- United Kingdom

- /

- Healthcare Services

- /

- AIM:CVSG

3 Undervalued Small Caps In UK With Insider Buying To Consider

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both experiencing declines amid weak trade data from China, highlighting concerns over global economic recovery. In this context of broader market volatility, small-cap stocks with insider buying may present intriguing opportunities for investors seeking potential value plays.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 17.4x | 1.4x | 32.44% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 31.87% | ★★★★★☆ |

| NCC Group | NA | 1.3x | 27.05% | ★★★★★☆ |

| Robert Walters | 33.7x | 0.2x | 32.56% | ★★★★☆☆ |

| iomart Group | 23.5x | 0.6x | 35.59% | ★★★★☆☆ |

| CVS Group | 26.5x | 1.1x | 46.23% | ★★★★☆☆ |

| XPS Pensions Group | 11.3x | 3.2x | 5.29% | ★★★☆☆☆ |

| Telecom Plus | 17.2x | 0.7x | 33.39% | ★★★☆☆☆ |

| Warpaint London | 24.2x | 4.2x | 0.99% | ★★★☆☆☆ |

| THG | NA | 0.3x | -512.81% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

CVS Group (AIM:CVSG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CVS Group operates as a provider of veterinary services, including crematoria and laboratory services, with a focus on veterinary practices and online retail, holding a market cap of approximately £1.57 billion.

Operations: The primary revenue stream is from Veterinary Practices, contributing significantly to the overall revenue of £647.3 million, with additional income from Laboratories and Online Retail Business. The gross profit margin has shown fluctuations over time, reaching 43.83% in June 2023 before slightly declining to 42.93% by January 2025. Operating expenses are a major cost component, with General & Administrative Expenses being consistently significant across periods.

PE: 26.5x

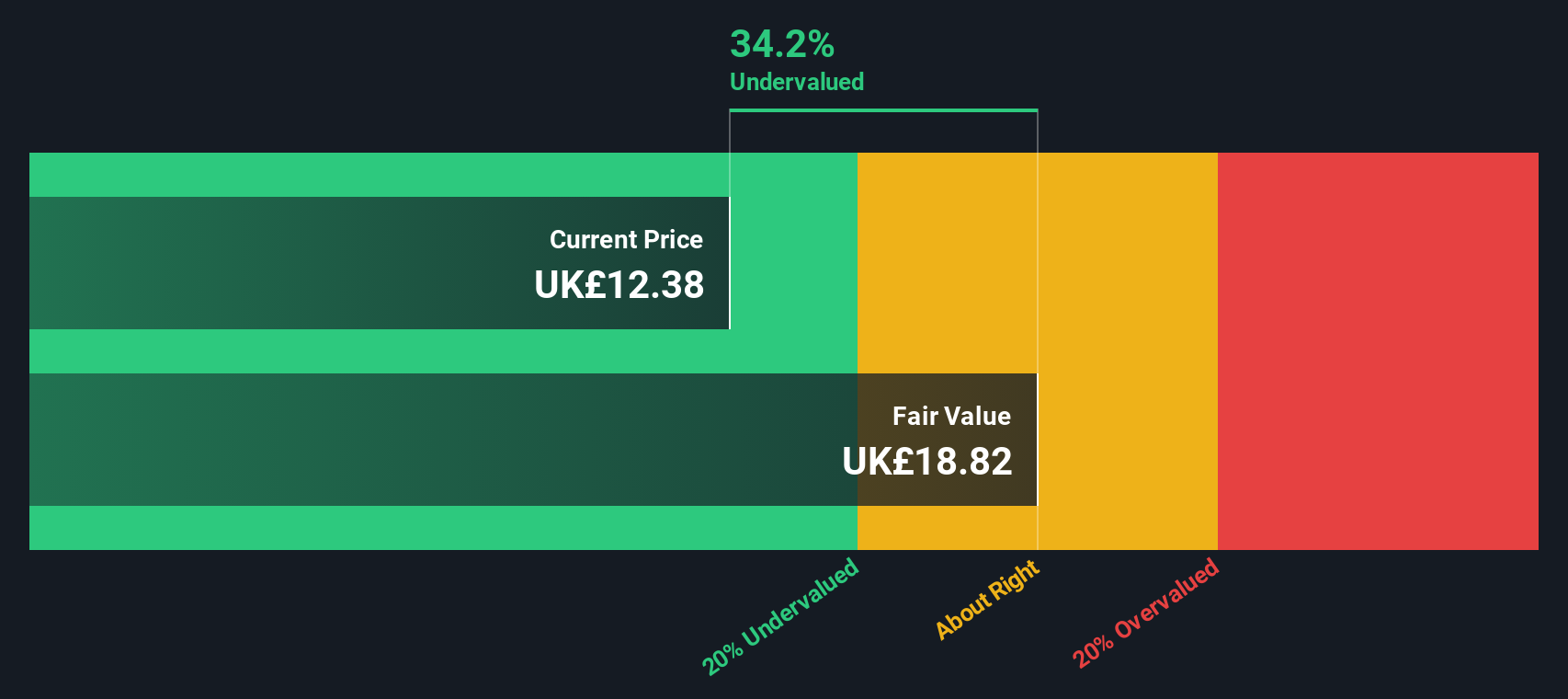

CVS Group, a UK-based company, is drawing attention in the small-cap sector due to its potential for value appreciation. Despite a dip in profit margins from 8.2% to 4%, earnings are expected to grow by 15.48% annually. The company plans a dividend increase pending shareholder approval, indicating confidence in future cash flows. However, their high reliance on external borrowing poses risks despite no customer deposits being involved.

- Unlock comprehensive insights into our analysis of CVS Group stock in this valuation report.

Gain insights into CVS Group's historical performance by reviewing our past performance report.

Judges Scientific (AIM:JDG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Judges Scientific is a company specializing in the acquisition and development of scientific instrument businesses, with operations primarily in vacuum and materials sciences, and a market cap of approximately £0.54 billion.

Operations: The company generates revenue primarily from the Vacuum and Materials Sciences segments, with recent figures showing £65.40 million and £70.20 million respectively. The gross profit margin has shown an upward trend, reaching 68.95% by mid-2024, indicating efficient cost management relative to revenue growth.

PE: 39.3x

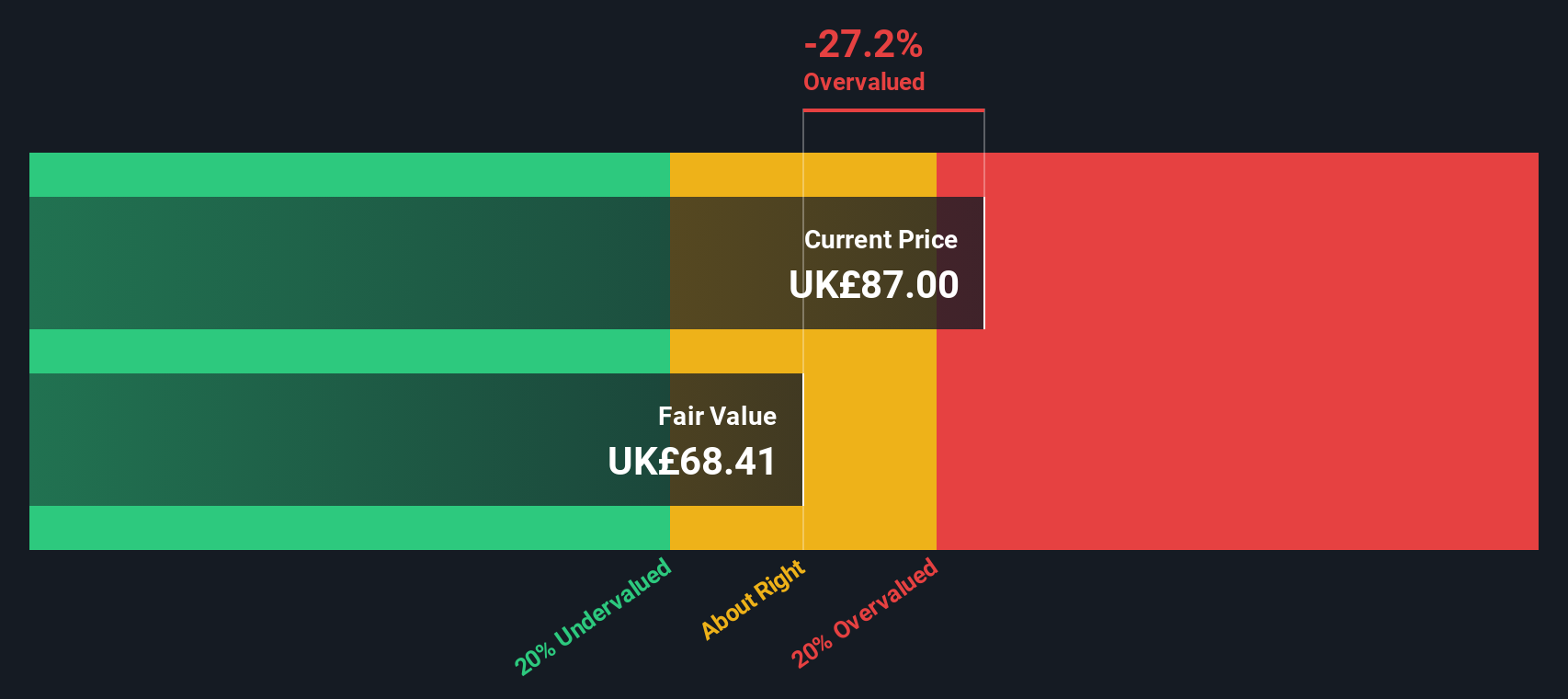

Judges Scientific, a UK-based company, is considered undervalued in its sector. Despite having high debt levels and relying entirely on external borrowing, the company's earnings are projected to grow by 23% annually. Insider confidence is evident with recent share purchases by key personnel, indicating belief in the company's potential. Changes at the board level include Ralph Elman stepping up as Non-Executive Chair from January 2025. These factors suggest a promising outlook amidst financial challenges.

- Click to explore a detailed breakdown of our findings in Judges Scientific's valuation report.

Explore historical data to track Judges Scientific's performance over time in our Past section.

Safestore Holdings (LSE:SAFE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Safestore Holdings is a company that provides self-storage accommodation and related services, with a market capitalization of £2.55 billion.

Operations: The company generates revenue primarily from the provision of self-storage accommodation and related services, with a recent quarterly revenue of £223.4 million. The cost of goods sold (COGS) was £73.9 million, leading to a gross profit margin of 66.92%. Operating expenses were reported at £16.1 million, and net income reached £372.3 million, resulting in a net income margin of 166.65%.

PE: 3.5x

Safestore Holdings, a smaller company in the UK market, is catching attention with its insider confidence as key figures increased their shareholdings over recent months. Despite earnings forecasted to decline by 12.9% annually over three years, revenue is expected to grow 6.63% each year. The latest earnings call on January 16, 2025, revealed net income of £372.3 million for the fiscal year ending October 31, 2024—an impressive jump from £200.2 million previously—indicating strong operational performance despite external borrowing risks and one-off financial impacts.

- Get an in-depth perspective on Safestore Holdings' performance by reading our valuation report here.

Understand Safestore Holdings' track record by examining our Past report.

Next Steps

- Investigate our full lineup of 37 Undervalued UK Small Caps With Insider Buying right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CVSG

CVS Group

Engages in veterinary, online pharmacy, and retail businesses in the United Kingdom and Australia.

Fair value with moderate growth potential.

Market Insights

Community Narratives