Stock Analysis

- United Kingdom

- /

- Healthcare Services

- /

- AIM:CVSG

CVS Group And 2 More Undervalued Small Caps With Insider Actions In The United Kingdom

Reviewed by Simply Wall St

Recent trends in the United Kingdom's financial markets have shown a downturn, with the FTSE 100 and FTSE 250 indices both closing lower amid weak global cues and disappointing trade data from China. This backdrop sets a challenging stage for investors, but it also highlights potential opportunities in undervalued small-cap stocks that may be poised for recovery or growth despite broader market headwinds. In such times, discerning investors often look for companies with strong fundamentals and positive insider actions as indicators of potential resilience and upside.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 25.2x | 5.7x | 0.08% | ★★★★★☆ |

| Tracsis | 41.9x | 2.5x | 36.36% | ★★★★★☆ |

| GB Group | NA | 3.1x | 22.75% | ★★★★★☆ |

| THG | NA | 0.4x | 43.14% | ★★★★★☆ |

| Breedon Group | 15.1x | 1.0x | 37.62% | ★★★★☆☆ |

| CVS Group | 22.4x | 1.2x | 38.69% | ★★★★☆☆ |

| Hochschild Mining | NA | 1.7x | 39.84% | ★★★★☆☆ |

| Norcros | 8.0x | 0.5x | -15.23% | ★★★☆☆☆ |

| H&T Group | 7.9x | 0.8x | -11.55% | ★★★☆☆☆ |

| Harworth Group | 14.2x | 7.4x | -597.15% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

CVS Group (AIM:CVSG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CVS Group operates in various segments including veterinary practices, laboratories, online retail businesses, and crematoria, with a market capitalization of approximately £1.5 billion.

Operations: The company generates £641.90 million in revenue, with a gross profit of £276.70 million, reflecting a gross profit margin of approximately 43.13%. Its net income stands at £35.40 million, indicating a net income margin of about 5.52%.

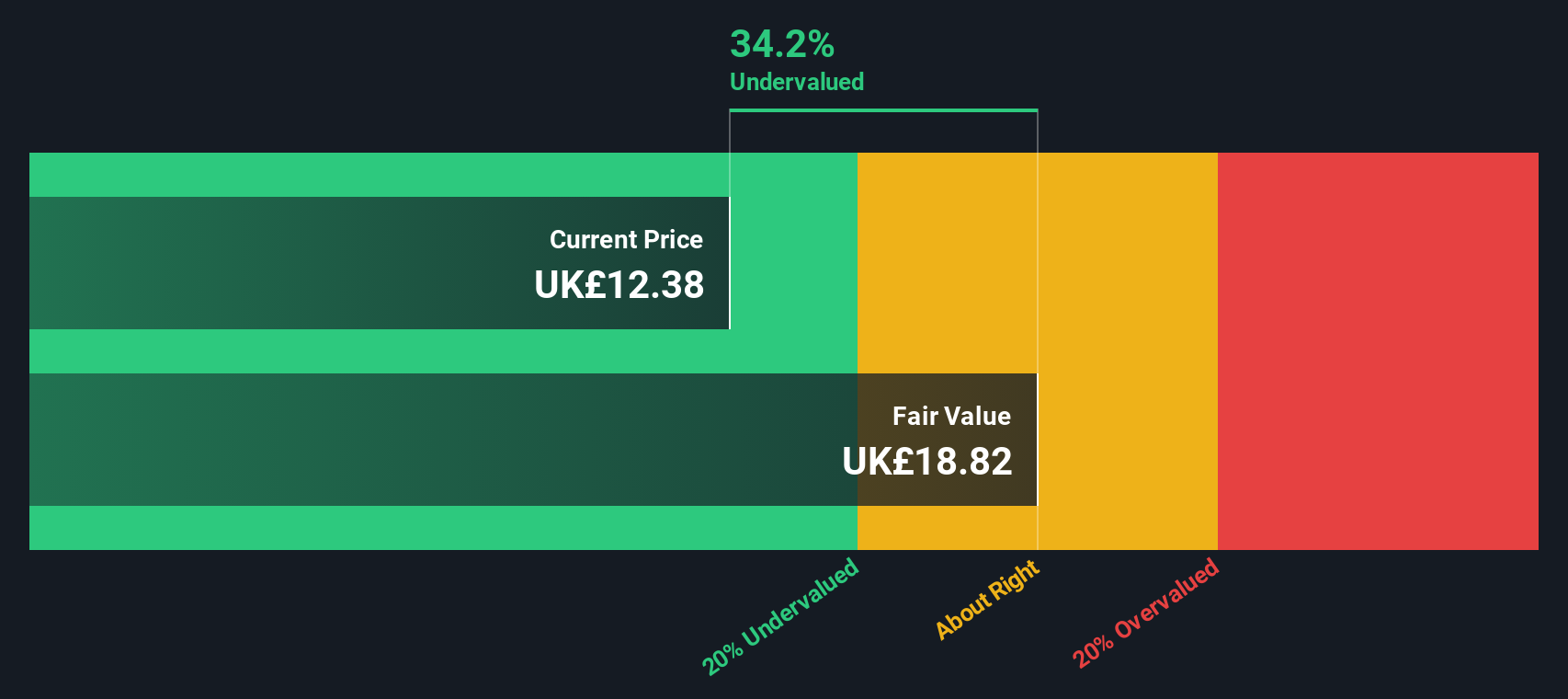

PE: 22.4x

CVS Group, a notable player in the UK's market, recently saw David Wilton purchase 2,500 shares, signaling insider confidence amidst strategic shifts including his appointment as Chair. This move aligns with a robust financial outlook for CVS, expecting earnings growth of 12.83% annually. Despite high debt levels and reliance on external borrowing—a riskier funding strategy—the company’s commitment to investing in technology under Wilton’s guidance suggests promising prospects for value recognition.

- Dive into the specifics of CVS Group here with our thorough valuation report.

Evaluate CVS Group's historical performance by accessing our past performance report.

Polar Capital Holdings (AIM:POLR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Polar Capital Holdings is a specialist, investment-led, active fund management company with a market cap of approximately £0.55 billion.

Operations: The Investment Management Business generates revenue of £197.25 million, with a notable gross profit margin of 88.51%. This financial performance highlights the company's ability to manage costs effectively relative to its revenue generation.

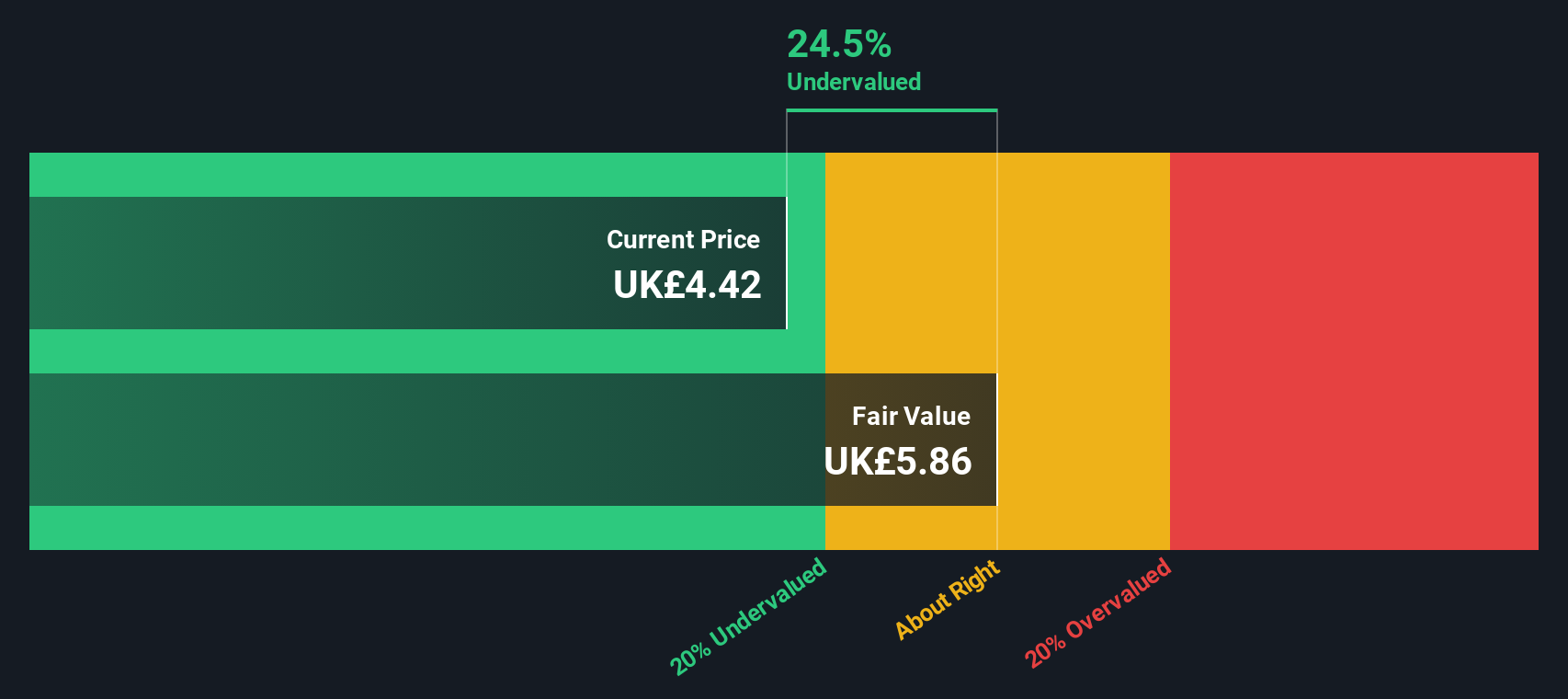

PE: 14.4x

Polar Capital Holdings, with its recent financial uplift, reported a significant increase in net income to £40.79 million for FY 2024 from £35.61 million the previous year, underscoring robust earnings growth and revenue enhancement to £197.59 million. This financial health is complemented by stable dividend payouts, maintaining a total of 46 pence per share annually. The firm operates on a high-risk funding model without customer deposits, relying solely on external borrowing. Notably, insider confidence is reflected through recent strategic share purchases by executives, signaling strong belief in the company's prospects amidst its undervalued market position.

- Click to explore a detailed breakdown of our findings in Polar Capital Holdings' valuation report.

Assess Polar Capital Holdings' past performance with our detailed historical performance reports.

Aston Martin Lagonda Global Holdings (LSE:AML)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aston Martin Lagonda Global Holdings is a luxury automotive manufacturer known for its high-performance vehicles, with a market capitalization of approximately £1.56 billion.

Operations: Automotive revenue reached £1.56 billion, with a gross profit margin of 40.80%, reflecting the company's cost of goods sold at £922.6 million and operating expenses at £730.9 million for the period ending July 29, 2024.

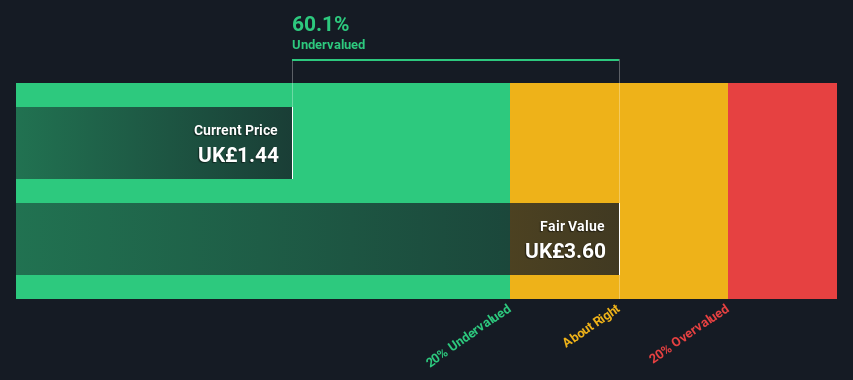

PE: -4.6x

Amidst leadership transitions and financial challenges, Aston Martin Lagonda Global Holdings plc recently indicated insider confidence through share purchases. Their sales dipped to £603 million in the first half of 2024, reflecting a challenging period with a net loss increase. However, looking ahead, they've set ambitious revenue targets of £2.5 billion by 2027-28. These moves suggest a strategic pivot aimed at revitalizing their market position and potentially enhancing shareholder value in the longer term.

- Navigate through the intricacies of Aston Martin Lagonda Global Holdings with our comprehensive valuation report here.

Learn about Aston Martin Lagonda Global Holdings' historical performance.

Next Steps

- Dive into all 25 of the Undervalued UK Small Caps With Insider Buying we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CVSG

CVS Group

Engages in veterinary, pet crematoria, online pharmacy, and retail businesses.

Good value with proven track record.