Stock Analysis

- United Kingdom

- /

- Oil and Gas

- /

- LSE:ENOG

Three UK Growth Companies With High Insider Ownership And A Minimum 13% Earnings Growth

Reviewed by Simply Wall St

Recent performance in the United Kingdom’s financial markets has been subdued, influenced heavily by external economic factors such as weak trade data from China. Amid these challenging global cues, investors may find reassurance in growth companies with high insider ownership, which can signal strong confidence in the company's prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 34.2% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 39.5% | 117.8% |

| Velocity Composites (AIM:VEL) | 27.6% | 173.3% |

| Judges Scientific (AIM:JDG) | 11.5% | 25.9% |

| Hochschild Mining (LSE:HOC) | 38.4% | 54.9% |

Let's uncover some gems from our specialized screener.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

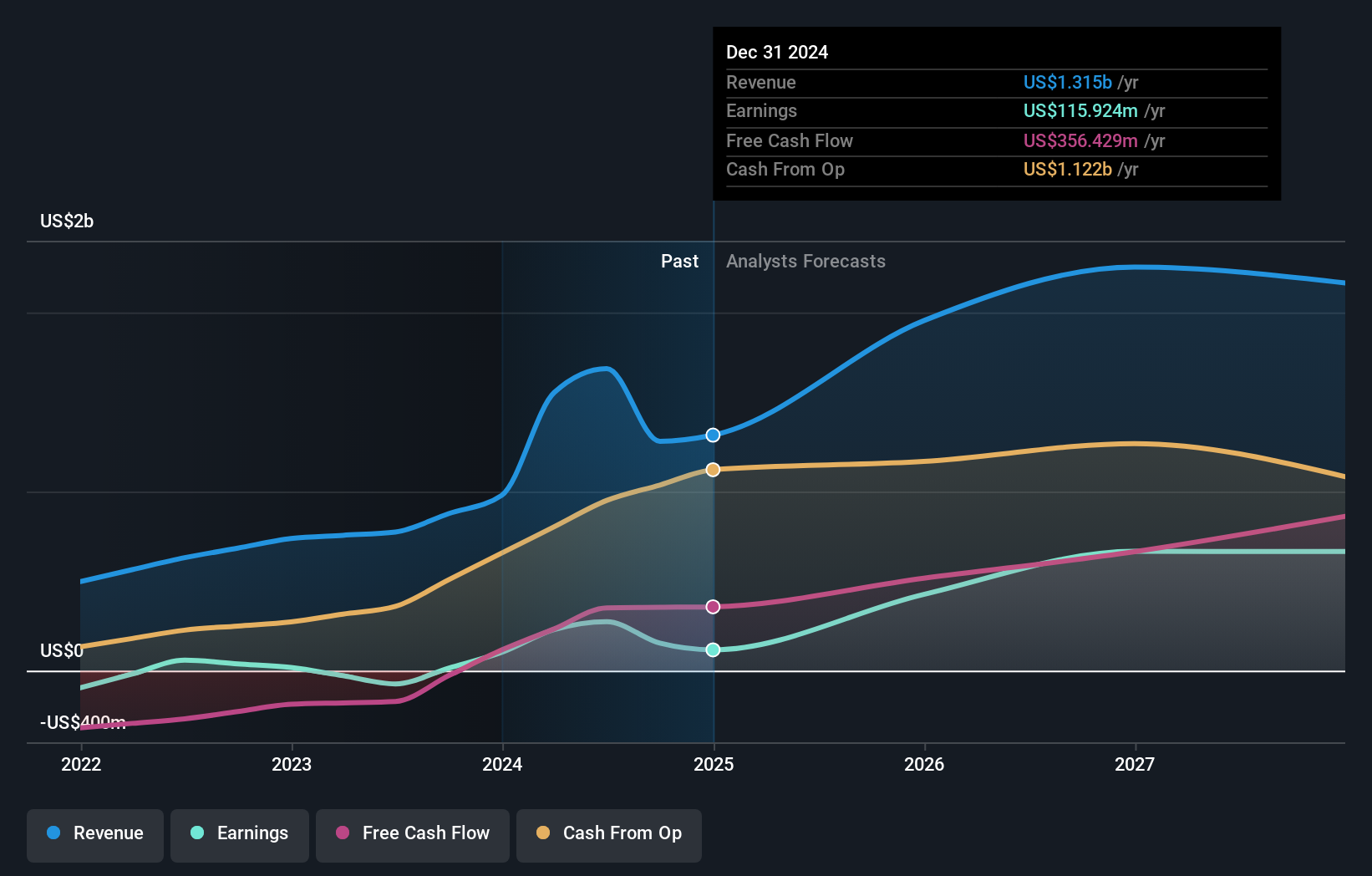

Overview: Energean plc is an oil and gas company focused on the exploration, production, and development of energy resources, with a market capitalization of approximately £2.01 billion.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, amounting to $1.42 billion.

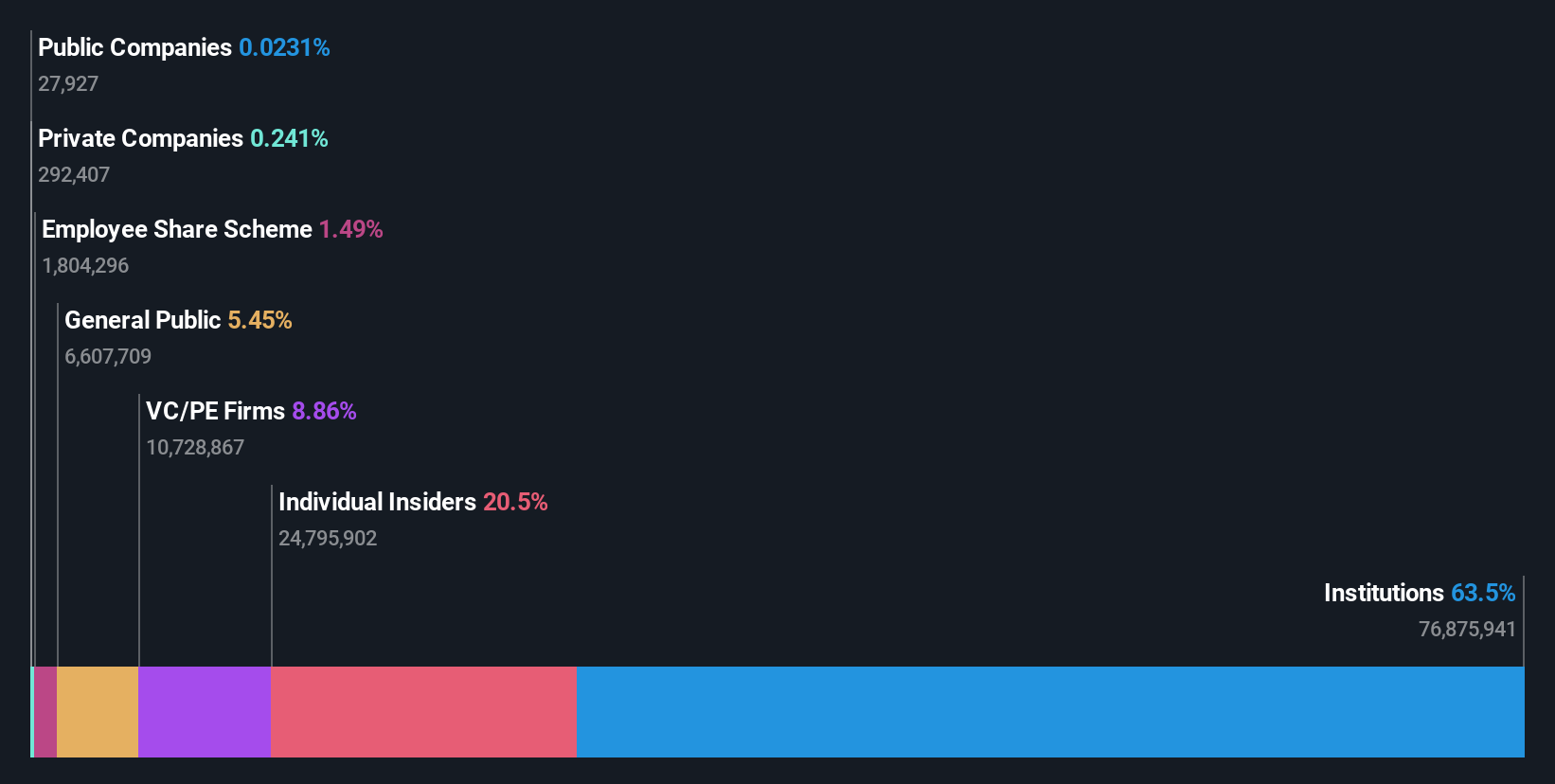

Insider Ownership: 10.6%

Earnings Growth Forecast: 14.2% p.a.

Energean, a growth company with high insider ownership in the UK, has recently committed to expanding its Katlan development project in Israel, aiming for first gas by H1 2027. Despite a substantial increase in production and ambitious future plans, the company trades below analyst price targets and faces challenges like high debt levels and shareholder dilution. However, Energean's earnings have surged significantly over the past year and are expected to continue growing, albeit at a slower pace than previously. The firm also declared a dividend recently but struggles with coverage from earnings or free cash flows.

- Take a closer look at Energean's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Energean's share price might be too pessimistic.

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kainos Group plc is a provider of digital technology services across the UK, Ireland, North America, Central Europe, and other international markets, with a market capitalization of approximately £1.42 billion.

Operations: The company generates revenue through three primary segments: Digital Services (£213.10 million), Workday Products (£57.25 million), and Workday Services (£112.04 million).

Insider Ownership: 23.3%

Earnings Growth Forecast: 13.1% p.a.

Kainos Group, a UK-based growth company with substantial insider ownership, is poised for robust expansion. The firm's revenue is forecasted to grow at 8.9% annually, outpacing the UK market average of 3.5%. Although its earnings growth projection of 13.12% per year isn't exceptionally high, it remains above market trends. Recent strategic alliances with Workday and Pulsora enhance Kainos' digital offerings in enterprise app development and ESG compliance solutions, potentially broadening its market reach and reinforcing its growth trajectory despite an unstable dividend record.

- Dive into the specifics of Kainos Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Kainos Group's current price could be quite moderate.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

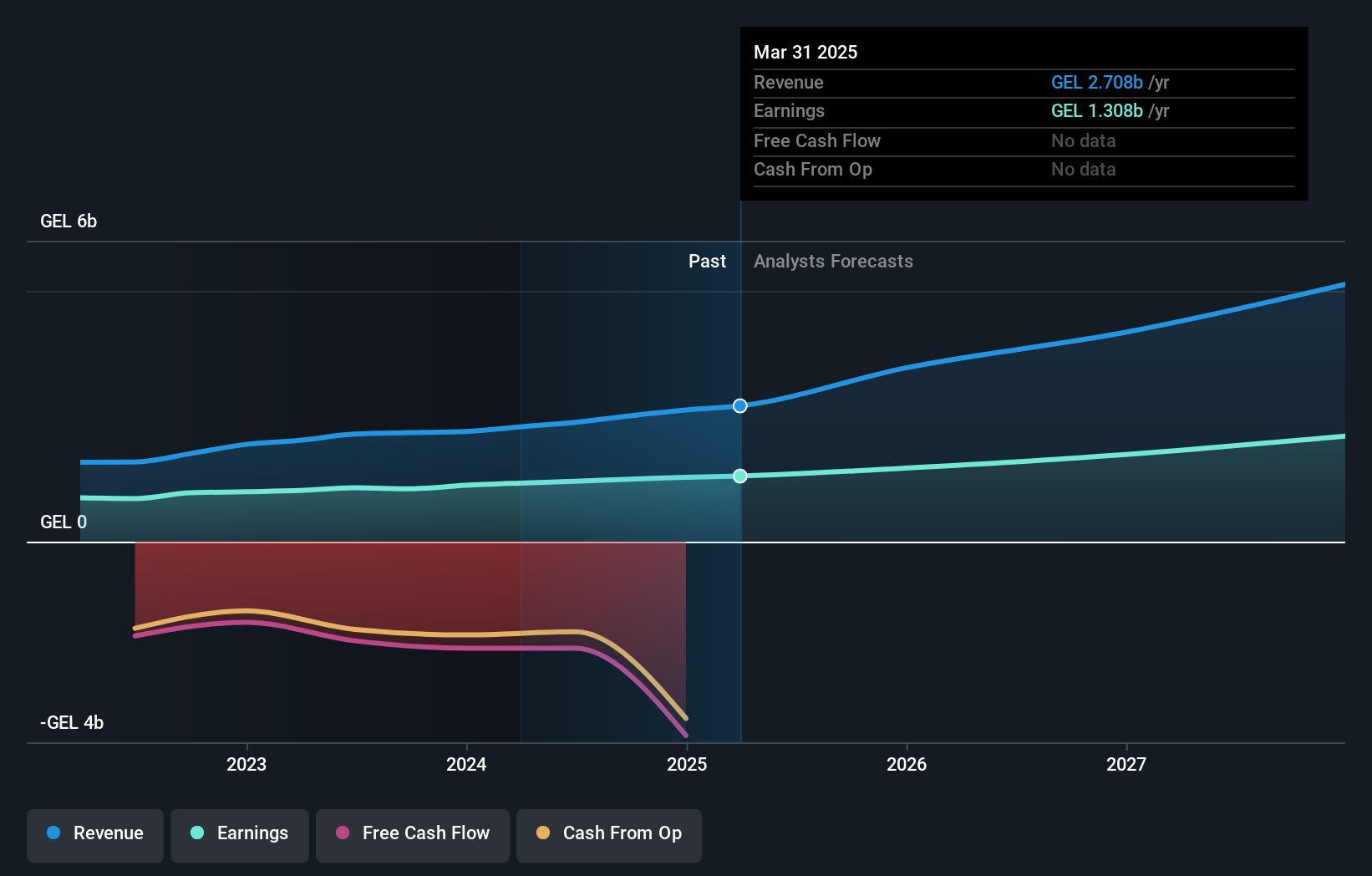

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of financial services including banking, leasing, insurance, brokerage, and card processing with a market capitalization of approximately £1.66 billion.

Operations: The company generates revenue from banking, leasing, insurance, brokerage, and card processing services across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 17.7%

Earnings Growth Forecast: 14.9% p.a.

TBC Bank Group, a key player in the UK financial sector, demonstrates strong insider ownership with significant recent developments. The bank's earnings are forecasted to grow by 14.9% annually, surpassing the UK market average. A recent GEL 75 million share buyback plan underscores a strategic move to enhance shareholder value, while robust first-quarter results with a net income increase to GEL 292.81 million highlight operational strength. However, concerns persist due to its high bad loans ratio at 2.1% and volatile share price.

- Click here and access our complete growth analysis report to understand the dynamics of TBC Bank Group.

- Our valuation report unveils the possibility TBC Bank Group's shares may be trading at a discount.

Next Steps

- Navigate through the entire inventory of 64 Fast Growing UK Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Energean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ENOG

Energean

Engages in the exploration, production, and development of oil and gas.

Solid track record and good value.