- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

Craneware's (LON:CRW) Upcoming Dividend Will Be Larger Than Last Year's

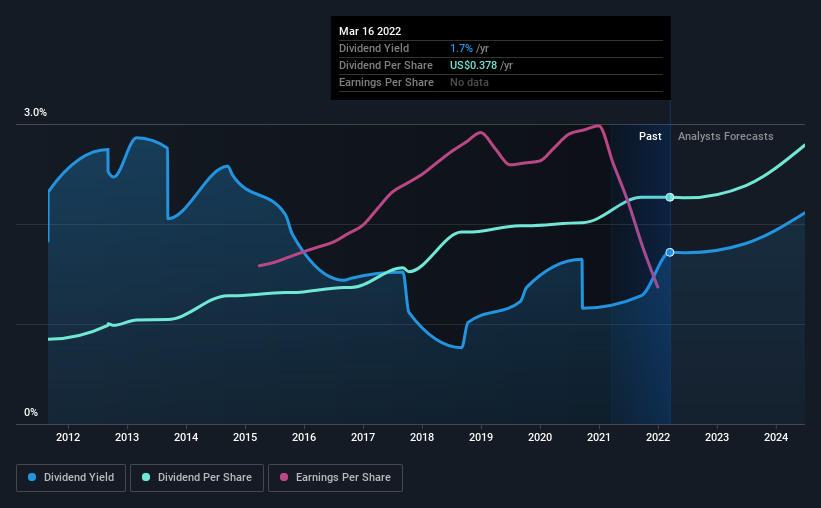

Craneware plc (LON:CRW) will increase its dividend on the 15th of April to UK£0.13. This will take the dividend yield to an attractive 1.7%, providing a nice boost to shareholder returns.

Check out our latest analysis for Craneware

Craneware's Dividend Is Well Covered By Earnings

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Based on the last payment, the company wasn't making enough to cover what it was paying to shareholders. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Over the next year, EPS is forecast to expand by 114.4%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 55% which brings it into quite a comfortable range.

Craneware Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2012, the first annual payment was US$0.14, compared to the most recent full-year payment of US$0.38. This works out to be a compound annual growth rate (CAGR) of approximately 10% a year over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

Dividend Growth May Be Hard To Come By

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Craneware has seen earnings per share falling at 9.5% per year over the last five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

We'd also point out that Craneware has issued stock equal to 33% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Craneware's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Craneware's payments are rock solid. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 4 warning signs for Craneware that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)