This article will reflect on the compensation paid to John Duffy who has served as CEO of Finsbury Food Group Plc (LON:FIF) since 2009. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Finsbury Food Group

Comparing Finsbury Food Group Plc's CEO Compensation With the industry

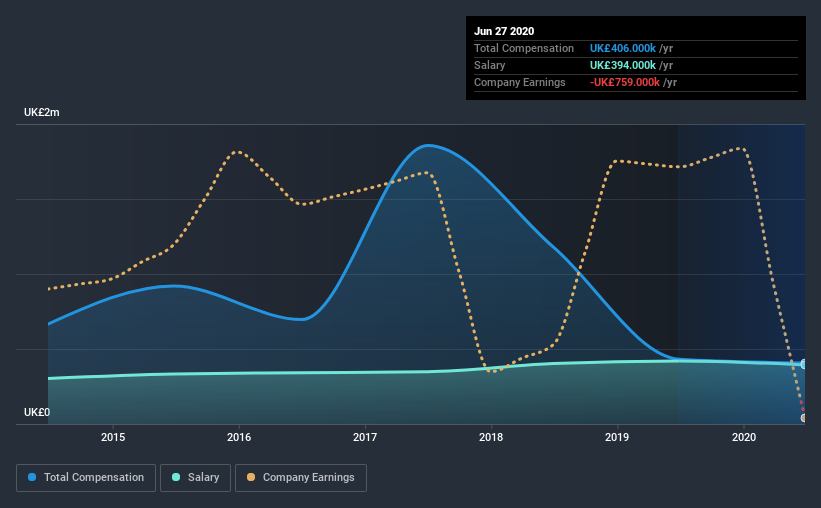

At the time of writing, our data shows that Finsbury Food Group Plc has a market capitalization of UK£101m, and reported total annual CEO compensation of UK£406k for the year to June 2020. We note that's a small decrease of 6.0% on last year. Notably, the salary which is UK£394.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below UK£147m, we found that the median total CEO compensation was UK£263k. This suggests that John Duffy is paid more than the median for the industry. What's more, John Duffy holds UK£2.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£394k | UK£420k | 97% |

| Other | UK£12k | UK£12k | 3% |

| Total Compensation | UK£406k | UK£432k | 100% |

On an industry level, roughly 71% of total compensation represents salary and 29% is other remuneration. Finsbury Food Group is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Finsbury Food Group Plc's Growth

Finsbury Food Group Plc's earnings per share (EPS) grew 6.0% per year over the last three years. In the last year, its revenue is down 2.8%.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Finsbury Food Group Plc Been A Good Investment?

Given the total shareholder loss of 23% over three years, many shareholders in Finsbury Food Group Plc are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Finsbury Food Group pays its CEO a majority of compensation through a salary. As we noted earlier, Finsbury Food Group pays its CEO higher than the norm for similar-sized companies belonging to the same industry. While we have not been overly impressed by the business performance, the shareholder returns have been utterly depressing, over the last three years. This doesn't look good when you see that John is earning more than the industry median. With such poor returns, we would understand if shareholders had concerns related to the CEO's pay.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 1 warning sign for Finsbury Food Group that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Finsbury Food Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Finsbury Food Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:FIF

Finsbury Food Group

Finsbury Food Group Plc, together with its subsidiaries, engages in manufacture and sale of range of cakes, bread, and bakery snack products in the United Kingdom and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives