- United Kingdom

- /

- Commercial Services

- /

- AIM:RST

Discover Restore And 2 Other UK Stocks Possibly Trading Below Fair Value Estimates

Reviewed by Simply Wall St

The UK stock market has been grappling with weak global cues, particularly influenced by faltering trade data from China, leading to declines in both the FTSE 100 and FTSE 250 indices. In such a challenging environment, identifying undervalued stocks can offer investors potential opportunities for growth; here we explore Restore and two other UK stocks that might be trading below their fair value estimates.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TBC Bank Group (LSE:TBCG) | £30.45 | £58.86 | 48.3% |

| EnSilica (AIM:ENSI) | £0.43 | £0.81 | 47.1% |

| Liontrust Asset Management (LSE:LIO) | £6.34 | £12.28 | 48.4% |

| Gaming Realms (AIM:GMR) | £0.4025 | £0.76 | 47.3% |

| Topps Tiles (LSE:TPT) | £0.4685 | £0.9 | 47.9% |

| Marks Electrical Group (AIM:MRK) | £0.65 | £1.27 | 48.9% |

| C&C Group (LSE:CCR) | £1.544 | £3.00 | 48.6% |

| AstraZeneca (LSE:AZN) | £131.02 | £251.50 | 47.9% |

| Mercia Asset Management (AIM:MERC) | £0.35 | £0.68 | 48.2% |

| Franchise Brands (AIM:FRAN) | £1.82 | £3.61 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

Restore (AIM:RST)

Overview: Restore plc, with a market cap of £366.27 million, offers office and workplace services to public and private sectors mainly in the United Kingdom through its subsidiaries.

Operations: The company's revenue segments include Secure Lifecycle Services generating £104.40 million and Digital & Information Management contributing £172.50 million.

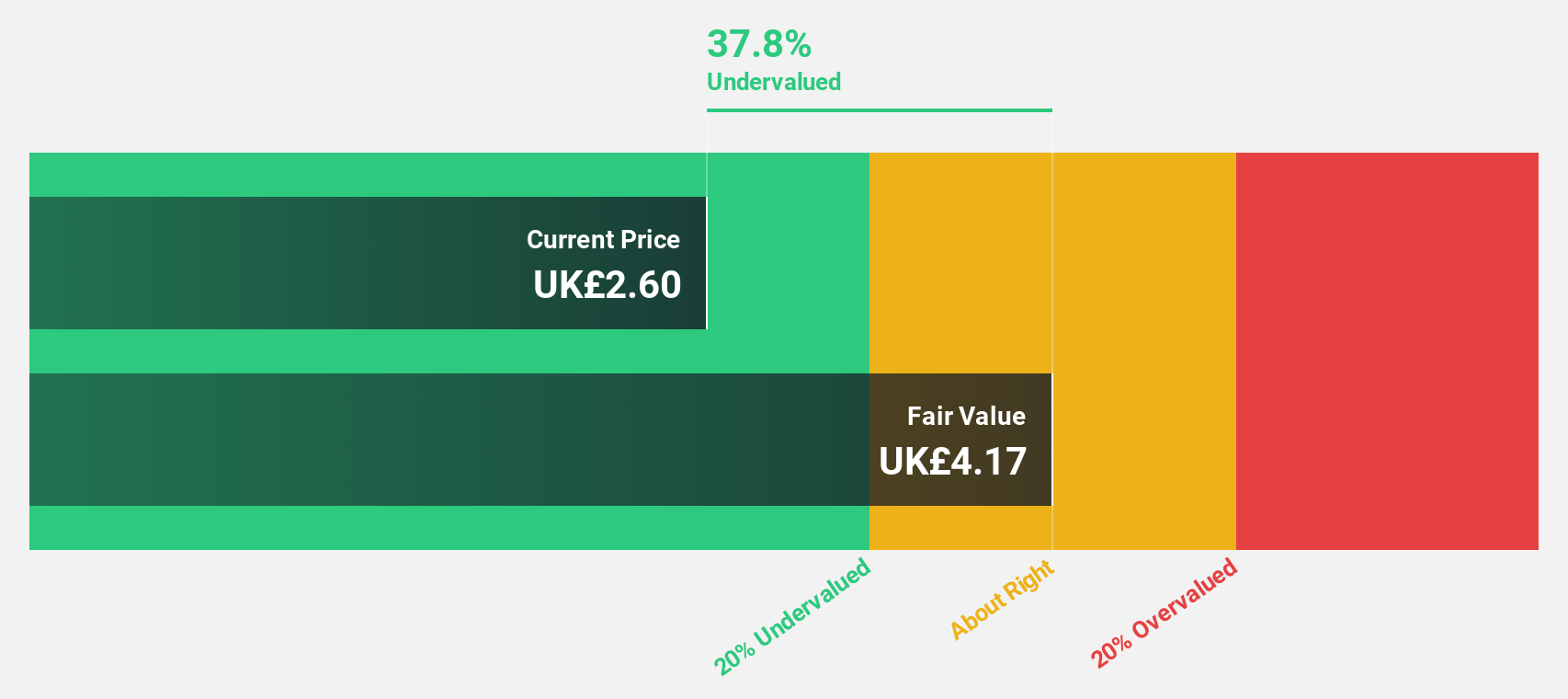

Estimated Discount To Fair Value: 39.7%

Restore plc, trading at £2.68, is significantly undervalued with an estimated fair value of £4.43. The company reported a net income of £6.4 million for H1 2024, reversing a net loss from the previous year. Despite slower revenue growth forecasts (4.4% annually), earnings are expected to grow significantly at 48.7% per year, outpacing the UK market average of 14.3%. However, interest payments are not well covered by earnings and one-off items impact financial results.

- Our growth report here indicates Restore may be poised for an improving outlook.

- Take a closer look at Restore's balance sheet health here in our report.

C&C Group (LSE:CCR)

Overview: C&C Group plc manufactures, markets, and distributes beer, cider, wine, spirits, and soft drinks in the Republic of Ireland, Great Britain, and internationally with a market cap of £594.62 million.

Operations: Revenue segments (in millions of €): Ireland: €286.30, Great Britain: €1.37 billion

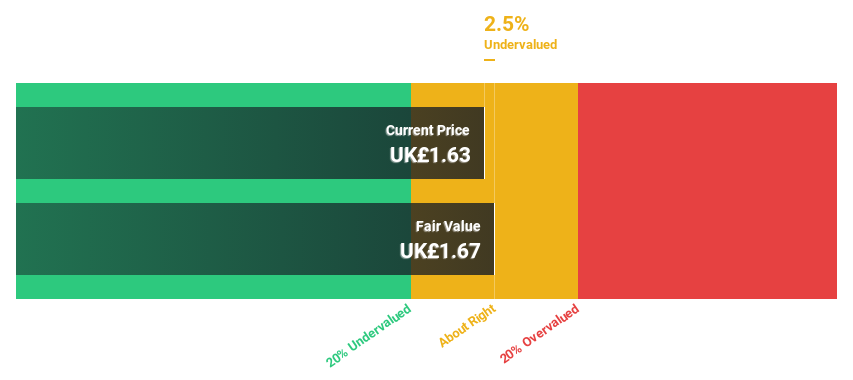

Estimated Discount To Fair Value: 48.6%

C&C Group is trading at £1.54, significantly below its estimated fair value of £3. Despite a net loss of €113.5 million for FY2024, earnings are forecast to grow 77.21% annually, and the company is expected to become profitable within three years. Recent investor activism has led to board changes and strategic reviews aimed at enhancing shareholder value, including a potential sale that could offer a substantial premium over the current share price.

- The analysis detailed in our C&C Group growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of C&C Group.

Marshalls (LSE:MSLH)

Overview: Marshalls plc, with a market cap of £846.49 million, manufactures and sells landscape, building, and roofing products in the United Kingdom and internationally through its subsidiaries.

Operations: The company's revenue segments are comprised of £174.70 million from roofing products, £164.70 million from building products, and £284.40 million from landscape products.

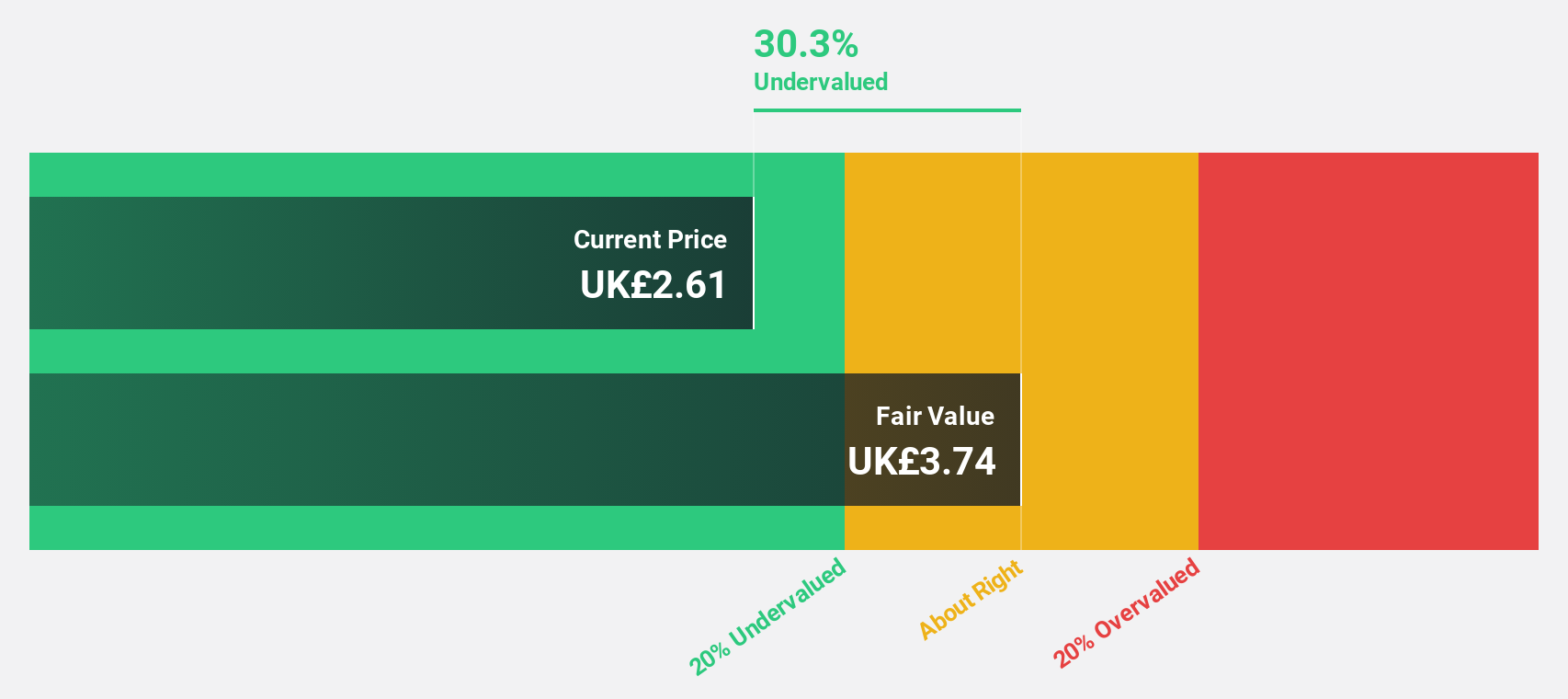

Estimated Discount To Fair Value: 10.4%

Marshalls plc, trading at £3.36, is 10.4% below its estimated fair value of £3.74. The company reported H1 2024 net income of £16.1 million, up from £13.1 million a year ago despite lower sales (£306.7 million vs £354.1 million). Earnings are forecast to grow significantly at 28.28% per year over the next three years, outpacing the UK market's growth rate of 14.3%. However, its dividend yield of 2.47% is not well covered by earnings and profitability remains in line with expectations for the full year.

- Our expertly prepared growth report on Marshalls implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Marshalls here with our thorough financial health report.

Make It Happen

- Click this link to deep-dive into the 58 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RST

Restore

Provides services to offices and workplaces in the public and private sectors primarily in the United Kingdom.

Reasonable growth potential and fair value.