- United Kingdom

- /

- Specialty Stores

- /

- LSE:WIX

UK Stocks Estimated To Be Trading At Discounts Up To 49%

Reviewed by Simply Wall St

The United Kingdom's stock market has faced recent challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and falling commodity prices impacting major sectors. In this environment of uncertainty, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer potential value despite broader market pressures.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SigmaRoc (AIM:SRC) | £1.21 | £2.40 | 49.6% |

| PageGroup (LSE:PAGE) | £2.29 | £4.42 | 48.2% |

| Mitie Group (LSE:MTO) | £1.388 | £2.61 | 46.9% |

| Likewise Group (AIM:LIKE) | £0.27 | £0.52 | 48.1% |

| Hollywood Bowl Group (LSE:BOWL) | £2.545 | £4.86 | 47.6% |

| Gym Group (LSE:GYM) | £1.488 | £2.93 | 49.2% |

| Gooch & Housego (AIM:GHH) | £5.60 | £10.80 | 48.2% |

| Essentra (LSE:ESNT) | £1.05 | £1.98 | 46.8% |

| Begbies Traynor Group (AIM:BEG) | £1.165 | £2.20 | 47.1% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.23 | £4.37 | 49% |

Let's review some notable picks from our screened stocks.

Advanced Medical Solutions Group (AIM:AMS)

Overview: Advanced Medical Solutions Group plc develops, manufactures, and distributes surgical, woundcare, and wound-closure products across the UK, Germany, Europe, the US, and internationally with a market cap of £480.63 million.

Operations: The company's revenue is primarily derived from its Surgical segment, contributing £175.23 million, and its Woundcare segment, adding £45.07 million.

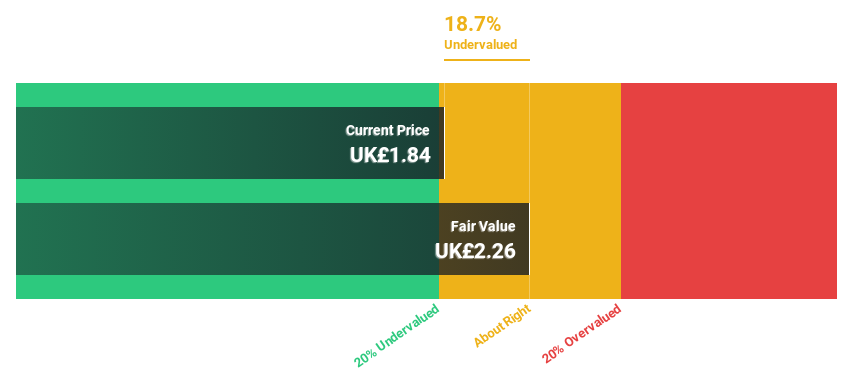

Estimated Discount To Fair Value: 49%

Advanced Medical Solutions Group is trading at £2.23, significantly below its estimated fair value of £4.37, suggesting potential undervaluation based on discounted cash flow analysis. Despite a lower profit margin this year (4.1% vs 8.5% last year), earnings are forecast to grow by over 30% annually, exceeding the UK market's growth rate. Recent half-year earnings showed sales of £110.77 million and net income of £6.21 million, indicating robust performance and growth prospects.

- Our earnings growth report unveils the potential for significant increases in Advanced Medical Solutions Group's future results.

- Get an in-depth perspective on Advanced Medical Solutions Group's balance sheet by reading our health report here.

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories for both B2C and trade customers in the United Kingdom, with a market cap of £222.68 million.

Operations: Victorian Plumbing Group generates revenue through its online retail of bathroom products and accessories, catering to both consumer and trade markets in the UK.

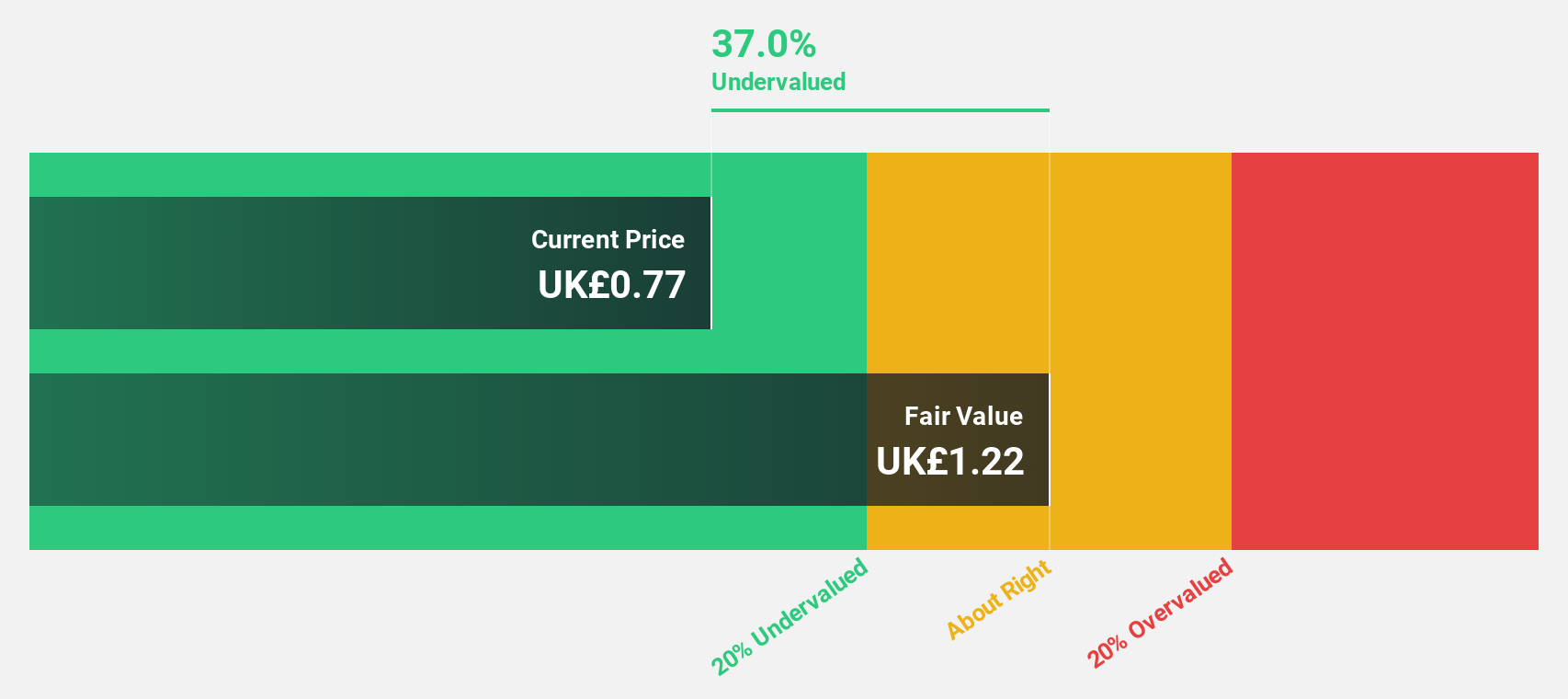

Estimated Discount To Fair Value: 43.6%

Victorian Plumbing Group is trading at £0.68, well below its estimated fair value of £1.2, indicating significant undervaluation based on discounted cash flow analysis. Despite recent insider selling and lower profit margins this year (2.2% vs 4.3% last year), earnings are expected to grow significantly by 29.7% annually, outpacing the UK market's growth rate. However, revenue growth remains moderate at 6.1%, and the dividend yield of 2.37% lacks robust coverage from free cash flows.

- Our comprehensive growth report raises the possibility that Victorian Plumbing Group is poised for substantial financial growth.

- Click here to discover the nuances of Victorian Plumbing Group with our detailed financial health report.

Wickes Group (LSE:WIX)

Overview: Wickes Group plc is a UK-based retailer specializing in home improvement products and services, with a market cap of approximately £511.80 million.

Operations: The company generates revenue of £1.58 billion from its retail operations in home improvement products and services within the United Kingdom.

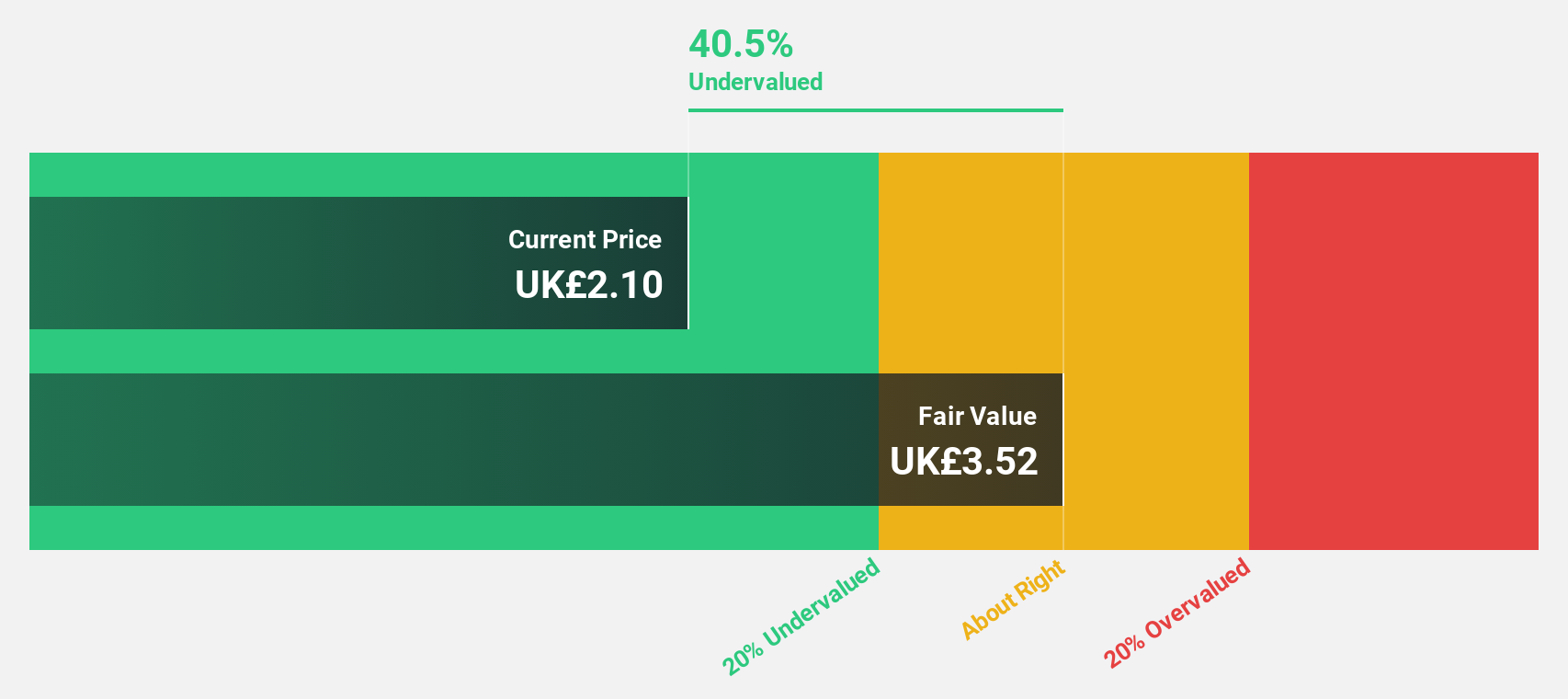

Estimated Discount To Fair Value: 41.1%

Wickes Group, trading at £2.17, is significantly undervalued with an estimated fair value of £3.68 based on discounted cash flow analysis. Despite a dividend yield of 5.02% not being well covered by earnings, the company's earnings are forecast to grow substantially at 25.5% annually over the next three years, surpassing market expectations. Recent financial results show improved performance with net income rising to £20.9 million and ongoing share buybacks enhancing shareholder value further.

- According our earnings growth report, there's an indication that Wickes Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Wickes Group.

Seize The Opportunity

- Dive into all 51 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wickes Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WIX

Wickes Group

Operates as a retailer of home improvement products and services in the United Kingdom.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives