- United Kingdom

- /

- Specialty Stores

- /

- LSE:AO.

3 UK Stocks Estimated To Be Trading At Discounts Of Up To 48.3%

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China, the UK market reflects broader global economic challenges that are impacting investor sentiment. In such a climate, identifying stocks that are potentially undervalued can offer opportunities for investors seeking value, especially as they look for companies with strong fundamentals that may be trading at significant discounts.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pan African Resources (AIM:PAF) | £0.978 | £1.86 | 47.4% |

| PageGroup (LSE:PAGE) | £2.338 | £4.47 | 47.7% |

| On the Beach Group (LSE:OTB) | £2.25 | £4.39 | 48.7% |

| Norcros (LSE:NXR) | £2.88 | £5.51 | 47.8% |

| Likewise Group (AIM:LIKE) | £0.265 | £0.52 | 49.3% |

| Gooch & Housego (AIM:GHH) | £5.62 | £11.19 | 49.8% |

| Fevertree Drinks (AIM:FEVR) | £8.12 | £15.71 | 48.3% |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £2.22 | 49.5% |

| AOTI (AIM:AOTI) | £0.40 | £0.78 | 48.8% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.29 | £4.39 | 47.8% |

Let's take a closer look at a couple of our picks from the screened companies.

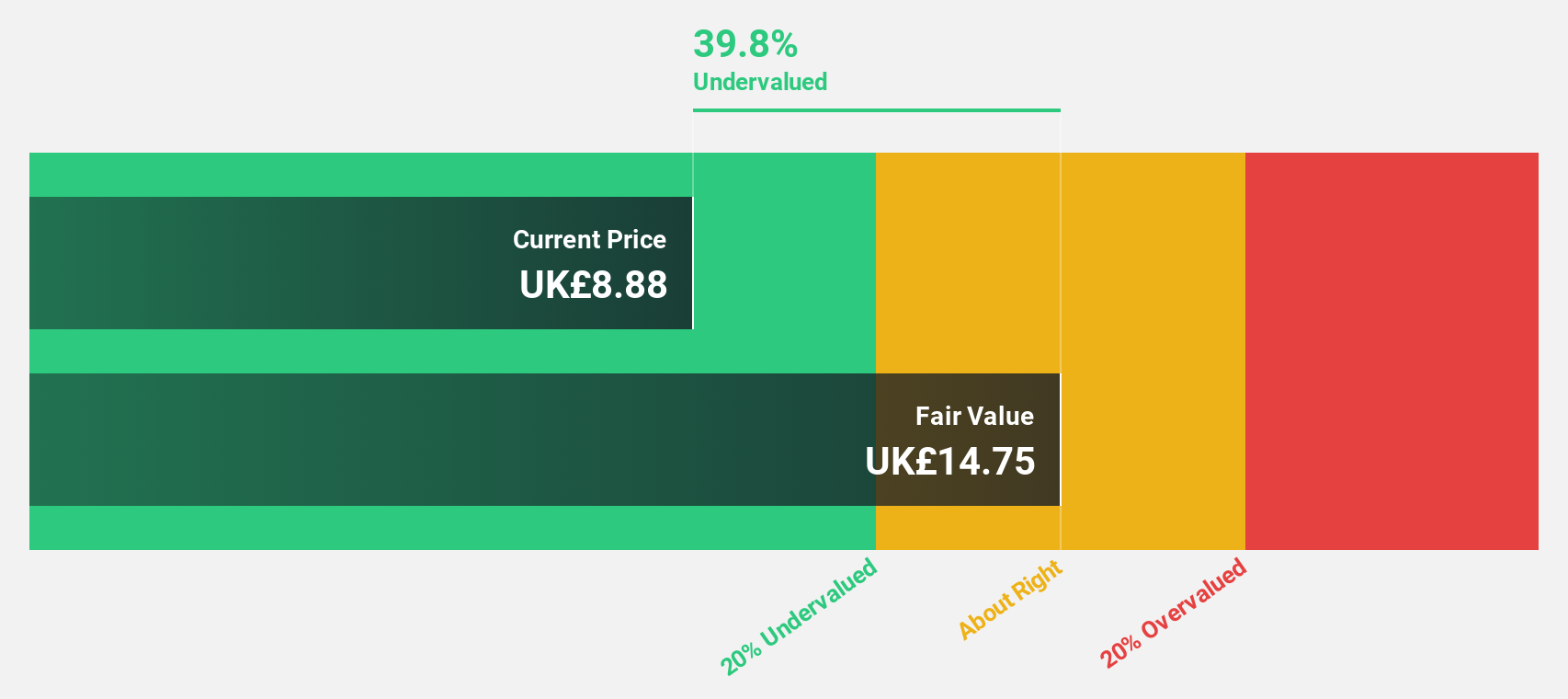

Fevertree Drinks (AIM:FEVR)

Overview: Fevertree Drinks PLC, along with its subsidiaries, develops and sells mixer drinks across the United Kingdom, the United States, Europe, and other international markets, with a market capitalization of £951.04 million.

Operations: The company's revenue is primarily derived from its non-alcoholic beverages segment, which generated £339.90 million.

Estimated Discount To Fair Value: 48.3%

Fevertree Drinks is trading at £8.12, significantly below its estimated fair value of £15.71, indicating it may be undervalued based on cash flows. Despite a decrease in sales to £144.3 million for H1 2025, net income rose to £8.4 million from the previous year. The company has completed a share buyback worth £53.6 million and declared an increased interim dividend of 5.97 pence per share, reflecting strong cash flow management and potential growth prospects with forecasted earnings growth above market expectations at 21.5% annually.

- Upon reviewing our latest growth report, Fevertree Drinks' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Fevertree Drinks.

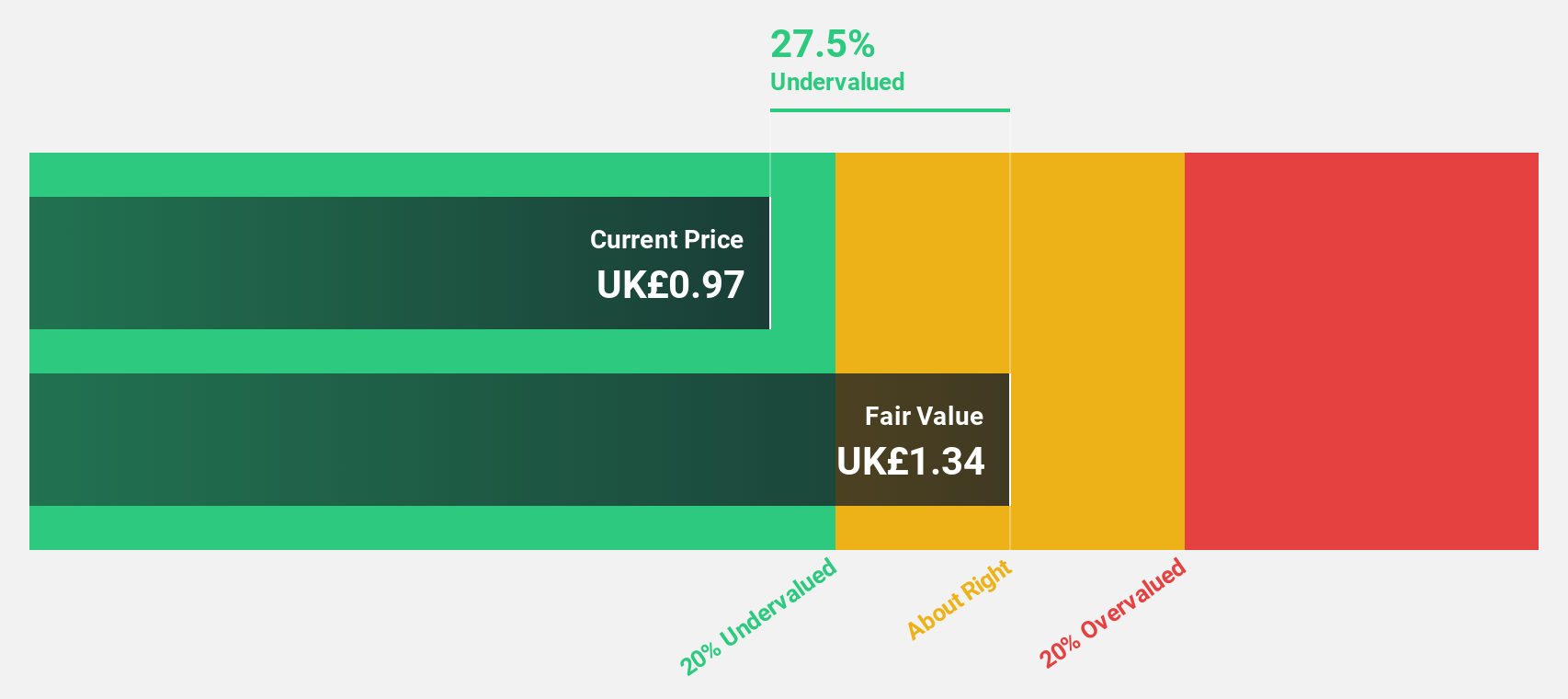

AO World (LSE:AO.)

Overview: AO World plc, along with its subsidiaries, operates as an online retailer of domestic appliances and ancillary services in the United Kingdom and Germany, with a market cap of £555.34 million.

Operations: The company's revenue segment comprises £1.14 billion from its online retailing of domestic appliances and ancillary services in the United Kingdom and Germany.

Estimated Discount To Fair Value: 26.7%

AO World is trading at £0.98, below its estimated fair value of £1.34, suggesting potential undervaluation based on cash flows. Revenue is forecast to grow 8.3% annually, surpassing the UK market's 4.2%. However, profit margins have decreased to 0.9% from last year's 2.4%, and significant insider selling has occurred recently. Despite these challenges, earnings are expected to grow significantly at 36% per year over the next three years, supported by a projected 13% year-on-year revenue increase for H1 FY2026.

- Our growth report here indicates AO World may be poised for an improving outlook.

- Navigate through the intricacies of AO World with our comprehensive financial health report here.

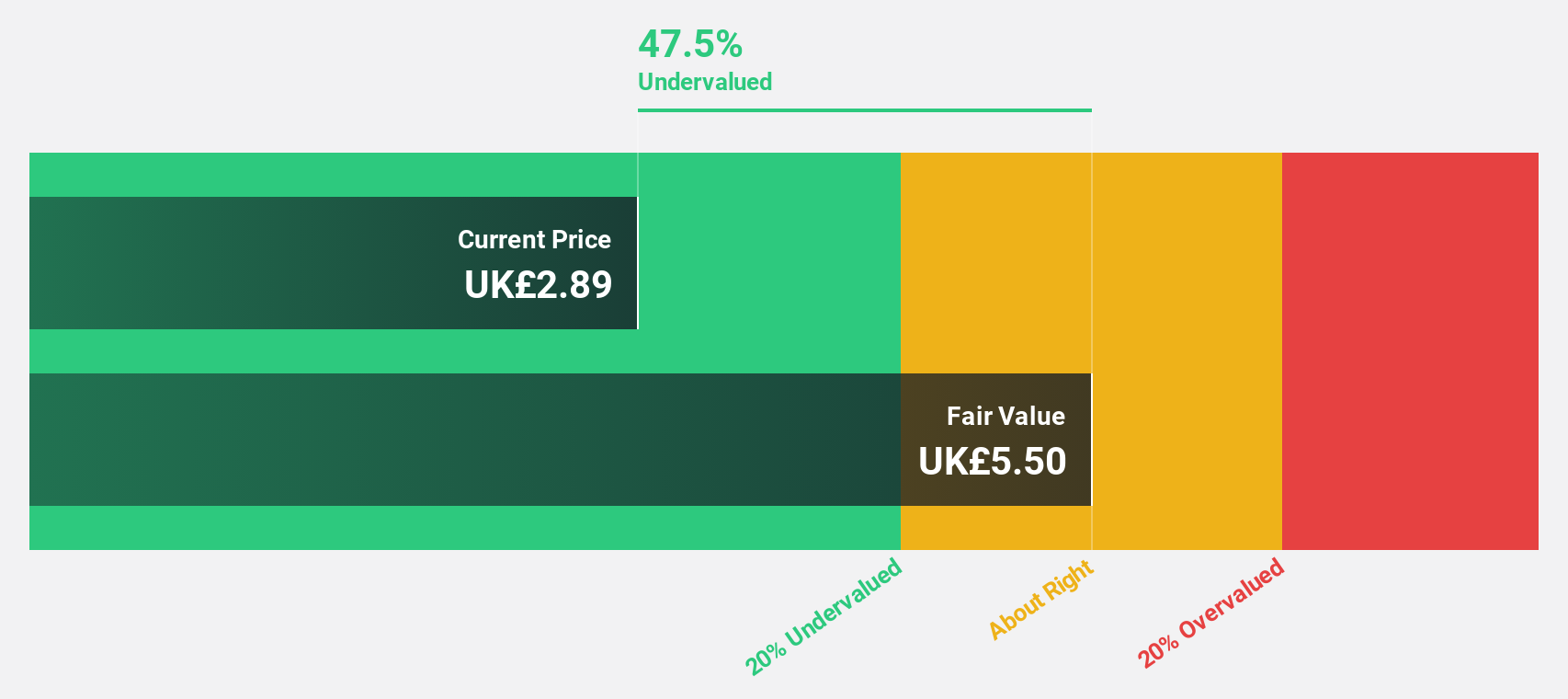

Norcros (LSE:NXR)

Overview: Norcros plc, with a market cap of £258.31 million, designs and supplies bathroom and kitchen products in the United Kingdom, Ireland, and South Africa through its subsidiaries.

Operations: The company generates revenue of £368.10 million from its Building Products segment.

Estimated Discount To Fair Value: 47.8%

Norcros is trading at £2.88, significantly below its estimated fair value of £5.51, highlighting potential undervaluation based on cash flows. Despite a decrease in profit margins to 1% from 6.8% last year due to large one-off items, earnings are expected to grow substantially at 40.9% annually, outpacing the UK market's growth rate. Recent revenue growth and a dividend increase further support its financial position, though the dividend coverage remains weak at 3.61%.

- The analysis detailed in our Norcros growth report hints at robust future financial performance.

- Get an in-depth perspective on Norcros' balance sheet by reading our health report here.

Seize The Opportunity

- Unlock our comprehensive list of 52 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AO.

AO World

Engages in the online retailing of domestic appliances and ancillary services in the United Kingdom and Germany.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives