- United Kingdom

- /

- Beverage

- /

- LSE:CCR

Undervalued Small Caps In United Kingdom With Insider Action October 2024

Reviewed by Simply Wall St

Over the past year, the United Kingdom market has experienced a 6.6% rise despite remaining flat over the last week, with earnings expected to grow by 14% annually. In this environment, identifying small-cap stocks that may be undervalued and exhibit insider activity can offer intriguing opportunities for investors seeking growth potential.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 24.6x | 5.6x | 11.41% | ★★★★★☆ |

| NWF Group | 8.7x | 0.1x | 35.27% | ★★★★★☆ |

| Domino's Pizza Group | 15.1x | 1.7x | 39.11% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 25.01% | ★★★★★☆ |

| Essentra | 724.1x | 1.4x | 26.63% | ★★★★☆☆ |

| Genus | 170.6x | 2.0x | -1.55% | ★★★★☆☆ |

| Marlowe | NA | 0.8x | 39.83% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 40.09% | ★★★★☆☆ |

| Harworth Group | 11.9x | 6.2x | -574.33% | ★★★☆☆☆ |

| Oxford Instruments | 22.3x | 2.4x | -25.11% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

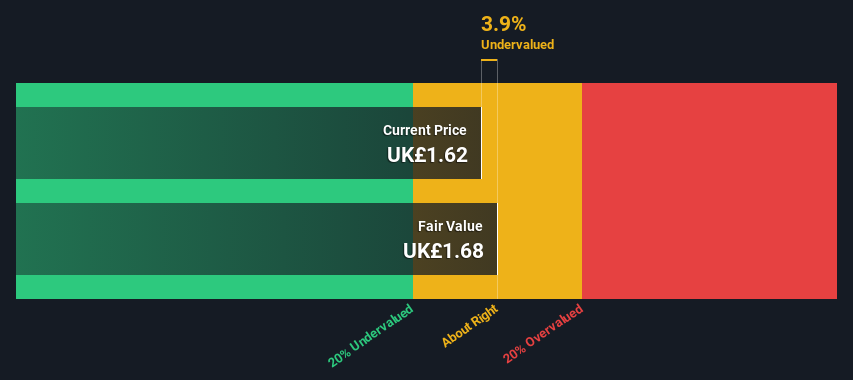

Restore (AIM:RST)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Restore is a company that provides secure lifecycle services and digital & information management solutions, with a market cap of £0.52 billion.

Operations: Secure Lifecycle Services and Digital & Information Management are the primary revenue streams, contributing £104.40 million and £172.50 million respectively. The gross profit margin shows an upward trend from 34.89% in December 2013 to a peak of 44.20% in December 2019, before experiencing fluctuations in recent periods, reaching 42.90% by June 2024.

PE: 89.2x

Restore, a UK-based company, recently reported a turnaround with net income of £6.4 million for H1 2024, compared to a £28.1 million loss the previous year. The interim dividend increased to 2 pence per share from 1.85 pence in H1 2023, signaling potential growth in shareholder returns. Insider confidence is evident as Charles Skinner acquired 100,000 shares for approximately £280K, reflecting belief in future prospects despite reliance on external borrowing and interest coverage challenges.

- Dive into the specifics of Restore here with our thorough valuation report.

Examine Restore's past performance report to understand how it has performed in the past.

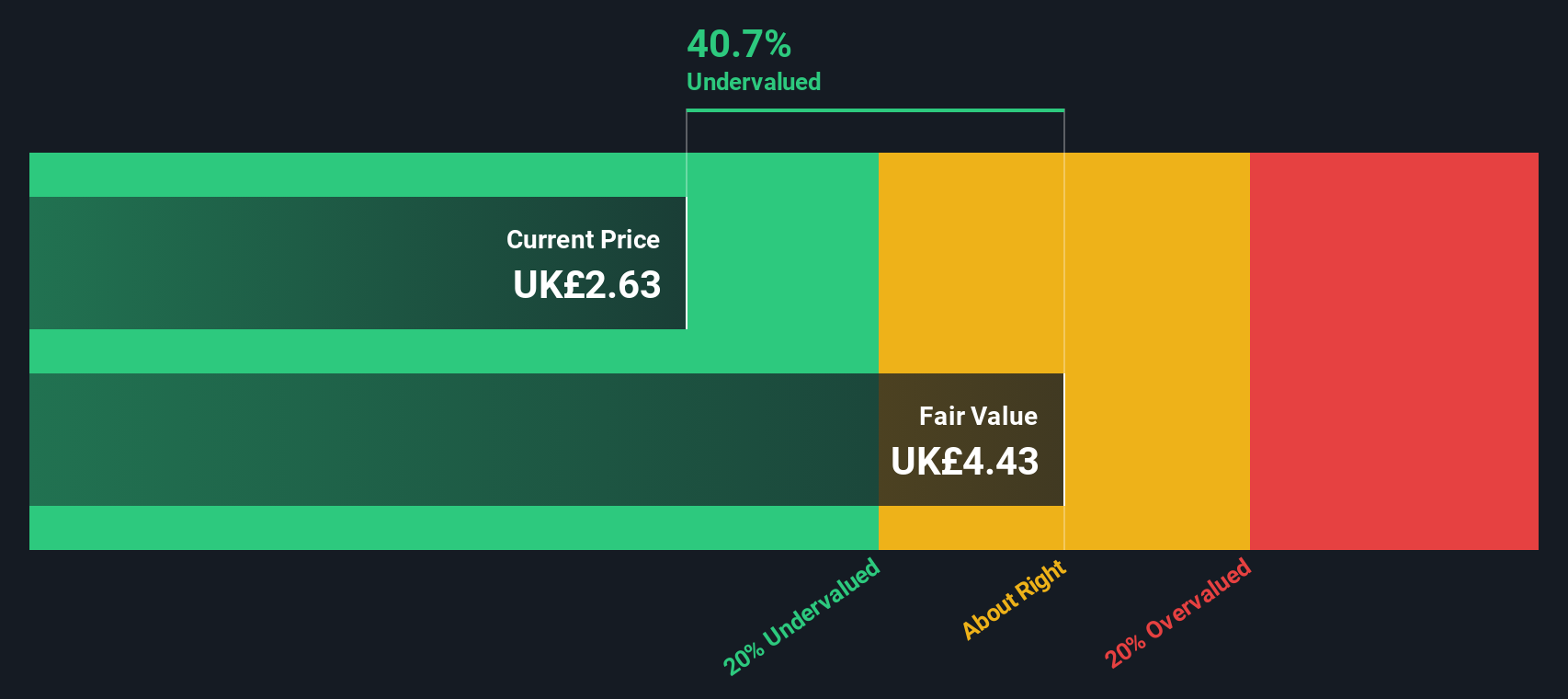

C&C Group (LSE:CCR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: C&C Group is a beverage company primarily operating in Ireland and Great Britain, with a market capitalization of €1.14 billion.

Operations: The company's primary revenue streams are from Ireland and Great Britain, with the latter contributing significantly more. The gross profit margin has shown variability, reaching 23.05% in recent periods. Operating expenses include significant allocations to general and administrative costs, which have been a major component of total expenses.

PE: -6.5x

C&C Group, a UK-based company, is attracting attention for its potential value among smaller stocks. The forecasted 77% annual earnings growth suggests promising prospects. However, reliance on external borrowing adds risk to its funding structure. Recent board appointments, like Sanjay Nakra as an independent director in September 2024, bring seasoned expertise. The company initiated a €15 million share repurchase program in September 2024 to reduce capital and enhance shareholder value amidst strategic realignments.

- Click here and access our complete valuation analysis report to understand the dynamics of C&C Group.

Gain insights into C&C Group's historical performance by reviewing our past performance report.

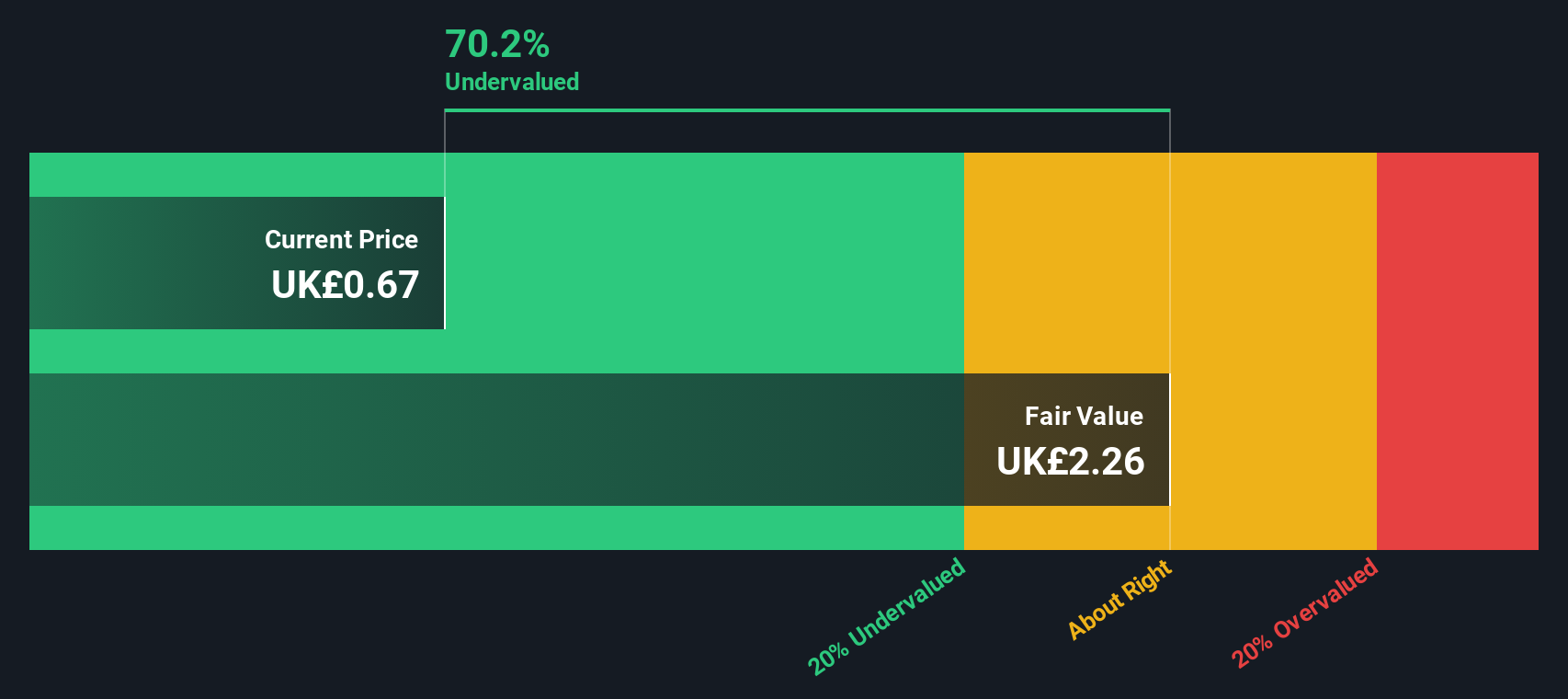

Genel Energy (LSE:GENL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Genel Energy is an independent oil and gas exploration and production company with operations primarily focused in the Kurdistan Region of Iraq, boasting a market capitalization of approximately £0.48 billion.

Operations: Genel Energy's revenue primarily comes from production, with a recent figure of $74.40 million. The company has experienced fluctuations in its gross profit margin, reaching as high as 102.26% and more recently at 80.11%. Operating expenses have varied significantly over time, impacting net income which has seen both positive and negative margins across different periods. The financial data reveals a complex cost structure with notable non-operating expenses and depreciation & amortization charges affecting overall profitability.

PE: -8.4x

Genel Energy, a smaller player in the UK market, has seen insider confidence with Yetik Mert purchasing 107,000 shares for approximately £91,774. Despite a net loss of US$21.9 million for the first half of 2024 and sales dropping to US$37.6 million from US$48 million the previous year, production increased significantly to 19,510 bopd from 13,440 bopd. Recent board changes include Sir Dominick Chilcott's appointment as an Independent Non-Executive Director.

- Unlock comprehensive insights into our analysis of Genel Energy stock in this valuation report.

Explore historical data to track Genel Energy's performance over time in our Past section.

Next Steps

- Embark on your investment journey to our 25 Undervalued UK Small Caps With Insider Buying selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CCR

C&C Group

Manufactures, markets, and distributes beer, cider, wine, spirits, and soft drinks in the Republic of Ireland, Great Britain, and internationally.

Flawless balance sheet with reasonable growth potential.