- United Kingdom

- /

- Capital Markets

- /

- LSE:REC

3 UK Penny Stocks With Market Caps Under £300M To Watch

Reviewed by Simply Wall St

The UK market has been experiencing fluctuations, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting global economic interdependencies. Amid these broader market movements, investors may find potential in penny stocks—smaller or newer companies that often fly under the radar yet offer intriguing opportunities. While traditionally seen as high-risk ventures, those with strong financials and growth potential can provide a compelling investment case for those looking beyond established blue-chip stocks.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.125 | £821.34M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.78 | £471.81M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.55 | £360.49M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.025 | £391.86M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.53 | £180.75M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.53 | £191.03M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.324 | £205.74M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.42 | £115.25M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.86 | £68.92M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.15 | £200.13M | ★★★★★★ |

Click here to see the full list of 475 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kooth (AIM:KOO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kooth plc, with a market cap of £63.48 million, provides digital mental health services to children, young people, and adults in the United Kingdom.

Operations: The company's revenue is generated from its Pharmacy Services segment, amounting to £54.17 million.

Market Cap: £63.48M

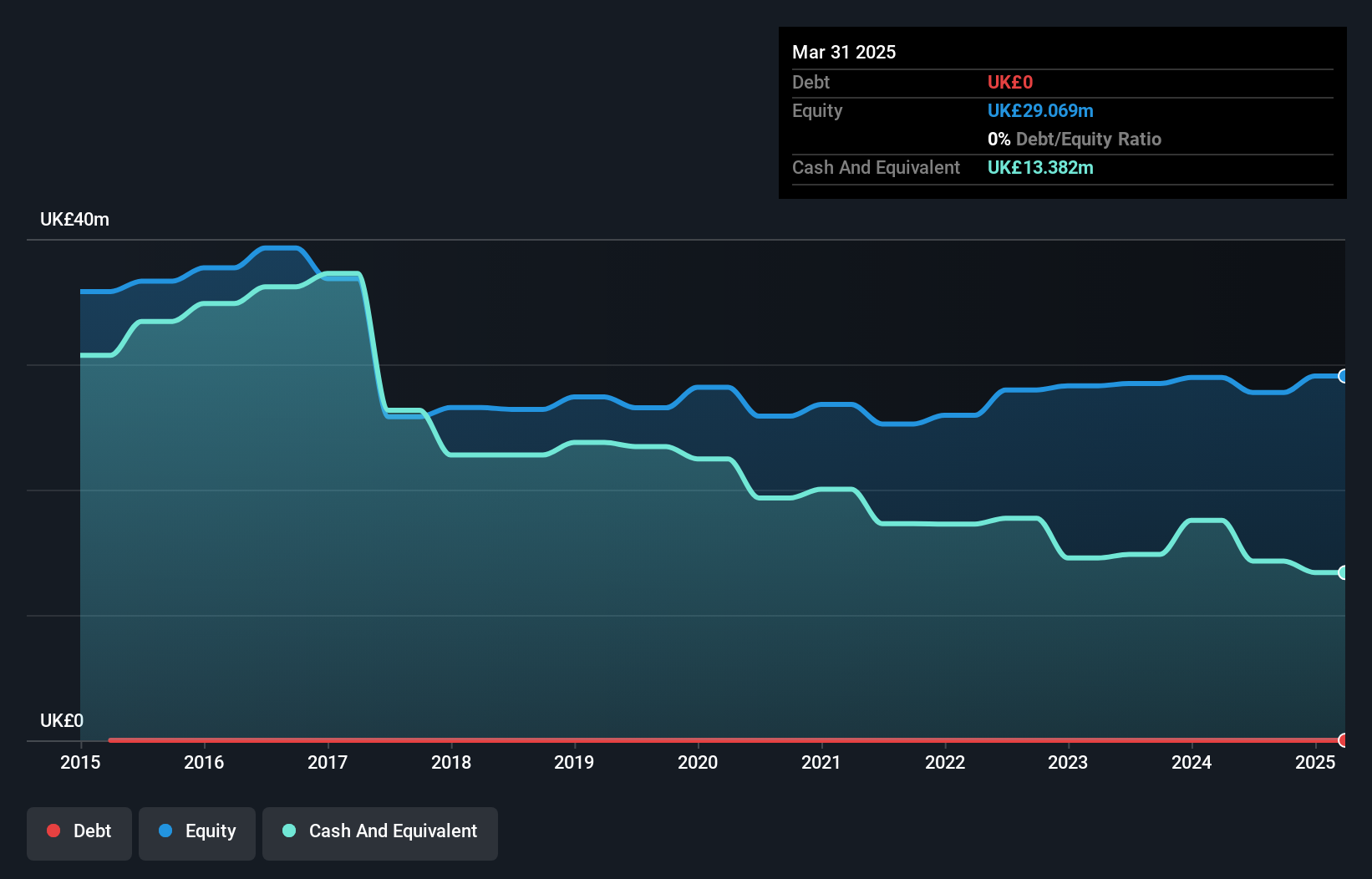

Kooth plc, with a market cap of £63.48 million, has shown significant revenue growth, reporting £32.49 million for the first half of 2024 compared to £11.66 million the previous year. The company recently became profitable and operates debt-free, with short-term assets exceeding liabilities by a substantial margin. Despite a volatile share price and an inexperienced management team, Kooth is trading at good value relative to its peers and industry standards. Recent challenges include uncertainty over its pilot contract in Pennsylvania; however, its new partnership with Aetna in Illinois marks an expansion into the U.S. private sector market.

- Unlock comprehensive insights into our analysis of Kooth stock in this financial health report.

- Gain insights into Kooth's outlook and expected performance with our report on the company's earnings estimates.

Science Group (AIM:SAG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Science Group plc is a science, engineering, and technology company offering consultancy services and systems businesses across the UK, Europe, North America, Asia, and globally with a market cap of £204.70 million.

Operations: The company's revenue is primarily derived from consultancy services (£75.51 million) and freehold properties (£3.98 million), with a segment adjustment of £34.68 million.

Market Cap: £204.7M

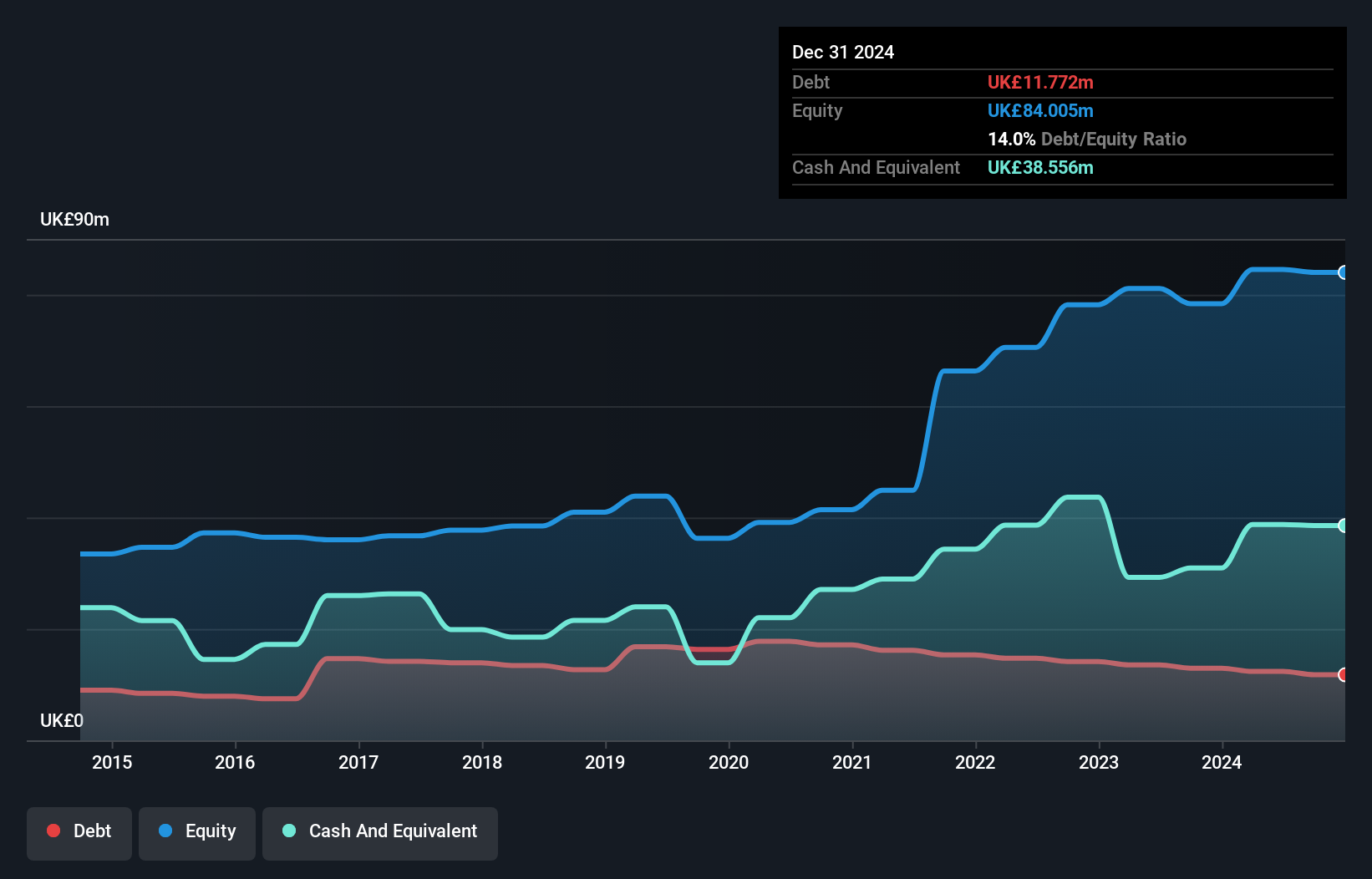

Science Group plc, with a market cap of £204.70 million, demonstrates financial stability as its short-term assets (£65.0M) and cash reserves exceed both short-term (£32.4M) and long-term liabilities (£19.2M). Despite a decline in net profit margins from 11.6% to 5.4%, the company maintains high-quality earnings and strong interest coverage (64.9x EBIT). Its debt level is well-managed, supported by operating cash flow coverage of 80.7%. Although recent earnings growth has been negative (-46.6%), the company's debt-to-equity ratio has improved significantly over five years, indicating prudent financial management amidst volatility concerns.

- Dive into the specifics of Science Group here with our thorough balance sheet health report.

- Evaluate Science Group's prospects by accessing our earnings growth report.

Record (LSE:REC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Record plc, with a market cap of £123.11 million, offers currency and derivative management services across the United Kingdom, North America, Continental Europe, Australia, and other international markets.

Operations: The company generates £45.38 million from its currency and derivatives management services.

Market Cap: £123.11M

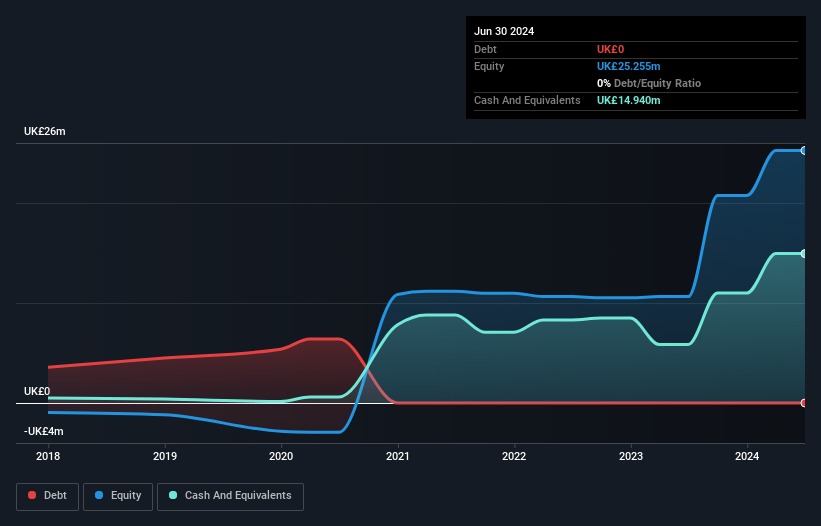

Record plc, with a market cap of £123.11 million, offers currency and derivative management services and has demonstrated financial resilience by maintaining no debt and covering both short-term (£7.0M) and long-term liabilities (£79.0K) with its short-term assets (£30.6M). Despite experiencing negative earnings growth over the past year, Record's return on equity remains high at 32%. The company is trading at 36% below its estimated fair value, suggesting potential undervaluation. However, recent insider selling may raise concerns about future prospects despite stable weekly volatility (4%) and a forecasted annual earnings growth of 6.56%.

- Navigate through the intricacies of Record with our comprehensive balance sheet health report here.

- Gain insights into Record's future direction by reviewing our growth report.

Next Steps

- Navigate through the entire inventory of 475 UK Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:REC

Record

Through its subsidiaries, provides currency and derivative management services in the United Kingdom, North America, Continental Europe, Australia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives