- United Kingdom

- /

- Software

- /

- AIM:IGP

UK Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The UK market has faced challenges recently, with the FTSE 100 index declining due to weak trade data from China, highlighting ongoing global economic uncertainties. Despite these broader market pressures, investors often look towards penny stocks for their potential to uncover value in smaller or newer companies. Although the term 'penny stock' might seem outdated, these investments can still offer significant growth opportunities when backed by solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.345 | £432.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.95 | £188.38M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.175 | £100.28M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.265 | £72.16M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.99 | £74.98M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.36 | £173.2M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.29 | £198.96M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4205 | $244.45M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CML Microsystems (AIM:CML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CML Microsystems plc, with a market cap of £41.01 million, designs, manufactures, and markets semiconductor products for the communications industries in the United Kingdom, the Americas, Far East, and internationally.

Operations: The company's revenue of £24.85 million is generated from semiconductor components for the communications industry.

Market Cap: £41.01M

CML Microsystems, with a market cap of £41.01 million, operates in the semiconductor sector and has shown stable weekly volatility over the past year. Despite being debt-free and having experienced management and board teams, CML faces challenges such as low return on equity (2.6%) and declining profit margins (5.2% from 20.8%). The company reported half-year sales of £12.53 million but saw a drop in net income to £0.697 million compared to the previous year (£1.47 million). Recent events include an interim dividend declaration and a change in auditors to Cooper Parry LLP.

- Click here and access our complete financial health analysis report to understand the dynamics of CML Microsystems.

- Explore historical data to track CML Microsystems' performance over time in our past results report.

EMV Capital (AIM:EMVC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EMV Capital plc is a venture capital firm focusing on seed, growth capital, and early to mid-stage investments, with a market cap of £12.67 million.

Operations: The company's revenue is primarily generated from the development of intellectual property, amounting to £1.81 million.

Market Cap: £12.67M

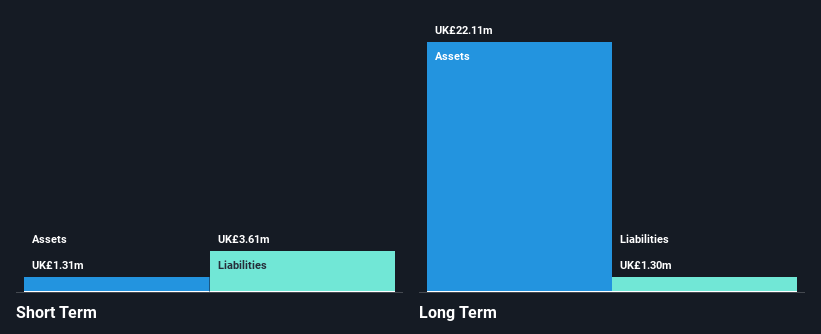

EMV Capital plc, with a market cap of £12.67 million, is currently unprofitable and has not generated meaningful revenue (£2M). The company faces liquidity challenges as its short-term assets (£1.3M) do not cover short-term liabilities (£3.6M), though its net debt to equity ratio remains satisfactory at 4.3%. Despite a forecasted revenue growth of 49.18% annually, EMV's financial stability is uncertain with only two months of cash runway based on recent free cash flow but has raised additional capital through a £1.5 million follow-on equity offering in December 2024 to bolster finances amidst ongoing losses and shareholder dilution.

- Take a closer look at EMV Capital's potential here in our financial health report.

- Review our growth performance report to gain insights into EMV Capital's future.

Intercede Group (AIM:IGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intercede Group plc is a cybersecurity company that develops and supplies identity and credential management software for digital trust across the United Kingdom, Europe, the United States, and internationally, with a market cap of £98.43 million.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated £21.51 million.

Market Cap: £98.43M

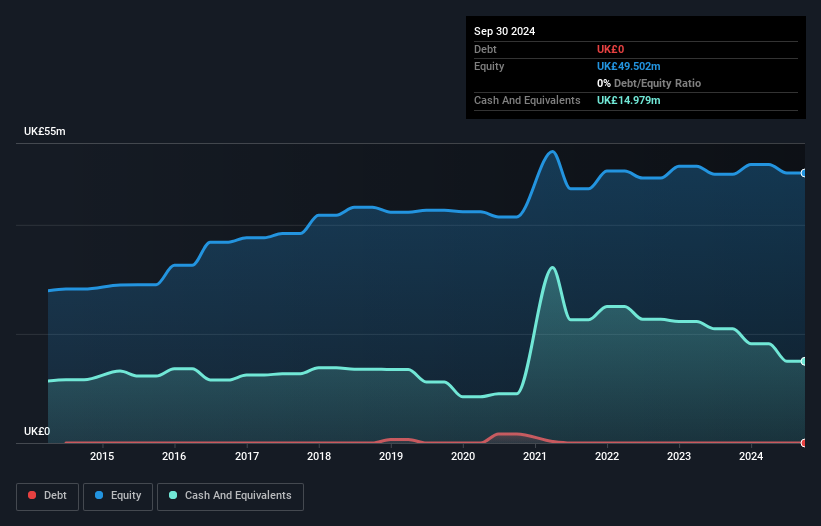

Intercede Group plc, with a market cap of £98.43 million, demonstrates strong financial health and growth potential in the cybersecurity sector. The company boasts an outstanding Return on Equity of 40.9% and significant earnings growth of 271.1% over the past year, surpassing industry averages. It maintains a robust balance sheet with no debt and short-term assets exceeding both its short- and long-term liabilities. Recent strategic initiatives include a partnership with Infinigate NL to expand its digital identity solutions market reach, alongside share repurchase plans aimed at enhancing shareholder value despite recent share price volatility.

- Navigate through the intricacies of Intercede Group with our comprehensive balance sheet health report here.

- Explore Intercede Group's analyst forecasts in our growth report.

Seize The Opportunity

- Discover the full array of 470 UK Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IGP

Intercede Group

A cybersecurity company, develops and supplies identity and credential management software for digital trust in the United Kingdom, rest of Europe, the United States, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives