- United Kingdom

- /

- Healthtech

- /

- AIM:IUG

3 UK Penny Stocks With Market Caps Over £10M

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced downward pressure due to weak trade data from China, highlighting the interconnectedness of global markets and their impact on domestic indices. In such a climate, investors often seek opportunities beyond the well-trodden paths of blue-chip stocks. Penny stocks, despite being an older term, still represent viable investment options for those interested in smaller or newer companies with potential growth prospects and solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.02 | £761.16M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.63M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.395 | £177.66M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £420.84M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.67 | £365M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.085 | £92.7M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.04 | £192.68M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.26 | £194.33M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.18 | £155.53M | ★★★★★☆ |

Click here to see the full list of 440 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Capital Metals (AIM:CMET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Capital Metals plc is involved in the exploration, evaluation, and development of mineral sand resources in the United Kingdom and Sri Lanka, with a market cap of £12.27 million.

Operations: Currently, there are no reported revenue segments for Capital Metals plc.

Market Cap: £12.27M

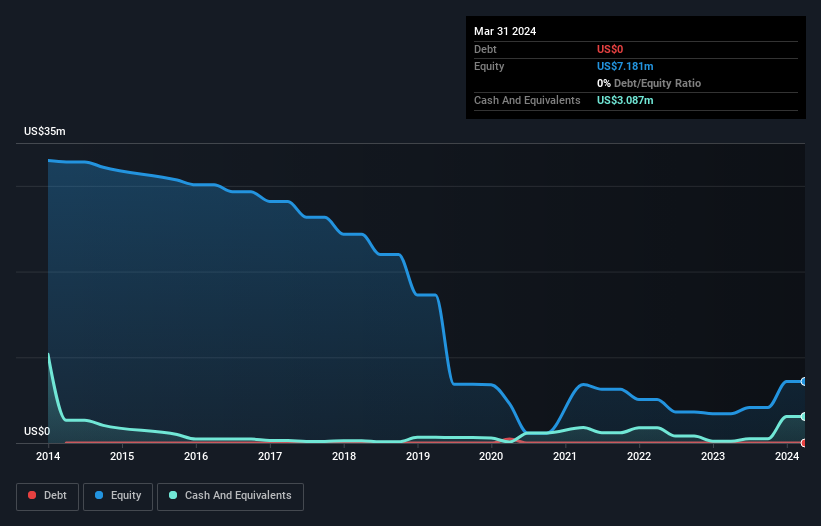

Capital Metals plc, with a market cap of £12.27 million, is navigating the challenges typical of pre-revenue companies in the mining sector. Recent strategic updates highlight a reduction in initial capital expenditure to $20.9 million and plans to expedite cash flow through process improvements and potential partnerships, aiming for self-funding operations. Despite having no debt and a sufficient cash runway exceeding one year, Capital Metals remains unprofitable but has reduced losses significantly over five years. The stock's high volatility may concern investors seeking stability, although shareholder dilution has been minimal recently.

- Dive into the specifics of Capital Metals here with our thorough balance sheet health report.

- Explore historical data to track Capital Metals' performance over time in our past results report.

Dianomi (AIM:DNM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dianomi plc, along with its subsidiaries, offers native advertising services across the financial services, technology, corporate, and lifestyle sectors in regions including Europe, the Middle East, Africa, the United States and Asia Pacific; it has a market cap of £10.81 million.

Operations: The company's revenue from advertising services is £29.50 million.

Market Cap: £10.81M

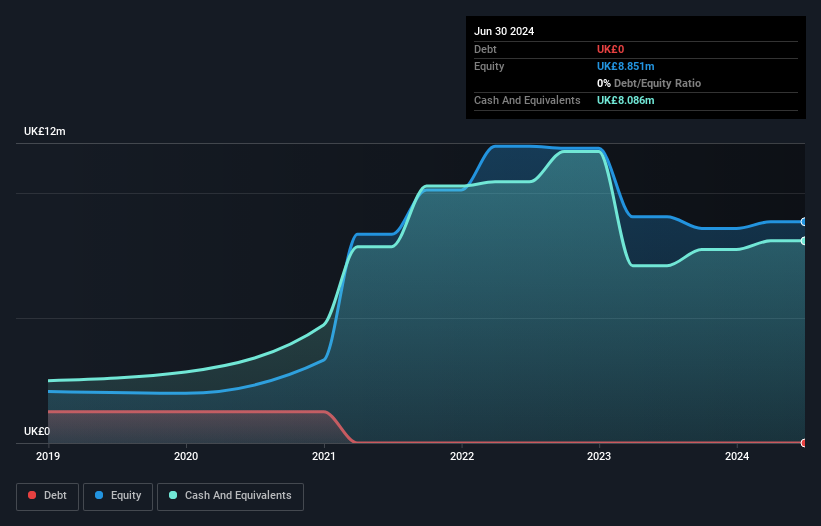

Dianomi plc, with a market cap of £10.81 million, operates in the native advertising space and reported revenues of £29.50 million. Despite being unprofitable, it has a stable cash runway exceeding three years due to positive free cash flow and no debt burden. Recent guidance indicates revenue expectations for 2024 align with market projections at around £28 million. The company benefits from experienced management and board members but faces challenges as losses have increased significantly over five years. Short-term assets comfortably cover liabilities, providing some financial stability amid its negative return on equity of -7.24%.

- Click here and access our complete financial health analysis report to understand the dynamics of Dianomi.

- Explore Dianomi's analyst forecasts in our growth report.

Intelligent Ultrasound Group (AIM:IUG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Intelligent Ultrasound Group plc develops, markets, and distributes medical training simulators globally, with a market cap of £42.04 million.

Operations: The company's revenue is derived from two segments: Simulation, generating £7.34 million, and Clinical AI, contributing £2.83 million.

Market Cap: £42.04M

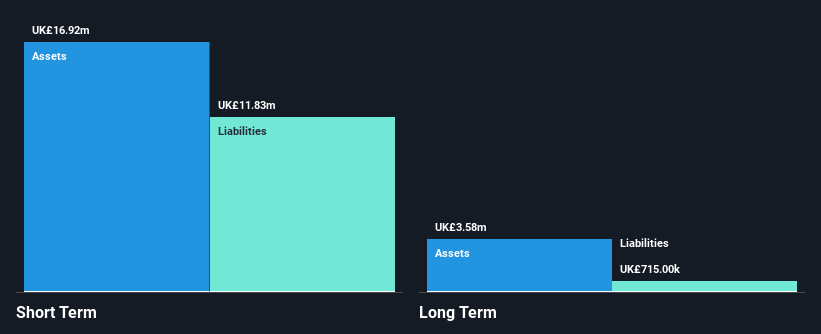

Intelligent Ultrasound Group, with a market cap of £42.04 million, is set to be acquired by Surgical Science Sweden AB for £43 million, valuing shares at £0.13 each. The company generates revenue from its Simulation (£7.34 million) and Clinical AI (£2.83 million) segments but remains unprofitable with a negative return on equity of -43.15%. Despite having no debt and experienced management, it faces financial constraints with less than one year of cash runway based on current free cash flow trends. The acquisition is expected to finalize in early 2025 following shareholder approval and regulatory clearances.

- Jump into the full analysis health report here for a deeper understanding of Intelligent Ultrasound Group.

- Gain insights into Intelligent Ultrasound Group's historical outcomes by reviewing our past performance report.

Where To Now?

- Gain an insight into the universe of 440 UK Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IUG

Intelligent Ultrasound Group

Through its subsidiaries, develops, markets, and distributes medical training simulators in the United Kingdom, North America, and internationally.

Adequate balance sheet very low.

Market Insights

Community Narratives