- United Kingdom

- /

- Basic Materials

- /

- LSE:MSLH

Undervalued European Small Caps With Insider Action For August 2025

Reviewed by Simply Wall St

The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 1.18% amid easing trade tensions and optimism regarding potential U.S. interest rate cuts. As major indices like France’s CAC 40 and Germany’s DAX experience gains, investors are increasingly focusing on small-cap stocks that may offer attractive valuations in this dynamic environment. Identifying good stocks often involves looking for companies with solid fundamentals and growth potential that align well with current economic conditions and market sentiment.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Kitwave Group | 12.1x | 0.3x | 48.70% | ★★★★★☆ |

| Foxtons Group | 10.8x | 1.0x | 39.55% | ★★★★★☆ |

| NCC Group | NA | 1.4x | 11.53% | ★★★★☆☆ |

| CVS Group | 45.4x | 1.3x | 37.66% | ★★★★☆☆ |

| Stelrad Group | 42.1x | 0.7x | 36.84% | ★★★☆☆☆ |

| Nyab | 23.0x | 1.0x | 32.83% | ★★★☆☆☆ |

| A.G. BARR | 19.2x | 1.8x | 46.79% | ★★★☆☆☆ |

| Hoist Finance | 10.6x | 2.1x | 16.86% | ★★★☆☆☆ |

| Oxford Instruments | 40.2x | 2.1x | 18.25% | ★★★☆☆☆ |

| Karnov Group | 216.9x | 4.6x | 34.80% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

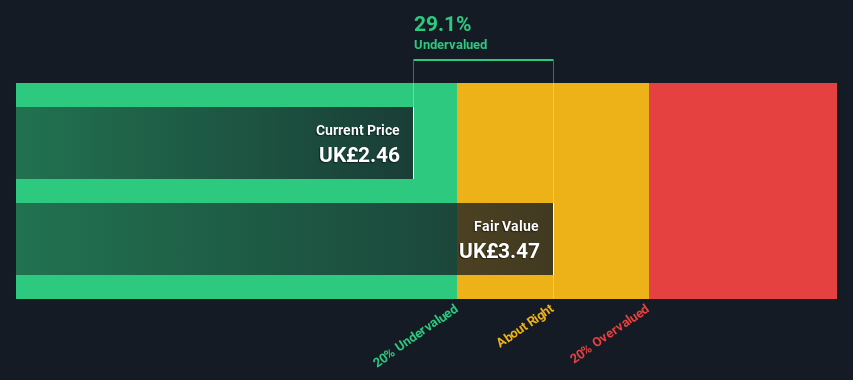

CVS Group (AIM:CVSG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CVS Group operates primarily in the veterinary services sector, offering services through its veterinary practices, laboratories, crematoria, and online retail business, with a market cap of £1.36 billion.

Operations: The primary revenue stream for the company is derived from Veterinary Practices, contributing £600.50 million, followed by Online Retail Business at £48.50 million and Laboratories at £30.90 million. The company's gross profit margin has shown variability, reaching 44.23% in recent periods before slightly declining to 42.90%. Operating expenses are significant, with General & Administrative Expenses being a major component, impacting overall profitability despite the robust revenue generation from its core segments.

PE: 45.4x

CVS Group, a smaller European company, has recently seen insider confidence with share purchases in the past six months. Despite a dip in profit margins from 7.3% to 2.9%, earnings are projected to grow by 18.2% annually, suggesting potential for future expansion. However, their financial position is strained as interest payments aren't fully covered by earnings and liabilities rely entirely on external borrowing, which carries higher risk without customer deposits as a buffer.

- Click here to discover the nuances of CVS Group with our detailed analytical valuation report.

Examine CVS Group's past performance report to understand how it has performed in the past.

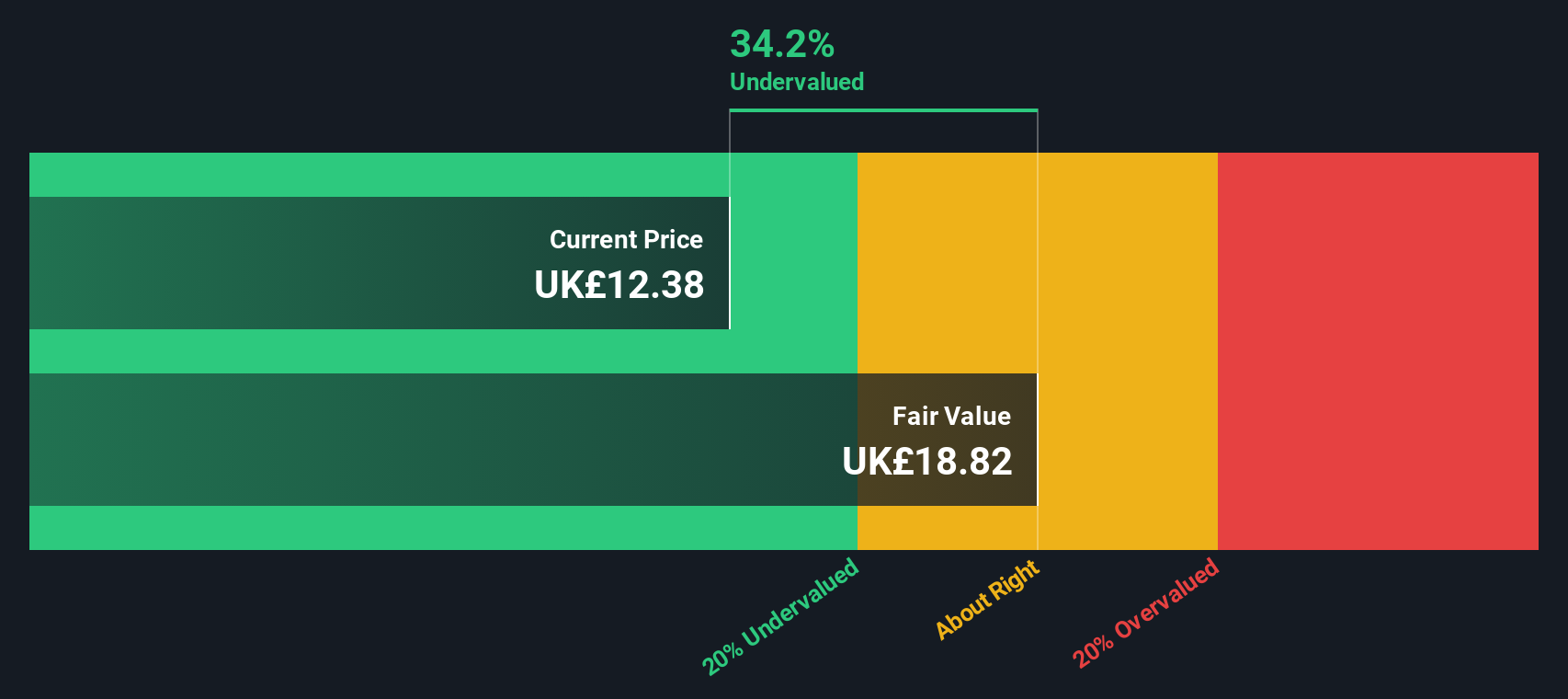

Marshalls (LSE:MSLH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Marshalls is a UK-based company specializing in the production and supply of landscaping, building, and roofing products, with a market capitalization of approximately £1.34 billion.

Operations: The company's revenue primarily comes from three segments: Roofing Products, Building Products, and Landscaping Products. Over recent periods, the gross profit margin has shown some fluctuations but generally remains around 62-63%. Operating expenses constitute a significant portion of costs, with General & Administrative Expenses being a notable component. The net income margin has varied across periods, reflecting changes in operating efficiency and cost management.

PE: 20.2x

Marshalls, a European company with a small market presence, recently reported half-year sales of £319.5 million, up from £306.7 million the previous year. Despite this increase, net income dropped to £8.9 million from £16.1 million, reflecting challenges in maintaining profitability amidst growth forecasts of 22% annually for earnings. Insider confidence is evident as executives have increased their stock holdings over the past few months, indicating belief in future prospects despite current dividend cuts and leadership changes on the board.

- Click to explore a detailed breakdown of our findings in Marshalls' valuation report.

Review our historical performance report to gain insights into Marshalls''s past performance.

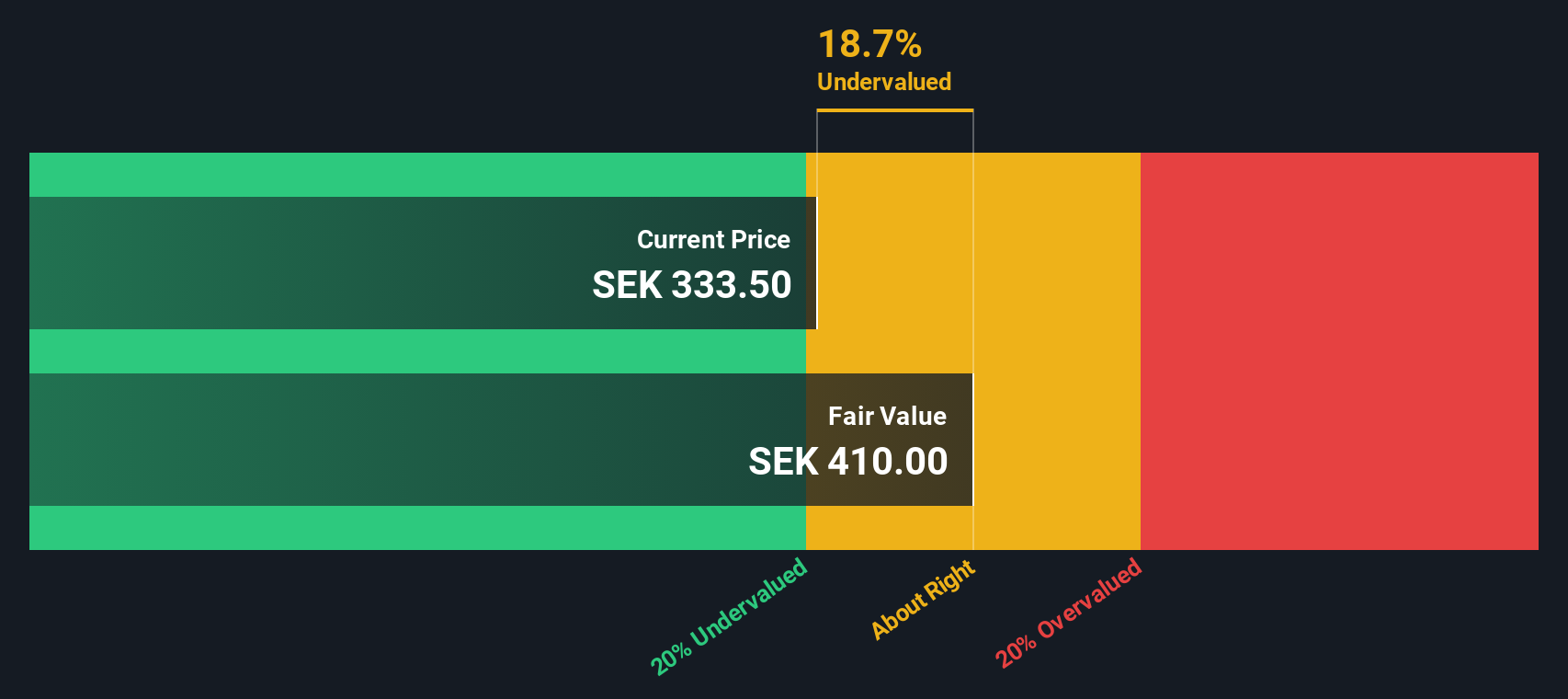

Lime Technologies (OM:LIME)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lime Technologies specializes in selling and implementing CRM software systems, with a market cap of approximately SEK 2.5 billion.

Operations: Lime Technologies generates revenue primarily from selling and implementing software, specifically CRM systems, with recent figures indicating a gross profit margin of 48.37%. The company's cost structure includes significant expenses in operating and non-operating areas, with depreciation and amortization being notable components.

PE: 44.5x

Lime Technologies, a European tech company, exhibits potential as an undervalued investment. Recent earnings for Q2 2025 show revenue growth to SEK 183.19 million from SEK 174.71 million year-on-year, with net income rising to SEK 26.16 million from SEK 20.42 million. Insider confidence is evident as the CFO bought shares worth approximately US$101K in July 2025, signaling belief in future prospects despite reliance on external borrowing for funding. The company is actively seeking acquisitions in Lime CRM and Sportadmin to bolster growth further this year.

Turning Ideas Into Actions

- Get an in-depth perspective on all 50 Undervalued European Small Caps With Insider Buying by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MSLH

Marshalls

Manufactures and sells landscape, building, and roofing products in the United Kingdom and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)