Stock Analysis

- United Kingdom

- /

- Capital Markets

- /

- LSE:ALPH

Exploring Undiscovered UK Stocks With Strong Fundamentals July 2024

Reviewed by Simply Wall St

As recent trends show, the United Kingdom's stock market has faced challenges, notably influenced by external economic factors such as weak trade data from China impacting major indices like the FTSE 100. Amidst these broader market movements, identifying stocks with strong fundamentals becomes crucial, especially for those looking for potential growth in less visible sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 17.80% | 18.35% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc is a company that specializes in foreign exchange risk management and alternative banking solutions, operating across the UK, Europe, Canada, and other international markets with a market capitalization of £1.09 billion.

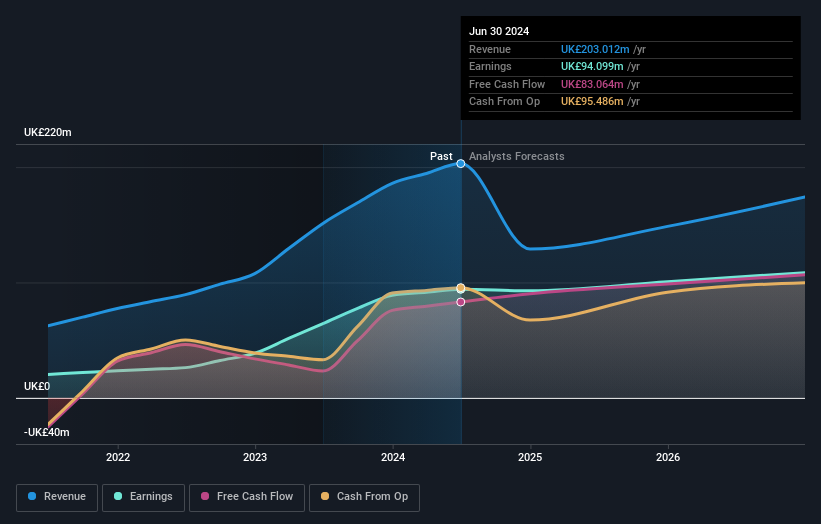

Operations: Alpha Group International generates revenue through diverse segments including Alpha Pay and Institutional services, which are its largest contributors at £64.30 million and £61.29 million respectively. The company has shown a robust gross profit margin growth, recently recorded at 85.66% as of the latest financial period, indicating efficient management of production costs and strong pricing strategies.

Alpha Group International, recently added to the FTSE 250 Index, showcases a robust financial and strategic posture. With a remarkable 130% earnings growth last year and a forecasted annual growth of 8.25%, the company's performance outpaces its sector significantly. Trading at a P/E ratio of 12.3x—below the UK market average of 16.5x—it represents compelling value. Additionally, Alpha is debt-free and maintains high-quality earnings with substantial non-cash components. The recent authorization for share repurchases further underscores its strong market position and shareholder confidence.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Law Debenture Corporation p.l.c. is an investment trust offering independent professional services globally, with a market capitalization of £1.19 billion.

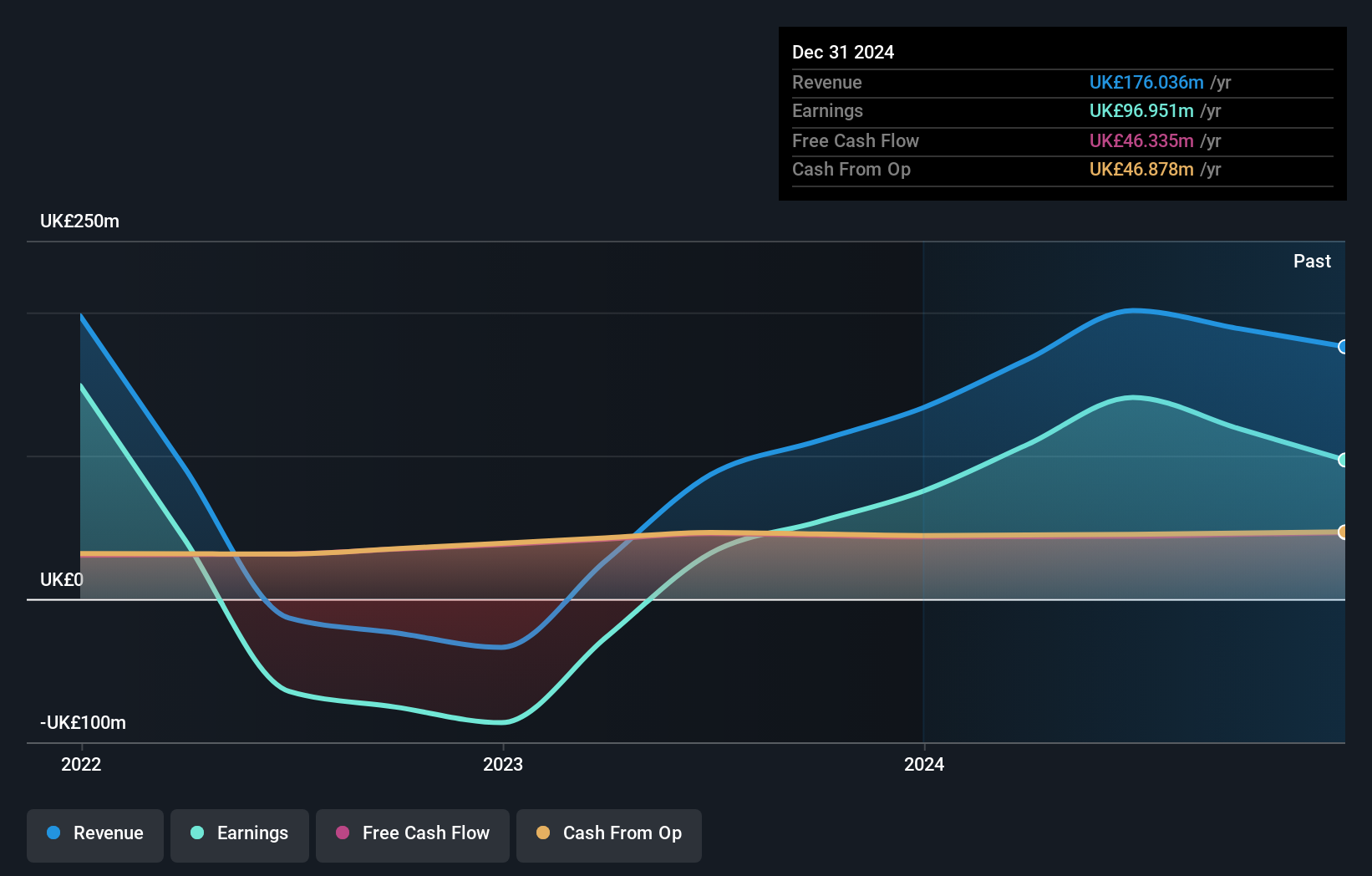

Operations: The company generates its revenue through two primary segments: managing an investment portfolio, which contributed £35.62 million, and providing independent professional services, accounting for £61.55 million in revenue. The firm consistently achieves high gross profit margins, exemplified by a margin of 95.44% as of June 2024, highlighting effective cost management relative to its revenue generation.

Law Debenture, a lesser-known UK entity, recently showcased impressive financial growth with its half-year earnings soaring to GBP 82 million from GBP 16.54 million last year, alongside a revenue jump to GBP 111.97 million from GBP 44.02 million. This performance eclipses the Capital Markets industry's modest growth of 0.3%. The company's robust Price-To-Earnings ratio of 8.4x, significantly below the UK market average of 16.5x, and a debt to equity increase to 17.9%, reflect its strategic financial management while maintaining satisfactory net debt levels at 15%.

- Navigate through the intricacies of Law Debenture with our comprehensive health report here.

Review our historical performance report to gain insights into Law Debenture's's past performance.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Wilmington plc operates as a provider of information, data, training, and education solutions targeting professional markets across the UK, Europe, North America, and other global regions, with a market capitalization of approximately £352.41 million.

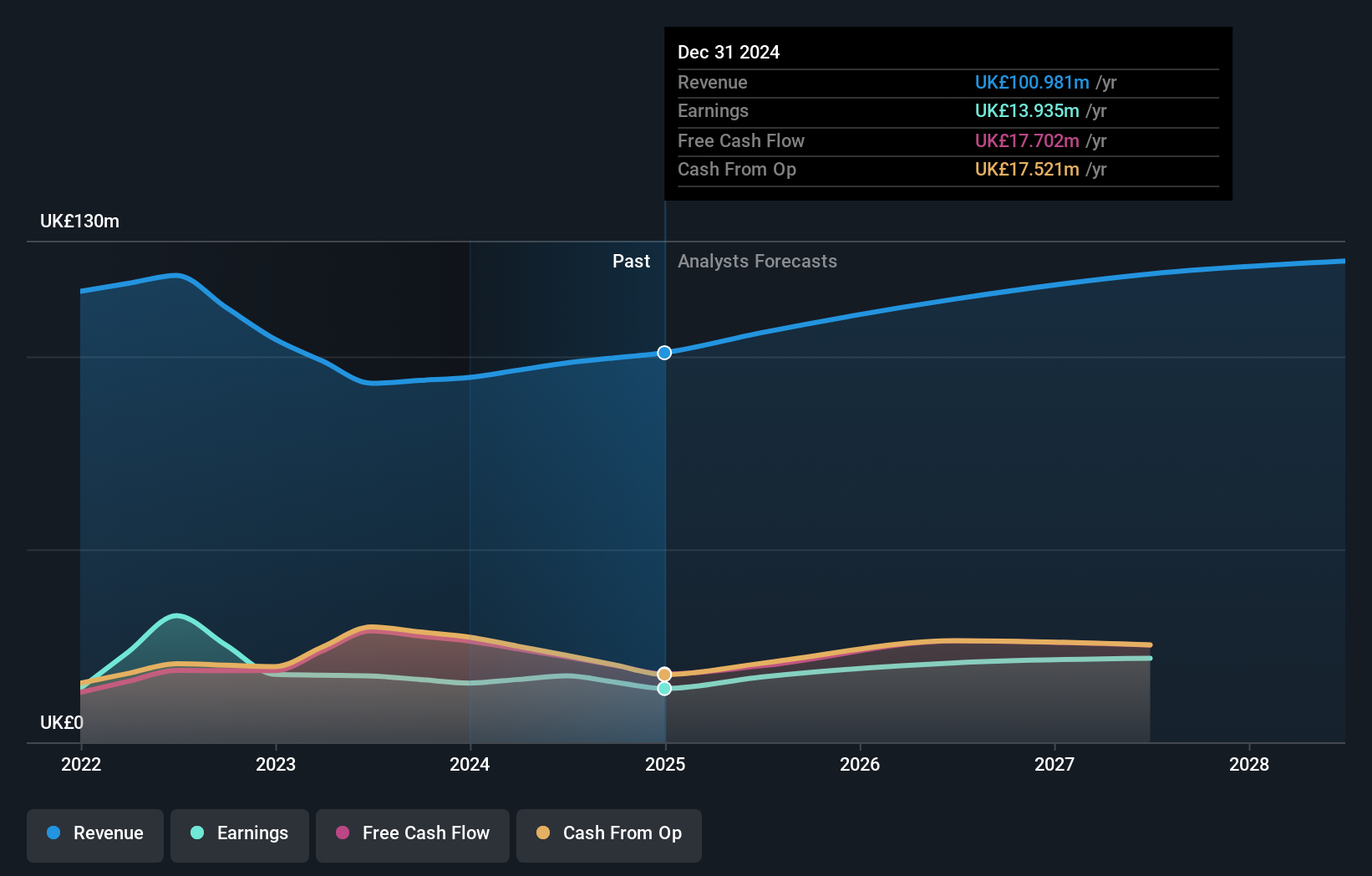

Operations: The company operates primarily in two segments: Intelligence and Training & Education, generating revenues of £57.86 million and £67.13 million respectively. It has shown a capacity to manage costs effectively, with recent data indicating a gross profit margin of approximately 19.63%.

Wilmington, a lesser-known gem in the UK market, is trading at a 29% discount to its estimated fair value. This debt-free company has outpaced its industry with a 4.4% earnings growth last year against the industry's 2%. Despite projections of a 6.6% annual earnings decline over the next three years, Wilmington's robust past performance and positive free cash flow position it as an intriguing prospect for discerning investors seeking value and stability.

- Click here and access our complete health analysis report to understand the dynamics of Wilmington.

Evaluate Wilmington's historical performance by accessing our past performance report.

Where To Now?

- Take a closer look at our UK Undiscovered Gems With Strong Fundamentals list of 75 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALPH

Alpha Group International

Provides foreign exchange risk management and alternative banking solutions in the United Kingdom, Europe, Canada, and internationally.

Flawless balance sheet with solid track record.