

Kooth plc, with a market cap of £64.75 million, has recently become profitable, reporting a net income of £3.92 million for the half year ended June 30, 2024. The company is debt-free and its short-term assets exceed liabilities by a significant margin (£23.3M vs £10.6M). Despite high volatility in its share price over the past three months and an inexperienced management team (average tenure of 1.9 years), Kooth's earnings are forecast to grow annually by 11.05%. Recent challenges include potential contract termination in Pennsylvania, which may impact future operations there.

- Dive into the specifics of Kooth here with our thorough balance sheet health report.

- Gain insights into Kooth's outlook and expected performance with our report on the company's earnings estimates.

Renold (AIM:RNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Renold plc manufactures and sells high precision engineered products and solutions globally, with a market cap of £99.88 million.

Operations: The company generates revenue from two main segments: Chain, contributing £191 million, and Torque Transmission, accounting for £53.9 million.

Market Cap: £99.88M

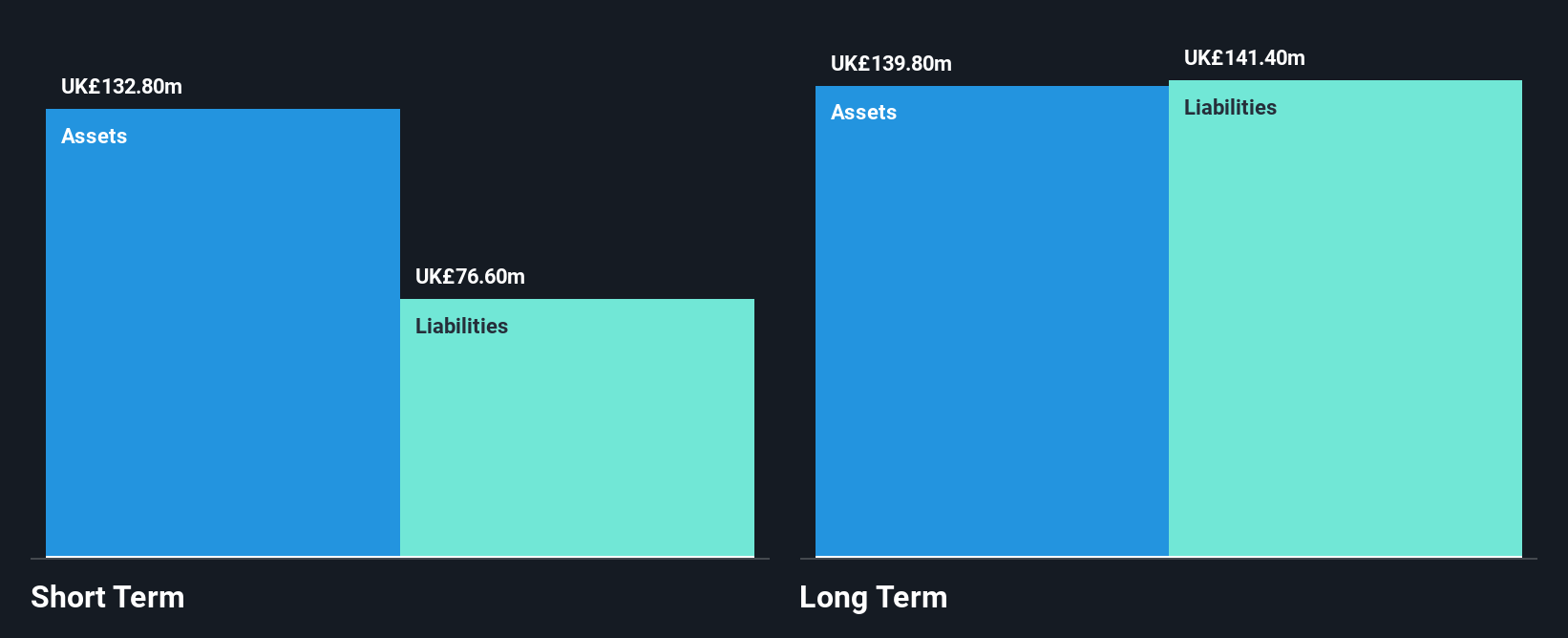

Renold plc, with a market cap of £99.88 million, has shown financial resilience despite recent challenges. For the half year ended September 30, 2024, the company reported sales of £123.4 million and net income of £6.5 million, reflecting a decline from the previous year. The company's short-term assets (£132.8M) exceed its short-term liabilities (£76.6M), although long-term liabilities remain uncovered by current assets (£141.4M). While earnings growth has been negative recently (-9.9%), Renold's earnings have grown significantly over five years and are forecast to grow by 23% annually moving forward, indicating potential for recovery and growth in this penny stock segment.

- Take a closer look at Renold's potential here in our financial health report.

- Evaluate Renold's prospects by accessing our earnings growth report.

Castings (LSE:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Castings P.L.C. is involved in iron casting and machining operations across the UK, Europe, the Americas, and internationally, with a market cap of £115.60 million.

Operations: The company generates revenue primarily from Foundry Operations (£225.67 million) and Machining Operations (£35.57 million).

Market Cap: £115.6M

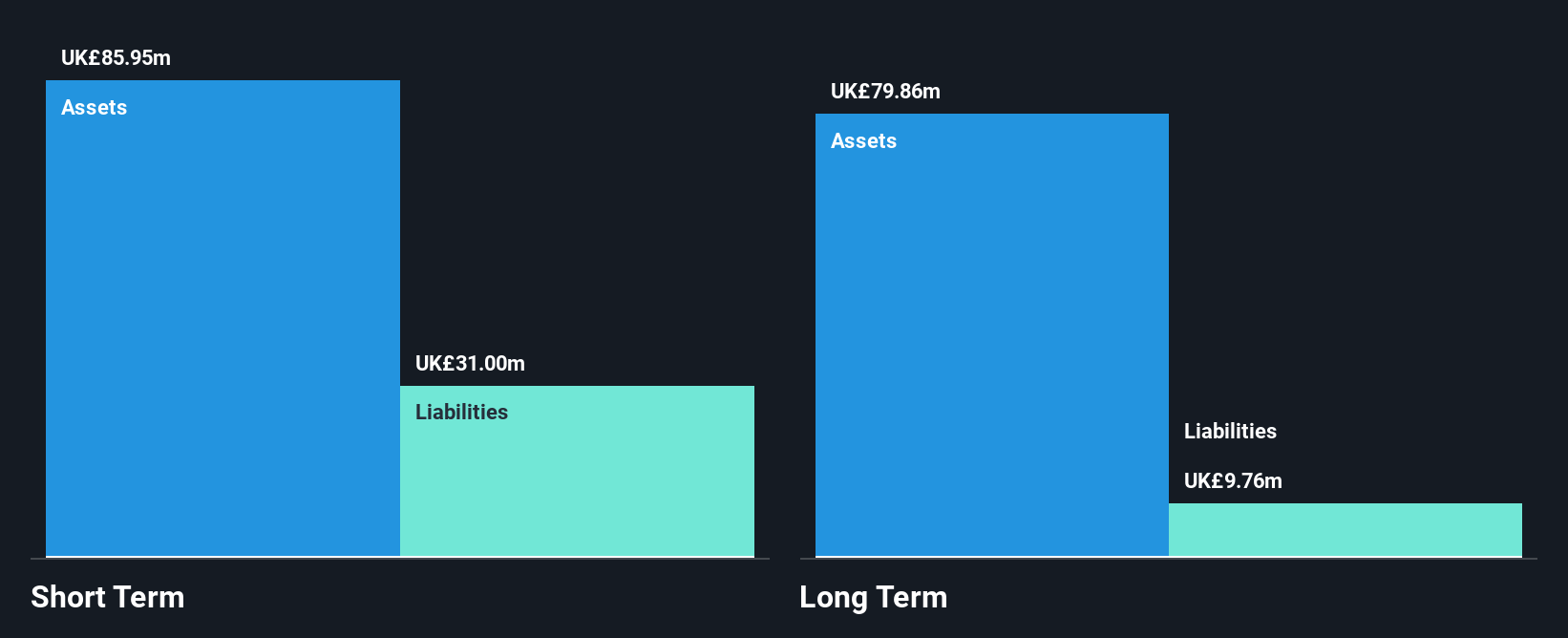

Castings P.L.C., with a market cap of £115.60 million, reported a decline in half-year sales to £89.18 million and net income to £3.07 million compared to the previous year. Despite this, the company remains debt-free and its short-term assets (£98.3M) comfortably cover both short-term (£27.8M) and long-term liabilities (£7.9M). The board is experienced with an average tenure of 9.5 years, but recent earnings growth has been negative at -21.6%. Castings trades at 35% below estimated fair value, yet its dividend yield of 9.52% isn't well covered by free cash flows, posing sustainability concerns.

- Unlock comprehensive insights into our analysis of Castings stock in this financial health report.

- Learn about Castings' future growth trajectory here.

Turning Ideas Into Actions

- Jump into our full catalog of 465 UK Penny Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CGS

Castings

Engages in the iron casting and machining activities in the United Kingdom, Germany, Sweden, the Netherlands, rest of Europe, North and South America, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives