- United Kingdom

- /

- Healthcare Services

- /

- AIM:CVSG

Discover Top Undervalued Small Caps With Insider Buying In United Kingdom September 2024

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face turbulence due to weak trade data from China, investors are increasingly cautious about global economic conditions. Despite this, opportunities still exist within the undervalued small-cap sector in the United Kingdom, particularly those with insider buying—a key indicator of potential value and confidence in future performance.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Domino's Pizza Group | 15.0x | 1.7x | 39.27% | ★★★★★☆ |

| GB Group | NA | 2.8x | 36.89% | ★★★★★☆ |

| Genus | 154.7x | 1.8x | 5.09% | ★★★★★☆ |

| Bytes Technology Group | 26.6x | 6.0x | 5.23% | ★★★★☆☆ |

| CVS Group | 23.7x | 1.3x | 38.05% | ★★★★☆☆ |

| Essentra | 709.3x | 1.4x | 40.45% | ★★★★☆☆ |

| NWF Group | 8.8x | 0.1x | 34.66% | ★★★☆☆☆ |

| Alpha Group International | 10.1x | 4.7x | -25.51% | ★★★☆☆☆ |

| Harworth Group | 12.6x | 6.6x | -625.32% | ★★★☆☆☆ |

| Rank Group | 31.2x | 0.5x | 39.06% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

CVS Group (AIM:CVSG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CVS Group operates veterinary practices, laboratories, crematorium services, and an online retail business, with a market cap of approximately £1.34 billion.

Operations: The company generates revenue primarily from Veterinary Practices (£573 million), Online Retail Business (£49.6 million), Laboratories (£31.4 million), and Crematorium services (£11.6 million). The gross profit margin has ranged between 32.62% and 52.31%, reflecting changes in cost of goods sold over various periods.

PE: 23.7x

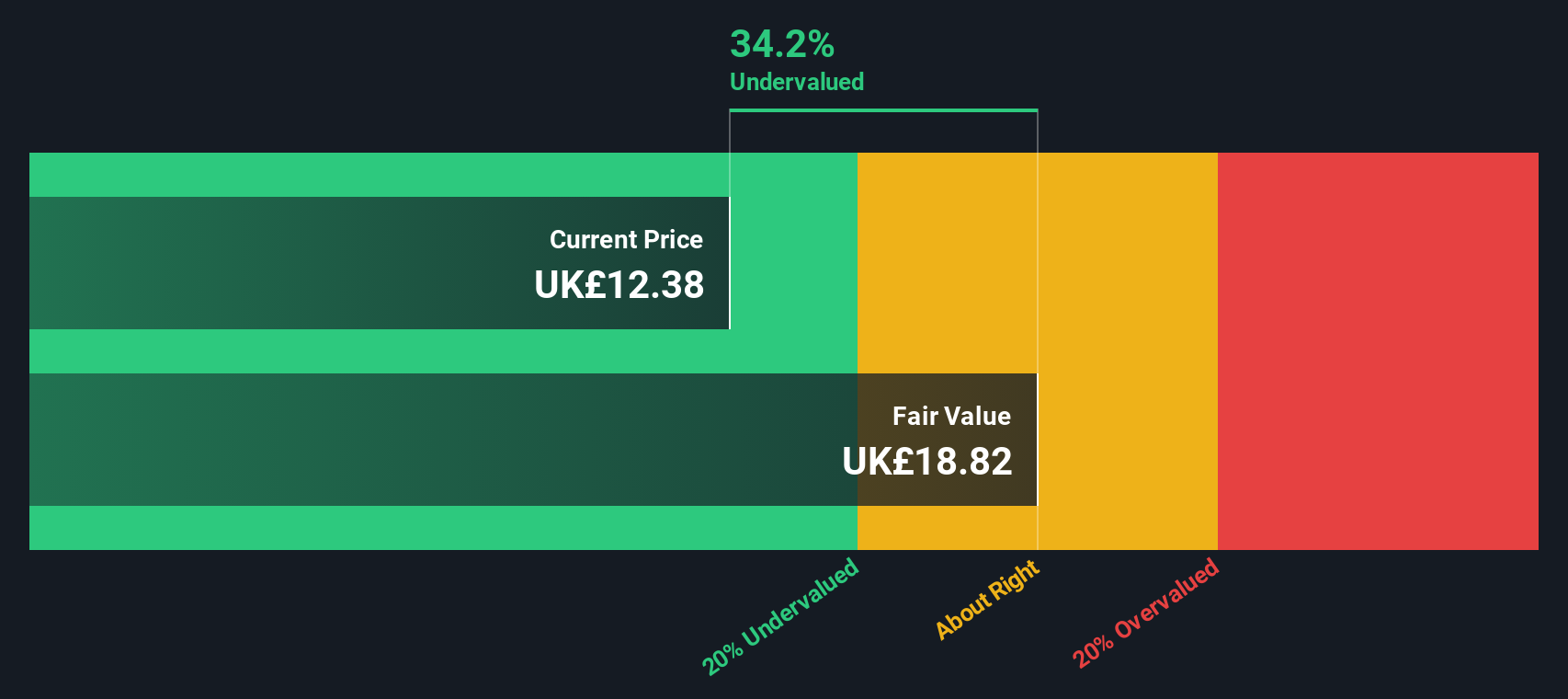

CVS Group, a UK-based company, has shown signs of being undervalued. Despite having high external debt, the company's earnings are forecasted to grow by 12.07% annually. Notably, insider confidence is evident as David Wilton purchased 2,500 shares worth £26,300 in recent months. This small cap stock's reliance on external borrowing poses some risk but its growth projections and insider activity suggest potential for future value appreciation.

- Navigate through the intricacies of CVS Group with our comprehensive valuation report here.

Understand CVS Group's track record by examining our Past report.

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bytes Technology Group is an IT solutions provider with a market cap of approximately £1.10 billion.

Operations: The company generates revenue primarily from its IT solutions segment, with recent figures showing £207.02 million. It has shown a net income margin of 22.63% and gross profit margin of 70.42%.

PE: 26.6x

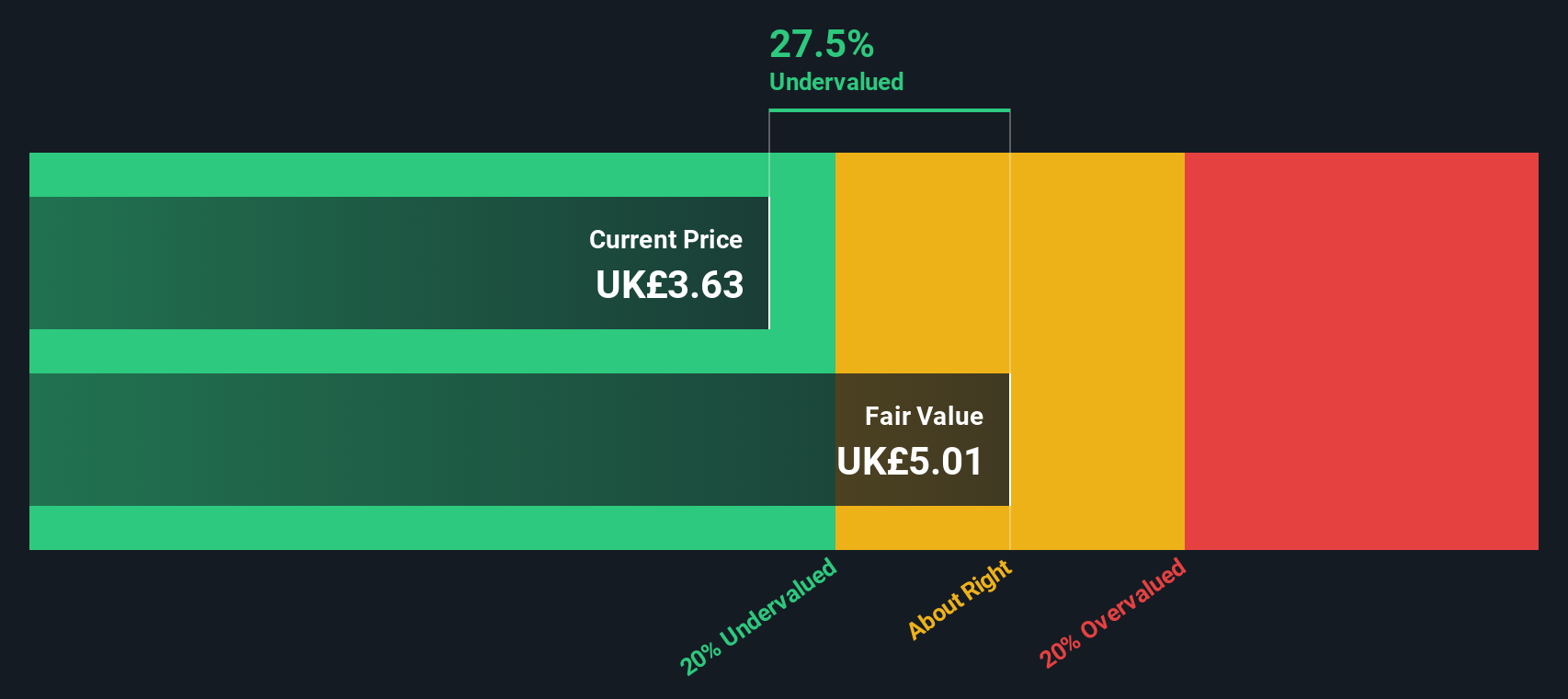

Bytes Technology Group, a UK-based small cap, has shown insider confidence with significant share purchases over the past six months. They recently approved a final dividend of 6.0 pence per share and a special dividend of 8.7 pence per share at their AGM in July 2024, signaling strong shareholder returns. With earnings forecasted to grow by 9.23% annually and recent participation in industry events like Smarter Working Live 2024, Bytes demonstrates potential for future growth despite relying solely on external borrowing for funding.

- Take a closer look at Bytes Technology Group's potential here in our valuation report.

Evaluate Bytes Technology Group's historical performance by accessing our past performance report.

Card Factory (LSE:CARD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Card Factory operates a chain of retail stores specializing in greeting cards, gifts, and party supplies with a market cap of approximately £0.30 billion.

Operations: Card Factory generates revenue primarily through its Cardfactory Stores (£478.90 million), with additional contributions from Cardfactory Online (£8.80 million), Partnerships (£17 million), and Getting Personal (£5.90 million). The company's gross profit margin has shown a trend, peaking at 37.98% in January 2019 and most recently recorded at 36.19% in January 2024, indicating fluctuations over the periods observed.

PE: 10.0x

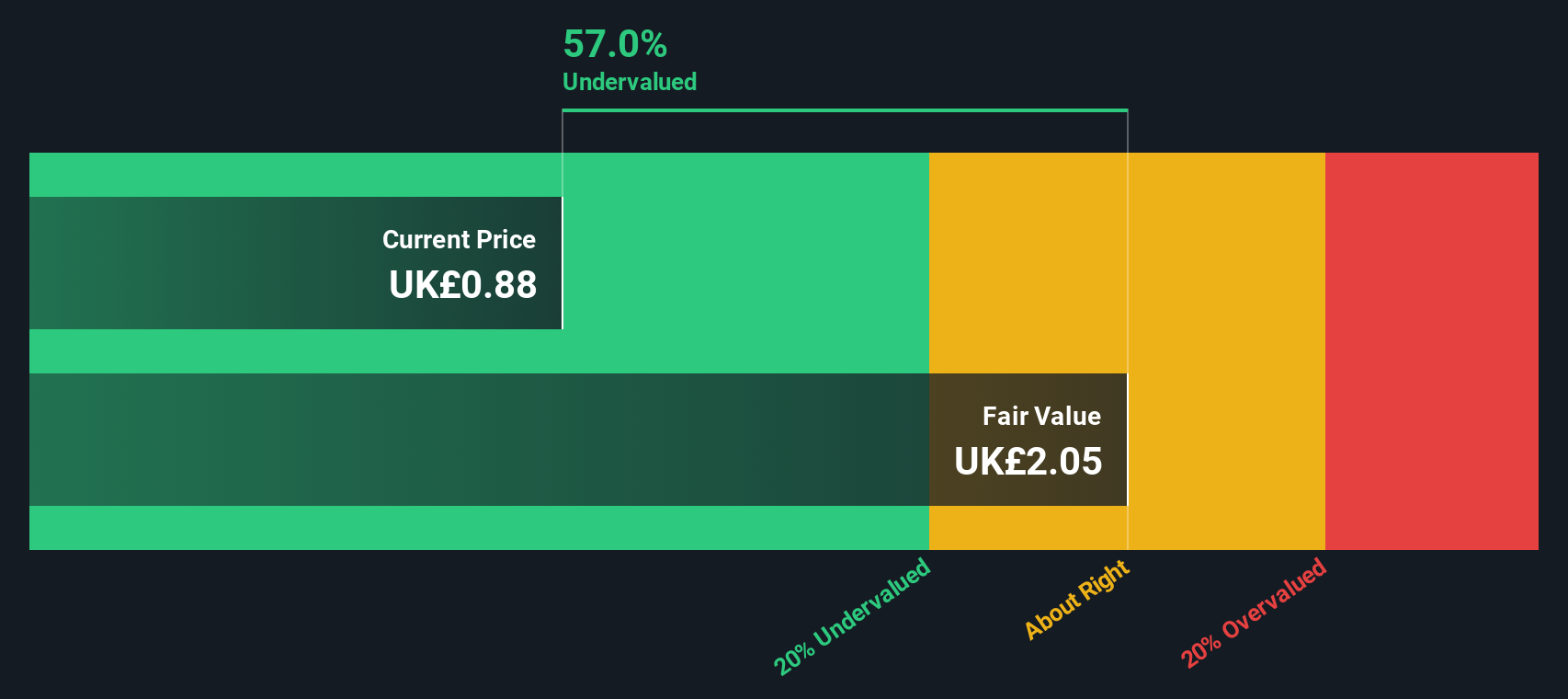

Card Factory, a small-cap stock in the UK, has recently shown signs of being undervalued. CEO & Executive Director Darcy Willson-Rymer's insider confidence is evident from their purchase of 92,371 shares worth £89,554 in July 2024, reflecting a significant 34.76% increase in their holdings. This move suggests strong belief in the company's future prospects. Despite relying solely on external borrowing for funding and upcoming H1 2025 earnings results on September 24th, Card Factory projects an annual earnings growth rate of 6.12%.

- Click here to discover the nuances of Card Factory with our detailed analytical valuation report.

Examine Card Factory's past performance report to understand how it has performed in the past.

Taking Advantage

- Get an in-depth perspective on all 24 Undervalued UK Small Caps With Insider Buying by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CVSG

CVS Group

Engages in veterinary, pet crematoria, online pharmacy, and retail businesses.

Good value with adequate balance sheet.